Phantom said the $150 million funding round accelerates Phantom’s mission to become the world’s biggest consumer finance platform.

Digital asset wallet Phantom announced has raised $150 million from a Series C funding round led by venture capital firms Sequoia Capital and Paradigm, valuing the firm at $3 billion.

Andreessen Horowitz and Variant also participated in the funding round.

“Our mission has always been to make crypto more accessible, intuitive, and safe for everyone. This latest round of funding allows us to invest further in innovation and ultimately modernize consumer finance,” Phantom’s CEO Brandon Millman said in the Jan. 16 announcement.

An Omaha grandmother is fighting for reimbursement from Wells Fargo after her savings were drained by someone claiming to work at the bank. Arlene Gibbs says she received worrying text messages telling her that three of her accounts had been compromised and that further action was required, reports the NBC-affiliated news station WOWT. Gibbs says the […]

The post Wells Fargo Refuses To Reimburse Customer After $15,000 Drained From Account in Sophisticated Scam: Report appeared first on The Daily Hodl.

Block missed its revenue estimates for Q3 and said it is “winding down” its DeFi business to shift money into its Bitcoin mining and wallet businesses.

Block Inc’s (SQ) shares tumbled early after hours as its Bitcoin revenue flatlined in Q3 compared to the previous year, and total revenues missed Wall Street expectations.

Block shares dropped by 12.3% to a bottom of $66 ten minutes after the closing bell on Nov. 7 after closing the day down 3.05% at $75.27, according to Google Finance.

It’s since recovered to a loss of 1.7% and its share price is up 4.2% so far this year.

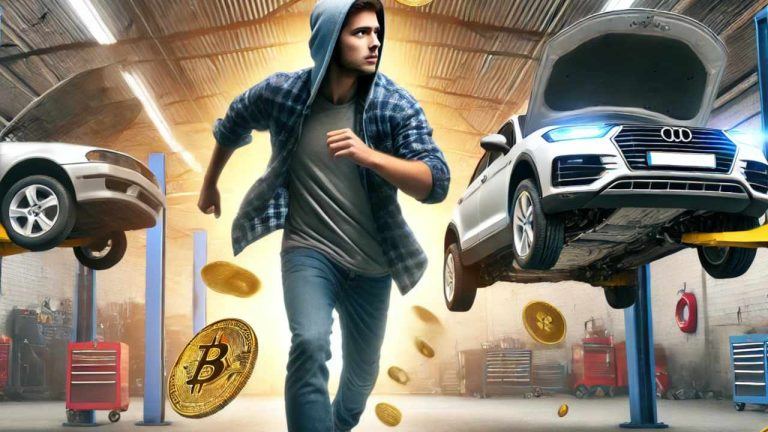

Seven individuals have been indicted for stealing over $300,000 in bitcoin from a Queens resident. The charges against them include grand larceny, money laundering, and identity theft, stemming from a lengthy investigation into a cryptocurrency wallet hack. Using advanced hacking techniques, the group allegedly stole the bitcoin and now face potential sentences of five to […]

Seven individuals have been indicted for stealing over $300,000 in bitcoin from a Queens resident. The charges against them include grand larceny, money laundering, and identity theft, stemming from a lengthy investigation into a cryptocurrency wallet hack. Using advanced hacking techniques, the group allegedly stole the bitcoin and now face potential sentences of five to […] Seven individuals have reportedly been indicted on charges of grand larceny, money laundering, and identity theft for stealing $300,000 in bitcoin from a Queens auto body shop owner. The victim’s 5.75 BTC, originally valued at $92,000, was taken by 20-year-old Aaron Peterson Jr. in November 2022 and later used to purchase luxury items, including a […]

Seven individuals have reportedly been indicted on charges of grand larceny, money laundering, and identity theft for stealing $300,000 in bitcoin from a Queens auto body shop owner. The victim’s 5.75 BTC, originally valued at $92,000, was taken by 20-year-old Aaron Peterson Jr. in November 2022 and later used to purchase luxury items, including a […]Cash App, a popular mobile payment platform, will cease operations in the United Kingdom by September 15. Block, the fintech company behind Cash App, announced the closure on Thursday. The decision to withdraw from the UK market comes as part of Block’s strategy to prioritize its focus on the United States and deprioritize global expansion.

