Non-fungible token (NFT) sales have soared this past week, climbing 138.15% higher than the week before. Sales recorded between last Friday and Feb. 24, 2023, indicate that $801 million in NFT sales have been settled over the last seven days. Ethereum Digital Collectibles and Mutant Ape Yacht Club Lead NFT Sales Surge While crypto asset […]

Non-fungible token (NFT) sales have soared this past week, climbing 138.15% higher than the week before. Sales recorded between last Friday and Feb. 24, 2023, indicate that $801 million in NFT sales have been settled over the last seven days. Ethereum Digital Collectibles and Mutant Ape Yacht Club Lead NFT Sales Surge While crypto asset […]

Crypto’s value increases with more users, creating a positive feedback loop due to the network effect.

The network effect is a phenomenon where the value of a product or service increases as more people use it. As the user base grows, there are more opportunities for interactions, which can lead to increased benefits and positive outcomes for each user.

The network effect is a powerful driver of growth and adoption for many technologies and platforms, including social media, messaging apps and marketplaces.

The network effect is also a central concept in the world of cryptocurrency. In general, it means that a cryptocurrency’s value rises as more people use it. This is because a larger user base results in higher liquidity and trading volume, which increases acceptance and utilization.

For instance, the enormous and expanding user base of the Bitcoin network creates a powerful network effect that has increased its market acceptability, liquidity and value. A self-reinforcing cycle develops when more people use Bitcoin (BTC) because it becomes more valuable to each individual user as more people use it.

ETH is Bitcoin Killer.

— Kashif Raza (@simplykashif) August 22, 2021

Solana is ETH Killer.

Soon,.........is Solana Killer.

In crypto, narratives keep changing every now and then.

The basic parameter to find a winner in the crypto space is to see the "network effect".

The success of cryptocurrencies is largely due to the network effect, which is one of the reasons why early adoption can be so important for long-term investment returns. However, it’s crucial to remember that the network effect is not a guarantee of success and that other factors can affect a cryptocurrency’s value and uptake, including technological developments, competition, news and market sentiment.

The network effect significantly impacts the value of nonfungible tokens (NFTs). NFTs become increasingly beneficial to each user as more individuals adopt and use them. With a larger user base comes more liquidity, demand and chances for purchasing and repurchasing NFTs.

It’s also easier for musicians, artists and producers to make money from selling NFTs as more people use them.

Related: How do you assess the value of an NFT?

Nonetheless, it’s essential to note that the network effect is not the only factor that influences the adoption of NFTs. Other factors, such as ease of use, security and the quality of the underlying digital asset, can also impact the adoption of NFTs. Regardless, the network effect is a key driver of growth and adoption for NFTs, and it is likely to play an important role in future development.

The network effect creates a cycle of growth and adoption when users and activity on decentralized finance (DeFi) or Web3 apps and networks increases, ultimately raising the value and utility for all participants.

For instance, decentralized exchanges (DEXs) like Uniswap and SushiSwap become more valuable as more users and liquidity providers join, leading to tighter spreads, deeper order books and better prices for traders.

Related: DeFi vs. Web3: Key differences explained

Similarly, NFT marketplaces like OpenSea and Rarible benefit from network effects as more creators and collectors join, leading to a wider variety of unique and valuable assets, higher trading volumes and more visibility for the platform.

Monetizing digital art with NFTs provides proof of ownership, increased value and potential for royalties.

Nonfungible tokens (NFTs) offer a new way to sell and distribute digital art, and they have the potential to unlock new revenue streams for artists in the digital age. Here are five ways to monetize your digital art with NFTs.

This involves splitting the ownership of an artwork into smaller parts and selling them as tokens, allowing multiple investors to own a stake in the artwork. For example, an artist can create 100 tokens for a piece of art and sell them to 100 different buyers, each of whom owns a share of the artwork.

Related: How do you assess the value of an NFT?

Dynamic NFTs are a type of NFT that changes over time, creating a unique and evolving experience for the owner. Dynamic NFTs can use external data sources to update the artwork, such as social media feeds or actual occurrences.

For example, “The Eternal Pump” is a dynamic NFT that changes in response to the rise and fall of the cryptocurrency market. The artwork gets more complex and elaborate as the value of cryptocurrencies rises, while it gets more straightforward and abstract as their value falls. Because they allow viewers to follow changes to the artwork and see it develop over time, dynamic NFTs can bring a new degree of involvement and engagement to collectors.

