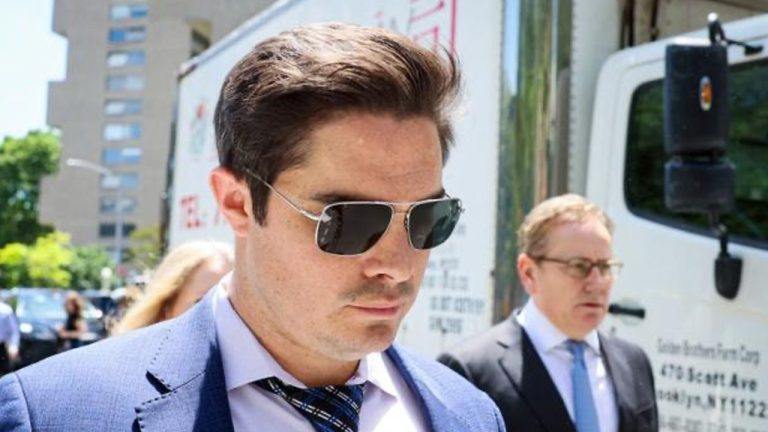

Ryan Salame, a former executive at the now-defunct cryptocurrency exchange FTX, has filed a motion to withdraw his guilty plea in federal court. Salame claims that prosecutors breached an agreement that led him to plead guilty by resuming an investigation into his domestic partner, Michelle Bond. Ryan Salame Challenges Guilty Plea, Claims Government Reneged on […]

Ryan Salame, a former executive at the now-defunct cryptocurrency exchange FTX, has filed a motion to withdraw his guilty plea in federal court. Salame claims that prosecutors breached an agreement that led him to plead guilty by resuming an investigation into his domestic partner, Michelle Bond. Ryan Salame Challenges Guilty Plea, Claims Government Reneged on […]

The US commodities regulator didn’t seek a civil monetary penalty, meaning the entire $12.7 billion would be used to pay back FTX’s creditors.

Bankrupt cryptocurrency exchange FTX and the United States commodities regulator have agreed to a $12.7 billion settlement, resolving a 19-month long lawsuit.

The agreement comes after months of back-and-forth negotiations and is now only subject to court approval, a recently released July 12 filing shows.

"The Proposed Settlement is an integral and valuable component of the Debtors’ proposed chapter 11 reorganization plan," said Commodity Futures Trading Commission senior trial attorney Carlin R. Metzger and FTX’s CEO John. J Ray III.

Following Genesis Global Capital’s receipt of authorization to divest its Grayscale fund holdings, reports disclose that Genesis executed the sale last week. The proceeds were then used to procure 32,041 bitcoin, aimed at reimbursing its clientele. Genesis Liquidates Grayscale GBTC Holdings According to Bloomberg Law, court filings dated April 2 reveal that Genesis liquidated approximately […]

Following Genesis Global Capital’s receipt of authorization to divest its Grayscale fund holdings, reports disclose that Genesis executed the sale last week. The proceeds were then used to procure 32,041 bitcoin, aimed at reimbursing its clientele. Genesis Liquidates Grayscale GBTC Holdings According to Bloomberg Law, court filings dated April 2 reveal that Genesis liquidated approximately […] In an email found within the motion by Digital Currency Group (DCG) and Barry Silbert to dismiss the lawsuit initiated by the New York Attorney General, discussions of a potential merger between Gemini and Genesis were revealed before Genesis ultimately opted to declare bankruptcy. “Combined Gemini and Genesis would be a juggernaut and would be […]

In an email found within the motion by Digital Currency Group (DCG) and Barry Silbert to dismiss the lawsuit initiated by the New York Attorney General, discussions of a potential merger between Gemini and Genesis were revealed before Genesis ultimately opted to declare bankruptcy. “Combined Gemini and Genesis would be a juggernaut and would be […] Genesis Global Capital has received authorization to offload its stake in Grayscale’s Bitcoin Trust (GBTC), valued at approximately $1.3 billion. Genesis Global Permitted to Liquidate $1.3 Billion in Bitcoin Trust Shares According to Bloomberg, Genesis Global Holdco LLC secured Judge Sean Lane’s approval to liquidate its GBTC investments, currently estimated at $1.3 billion. The request […]