The post Cash App to shut down in the UK, citing focus on US market appeared first on Crypto Briefing.

Block, Inc. co-founder Jack Dorsey told shareholders its Bitcoin-buying plan during an earnings call, saying its an “investment in a future where economic empowerment is the norm.”

Twitter co-founder Jack Dorsey said his fintech firm Block, Inc. will flip 10% of its gross profit made off its Bitcoin products into buying Bitcoin (BTC) every month.

“Going forward, each month we will be investing 10% of our gross profit from Bitcoin products into Bitcoin purchases,” Dorsey wrote in a May 2 shareholder letter inclusive of its better-than-expected first-quarter results.

“We were one of the first public companies to put Bitcoin on our balance sheet,” he added. Block bought $220 million worth of BTC across Q4 2020 and Q1 2021.

Block’s first-quarter 2024 results beat Wall Street analyst estimates on earnings and revenue which saw its share price surge after the bell.

Fintech firm Block’s first-quarter results have beat Wall Street analyst revenue and earnings expectations which saw its shares jump after-hours.

On May 2, Block, Inc. posted its Q1 2024 results showing revenues of $5.96 billion — beating estimates from analytic firm Zacks by 3.54%.

Block’s earnings per share was $0.85 — up from Zack’s $0.62 per share estimate. Its Q1 gross profits reached $2.09 billion, up 22% from the year-ago quarter.

On Wednesday, Block, the financial services firm, disclosed that merchants using Square can convert their daily sales into bitcoin through the Cash App. Block’s founder, Jack Dorsey, revealed this update on X, and as of today, merchants have the option to transfer between 1-10% of their Square-generated earnings into bitcoin, the leading crypto asset by […]

On Wednesday, Block, the financial services firm, disclosed that merchants using Square can convert their daily sales into bitcoin through the Cash App. Block’s founder, Jack Dorsey, revealed this update on X, and as of today, merchants have the option to transfer between 1-10% of their Square-generated earnings into bitcoin, the leading crypto asset by […]

Apple is facing the wrath of crypto users yet again as a popular Bitcoin Lightning wallet disappeared from its U.S.-facing App Store.

Bitcoin (BTC) Lightning payments app Wallet of Satoshi (WoS) has disappeared from Apple’s App Store and Google’s Play Store in the United States as it closes in on over 1 million transactions for November.

On Nov. 24, several users and crypto community participants shared on X (Twitter) their attempts to search for the WoS app, which turned up no results or redirected users to competing wallet apps.

Wallet of Satoshi banned in the US? pic.twitter.com/S44qN5UI2U

— ck (@ck_SNARKs) November 23, 2023

However, the WoS app still appeared for download on the Australian Apple App Store and the Australian and Singapore Google Play Store versions at the time of writing.

Wallet of Satoshi is a popular Lightning payments platform that is on pace to process over 1.1 million Lightning payments in November, according to industry author and podcaster Kevin Rooke.

Wallet of Satoshi is on pace to process over 1.1 million Lightning payments in November.

— Kevin Rooke (@kerooke) November 22, 2023

This will be their largest month of Lightning payments ever.

⚡️ pic.twitter.com/oCxIce7kit

Rooke added that it would be the firm’s “largest month of Lightning payments ever.”

Apple and Wallet of Satoshi did not immediately respond to a request for more details.

Related: Demand for Bitcoin could grow by up to 10x within 12 months: Michael Saylor

Apple levies a hefty 30% tax on in-app payments, which it maintains a tight leash over and has been a barrier for crypto platforms wanting an App Store presence.

On Nov. 17, a group of disgruntled PayPal Venmo and Block Cash App users filed a class-action lawsuit against Apple, claiming the company had entered into anti-competitive agreements with PayPal and Block to restrict the use of crypto technology and payments on iOS.

Apple has a history of removing crypto apps, with the firm delisting the Nostr-based Damus app over a Bitcoin tip feature in June. It also briefly pulled the MetaMask wallet app from its App Store in October.

Magazine: Blockchain detectives — Mt. Gox collapse saw birth of Chainalysis