Uniswap, one of the main decentralized finance exchanges in the cryptocurrency world, is now taking measures to ensure illegal funds cannot be transacted using its platform. The company has already started blocking addresses linked to “blocked activities” and will apply a filter with data provided by TRM Labs, a blockchain analysis firm that focuses on […]

Uniswap, one of the main decentralized finance exchanges in the cryptocurrency world, is now taking measures to ensure illegal funds cannot be transacted using its platform. The company has already started blocking addresses linked to “blocked activities” and will apply a filter with data provided by TRM Labs, a blockchain analysis firm that focuses on […] According to the project’s official Twitter account, Tornado Cash, the ethereum mixing service that allows participants to shuffle ether, is blocking flagged ethereum addresses listed on the Office of Foreign Assets Control’s (OFAC) Specially Designated Nationals And Blocked Persons list (SDN). The decision follows the recent OFAC update, that lists the Ronin exploiter’s ethereum address, […]

According to the project’s official Twitter account, Tornado Cash, the ethereum mixing service that allows participants to shuffle ether, is blocking flagged ethereum addresses listed on the Office of Foreign Assets Control’s (OFAC) Specially Designated Nationals And Blocked Persons list (SDN). The decision follows the recent OFAC update, that lists the Ronin exploiter’s ethereum address, […]Using Crypto Tech to Promote Sanctions Compliance

By Paul Grewal, Chief Legal Officer

Coinbase is committed to building a safe and responsible financial system that promotes economic freedom around the world. We strive to be the most trusted platform for buying, selling, and exchanging digital assets, helping everyday people to participate in the crypto economy. We earn that trust by working hard to ensure the integrity of all transactions supported by our platform, and a critical part of that goal is our compliance with economic sanctions.

Coinbase is committed to complying with sanctions

In the past few weeks, governments around the world have imposed a range of sanctions on individuals and territories in response to Russia’s invasion of Ukraine. Sanctions play a vital role in promoting national security and deterring unlawful aggression, and Coinbase fully supports these efforts by government authorities. Sanctions are serious interventions, and governments are best placed to decide when, where, and how to apply them.

No compliance program is perfect, including ours. But to play our part in these critical economic sanctions, Coinbase implements a multi-layered, global sanctions program. We take steps to:

Crypto technology enhances sanctions compliance efforts

The benefits of digital assets for sanctions enforcement extend beyond these initiatives. Digital assets have properties that naturally deter common approaches to sanctions evasion.

Ordinary fiat currency laundered through traditional financial institutions remains one of the most common mechanisms for sanctions evasion and money laundering. As the United States Treasury noted of sanctions against Iran, the “Iranian regime has long used front and shell companies to exploit financial systems around the world” to evade sanctions.

An entire money laundering industry has emerged to hide assets in ordinary fiat currency using these techniques. By transacting through shell companies, incorporating in known tax havens, and leveraging opaque ownership structures, bad actors continue to use fiat currency to obscure the movement of funds. In this way, they leave complex financial trails that are difficult to trace, requiring investigators to separately request information from many different financial institutions, and follow a trail across multiple countries (some of which refuse to cooperate or take years to produce records).

By contrast, digital asset transactions are traceable, permanent, and public. As a result, digital assets can actually enhance our ability to detect and deter evasion compared to the traditional financial system.

In addition to these technical advantages, adoption of digital assets is still nascent, making their use for widespread sanctions evasion — the kind that robs sanctions of their impact — unlikely, a fact recently noted by a national security expert.

For example, the Russian government and other sanctioned actors would need virtually unobtainable amounts of digital assets to meaningfully counteract current sanctions. The Russian central bank alone holds over $630 billion in largely immobilized reserve assets. That’s larger than the total market capitalization of all but one digital asset, and 5–10x the total daily traded volume of all digital assets. As a result, trying to obscure large transactions using open and transparent crypto technology would be far more difficult than other established methods (e.g., using fiat, art, gold, or other assets). This doesn’t mean that bad actors can’t try, but circumventing restrictions on this scale would require massive purchases that would be prohibitively expensive and detectable, as this buying activity would likely lead to price spikes.

