A top economist at the Coinbase Institute is revealing one factor that will likely determine the future prices of crypto assets. Cesare Fracassi, the chief economist of Coinbase’s research arm, says shifting attitudes toward future crypto market expectations could drive up the prices of digital assets. “The most important pillar of the market efficiency hypothesis […]

The post Coinbase Economist Reveals One Major Factor That Will Drive Crypto Prices in Future appeared first on The Daily Hodl.

A hedge against the traditional market? Nope, crypto assets are now looking closer in risk profile to oil and gas, or EV stocks like Tesla, says Coinbase Institute’s chief economist.

Despite some touting crypto as a hedge against traditional markets, digital assets today share a similar risk profile to commodities such as oil and gas, and tech and pharmaceutical stocks, according to analysis from Coinbase’s chief economist.

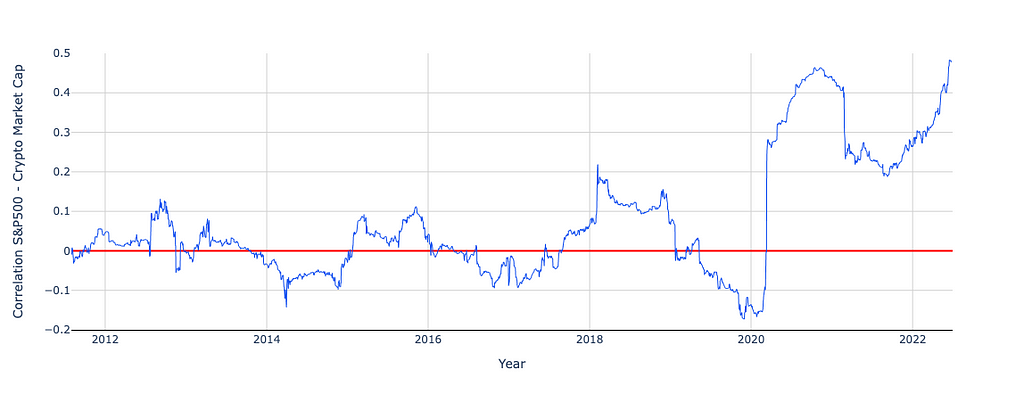

The observation comes from a blog post from Coinbase chief economist Cesare Fracassi on July 6, noting that the “correlation between the stock and crypto-asset prices has risen significantly” since the 2020 pandemic.

“While for the first decade of its existence, Bitcoin returns were on average uncorrelated with the performance of the stock market, the relationship increased quickly since the COVID pandemic started,” stated Fracassi.

“In particular, crypto assets today share similar risk profiles to oil commodity prices and technology stocks.”

The economist referred back to his institute’s monthly insights report in May, which found that Bitcoin and Ethereum have similar volatility to commodities such as natural gas and oil, fluctuating between 4% and 5% on a daily basis.

Since 2020, the correlation between crypto and the stock market has risen and with recent market movements we see how the market expects crypto assets to become more and more intertwined with the rest of the financial system in the future. (4/5)

— Cesare Fracassi (@CesareFracassi) July 5, 2022

Bitcoin, which is often likened to “digital gold,” had a far riskier profile compared to its real-world precious metal counterparts such as gold and silver, which see daily volatility closer to 1% and 2%, according to the research.

The most appropriate stock comparison to Bitcoin in terms of volatility and market cap was the electric car manufacturer Tesla (TSLA) the economist said.

Ethereum, on the other hand, is more comparable to electric car manufacturer Lucid (LCID) and pharmaceutical company Moderna (MRNA) based on market cap and volatility.

Fracassi said this puts crypto assets in a very similar risk profile to traditional asset classes such as technology stocks.

“This suggests that the market expects crypto assets to become more and more intertwined with the rest of the financial system, and thus to be exposed to the same macro-economic forces that move the world economy.”

Fracassi added that roughly two-thirds of the recent decline in crypto prices are the result of macro factors — such as inflation and a looming recession. One-third of the crypto decline can be attributed to a plain-old weakening outlook “solely” for cryptocurrencies.

