The growth of Core Scientific’s mining operations in 2024 resulted in the company achieving a total output of 6,595 BTC. Significant BTC Mining Output for Core Scientific Core Scientific, a bitcoin mining company announced its total mining output of 6,595 BTC for the entire 2024 with 974 BTC mined in Q4 2024. This was outlined […]

The growth of Core Scientific’s mining operations in 2024 resulted in the company achieving a total output of 6,595 BTC. Significant BTC Mining Output for Core Scientific Core Scientific, a bitcoin mining company announced its total mining output of 6,595 BTC for the entire 2024 with 974 BTC mined in Q4 2024. This was outlined […]

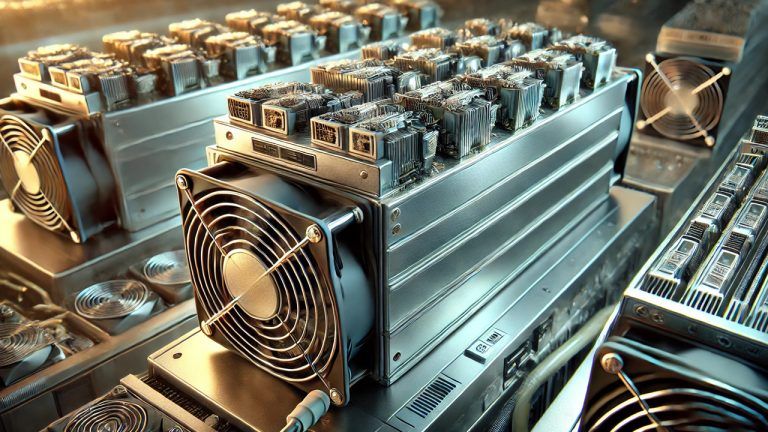

It comes as US Bitcoin miners have had to deal with delayed deliveries of Bitmain ASICs that have been stuck at US ports of entry for weeks.

Bitcoin mining hardware firm Bitmain says it has expanded its production line to the United States to improve supply chain efficiency, while trade tensions continue to escalate between China and the US.

“This strategic move aims to provide faster response times and more efficient services to the North American customers,” China-based Bitmain said in a Dec. 9 X post.

Bitmain is a crypto mining equipment manufacturer known for designing application-specific integrated circuit (ASIC) chips, with reports estimating it holds as much as a 90% marketshare of Bitcoin miners.

Core Scientific is converting its cryptocurrency mining campus in Denton, Texas, into a $6.1 billion data center hub for artificial intelligence (AI) workloads, signaling a shift in its business strategy amid increasing demand for AI-driven computing. Core Scientific’s Denton Campus to Host $6.1 Billion AI Project Core Scientific’s (Nasdaq: CORZ) revised lease agreements and power […]

Core Scientific is converting its cryptocurrency mining campus in Denton, Texas, into a $6.1 billion data center hub for artificial intelligence (AI) workloads, signaling a shift in its business strategy amid increasing demand for AI-driven computing. Core Scientific’s Denton Campus to Host $6.1 Billion AI Project Core Scientific’s (Nasdaq: CORZ) revised lease agreements and power […]

Deficit spending and lower interest rates have boosted global liquidity higher, benefiting Bitcoin and related markets, Blockware’s Mitchell Askew said.

Share prices of Bitcoin miners soared as high as 24.4% on Oct. 28 as Bitcoin rallied over $70,000 — with an analyst pointing to an increasingly favorable macroeconomic climate and miners’ continued diversification into AI.

“Deficit spending and lower interest rates are driving global liquidity higher [while] investors are fearful of high inflation over the long term, as evidenced by poor performance from treasury bonds since the Sept[ember] rate cut,” Mitchell Askew, head analyst at Bitcoin (BTC) mining firm Blockware told Cointelegraph.

As such, investors are turning to the Bitcoin markets where Bitcoin mining stocks are trading at a “beta.”