Feeling incredibly fortunate to have been one of the lucky few to pick up one of @dmitricherniak's works, The Eternal Pump, on the @artblocks_io Artist Playground today. Another stunning body of work by a fantastic artist. pic.twitter.com/NRywp1kQaC

— pixelpete (@pixelpete) February 22, 2021

Dynamic NFTs can be monetized via auction, where collectors can bid on them, and the highest bidder takes ownership. Dynamic NFTs that are highly sought after, due to their unique features and evolving nature, can command high prices at auction. Additionally, using subscription-based systems, artists can offer collectors exclusive dynamic NFTs for a fee. These NFTs might vary frequently, offering subscribers a steady stream of fresh content.

NFTs can be programmed to automatically pay the artist a percentage of the sale each time the NFT is resold on a secondary market. This allows artists to continue to profit from their work even after the initial sale. For example, the digital artist Pak sold an NFT called “The Fungible” for $502,000, and the NFT was automated to pay the artist a 10% royalty on every subsequent sale. Since then, the NFT has been resold multiple times, and the artist has earned over $2 million in royalties.

X/X: Cube

— Pak (@muratpak) April 6, 2021

Fungible* Open Editions

The number of owned cubes will deliver a personalized set of NFTs totaling the same fungible cube count. pic.twitter.com/p5qO4NgHJp

This involves creating interactive nonfungible tokens that users can play with or use in games. For example, Axie Infinity is a game that uses NFTs as game assets, with players able to buy, sell and trade them to build their game characters.

In addition, NFTs can be given as rewards for achieving particular goals or activities in a game or app. For instance, a fitness app may offer nonfungible tokens to users who reach their daily workout targets.

Related: What is STEPN (GMT)? A beginner’s guide on the Web3 lifestyle app

Physical asset tie-ins with NFTs involve linking a physical object to a unique digital asset, typically using a unique identifier or code. This can provide a way to verify the authenticity and ownership of the physical object, while also allowing for the transfer of ownership and value of the associated digital asset.

That said, an NFT can be used to represent ownership of a physical asset, such as a piece of real estate or a car. For instance, a company called CarForce is developing NFTs that reflect ownership of high-end automobiles, with the NFT serving as a digital car key that permits the owner to enter and operate the actual automobile.

Related: What is tokenized real estate? A beginner’s guide to digital real estate ownership

Sales of non-fungible token (NFT) assets over the last seven days rose 43.97% compared to the previous week, according to statistics recorded on Feb. 18, 2023. The volume of NFT sales reached $397.86 million this week, with 345,716 NFT buyers and roughly 1.62 million transactions. NFT Sales Continue to Rise in 2023, Ethereum Dominates NFT […]

Sales of non-fungible token (NFT) assets over the last seven days rose 43.97% compared to the previous week, according to statistics recorded on Feb. 18, 2023. The volume of NFT sales reached $397.86 million this week, with 345,716 NFT buyers and roughly 1.62 million transactions. NFT Sales Continue to Rise in 2023, Ethereum Dominates NFT […] The largest marketplace for non-fungible tokens (NFTs), Opensea, has announced major changes to its fee structure and policies in response to a shift in the NFT ecosystem. The company detailed that it will drop fees to zero for a limited time and offer an optional creator earnings model with a minimum of 0.5% for all […]

The largest marketplace for non-fungible tokens (NFTs), Opensea, has announced major changes to its fee structure and policies in response to a shift in the NFT ecosystem. The company detailed that it will drop fees to zero for a limited time and offer an optional creator earnings model with a minimum of 0.5% for all […]

Foot fetishists and crypto degens have taken interest in an NFT collection boasting 10,000 unique pixelated trotters with over $1 million in trading volume.

Feetpix.wtf’s newly launched nonfungible token (NFT) collection, “Feetpix” has seemingly taken the NFT community by storm with surging trading volumes, prompting some to suggest the return of “degen” season.

Feetpix.wtf’s collection soared ahead of the likes of Bored Ape Yacht Club (BAYC) on Jan. 11 with the fifth-highest trading volume recorded on NFT marketplace OpenSea.

The project — which released 10,000 Feetpix NFTs — has traded over 825 Ether (ETH)($1,157,000) across nearly 18,000 transactions since its release on Jan. 8.

Crypto Twitter is still split on what inspired the surge in foot fetish-NFT trading volumes, though Feetpix noted the absence of a roadmap, promise and marketing scheme suggested a “love for feet” is not just legitimate but also clearly monetizable through the use of digital art.

0 Roadmap

— feetpix (@feetpixwtf) January 10, 2023

0 Promises

0 Marketing

0 Paid influencers

1 Common love for feet pic.twitter.com/Z8R8BWTXFh

Several Twitter users highlighted the absurd, short-term success of the project, suggesting a return of “degen szn” (season) which entailed a mass trading volume of high-risk NFT collectibles at the peak of the bull market in 2021.

