One low-cap altcoin surged by more than 27% this week amid its newly announced involvement in a central bank digital currency (CBDC) project. Coti (COTI) is a privacy-focused layer-2 network built on Ethereum (ETH). The project’s native asset is trading at $0.118 at time of writing, up from $0.0929 one week ago. Coti announced on […]

The post Low-Cap Altcoin Surges by More Than 27% This Week Amid New Involvement in CBDC Project appeared first on The Daily Hodl.

The recently completed proof of concept by the Bank of Ghana and the Monetary Authority of Singapore demonstrated that the latter’s central bank digital currency enables cross-border payments, excluding many intermediaries and associated costs. Giesecke+Devrient (G+D) stated that the proof of concept (POC) demonstrated the effectiveness of utilizing digital credentials for international trade and cross-border […]

The recently completed proof of concept by the Bank of Ghana and the Monetary Authority of Singapore demonstrated that the latter’s central bank digital currency enables cross-border payments, excluding many intermediaries and associated costs. Giesecke+Devrient (G+D) stated that the proof of concept (POC) demonstrated the effectiveness of utilizing digital credentials for international trade and cross-border […] The People’s Bank of China and the National Bank of Kazakhstan have signed an agreement to collaborate on central bank digital currencies (CBDCs). This collaboration agreement, formalized during President Xi Jinping’s visit to Kazakhstan, aims to enhance CBDC research through joint initiatives and professional development. China and Kazakhstan to Collaborate on Central Bank Digital Currencies […]

The People’s Bank of China and the National Bank of Kazakhstan have signed an agreement to collaborate on central bank digital currencies (CBDCs). This collaboration agreement, formalized during President Xi Jinping’s visit to Kazakhstan, aims to enhance CBDC research through joint initiatives and professional development. China and Kazakhstan to Collaborate on Central Bank Digital Currencies […] The Bank of Israel (BOI) is exploring a central bank digital currency (CBDC), a digital shekel, to modernize Israel’s payment system and drive innovation. However, BOI Deputy Governor Andrew Abir stated that the BOI is waiting for a major central bank, likely the European Central Bank (ECB), to introduce a digital currency before proceeding. This […]

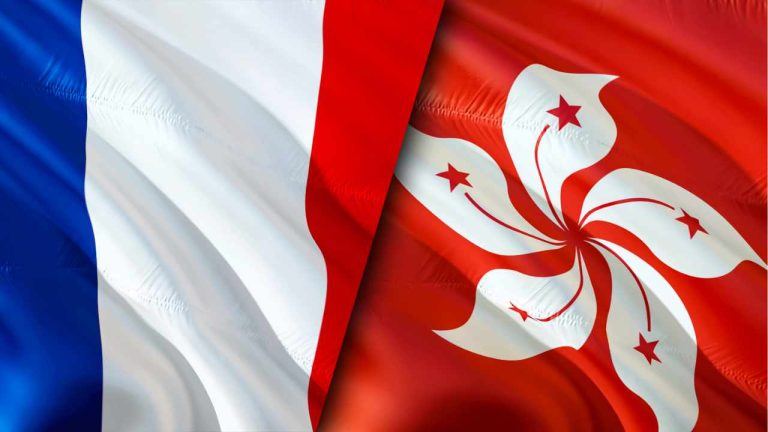

The Bank of Israel (BOI) is exploring a central bank digital currency (CBDC), a digital shekel, to modernize Israel’s payment system and drive innovation. However, BOI Deputy Governor Andrew Abir stated that the BOI is waiting for a major central bank, likely the European Central Bank (ECB), to introduce a digital currency before proceeding. This […] The Banque de France (BDF) and the Hong Kong Monetary Authority (HKMA) have announced a collaboration on wholesale central bank digital currency (wCBDC). This partnership includes the HKMA’s involvement in Wave 2 of the European Central Bank’s Eurosystem exploratory work. The institutions signed a Memorandum of Understanding (MoU) to innovate in wCBDC and tokenization markets, […]

The Banque de France (BDF) and the Hong Kong Monetary Authority (HKMA) have announced a collaboration on wholesale central bank digital currency (wCBDC). This partnership includes the HKMA’s involvement in Wave 2 of the European Central Bank’s Eurosystem exploratory work. The institutions signed a Memorandum of Understanding (MoU) to innovate in wCBDC and tokenization markets, […] The governor of the U.S. state of North Carolina has vetoed House Bill 690, which seeks to ban state payments using central bank digital currencies (CBDCs) and the state’s participation in the Federal Reserve’s CBDC testing. The governor argued the bill was premature and emphasized the need for more funding for cybersecurity. House Bill 690 […]

The governor of the U.S. state of North Carolina has vetoed House Bill 690, which seeks to ban state payments using central bank digital currencies (CBDCs) and the state’s participation in the Federal Reserve’s CBDC testing. The governor argued the bill was premature and emphasized the need for more funding for cybersecurity. House Bill 690 […] The Bahamas, the first country to issue a central bank digital currency (CBDC) called the Sand Dollar, is preparing regulations to mandate commercial banks to provide access to the e-money to boost adoption. Central Bank Governor John Rolle indicated that these regulations would be implemented within two years. “We’ve begun to signal that to our […]

The Bahamas, the first country to issue a central bank digital currency (CBDC) called the Sand Dollar, is preparing regulations to mandate commercial banks to provide access to the e-money to boost adoption. Central Bank Governor John Rolle indicated that these regulations would be implemented within two years. “We’ve begun to signal that to our […] The General Assembly of the U.S. state of North Carolina has approved a bill that prevents the state from participating in the Federal Reserve’s testing of a central bank digital currency (CBDC). The General Assembly is North Carolina’s legislative body, comprising two chambers: the House of Representatives and the Senate. The bill passed with significant […]

The General Assembly of the U.S. state of North Carolina has approved a bill that prevents the state from participating in the Federal Reserve’s testing of a central bank digital currency (CBDC). The General Assembly is North Carolina’s legislative body, comprising two chambers: the House of Representatives and the Senate. The bill passed with significant […] India’s central bank digital currency (CBDC), the digital rupee, has experienced a significant decline in usage, decreasing to a tenth of its peak in December 2023, according to sources involved in the pilot project. The Reserve Bank of India (RBI) initially reached 1 million daily retail transactions with the digital rupee by incentivizing banks and […]

India’s central bank digital currency (CBDC), the digital rupee, has experienced a significant decline in usage, decreasing to a tenth of its peak in December 2023, according to sources involved in the pilot project. The Reserve Bank of India (RBI) initially reached 1 million daily retail transactions with the digital rupee by incentivizing banks and […] The president of Germany’s central bank has highlighted the ongoing debate about the holding limit for the digital euro, Europe’s central bank digital currency (CBDC). He noted that recent Bundesbank research indicates that the optimal amount could be in the range of 1,500 to 2,500 digital euros per person. ‘The Jury Is Still Out Here’ […]

The president of Germany’s central bank has highlighted the ongoing debate about the holding limit for the digital euro, Europe’s central bank digital currency (CBDC). He noted that recent Bundesbank research indicates that the optimal amount could be in the range of 1,500 to 2,500 digital euros per person. ‘The Jury Is Still Out Here’ […]