On Sunday evening, March 19, 2023, at 5:00 p.m. Eastern Time, the U.S. Federal Reserve, along with several central banks including the Bank of England, Bank of Canada, Bank of Japan, the European Central Bank, and the Swiss National Bank, announced a coordinated action to enhance the provision of liquidity via the standing U.S. dollar […]

On Sunday evening, March 19, 2023, at 5:00 p.m. Eastern Time, the U.S. Federal Reserve, along with several central banks including the Bank of England, Bank of Canada, Bank of Japan, the European Central Bank, and the Swiss National Bank, announced a coordinated action to enhance the provision of liquidity via the standing U.S. dollar […] A European lawmaker has urged authorities to impose a ban on cryptocurrencies citing the current crisis in the banking sector as a reason. Johan Van Overtveldt, former finance minister of Belgium, believes these assets bring no economic or social value. Belgium’s Ex-Finance Minister Suggests Ban on Decentralized Digital Currencies Member of the European Parliament, Johan […]

A European lawmaker has urged authorities to impose a ban on cryptocurrencies citing the current crisis in the banking sector as a reason. Johan Van Overtveldt, former finance minister of Belgium, believes these assets bring no economic or social value. Belgium’s Ex-Finance Minister Suggests Ban on Decentralized Digital Currencies Member of the European Parliament, Johan […]

The collapse of FTX led to a similar exodus from centralized exchanges, as users worried they may lose access to funds during crises.

The collapse of Silicon Valley Bank saw investors loading their bags with USD Coin (USDC), along with an exodus of funds from centralized exchanges (CEXs) to decentralized exchanges (DEXs).

Outflows from centralized exchanges often spike when the markets are in turmoil, blockchain analysis firm Chainalysis said in a March 16 blog post, as users are likely worried about losing access to their funds when exchanges go down.

The Chainalysis data shows that hourly outflows from CEXs to DEXs spiked to over $300 million on March 11, soon after SVB was shut down by a Californiaregulator.

A similar phenomenon was observed during the collapse of cryptocurrency exchange FTX last year, amid fears that the contagion could spread to other crypto firms.

However, data from the blockchain analytics platform Token Terminal suggests that the surge in daily trading volumes for large DEXs was short-lived in both cases.

USDC was identified as one of the top assets being moved to DEXs, which Chainalysis said was unsurprising given that USDC depegged after stablecoin issuer Circle announced it had $3.3 billion in reserves stuck on SVB, prompting many CEXs like Coinbase to temporarily halt USDC trading.

Related: Circle clears ‘substantially all’ minting and redemption backlog for USDC

What was surprising, Chainalysis noted, was the surge in USDC acquisitions on large DEXs such as Curve3pool and Uniswap. “Several assets saw large spikes in user acquisition, but none more than USDC,” the blockchain analysis firm wrote.

Chainalysis theorized that this was due to confidence in the stablecoin, with some crypto users loading up on USDC while it was relatively cheap and betting that it would regain its peg — which it did on March 13 according to CoinMarketCap.

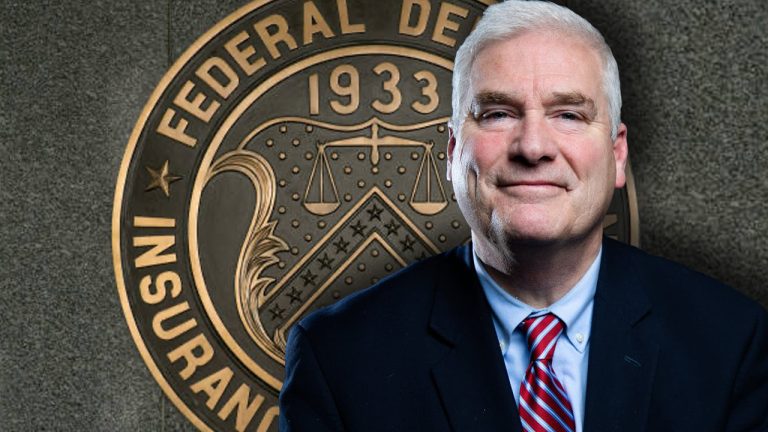

On Wednesday, Tom Emmer, the U.S. Republican congressman from Minnesota, revealed he sent a letter to Martin Gruenberg, the chairman of the Federal Deposit Insurance Corporation (FDIC), regarding reports that the FDIC is “weaponizing recent instability” in the U.S. banking industry to “purge legal crypto activity” from the United States. Specifically, Emmer asked Gruenberg if […]