Genesis Global Capital has received authorization to offload its stake in Grayscale’s Bitcoin Trust (GBTC), valued at approximately $1.3 billion. Genesis Global Permitted to Liquidate $1.3 Billion in Bitcoin Trust Shares According to Bloomberg, Genesis Global Holdco LLC secured Judge Sean Lane’s approval to liquidate its GBTC investments, currently estimated at $1.3 billion. The request […]

BlockFi argues its creditors, not FTX’s, are the “ultimate victims” of FTX’s alleged fraud.

Bankrupt cryptocurrency lender BlockFi is trying to block attempts by the similarly bankrupt FTX and Three Arrows Capital (3AC) that aim to retrieve hundreds of millions of dollars to pay back their creditors.

BlockFi claimed in an Aug. 21 filing to a New Jersey bankruptcy court that its own creditors shouldn’t be pushed to the back of the line because FTX’s creditors were harmed by the exchange allegedly misappropriating $5 billion BlockFi lent it.

“FTX seeks to recover on over $5 billion of claims filed against the BlockFi estates at the direct expense of the ultimate victims of FTX’s fraud: BlockFi’s clients and other legitimate creditors.”

“To prevent further injustice to the creditors of BlockFi’s estates, the Court should disallow the FTX Claims under the doctrine of unclean hands,” BlockFi added.

FTX also provided $400 million to BlockFi in June 2022 in addition to buying BlockFi equity pursuant to a loan agreement, the filing stated.

However, BlockFi claimed it wasn’t a standard loan agreement — it was an unsecured, 5-year term that was well below market interest rates and repayments weren’t due until the firm would supposedly mature.

BlockFi referred to FTX’s investment as a “gamble” that BlockFi creditors shouldn’t be liable for.

“Just because FTX’s fraudulent actions caused FTX’s bet to fail does not mean BlockFi’s creditors are now somehow liable to refund the purchase price,” it argued.

Estimates show BlockFi owes up to $10 billion to over 100,000 creditors including $1 billion to its three largest creditors and $220 million to bankrupt crypto hedge fund 3AC.

BlockFi claimed 3AC committed fraud with the money it borrowed and argued it also shouldn’t be entitled to a potential repayment.

BlockFi claims its litigation with FTX, 3AC and other firms could cost it up to $1 billion — impacting the amount its creditors are owed.

Related: BlockFi opens crypto withdrawals for eligible US users following court order

Several BlockFi creditors previously accused the firm of overlooking several red flags before transacting with FTX and its trading firm Alameda Research in the months prior to FTX’s collapse in November 2022.

Despite this, creditors settled with BlockFi last month to move forward with a repayment plan.

BlockFi filed for Chapter 11 bankruptcy on Nov. 28, about two weeks after FTX similarly filed for bankruptcy.

Magazine: Deposit risk: What do crypto exchanges really do with your money?

One judge has ruled on a key crypto case of late, while the other has ruled on high-profile political cases in the United States in recent times.

Court filings have revealed the names of the two United States District Court Judges that will preside over the Coinbase and Binance lawsuits brought against them by the U.S. Securities and Exchange Commission.

The case of SEC v Coinbase will be heard by District Court Judge Jennifer H. Rearden in the Southern District of New York, filings show.

Meanwhile, District Court Judge Amy Berman Jackson will tackle the case of SEC v Binance in the District of Columbia, according to recent filings.

Rearden, aged 53, was nominated by President Joe Biden to be a United States district judge in January 2022. She was confirmed by the Senate last September.

While Rearden’s tenure has been fairly short, she recently ruled on a crypto-related matter which involved a brush with Binance.US.

