Ethereum (ETH) co-creator Vitalik Buterin reportedly says that central bank digital currencies (CBDCs) are not developing in the way he had once hoped for. In a new interview with CNBC, Buterin says that he was once more optimistic about CBDCs, but now he believes they have mostly become “front ends” for the traditional banking system. […]

The post Vitalik Buterin Warns CBDCs Moving in Wrong Direction, Calls Them ‘Front Ends’ for the Banking System: Report appeared first on The Daily Hodl.

The chief executive of top US-based crypto exchange Coinbase says that the lack of clear crypto guidelines in the US has caused multiple issues within the industry. In a new interview with CNBC, Coinbase CEO Brian Armstrong says that clear regulatory rules are needed for the US digital assets industry as it continues to burgeon. […]

The post Coinbase CEO Says Lack of Clear Crypto Rules Has Caused ‘Terrible Things,’ Calls for Regulatory Clarity in US appeared first on The Daily Hodl.

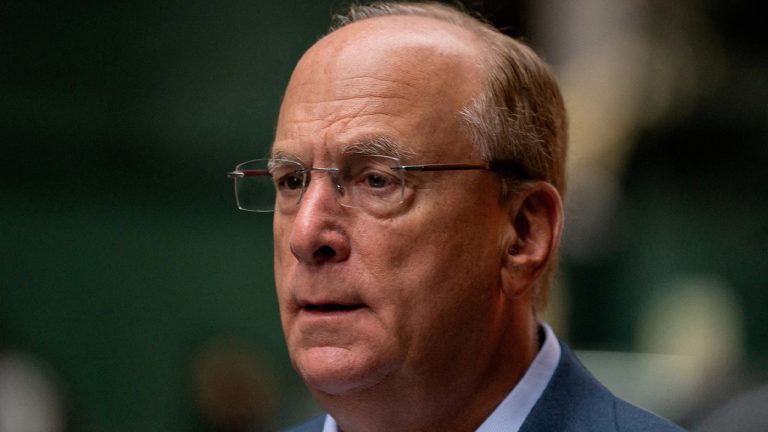

Blackrock’s CEO, Larry Fink, stated in an interview on Friday that he does not anticipate a “big recession” in the United States. However, he believes that “inflation is going to be stickier for longer.” In contrast to the U.S. central bank’s 2% goal, Fink predicts that “we’re going to have a 4ish floor in inflation.” […]

Blackrock’s CEO, Larry Fink, stated in an interview on Friday that he does not anticipate a “big recession” in the United States. However, he believes that “inflation is going to be stickier for longer.” In contrast to the U.S. central bank’s 2% goal, Fink predicts that “we’re going to have a 4ish floor in inflation.” […] Finance mogul Warren Buffett, one of the most successful investors in history, discussed bitcoin during an interview on CNBC’s Squawk Box on April 12. As he has done in previous interviews, the business magnate likened bitcoin to a gambling scheme and chain letters he received as a child. Buffett Shares His Two Cents on Bitcoin, […]

Finance mogul Warren Buffett, one of the most successful investors in history, discussed bitcoin during an interview on CNBC’s Squawk Box on April 12. As he has done in previous interviews, the business magnate likened bitcoin to a gambling scheme and chain letters he received as a child. Buffett Shares His Two Cents on Bitcoin, […] On Tuesday, French officials conducted raids on five major banks located in and around Paris, including Societe Generale, BNP Paribas, HSBC, Natixis, and BNP’s Exane Bank, over alleged charges of money laundering and fiscal fraud. According to a spokesperson for France’s Financial Prosecutor’s Office (PNF), the preliminary investigation into four French banks and one international […]

On Tuesday, French officials conducted raids on five major banks located in and around Paris, including Societe Generale, BNP Paribas, HSBC, Natixis, and BNP’s Exane Bank, over alleged charges of money laundering and fiscal fraud. According to a spokesperson for France’s Financial Prosecutor’s Office (PNF), the preliminary investigation into four French banks and one international […]

The Galaxy Digital CEO predicts tough times ahead for the U.S. economy, but continues to be bullish on crypto.