On Wednesday, Tom Emmer, the U.S. Republican congressman from Minnesota, revealed he sent a letter to Martin Gruenberg, the chairman of the Federal Deposit Insurance Corporation (FDIC), regarding reports that the FDIC is “weaponizing recent instability” in the U.S. banking industry to “purge legal crypto activity” from the United States. Specifically, Emmer asked Gruenberg if […] On March 14, 2023, the U.K.-based bank Natwest Group announced new limits on cryptocurrency payments, citing crypto scams that cost U.K. consumers £329 million annually. The limit imposed on crypto exchanges is £1,000 daily ($1,215), with a 30-day limit of £5,000 ($6,077). Natwest’s Cautious Approach Towards Crypto Assets Prompts Another Transfer Limit Amid the banking […]

On March 14, 2023, the U.K.-based bank Natwest Group announced new limits on cryptocurrency payments, citing crypto scams that cost U.K. consumers £329 million annually. The limit imposed on crypto exchanges is £1,000 daily ($1,215), with a 30-day limit of £5,000 ($6,077). Natwest’s Cautious Approach Towards Crypto Assets Prompts Another Transfer Limit Amid the banking […] The parent company of Silicon Valley Bank, SVB Financial Group, and two senior executives have been sued by shareholders after SVB’s collapse last Friday. The proposed class action accuses SVB of hiding the fact that interest rate hikes would leave the bank in jeopardy. Additionally, anonymous sources say the U.S. Department of Justice (DOJ) and […]

The parent company of Silicon Valley Bank, SVB Financial Group, and two senior executives have been sued by shareholders after SVB’s collapse last Friday. The proposed class action accuses SVB of hiding the fact that interest rate hikes would leave the bank in jeopardy. Additionally, anonymous sources say the U.S. Department of Justice (DOJ) and […] Silicon Valley Bank (SVB) has become the center of attention after its collapse prompted the U.S. Federal Deposit Insurance Corporation (FDIC) to shut the bank down on Friday. It was the largest U.S. bank failure since 2008, and various alleged catalysts have been pointed to. Some believe venture capitalists caused a bank run, while others […]

Silicon Valley Bank (SVB) has become the center of attention after its collapse prompted the U.S. Federal Deposit Insurance Corporation (FDIC) to shut the bank down on Friday. It was the largest U.S. bank failure since 2008, and various alleged catalysts have been pointed to. Some believe venture capitalists caused a bank run, while others […]

A January survey from Paxos found that 89% of respondents still trusted “intermediaries” to hold their crypto, despite the collapses and bankruptcies last year.

American crypto users haven’t lost their trust in “intermediaries” to hold their crypto, with a January survey from Paxos suggesting a majority of United States crypto hodlers still trust banks, exchanges and mobile payment apps to custody their assets.

An annual online survey published on March 7 by the stablecoin issuer conducted on Jan. 5 and Jan. 6 sought to understand how the crypto winter and “large industry fallouts” in 2022 — including the bankruptcies of FTX and Alameda Research — impacted consumer behavior and confidence in the crypto ecosystem. Paxos noted:

“2022 was a rollercoaster year for the crypto industry.”

“Ranging from some of the highest Bitcoin prices ever to some of the lowest, largescale industry fallouts from companies like Terra, FTX, Alameda Research, and more — it was a volatile and potentially confidence-testing year for the ecosystem,” Paxos added.

After a turbulent end to 2022, crypto consumers have remained confident for 2023. We conducted a consumer survey and found many reasons why crypto is still viewed as a primary staple for financial livelihoods. Read our full survey here: https://t.co/AwFrGMuX0r pic.twitter.com/TZcmct0O5L

— Paxos (@PaxosGlobal) March 7, 2023

However, the survey found that of those that heard and followed the FTX saga, more than half (57%) of respondents either planned to buy more crypto or simply do nothing as a result of the news.