On March 27, Rearden approved the U.S. DOJ’s emergency motion to temporarily halt a $1.03 billion deal between Binance.US and the bankrupt crypto lending platform Voyager Digital.

The decision meant that impacted Voyager customers would have to wait longer to be paid out.

Rearden applied the “balance of hardship” test to arrive at the decision in favor of the U.S. government:

This later proved to be a deal breaker for Voyager, with Binance.US pulling out of the deal a month later, blaming a “hostile and uncertain regulatory climate in the United States” for its change in heart.

Voyager’s bankruptcy plan was finally approved on May 17 — however not by Rearden.

Prior to serving as a judge, Rearden worked as a commercial litigator and received her Juris Doctorate from New York Law School in 1996.

It should be noted that a judge's background, experience, or previous rulings in other cases are not an indication of the outcome of future cases.

Judge Jackson, aged 68, was appointed as a United States District Judge in March 2011 by then-U.S. President Barack Obama. Prior to that, she received her Juris Doctorate from Harvard Law School.

While Jackson has provided opinions in 888 cases, it appears that none of them have related to cryptocurrency-related disputes.

The SEC v. @Binance case has just been assigned to D.C. Judge Amy Berman Jackson.

— MetaLawMan (@MetaLawMan) June 7, 2023

Judge Berman Jackson previously served as a federal prosecutor, but she has also worked on the criminal defense side.

She was appointed to the bench by President Obama in 2010.

She has presided…

She has, however, adjudicated on several highly political disputes in recent times.

Jackson sentenced Paul Manafort Jr and Roger J. Stone Jr — former advisers and friends of former U.S. President Donald Trump — to 43 and 40 months imprisonment, respectively, over a series of charges related to a Russia investigation in 2019.

Trump shared negative sentiment towards Jackson and her decision.

Is this the Judge that put Paul Manafort in SOLITARY CONFINEMENT, something that not even mobster Al Capone had to endure? How did she treat Crooked Hillary Clinton? Just asking! https://t.co/Fe7XkepJNN

— Donald J. Trump (@realDonaldTrump) February 12, 2020

In May, Jackson approved a motion filed by the U.S. Department of Justice to block a deposition of Trump that was related to two other lawsuits filed by former FBI officials.

Jackson served as an assistant U.S. attorney in D.C. between 1980-1986.

While there, she received Department of Justice special achievement awards for her work on several high-profile murder and sexual assault cases.

Related: US federal judge approves of Justice Dept criminal complaint on using crypto to evade sanctions

The SEC sued Binance on June 5 and Coinbase on June 6, alleging the exchanges broke various securities rules, most notably for purportedly offering cryptocurrencies that the regulator considers to be unregistered securities.

Binance was accused of operating illegally in the United States.

Binance and Coinbase have both confirmed they will “vigorously” defend the lawsuits laid against them.

Magazine: Tornado Cash 2.0 — The race to build safe and legal coin mixers

Crypto mining firm Riot Platforms seeks to terminate “certain hosting agreements” with Rhodium and requests exemption from any owed power credits to the counterparty.

Crypto mining firm Riot Platforms – formerly Riot Blockchain – has taken legal action in an effort to recover “more than $26 million” in alleged unpaid fees from Texas-based Bitcoin (BTC) miner, Rhodian Enterprises.

According to Riot Platform's Q1 2023 financial report published on May 10, Whinstone, a wholly owned subsidiary of Riot, filed a petition on May 2 in the 20th District Court of Milam County, Texas. It alleged that Rhodium Enterprises breached its contract by failing to pay hosting and service fees associated with its use of Whinstone's facilities for mining operations.

Riot is seeking to recover “more than $26 million,” plus legal fees and other expenses that are incurred during the legal proceedings, as outlined in the report.

It was further requested that “certain hosting agreements” with Rhodium are terminated and proposed that it is exempt from repaying any outstanding power credits to the Texas-based Bitcoin mining company.