But even the creators themselves implied something could be mentally wrong with collectors, suggesting buyers “stop buying feetpix” and instead “use that money for therapy.”

Game of Thrones’ highly anticipated "Build Your Realm" NFT collection launch has received a hefty dose of criticism despite completely selling out in seven hours on the NFT marketplace Nifty’s.

The collection was described by the pseudonymous co-founder of Web3 gaming project Treeverse, Loopify, on Jan. 11 as the “worst thing I’ve ever seen.”

Game Of Thrones NFT reveal

— Loopify ♂️ (@Loopifyyy) January 11, 2023

this is the worst thing I’ve ever seen pic.twitter.com/sMudsJgP2z

Loopify told their 200,000 Twitter followers in a separate post that some of the avatars possessed “salad fingers.”

NFT enthusiast Justin Taylor shared his criticism with his nearly 60,000 Twitter followers stating the launch lacked “creative vision” and was outright “terrible.”

This Game of Thrones NFT collection is just like the the last season of the show.

— Justin Taylor (@TheSmarmyBum) January 11, 2023

No creative vision and terrible pic.twitter.com/I0v7cXai5N

The first series NFT collection was born from a collaboration between Nifty’s and NFT production company Daz 3D, where each NFT is minted on Palm — an Ethereum-compatible sidechain — allowing collectors to create their own unique realms and avatars.

While the fast sellout came as little surprise due to the popularity of the show, many collectors reported issues with the minting process in addition to the widespread disappointment of the poorly designed avatars.

Yuga Labs — the creative team behind the BAYC — is set to expand its NFT ecosystem with the launch of a skill-based NFT game called “Dookey Dash.”

In order to participate, BAYC and Mutant Ape Yacht Club (MAYC) holders will need to mint a “Sewer Pass” on Jan. 17 in order to start playing the game on Jan. 18.

Apes, stretch your eyeballs and warm up your scroll muscles — lots of new info about next week. Short version: monkey butthole, Sewer Pass January 17, skill-based mint begins January 18, new power sources. Video explainer coming soon, more at https://t.co/h8JXeLkC57, and the pic.twitter.com/bF1h2qAXrM

— Bored Ape Yacht Club (@BoredApeYC) January 12, 2023

The aim of the game will be to navigate the sewer, claim as many NFT rewards as possible and record the highest score until Feb. 8 when the leaderboard freezes.

“Sewer Pass holders will compete for the highest score and earn their new power source," the BAYC wrote, adding “the highest single-run score on your specific Sewer Pass and accompanying wallet that achieved the run will determine what it reveals."

However, it’s not clear what the prizes will consist of with Yuga stating on BAYC’s Twitter account that prizes will “evolve throughout 2023.”

The four-week Dookey Dash experiment also appears to be the first part of a narrative experience, with segments “It’s Alive!” and “Chapter 1” expected to proceed with the “Sewer Close” on Feb. 8, according to a roadmap set out by Yuga.

Tennis Australia has confirmed it’s still investing in the NFT space, by continuing its Australian Open (AO) Artball NFT collection it created last year as a means to engage NFT collectors and tennis fanatics.

The Artball NFT serves to “leverage live match data to deepen global fan engagement beyond a tournament” through the digital realm, according to the Artball website.

(1)

— AOmetaverse (@AOmetaverse) January 10, 2023

Players ready?

Want to get your hands on the ball that has it all? The #AO23 collection mints soon, with brand new plots on the court and a Membership Multiplier https://t.co/5djxX1Sm1b

Let’s swing into it pic.twitter.com/B3oxu5pfU2

With 6776 Australian Open Artballs sold in last year’s collection, an additional 2,454 Artballs will hit the market in time for the 2023 tournament, which officially kicks off next Monday, Jan. 16 in Melbourne.

According to the website each Australian Open ArtBall is linked to live match data corresponding to a 17cm by 17cm plot on the court.

If a winning shot from any match lands on a collector's plot the NFT metadata will be updated in real time and the collector will be rewarded.

One of the special ArtBalls is Artball SuperSight which enables an entire suite of exclusive 360-degree front-row viewing tools, a 3D stats explorer and personalized streams that has been “custom built” for members.

Collectors will also be in the running to win two free tickets to the equivalent live match in AO24 if their Artball scores a “Match Point” in AO23 in addition to being granted access to “exclusive behind-the-scenes streams.”

Artball minting is currently subject to a waitlist, according to the AOmetaverse Twitter page.