Related: The crypto industry needs a crypto capital market structure

Crypto pundits have viewed the fact that the crypto crash being led by macro factors is a positive sign for the industry.

Erik Voorhees, co-founder of Coinapult and CEO and founder of ShapeShift wrote on Twitter last week that the current crash was least worrisome to him, as it was the first crypto crash that was clearly “the result of macro factors outside of crypto.”

Alliance DAO core contributor Qiao Wang made similar comments to his Twitter, explaining that previous cycles were caused by “endogenous” factors such as the fall of Mt. Gox in 2014 and the bursting of the Initial Coin Offering (ICO) bubble in 2018.

By Cesare Fracassi, Chief Economist, Coinbase Institute

TL;DR: How should we evaluate the recent highs and lows of crypto prices? In taking a market efficiency view, crypto prices are a reflection of the market’s assessment of the future prospects of digital assets. This view can help us understand the historical trends in crypto prices and its correlation with the overall financial markets:

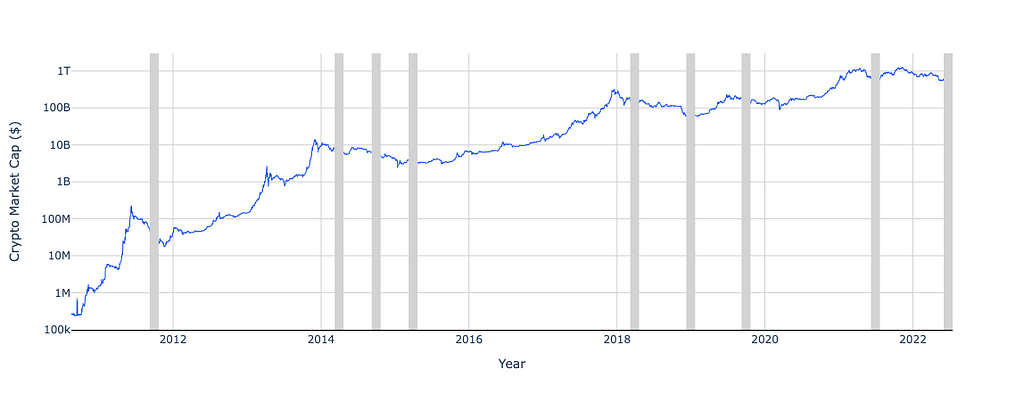

Over the last eight months, the market capitalization of all cryptocurrencies went from a peak of $2.9T to a current level of less than $1T, a decline of over two thirds. This is not unusual in crypto markets: Since 2010, total crypto market capitalization experienced a quarterly decline of 20% or more (a typical measure of bear market conditions) nine times.

Each time a sharp decline in crypto prices occurs, media and expert commentaries usually take one of two forms:

(i) the “Crypto is dead” response, where crypto is painted as a gigantic Ponzi scheme fueled by the desire not to be left out of great returns (Fear of Missing Out, or FOMO in short) followed by anxiety and despair when prices decline (Fear, Uncertainty, and Doubt, or FUD in short). The price drop is the sign that the bubble bursted, and we should run for the exits before prices go down to zero.

(ii) the “HODL” response, where crypto is seen as a groundbreaking technology. Crypto winters and summers are a feature, not a bug, of disruptive innovations, like national banks in the early 18th century, railways in the mid 19th century, and the internet and artificial intelligence in the late 20th century. We should hold and ride through the volatility, as crypto prices will resume their rise in the near future.

However, neither of these explain both the historical trends we have seen in crypto and how we are seeing the correlation with overall stock markets today. But there is a third way to interpret changes in prices, the “market efficiency” response, where prices are a reflection of the market’s assessment of the future prospects of digital assets.

Market Efficiency

Examining the crypto markets based on an understanding of market efficiency can help us interpret the data. For example:

There is one topic that the market-efficiency view is mostly silent about: the direction of crypto prices in the future. The most important pillar of the market efficiency hypothesis is that any traded asset, from stocks to bonds, commodities, and even crypto, incorporates into its price the market’s expectation about the future value of the asset. For example, if the market expects Tesla to sell a very large number of cars in the future, the stock price today will be high to reflect that expectation. If Tesla meets that expectation in the future, its stock price will not rise, because it already incorporated that event into its price today.