CoreWeave has exercised its final option agreement with Core Scientific, adding 120 MW of critical IT infrastructure to power Nvidia GPU operations.

Bitcoin miner Core Scientific has announced the expansion of its hosting contract with artificial intelligence computing firm CoreWeave.

According to an Oct. 22 announcement, the extended agreement adds 120 megawatts (MW) of power to CoreWeave’s high-performance computing (HPC) operations, bringing the total to 500 MW across six Core Scientific sites.

The revised partnership is expected to generate up to $8.7 billion in revenue over the next 12 years for Core Scientific.

Core Scientific has revealed that Coreweave has chosen to expand its high-performance computing (HPC) infrastructure by another 120 megawatts (MW), pushing the total contracted capacity to around 500 MW. Core Scientific and Coreweave Extend Partnership This contract extension could bring Core Scientific’s (Nasdaq: CORZ) total revenue up to $8.7 billion over the next 12 years. […]

Core Scientific has revealed that Coreweave has chosen to expand its high-performance computing (HPC) infrastructure by another 120 megawatts (MW), pushing the total contracted capacity to around 500 MW. Core Scientific and Coreweave Extend Partnership This contract extension could bring Core Scientific’s (Nasdaq: CORZ) total revenue up to $8.7 billion over the next 12 years. […]

Mining revenues hit 12-month lows in August, according to Bitbo.

Bitcoin (BTC) miners saw mining revenues dwindle to 12-month lows as the Bitcoin network’s April halving continues to erode mining output and, in turn, revenues, according to data from Bitbo, a Bitcoin dashboard.

Monthly BTC mining revenues declined to approximately $827 million in August 2024, according to Bitbo. That’s lower than any month since September 2023 and far below pre-halving peaks of almost $2 billion in March 2024.

Roughly every four years, a halving event hardcoded into the Bitcoin network cuts the number of BTC mined per block in half. The April halving reduced mining rewards from 6.25 BTC to 3.125 BTC per block.

Core Scientific, Inc., a prominent digital infrastructure provider for bitcoin mining, has revealed its intent to issue $350 million in convertible senior notes. This offering is anticipated to close in September 2029, with the raised capital earmarked primarily for debt repayment and other corporate necessities. Core Scientific Unveils Convertible Notes Offering, Eyes Debt Repayment On […]

Core Scientific, Inc., a prominent digital infrastructure provider for bitcoin mining, has revealed its intent to issue $350 million in convertible senior notes. This offering is anticipated to close in September 2029, with the raised capital earmarked primarily for debt repayment and other corporate necessities. Core Scientific Unveils Convertible Notes Offering, Eyes Debt Repayment On […] Core Scientific, a large U.S.-based bitcoin mining and hosting provider, and Block, a leading financial services firm, have partnered in a project to integrate the first 3nm bitcoin mining chips produced by the latter. Core Scientific will receive 15 exahash per second (EH/s) of Block’s mining ASIC chips, with the possibility of ordering additional silicon […]

Core Scientific, a large U.S.-based bitcoin mining and hosting provider, and Block, a leading financial services firm, have partnered in a project to integrate the first 3nm bitcoin mining chips produced by the latter. Core Scientific will receive 15 exahash per second (EH/s) of Block’s mining ASIC chips, with the possibility of ordering additional silicon […]

CleanSpark CEO Zach Bradford said his firm has set its sights on increasing future hashrate instead of branching out to alternative revenue streams.

Bitcoin miner CleanSpark increased its Bitcoin production by 6.7% in June and surpassed its mid-year hashrate target of 20 exahashes per second (EH/s).

The United States-based miner only sold 8 of the 445 Bitcoin (BTC) it mined in June, bringing its total Bitcoin holdings to 6,591 BTC as of June 30, worth more than $4 billion at current prices.

In a July 2 statement, CleanSpark CEO Zach Bradford said that the firm’s hashrate now stands at 20.4 EH/s — more than double what it was in December 2023.