Although the disclosure of unpaid fees was stated, Riot was transparent with stakeholders, acknowledging that “the likelihood” of recovering the funds at this stage is uncertain. It noted:

“Because this litigation is still at this early stage, we cannot reasonably estimate the likelihood of an unfavorable outcome or the magnitude of such an outcome, if any.”

It was reported that Rhodium was served on May 8, and have until May 30 to respond.

Related: Complaint filed against Compass Mining for losing BTC mining machines hits snag

The report also emphasized Riot’s growth in mining operations, stating that it had mined “2,115 Bitcoins,", representing an increase of 50.5% from the number of Bitcoins mined during the first quarter of 2022.

Furthermore, stakeholders were reassured in the report that Riot does not have any affiliations with the banks that have experienced collapses in recent times. It noted:

“We did not have any banking relationships with Silicon Valley Bank, Silvergate Bank, or First Republic Bank, and currently hold our cash and cash equivalents at multiple banking institutions.

Riot anticipates that crypto mining companies will continue to experience challenges due to the "significant price decline of Bitcoin" and “other national and global macroeconomic factors,” as seen in 2022.

It was stated that given Riot’s "relative position" in the industry, “liquidity and absence of long-term debt,” it is positioned to “benefit from such consolidation.”

Magazine: 3AC cooks up a storm, Bitcoin miner surges 360%, Bruce Lee NFTs dive: Asia Express

Daniel Friedberg, the former top compliance chief for FTX and FTX US, has provided a declaration that could support the lawsuit.

A class action lawsuit against celebrities who allegedly promoted the now-bankrupt FTX has scored the cooperation of a former exchange executive — ex-compliance chief Daniel Friedberg.

A May 11 proposed amended complaint filed in a Florida District Court from the class action lawyers said Daniel Friedberg provided evidence that promotional activity for FTX originated from Florida.

Friedberg was the chief regulatory officer at FTX and the chief compliance officer of FTX US, the exchange's United States arm.

The declaration could potentially rebut a key defense made by some of the defendants who claimed the Miami court has no jurisdiction and the claims have no association with Florida.

In sworn testimony, Friedberg said FTX US’ vice president of business development, Avinash “Avi” Dabir was based in Miami and was in charge of brand ambassadors for FTX, including defendants in the case — which include former basketball player Shaquille O’Neal, comedian Larry David, retired NFL player Tom Brady and FTX founder Sam Bankman-Fried.

We couldn't keep it secret any longer! We're partnering with...the one...the only...@SHAQ! (a.k.a. Shaqtoshi) pic.twitter.com/V37UQ5wsXI

— FTX (@FTX_Official) June 1, 2022

He said Dabir operated from an FTX office in Miami “early in 2021.” The class action lawyers said this refutes the arguments made by the defendants in their motions to dismiss.

Some of the alleged promoters claimed that “no conspiracy could have been ‘engineered in Florida’ because FTX did not even plan to move to Miami until late September 2022” which was before they entered into the alleged promotional agreements.

The class action lawyers are using the new evidence to amend their lawsuit to try to address the jurisdictional claims by the suit's defendants.

The court will decide if the evidence is sufficient.

Related: Shaquille O’Neal claims process servers ‘tossed’ FTX legal papers at his moving car

The suit was first filed in mid-November shortly after the collapse of the exchange. Other alleged celebrity promoters include Brady’s then-wife and model Gisele Bündchen, entrepreneur Kevin O’Leary, and basketball star Steph Curry along with his team the Golden State Warriors.

We’re proud to announce Tom Brady will serve as an FTX Ambassador, and Gisele as FTX’s Environmental & Social Initiatives Advisor.

— FTX (@FTX_Official) June 29, 2021

“We have the chance to create something really special here.” says the Super Bowl Champion and entrepreneur @TomBrady https://t.co/yDLC1Q1KFG

Friedberg was also named as a defendant in an amended complaint on Dec. 16.