Similarly, then, changes in prices occur only when there are changes in the expectation of the future outlook about the assets. Thus, according to the market-efficiency view of crypto markets, only changes in the outlook of the crypto industry relative to what is already expected will bring changes to prices.

NOTE: The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Coinbase or its employees and summarizes information and articles with respect to cryptocurrencies or related topics that the author believes may be of interest. This material is for informational purposes only, and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations or (iii) an official statement of Coinbase. No representation or warranty is made, expressed or implied, with respect to the accuracy or completeness of the information or to the future performance of any digital asset, financial instrument or other market or economic measure. The information is believed to be current as of the date indicated on the materials. Recipients should consult their advisors before making any investment decision. Coinbase may have financial interests in, or relationships with, some of the entities and/or publications discussed or otherwise referenced in the materials. Certain links that may be provided in the materials are provided for convenience and do not imply Coinbase’s endorsement, or approval of any third-party websites or their content.

Coinbase Institute Research: Crypto Prices and Market Efficiency was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

The leading US-based crypto exchange is announcing the launch of the Coinbase Institute, a new global think tank created to debate and advance the future of crypto and Web 3.0 protocols. According to a new Coinbase blog post, the think tank is launching with the purpose of bringing together academics, policymakers, and prominent figures within […]

The post Crypto Exchange Giant Coinbase Announces Launch of New Crypto-Focused Think Tank appeared first on The Daily Hodl.

Coinbase’s new “crypto native think tank” features an advisory board of finance and law academics from top United States universities and will publish original research to shape policies around crypto.

Cryptocurrency exchange Coinbase has created a “crypto native think tank” in an attempt to help shape the global conversation around policies for digital assets.

The newly formed Coinbase Institute will also publish research on crypto and Web3.

Coinbase tapped its Director of Policy Hermine Wong to head the institute. She previously served in the Division of Economic and Risk Analysis at the United States Securities and Exchange Commission (SEC) and before that worked at the Department of State.

The related Coinbase Institute Advisory Board has also been formed and will feature academics across law and finance from top universities such as Harvard, MIT, Duke and John Hopkins coupled with an academic partnership with the University of Michigan.

The University of Michigan has conducted surveys for the U.S. Census Bureau and the Department of Defense and will partner with Coinbase on an annual U.S. based survey measuring the adoption of cryptocurrencies and sentiment towards digital assets.

The institute published the first in a series of “Coinbase Primers” — reports explaining key issues in crypto. It released a “Crypto and the Climate” report on May 19 to warrant the high energy usage of proof-of-work blockchains like Bitcoin (BTC).

The first monthly insight report in crypto markets was also released which compared market movements in crypto and traditional finance. Each report will focus on a particular theme.

The formation of the institute marks another instance of Coinbase aiming to influence the conversation around cryptocurrencies. In May 2021 it launched a “fact checking portal” with CEO Brian Armstrong saying the blog would be used “to combat misinformation and mischaracterizations about Coinbase or crypto being shared in the world.”

Related: Global financial regulators will discuss crypto at G7: Report

The crypto exchange also created a political action committee in February 2022 ahead of the November 8 midterm elections in the U.S., Coinbase spent over $1.3 million lobbying in 2021, the biggest-spend by a blockchain company that year.

Coinbase broke away from the crypto industry's largest lobbying group, the Blockchain Association in August 2020, believed to be in protest of the admittance of Binance.US.

The company then formed the Crypto Council for Innovation in April 2021 along with Jack Dorsey’s Square (now Block) and crypto investment firm Paradigm aiming to engage governments, regulatory agencies and policymakers on crypto regulation.

The institute hasn't singled out specific policies to advocate for but its next move will be to publish more original research which “will provide the public, policymakers, regulators, and academics with a better understanding of crypto’s diversity and interconnection to the overall economy.”