NFT platform Upshot has created a trading tool that scores and classifies wallets based on their trading success, which will enable crypto newcomers to get a closer look into the strategies adopted by successful collectors.

Blockchain security firm SlowMist revealed a sneaky trick scammers used in 2022 to steal NFTs was a “zero dollar purchase” scam where victims were tricked into signing over NFTs for basically no cost in a fake sales order, with scammers able to purchase the NFTs through a marketplace at a price they determined.

The multinational mass media and entertainment conglomerate Warner Bros. has announced the firm is working with Cartamundi Group in order to launch DC Comics-themed hybrid trading cards. DC multiverse fans can leverage the Hro application in order to gain access to their favorite DC superheroes, supervillains, and other DC characters. Warner Bros. Reveals DC Comics-Themed […]

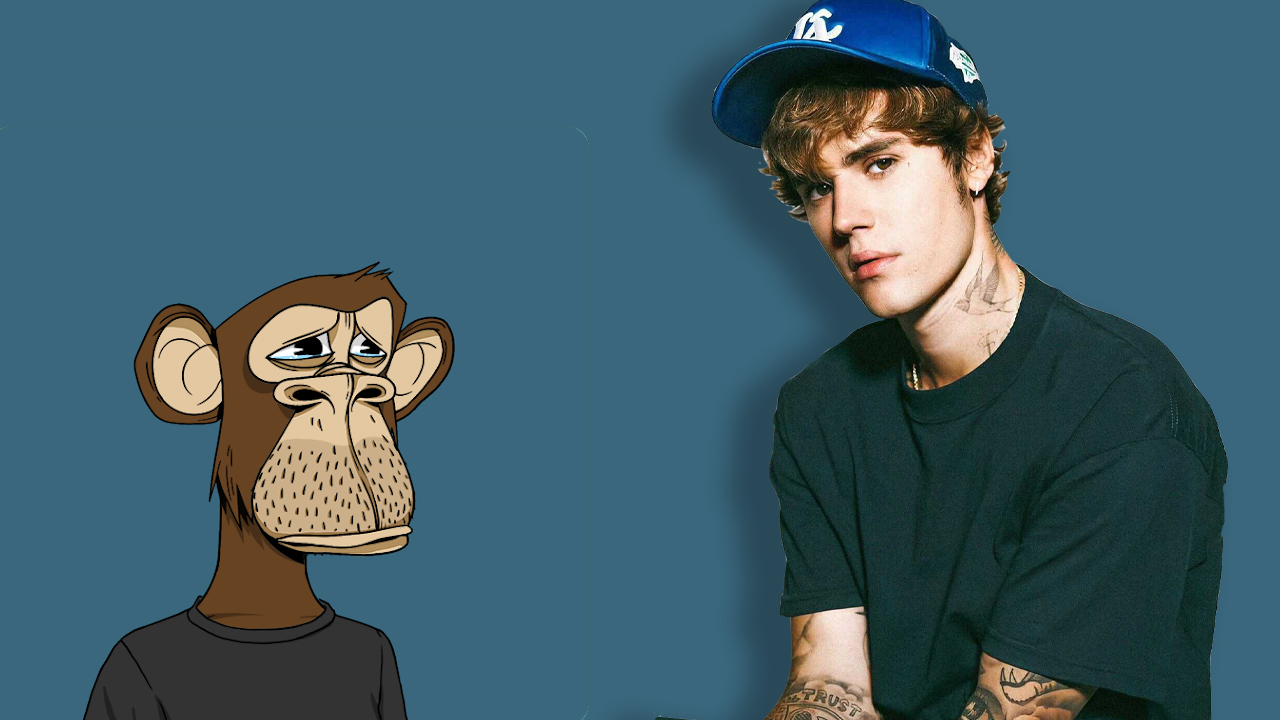

The multinational mass media and entertainment conglomerate Warner Bros. has announced the firm is working with Cartamundi Group in order to launch DC Comics-themed hybrid trading cards. DC multiverse fans can leverage the Hro application in order to gain access to their favorite DC superheroes, supervillains, and other DC characters. Warner Bros. Reveals DC Comics-Themed […] The Canadian singer Justin Bieber has purchased a Bored Ape Yacht Club (BAYC) non-fungible token (NFT) for 500 ethereum or $1.29 million at the time of settlement. Bieber has a significant collection of NFTs and his wallet holds 340.43 ether worth $879K. Justin Bieber Spends $1.29 Million in Ethereum for BAYC #3001 Justin Bieber spent […]

