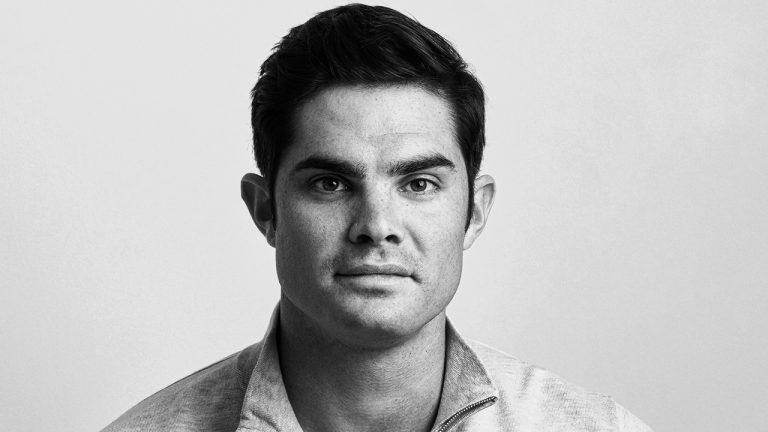

“Where other exchanges see regulatory risk, we see opportunity,” said Coinjar CEO and co-founder Asher Tan in a recent interview.

Australian crypto exchange Coinjar is seeking to put its boots on the ground in the United States, with its CEO seemingly unfazed by the market's “regulatory risk."

In an interview with The Australian on May 1, Coinjar CEO and co-founder Asher Tan said he saw opportunity despite a recent wave of U.S. crypto firms sounding alarm bells over the government’s approach to regulation.

“Where other exchanges see regulatory risk, we see opportunity,” he said, adding:

“We’ve always understood that regulation has a key role to play in crypto’s future and we believe the American market will reward an exchange with our unparalleled compliance bona fides.”

Coinjar is based in Melbourne and was founded in late 2013. It was one of the earliest exchanges to hit the market in Australia and also secured a license to operate in the United Kingdom in September 2021. It is reported to have around 500,000 customers across the two countries.

Coinjar kicked off its U.S. expansion plans in May by listing a single open role for an anti-money laundering (AML) compliance officer.

“CoinJar is expanding to the US, and we are seeking an AML Compliance Officer. The successful candidate will report to the Head of Legal & Compliance and the Board, take ownership of applicable programs and policies, including the AML/OFAC Program, and implement processes to ensure adherence to them,” the job listing reads.

Tan suggested that Coinjar’s focus on regulatory compliance will be key to thriving in a difficult environment like the United States.

“Licensing is done at a state level in the US, so we will be gradually adding states until we can get close to full coverage of states,” he said, adding that “while not every company is able or willing to satisfy this criteria, CoinJar believes we’re well suited to take on this challenge.”

Related: On the shutdown of Bittrex in the US and SEC actions — Bittrex Global CEO at Consensus 2023

While the idea sounds good in theory, U.S. exchanges such as Coinbase provide an example of the potential roadblocks that Coinjar could face.

Coinbase has claimed on several occasions that it has actively sought to engage in dialogues with the Securities and Exchange Commision (SEC) in the name of compliance, but has ultimately had those efforts thrown back in its face.

The SEC slapped Coinbase with a Wells notice on March 22, essentially threatening legal action over some of the firm’s offerings, which it asserts are violating securities law. Coinbase however, has argued that it already disclosed such an offering to the SEC prior to getting the greenlight to go public.

In response, Coinbase has since filed a petition in federal court requesting the SEC to propose and adopt clearer regulatory guidelines for the cryptocurrency industry in the U.S.

“We are literally sitting up here on stage asking for regulation, asking for rules, asking for a framework that makes sense for our particular technology so that we can be registered,” Coinbase Chief Legal Officer Paul Grewal said at Consensus 2023 on April 27.

Just In: Coinbase Chief Legal Officer Paul Grewal is an absolute boss. pic.twitter.com/bHA3sCNIet

— Dan Gambardello (@cryptorecruitr) April 27, 2023

Magazine: Crypto regulation — Does SEC Chair Gary Gensler have the final say?