It also found that 89% of respondents still trusted “intermediaries” such as “banks, crypto exchanges and/or mobile payment apps” to hold their crypto, stating:

“In fact, despite the high-profile collapses and underlying poor risk management practices seen in several crypto companies, crypto owners still trust intermediaries to hold crypto on their behalf.”

The survey also found more desire from consumers to be able to buy Bitcoin (BTC), Ether (ETH) and other digital assets from household or traditional banks, with 75% of respondents indicating they were “likely or very likely” to purchase crypto from their “primary bank” if it were offered, a 12 percentage point increase from the year before.

“Additionally, 45% of respondents reported they would be encouraged to invest more in crypto if there was more mainstream adoption by banks and other financial institutions,” Paxos added.

It said a "significant untapped opportunity" existed for banks if they expanded offerings to digital assets. "Not only would these services satisfy increasing demand, but they would also result in higher engagement,” Paxos claimed.

Related: Paxos is engaged in ‘constructive discussions’ with SEC: Report

Respondents qualified for the survey if they lived in the United States, were over 18 years of age, had a total household income greater than $50,000 and purchased cryptocurrency sometime within the last three years. The survey recruited 5,000 participants.

“Despite the volatile 2022 crypto landscape, consumers didn’t lose faith in their crypto investments. This number was unchanged from the previous year’s report, underlining the long-term confidence of those participating in crypto markets,” wrote Paxos.

The timing of the survey, however, means that the gleaned results did not take into account more recent crypto headwinds, such as the bankruptcy of crypto lender Genesis, the crackdown on Binance USD (BUSD) involving Paxos and the financial uncertainty of crypto bank Silvergate Capital.

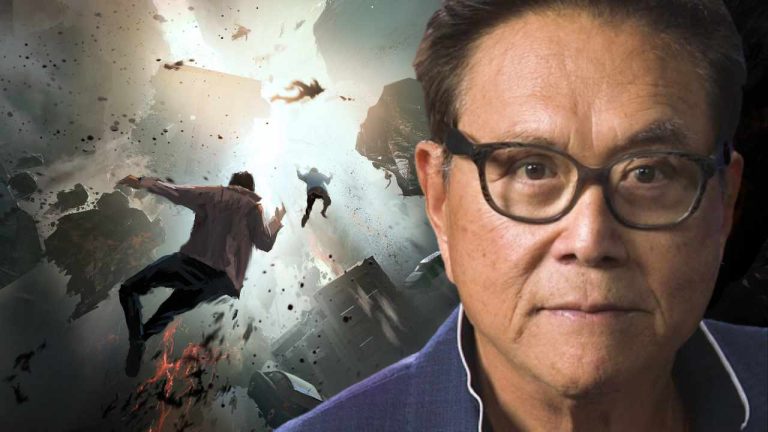

The famous author of the best-selling book Rich Dad Poor Dad, Robert Kiyosaki, says the world economy is on the verge of collapse. He warned investors about the risks of bank runs, frozen savings, and bail-ins that may come next. Robert Kiyosaki on Collapsing World Economy The author of Rich Dad Poor Dad, Robert Kiyosaki, […]

The famous author of the best-selling book Rich Dad Poor Dad, Robert Kiyosaki, says the world economy is on the verge of collapse. He warned investors about the risks of bank runs, frozen savings, and bail-ins that may come next. Robert Kiyosaki on Collapsing World Economy The author of Rich Dad Poor Dad, Robert Kiyosaki, […] According to a recent report from sources familiar with the matter, Mastercard and Visa, the credit card and payment services giants, are halting new partnerships with cryptocurrency firms. This news comes after the collapse of several cryptocurrency ventures that offered crypto debit cards and failed due to financial difficulties last year. After the report published, […]

According to a recent report from sources familiar with the matter, Mastercard and Visa, the credit card and payment services giants, are halting new partnerships with cryptocurrency firms. This news comes after the collapse of several cryptocurrency ventures that offered crypto debit cards and failed due to financial difficulties last year. After the report published, […]