The chief investment officer at asset management firm Bitwise has addressed the current market downturn, drawing parallels with the market crash on March 12, 2020, when the Covid-19 pandemic caused global panic. “People smash the sell button for liquid assets during broad-based panics. But from my seat, today’s events play into the long-term story for […]

The chief investment officer at asset management firm Bitwise has addressed the current market downturn, drawing parallels with the market crash on March 12, 2020, when the Covid-19 pandemic caused global panic. “People smash the sell button for liquid assets during broad-based panics. But from my seat, today’s events play into the long-term story for […] Gold companies operating in China ramped up their production levels during the first quarter of 2023. According to industry reports, the Chinese gold industry managed to recover its extraction levels, reaching numbers it saw before the Covid pandemic, with the country engaging in a record streak of purchasing gold during the last five months. China […]

Gold companies operating in China ramped up their production levels during the first quarter of 2023. According to industry reports, the Chinese gold industry managed to recover its extraction levels, reaching numbers it saw before the Covid pandemic, with the country engaging in a record streak of purchasing gold during the last five months. China […] When inflation in advanced economies is tamed, real interest rates are likely to drop to pre-pandemic levels, the latest International Monetary Fund (IMF) blog post has said. According to the authors of the blog post, the transition to a “cleaner economy in a budget-neutral way” could result in lower rates in the medium term. Recent […]

When inflation in advanced economies is tamed, real interest rates are likely to drop to pre-pandemic levels, the latest International Monetary Fund (IMF) blog post has said. According to the authors of the blog post, the transition to a “cleaner economy in a budget-neutral way” could result in lower rates in the medium term. Recent […] The annual inflation rate in China has unexpectedly slowed down in March to its lowest level in a year and a half, the latest statistical data indicates. On a monthly basis, consumer prices decreased for a second consecutive month, despite estimates suggesting they will remain unchanged. Post Zero-Covid Policy Inflation in China Eases Further China’s […]

The annual inflation rate in China has unexpectedly slowed down in March to its lowest level in a year and a half, the latest statistical data indicates. On a monthly basis, consumer prices decreased for a second consecutive month, despite estimates suggesting they will remain unchanged. Post Zero-Covid Policy Inflation in China Eases Further China’s […] The collapse of Do Kwon’s Terra empire in May, and Sam Bankman-Fried’s FTX in early November 2022, will be remembered as two incidents that put the crypto industry on the back foot. It is now widely expected that regulators around the world will use the two incidents to justify the establishment of regulatory regimes that […]

The collapse of Do Kwon’s Terra empire in May, and Sam Bankman-Fried’s FTX in early November 2022, will be remembered as two incidents that put the crypto industry on the back foot. It is now widely expected that regulators around the world will use the two incidents to justify the establishment of regulatory regimes that […]

Two collections have appeared on NFT marketplace OpenSea depicting images and art related to the rare widespread protests in China over its lockdown policies.

Nonfungible tokens (NFTs) depicting the ongoing protests in China against the country’s tough zero-tolerance COVID-19 policy have found their way to the NFT marketplace OpenSea.

At least two collections have been created in November, the first is a Polygon (MATIC)-based collection called “Silent Speech” featuring 135 NFTs depicting images of protesters, signage, graffiti and even social media screenshots related to the ongoing protests up for auction starting at 0.01 Ether (ETH), or just under $11.50.

Another collection titled “Blank Paper Movement” of 36 Ethereum-based NFTs with a floor price of 10 ETH, or nearly $11,800, features a more artistic take as the images of the protests appears to be painted.

Holding a blank sheet of paper has emerged as a symbol representing the suppression of speech in the rare and widespread protests which have flared up across China since Nov. 14, starting with residents of Guangzhou, one of China’s biggest cities, tearing down police barricades in response to COVID-19 related measures.

Demonstrators in Beijing hold blank pieces of paper in a rally against the communist government.

