Ciphertrace, a blockchain analytics company, has announced that crypto-related crimes have moved to the realm of decentralized finance (defi) apps and protocols. Now, the impact these hacks and exploits represent is way bigger than the one classic hacks to centralized exchanges and other scams do, according to their latest “Cryptocurrency Crime and Anti-Money Laundering Report.” […]

Ciphertrace, a blockchain analytics company, has announced that crypto-related crimes have moved to the realm of decentralized finance (defi) apps and protocols. Now, the impact these hacks and exploits represent is way bigger than the one classic hacks to centralized exchanges and other scams do, according to their latest “Cryptocurrency Crime and Anti-Money Laundering Report.” […]CipherTrace’s DeFi Compli, a new compliance oracle on Chainlink, assists DeFi projects in following OFAC sanctions and block blacklisted cryptocurrency addresses.

DeFi Compli is targeted at helping DeFi projects be compliant with the Office of Foreign Assets Control (OFAC), a financial intelligence agency that enforces economic sanctions supporting U.S. national security.

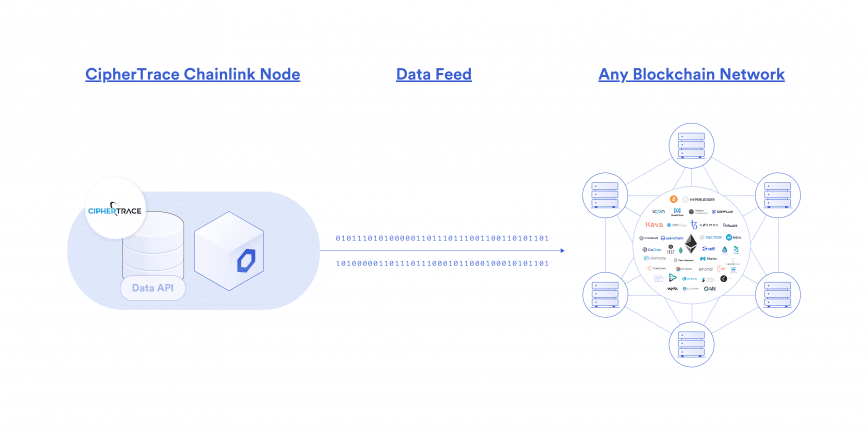

DeFi Compli has been developed on Chainlink, a decentralized oracle network that connects real-world data with any blockchain. As part of the solution, CipherTrace will implement a Chainlink node and provide relevant compliance feeds so teams can port them directly into smart contracts.

Like all other business sectors, DeFi activities such as swapping tokens, borrowing, and lending are subject to OFAC sanctions, along with anti-money laundering laws.

In March 2021, the Financial Action Task Force (FATF) published new guidance that specifies that most DeFi platforms resemble exchanges or VASPs (Virtual Asset Service Providers) and are therefore responsible for implementing AML and CFTC controls.

“Ensuring that sanctioned addresses cannot use DeFi to fund weapons of mass destruction programs should be among DEXs’ chief concerns right now,” said CipherTrace CEO Dave Jevans. “The time for DeFi to adopt compliance solutions is now, or risk facing the consequences.”