The former compliance head has reportedly lent a hand to other legal proceedings against the exchange he used to work for.

Investigators with the New York District Attorney, the Justice Department, the Federal Bureau of Investigation (FBI) and the Securities and Exchange Commission (SEC) purportedly got details about FTX from Friedberg a few weeks after the exchange collapsed.

Hall of Flame: William Clemente III tips Bitcoin will hit six figures toward end of 2024

The Coinbase CEO has a lot of faith in Congress in making a “clear rule book” for crypto firms to follow. But the SEC? Not so much.

United States-founded cryptocurrency exchange Coinbase has no plans to move its operations out of the U.S., CEO Brian Armstrong told investors in an Q1 earnings call.

On May 5, Armstrong assured shareholders the firm is “100% committed” to the U.S. market over the long term despite regulatory uncertainty in the U.S.

“So let me be clear, we're 100% committed to the U.S. I founded this company in the United States because I saw that rule of law prevails here. That's really important, and I'm actually really optimistic on the U.S. getting this right.”

The “optimism” alluded to by Armstrong comes from his confidence in Congress soon passing a clear set of rules for crypto firms to follow:

“When I go visit DC, there is strong bipartisan support for Congress to come in and create new legislation that would create a clear rule book in the U.S. and I think it's really important for America to get this right.”

However, Armstrong’s comments weren’t entirely “optimistic.”

The chief executive is concerned about the unpredictable enforcement action of the Securities Exchange Commission, which comes in light of the firm being served with a Wells Notice by the securities regulator in late March:

“Despite our ongoing engagement with the commission, they have not been as clear about what their specific concerns are with Coinbase as we might like, and so I have to refrain from speculating too much.”

“It's especially difficult to predict the timeline of any potential SEC litigation that we might face,” Armstrong added.

The troubles led Coinbase to file an action in a U.S. federal court seeking to compel the SEC to answer a petition that has been pending since July.

Today, to provide greater transparency in our long-standing engagement with the SEC, we are sharing our response to the Wells notice we received last month. https://t.co/aquuWmxmRM

— Coinbase ️ (@coinbase) April 27, 2023

The back and forth comes as Coinbase launched Coinbase International Exchange (CIE) on May 2, which prompted many pundits to believe that Coinbase was looking for an escape route from the U.S.

The exchange is open to customers in 30 countries worldwide, including Singapore, Hong Kong, El Salvador, Philippines, Thailand and Bermuda — where CIE is now licensed from.

Today Coinbase launched Coinbase International Exchange @CoinbaseIntExch and will begin by offering BTC & ETH perpetual futures settled in USDC with up to 5x leverage to institutional clients in eligible jurisdictions outside of the U.S.https://t.co/OzhbgJlZ2K

— Coinbase ️ (@coinbase) May 2, 2023

Related: SEC has 10 days to respond to Coinbase complaint: Legal exec

Armstrong said the European Union is “in front” in terms of regulatory progress with its Markets in Crypto Assets (MiCA) legislation set to enter into effect in mid-2024 or early 2025:

“They've adopted comprehensive crypto legislation called MiCA, creates a single clear rule book for the entire region. It's pretty powerful.”

“I just got back from a trip from the U.K. and D.C. Both of those, both have draft bills in the works that are working on things like around stable coins and market structure Singapore, Hong Kong, Australia, Brazil, all are essentially following in this direction,” Armstrong added.

The CEO’s remarks come as Coinbase managed to increase its revenue 22% and slashed its net income loss over $475 million to $79 million in Q1.

Our Q1'23 financial results are in and our letter to shareholders can be found on the Investor Relations website at https://t.co/8ovHEtPRgf pic.twitter.com/4iWAPGZNMh

— Coinbase ️ (@coinbase) May 4, 2023

Magazine: Crypto regulation: Does SEC Chair Gary Gensler have the final say?