We are always working to build trust in the crypto industry

These are just some of the ways that industry best practices and crypto technology help to support sanctions compliance. Of course, no traditional or crypto business can guarantee that its sanctions controls are completely airtight. Malicious individuals may find ways around even the strongest barriers.

The transparency of the blockchain is a formidable tool for law enforcement, and platforms like Coinbase work very hard to partner with law enforcement to root out bad actors. There is also a legitimate interest in protecting the privacy of individuals — a public policy principle long recognized in the traditional financial system. We believe we can balance these interests by continuing to support law enforcement efforts while promoting policy frameworks that respect individual privacy.

Coinbase helps everyday people to protect, build, and share their wealth through crypto technology. At the same time, we vigorously work to promote security, safety, and transparency on our platform, including through our commitment to sanctions compliance. We welcome public scrutiny of the crypto industry, and will continue working to enhance our overall compliance program and industry compliance standards. This is an integral part of our ongoing commitment to remaining the trusted platform that we, our customers, and the public expect.

Using Crypto Tech to Promote Sanctions Compliance was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

On Wednesday, the publicly-listed cryptocurrency firm Coinbase announced the launch of a collaborative effort called TRUST, which stands for “Travel Rule Universal Solution Technology.” The plan is described as an “industry-driven solution” developed to comply with the Financial Action Task Force (FATF) Travel Rule. There are currently 18 crypto firms that have joined TRUST so […]

On Wednesday, the publicly-listed cryptocurrency firm Coinbase announced the launch of a collaborative effort called TRUST, which stands for “Travel Rule Universal Solution Technology.” The plan is described as an “industry-driven solution” developed to comply with the Financial Action Task Force (FATF) Travel Rule. There are currently 18 crypto firms that have joined TRUST so […] American Express’ Amex Ventures, Visa, Citi Ventures, DRW Venture Capital, Jump Capital, Marshall Wace, Block (formerly Square Inc.), and Paypal Ventures are among investors in the latest funding round of crypto transaction monitoring and forensics platform TRM. Amex, Visa, Citi, Paypal Invest in TRM Platform Crypto transaction monitoring and forensics platform TRM announced Tuesday investments […]

American Express’ Amex Ventures, Visa, Citi Ventures, DRW Venture Capital, Jump Capital, Marshall Wace, Block (formerly Square Inc.), and Paypal Ventures are among investors in the latest funding round of crypto transaction monitoring and forensics platform TRM. Amex, Visa, Citi, Paypal Invest in TRM Platform Crypto transaction monitoring and forensics platform TRM announced Tuesday investments […] The Royal United Services Institute (RUSI), the British defense and security think tank, questions whether or not non-fungible token (NFT) assets can be used for money laundering purposes. The report determines that in order to mitigate the money laundering risks a ‘know your customer’ monitoring system “needs to be implemented.” RUSI: ‘NFT Technology Can Raise […]

The Royal United Services Institute (RUSI), the British defense and security think tank, questions whether or not non-fungible token (NFT) assets can be used for money laundering purposes. The report determines that in order to mitigate the money laundering risks a ‘know your customer’ monitoring system “needs to be implemented.” RUSI: ‘NFT Technology Can Raise […] Dapper Labs, one of the most successful companies in the NFT space, has partnered with Chainalysis, a blockchain intelligence company, to increase its compliance profile in the NFT business. The company will use Chainalysis insights to have a better understanding of each one of the transactions that users make with their products and the purpose […]

Dapper Labs, one of the most successful companies in the NFT space, has partnered with Chainalysis, a blockchain intelligence company, to increase its compliance profile in the NFT business. The company will use Chainalysis insights to have a better understanding of each one of the transactions that users make with their products and the purpose […]By the Coinbase Special Investigations Team

Following the fall of the elected Afghan government and rise of the Taliban in its place, many speculated that the group had or may turn to cryptocurrencies as a way to finance its operations. As part of our compliance program, Coinbase tracks these types of transactions and often works with law enforcement agencies around the world on interdiction and enforcement efforts.