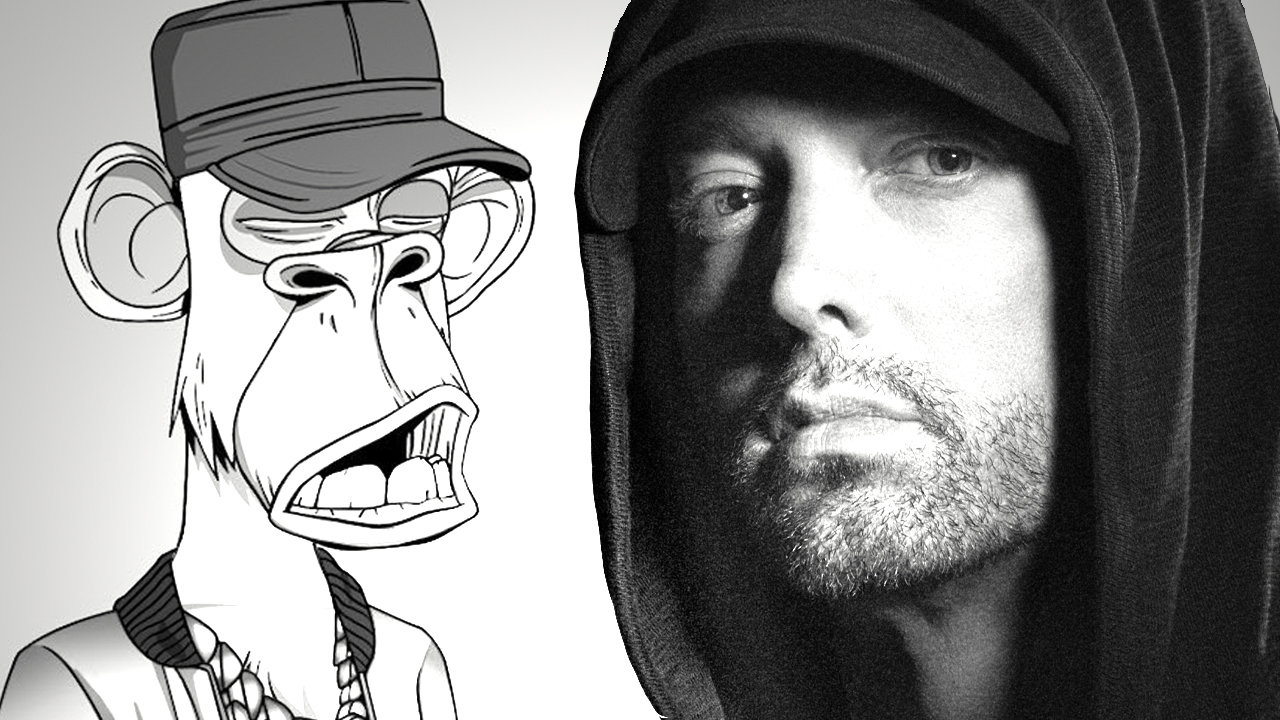

The Canadian singer Justin Bieber has purchased a Bored Ape Yacht Club (BAYC) non-fungible token (NFT) for 500 ethereum or $1.29 million at the time of settlement. Bieber has a significant collection of NFTs and his wallet holds 340.43 ether worth $879K. Justin Bieber Spends $1.29 Million in Ethereum for BAYC #3001 Justin Bieber spent […] Marshall Mathers, known professionally as Eminem has joined the community of bored apes by purchasing a Bored Ape Yacht Club (BAYC) non-fungible token (NFT) collectible for 123.45 ethereum or $452K at the time of settlement. Slim Shady Purchases Bored Ape Yacht Club #9055 for $452K The Bored Ape Yacht Club (BAYC) NFTs have been very […]

Marshall Mathers, known professionally as Eminem has joined the community of bored apes by purchasing a Bored Ape Yacht Club (BAYC) non-fungible token (NFT) collectible for 123.45 ethereum or $452K at the time of settlement. Slim Shady Purchases Bored Ape Yacht Club #9055 for $452K The Bored Ape Yacht Club (BAYC) NFTs have been very […] On September 15, the top non-fungible token (NFT) marketplace, Opensea, revealed that an Opensea executive profited from insider trading. “Yesterday we learned that one of our employees purchased items that they knew were set to display on our front page before they appeared there publicly,” Opensea informed the public on Wednesday. Opensea did not name […]

On September 15, the top non-fungible token (NFT) marketplace, Opensea, revealed that an Opensea executive profited from insider trading. “Yesterday we learned that one of our employees purchased items that they knew were set to display on our front page before they appeared there publicly,” Opensea informed the public on Wednesday. Opensea did not name […]