The United States is headed for a credit crunch and now is the right time to buy gold, silver and Bitcoin (BTC), says Galaxy Digital founder and CEO Michael Novogratz.

“We are going to have a credit crunch in the U.S. and globally,” Novogratz explained in an interview on CNBC. "You want to be long gold and silver [...] and you want to be long Bitcoin,” he said.

Speaking on CNBC’s Squawk Box on March 15, Novogratz noted that banks typically rebuild capital by lending less, meaning that a credit crunch is imminent, noting that indicators like the commodities market are already pointing to a recession.

The U.S. banking industry fell into turmoil this month, with Silvergate Bank, Signature Bank, and Silicon Valley Bank (SVB) all collapsing in the same week. Moody's downgraded the U.S. banking system outlook to "negative."

Related: Blame traditional finance for the collapse of Silicon Valley Bank

In the interview, Novogratz suggested a reversal in interest rate policy was on the cards, saying that while the Federal Reserve would “like to do a dovish hike, just for credibility’s sale,” doing so would be a “huge policy error.”

Alongside his prediction of tough times for the U.S. economy, Novogratz expressed a bullish sentiment for crypto, saying:

“If there was ever a time to be in bitcoin and crypto, this is why it was created, in that governments print too much money whenever the pain gets too great, and we’re seeing that.”

The price of Bitcoin dipped after the collapse of Silicon Valley Bank last week but managed to reach new 2023 highs of $26,514.72 on March 14, according to CoinMarketCap.

Looks like Bitcoin is moving on from its risk asset days. As more and more people begin to understand its fundamental value case, the market is slowly turning to Bitcoin as a digital form of gold.

— Handre van Heerden (@Handrev) March 14, 2023

The U.S. Labor Department released the consumer price index (CPI) report on Tuesday. Although inflation increased in February year-over-year, the rise was expected, and the annual inflation rate for all items was 6%. The cooling inflation has eased some concerns, but fears of financial contagion have spread. Market strategists are further anticipating the U.S. central […]

The U.S. Labor Department released the consumer price index (CPI) report on Tuesday. Although inflation increased in February year-over-year, the rise was expected, and the annual inflation rate for all items was 6%. The cooling inflation has eased some concerns, but fears of financial contagion have spread. Market strategists are further anticipating the U.S. central […] Barney Frank, a former member of the U.S. House of Representatives from Massachusetts and leading co-sponsor of the 2010 Dodd-Frank Act, discussed his opinion on the recent failure of Signature Bank. In an interview, Frank stated that he believes regulators aimed to “send a very strong anti-crypto message.” Frank, who also serves as a Signature […]

Barney Frank, a former member of the U.S. House of Representatives from Massachusetts and leading co-sponsor of the 2010 Dodd-Frank Act, discussed his opinion on the recent failure of Signature Bank. In an interview, Frank stated that he believes regulators aimed to “send a very strong anti-crypto message.” Frank, who also serves as a Signature […] On March 2, 2023, the cryptocurrency exchange Coinbase announced that, in light of recent developments, the company is “no longer accepting or initiating payments to or from Silvergate Bank.” The news follows the crypto bank’s delay of its annual 10-K filing with the U.S. Securities and Exchange Commission (SEC) and JPMorgan’s downgrade of the company’s […]

On March 2, 2023, the cryptocurrency exchange Coinbase announced that, in light of recent developments, the company is “no longer accepting or initiating payments to or from Silvergate Bank.” The news follows the crypto bank’s delay of its annual 10-K filing with the U.S. Securities and Exchange Commission (SEC) and JPMorgan’s downgrade of the company’s […] Coinbase, one of the biggest cryptocurrency exchanges in the U.S., has stated that the staking services offered on its platform do not constitute securities. The statements, made in the wake of the $30 million settlement that Kraken, another U.S.-based crypto exchange, completed with the U.S. Securities and Exchange Commission (SEC), also criticize the institution’s approach […]

Coinbase, one of the biggest cryptocurrency exchanges in the U.S., has stated that the staking services offered on its platform do not constitute securities. The statements, made in the wake of the $30 million settlement that Kraken, another U.S.-based crypto exchange, completed with the U.S. Securities and Exchange Commission (SEC), also criticize the institution’s approach […]