After conducting an exhaustive analysis of global crypto transactions, our Coinbase Special Investigations Team is sharing its findings below. To conduct this research, Coinbase relied on cryptocurrency data analyzed by Coinbase Analytics across various blockchains. This data study provides a holistic overview of terror funding using cryptocurrencies across the entire industry and is not limited to Coinbase.

With institutional and consumer interest in crypto at an all-time high, alongside the continued rise of DeFi, 2020 and 2021 have seen cryptocurrency achieve the mainstream adoption that the space has anticipated for many years.

While the industry has come a long way since Satoshidice, Mt. Gox, and the Silk Road, illicit activity has dwindled but not fully ceased. However, representing far less than 1% of all activity in the crypto space in 2020, illicit activity is no more of a concern for the cryptoeconomy than it is for the traditional financial system.(1)

Further breaking down illicit activity, we find that transactions associated with terrorist financing (TF) in 2020 made up less than 0.05% of all illicit volume. As such, terror funding in cryptocurrencies remains extremely low in overall terms.

Nevertheless, so long as any organization thinks it can use crypto for TF, we are committed to proving them wrong. To that end, we provide this update on our ongoing work.

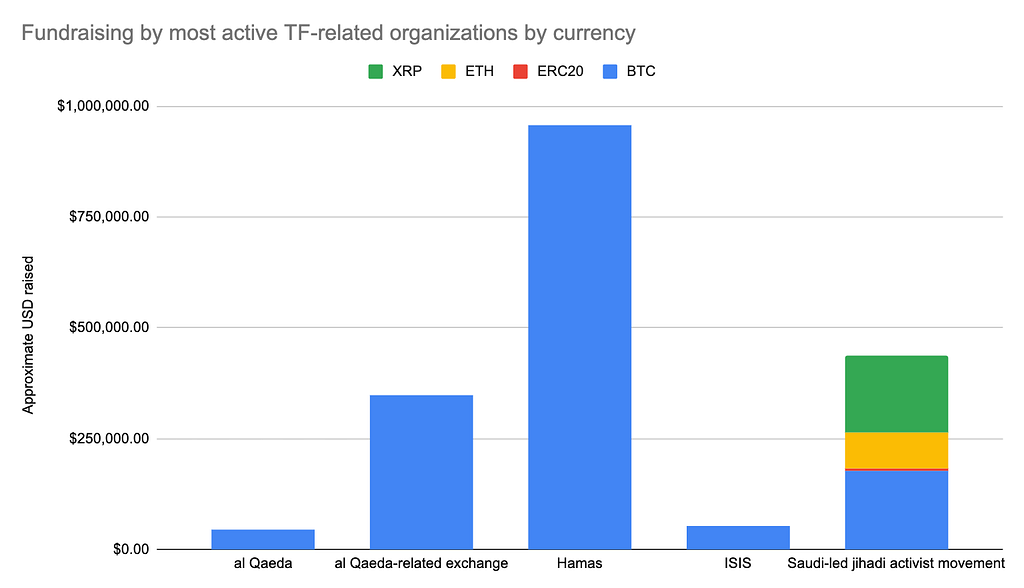

Our Coinbase Special Investigations team focused its research on the largest TF-related organizations’ fundraising efforts over the past few years. (2),(3),(4)

Assessing these organizations’ fundraising over time, we find that Hamas has raised the most funds, by far. This is likely because Hamas actively solicits donations primarily in the form of BTC on their website and related Telegram channels.

Breaking down these TF-related organization’s fundraising efforts, we find that Hamas’s fundraising efforts are staggering compared to the other organizations analyzed. Hamas first began soliciting donations in Bitcoin in January 2018, with a singular donation address. Within a few months, their fundraising tactics evolved to attempt obfuscate the funds raised by providing fresh donation addresses when accessing their donation page

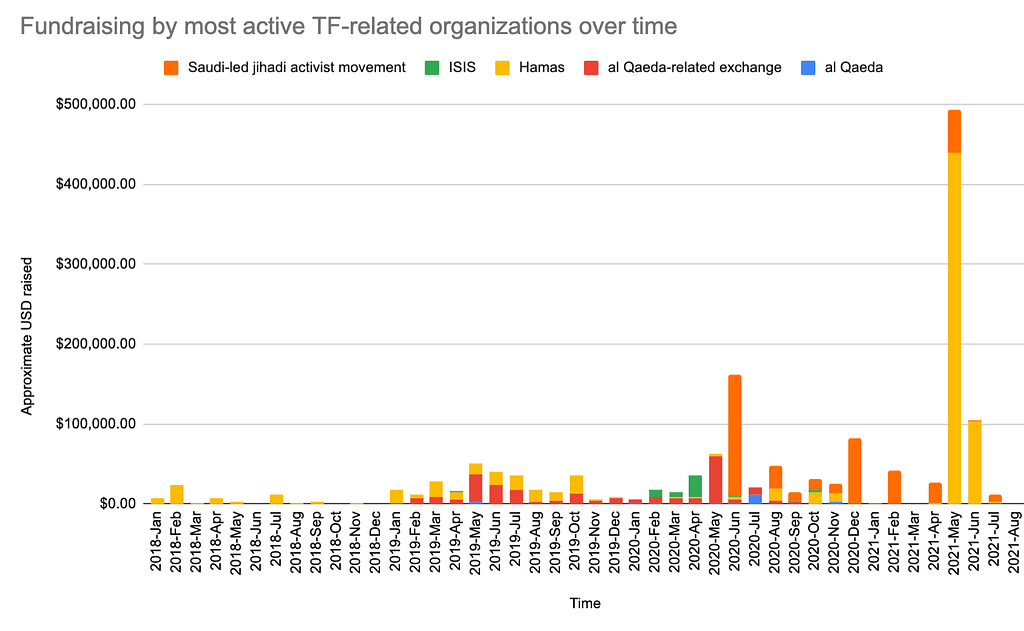

Periods of intensified fundraising activities by Hamas appear to correlate to the time frames of the most intense geopolitical conflict.

Removing Hamas’ fundraising efforts from the above chart, we find that the other TF-related organizations’ fundraising efforts trend for a finite period of time. For example, ISIS’ fundraising was primarily done between February and October 2020. This is likely due to various authorities taking its fundraising website down only for it to reappear months later.

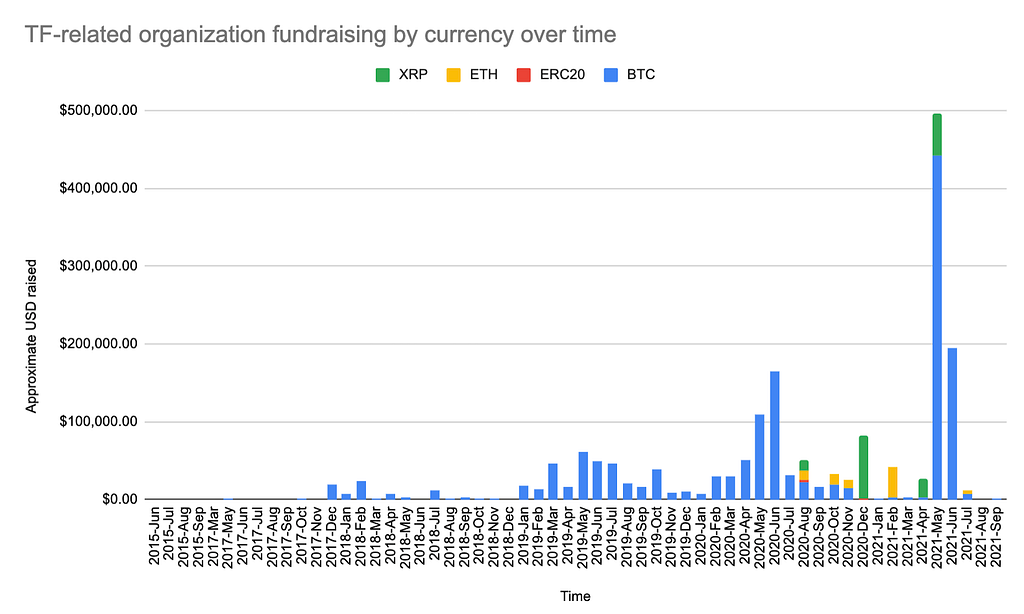

Further breaking down these TF-related organization fundraising efforts over time by currency, we find that although fundraising efforts continue in BTC across the TF-related organizations of interest, fundraising in ETH, ERC20s and XRP has fluctuated.

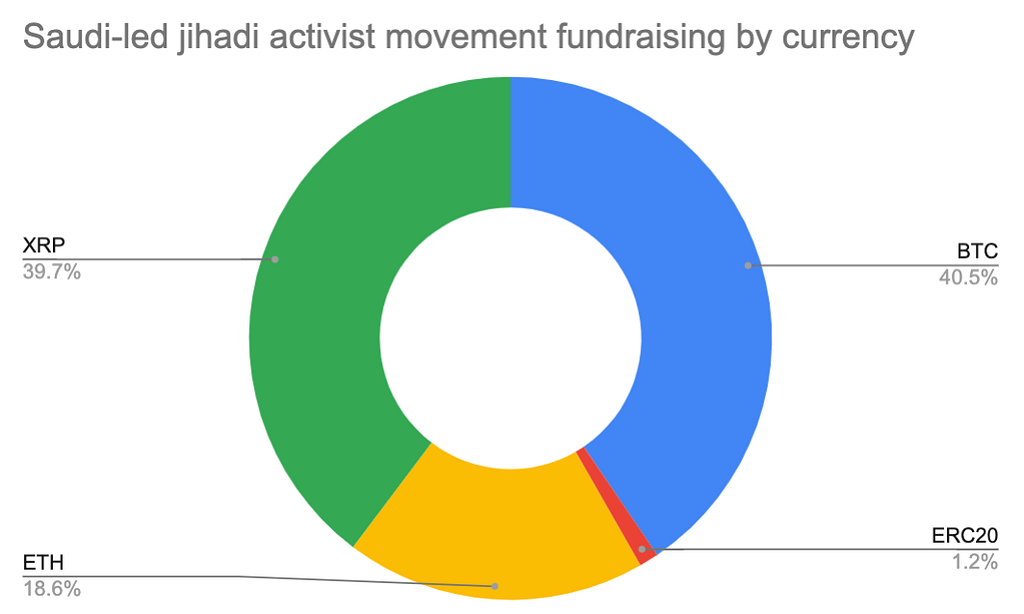

Beginning in August 2020 through August 2021, terror organizations began receiving ETH, ERC20 tokens, and XRP donations. This fundraising can solely be attributed to a Saudi-led jihadi activist movement, which began soliciting donations in the form of BTC, ETH, XRP, and various ERC20 tokens in 2020. The movement’s leader has advocated for the recent Taliban uprising in Afghanistan and appears to have incited violence against governments and countries, including Pakistan, Israel and the US on Twitter. A previous website belonging to the movement website was cited in a West Point study of Islamic terrorism.

Breaking down this movement’s fundraising by currency, we find that they have primarily raised funds in altcoins.

Coinbase is committed to minimizing — and ultimately ending — the use of crypto as a fundraising tactic for terrorist actors. Coinbase does not just actively research and identify trends in TF, we also take action. Preventing TF is a team effort that includes the Coinbase Special Investigations and Global Intelligence teams. After identifying a terror funding campaign, Coinbase takes at least three critical steps:

When it comes to terror funding, it is important to be accurate, but swift. Thanks to blockchain analytics, we can trace and accurately identify TF campaigns and do our part to stop them. TF may only make up less than 0.05% of all illicit activity, but it is and will always remain one of our highest priorities at Coinbase.

Footnotes

1) This percentage was taken from transactions on the BTC, ETH, LTC, BCH, and XRP blockchains/ledgers.

2) Please note that the selected organizations’ fundraising efforts have been amalgamated into generalized buckets. Coinbase included information in this analysis that could be independently confirmed through blockchain analytics.

3) Cryptocurrency USD values estimated at the time when donations were made.

4) Data last retrieved on August 24, 2021.

An overview of the use of cryptocurrencies in terrorist financing was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.