— 鄉港 (@sabaocean) November 28, 2022

This idea developed during a student movement by a group of high school students in HK. pic.twitter.com/jRmnQ50Mlz

The protests intensified on Nov. 24 as a fire that day in a high-rise building in the northeastern city of Urumqi killed 10 people.

Some Chinese internet users believe residents weren’t able to escape due to extreme lockdown measures which have included authorities wiring or welding doors shut.

NFT company Candy Digital has reportedly laid off a sizeable portion of its workforce amid turbulent crypto market conditions and a massive dip in NFT trading volumes this year.

More than one-third of the company’s roughly 100 employees were cut according to a Nov. 28 report from the sports industry outlet Sportico.

It’s unclear the reason for the layoffs and if any particular departments were affected as Candy Digital has not publicly addressed the layoffs. The former community content manager at Candy Digital, Matthew Muntner, in a Nov. 28 Twitter post publicly confirmed he was part of the staff cuts:

I hate that I have to share this as much as I loved my job at @CandyDigital but I was part of the layoffs that occurred earlier today.

— Muntner (@muntnerdesigns) November 28, 2022

I am quickly looking for a new role in Community Management, Graphic Design, or related Marketing.

Thanks, Candy Fam for one hell of a ride ❤️

Cointelegraph contacted Candy Digital for comment but did not receive an immediate response.

Candy Digital was launched in June 2021, backed by sports e-commerce store Fanatics, crypto-friendly entrepreneur Gary Vaynerchuk and Galaxy Digital CEO Mike Novogratz.

The company quickly gained partnerships with sports leagues including Major League Baseball, NASCAR’s collaborative Race Team Alliance, and several college athletes. It was valued at $1.5 billion in Oct. 2021 following a $100 million funding round.

Candy Digital’s layoffs follow others across technology firms such as NFT protocol Metaplex’s Nov. 17 cuts of “several members” of its team, Meta’s Nov. 9 layoff of 11,000 employees, and Flow blockchain developer Dapper Labs’ Nov. 2 layoffs of roughly 130 employees.

The Long Beach-based NFT-themed burger restaurant Bored & Hungry has set up a pop-up shop at the Philippine Blockchain Week which kicked off on Nov. 28 local time.

It’s the first time the restaurant has operated in South East Asia, the brand also operated a pop-up french fry stand at NFT.London in early November.

Grilling in Manila for 3 days only!

— Philippine Blockchain week (@philblockchain) November 27, 2022

Home of the Trill Burger, America’s best burger of 2022: @BorednHungry is bringing their apes and burgers to Manila! pic.twitter.com/RuDBy6Ykjg

The restaurant first opened in April and is themed using the owner's intellectual property of his owned Bored Ape Yacht Club and Mutant Ape Yacht club NFTs and accepted ETH and ApeCoin (APE) as payment.

Around two months after its opening, in June, the store inexplicably stopped accepting cryptocurrency as a form of payment, likely due to the drop in crypto prices.

Ripple’s XRP Ledger blockchain has recorded a new record NFT sale, with an XPUNK NFT — a clone of the popular Ethereum-native CryptoPunk NFTs — selling for 108,900 XRP (XRP), about $44,000 at the time of sale on Nov. 25.

The #XRPL has a new record! An @XRPLPUNKS NFT just got sold for 108900 $XRP (44000 USD).

— onXRP.com (@onXRPdotcom) November 25, 2022

This is just the beginning for #NFTonXRP.

The sale was a result of an open auction with over 20 people in a Discord voice chat according to the XPUNKS official Twitter account. It refused to disclose the purchaser but said “the community knows who it is.”

Related: The metaverse is a new frontier for earning passive income

The XRP Ledger introduced NFTs on Oct. 31 with the introduction of the XLS-20 standard that was first proposed on May 25, 2021, the NFTs feature “automatic royalties” for creators.

The community-led decentralized autonomous organization (DAO) made up of ApeCoin holders launched its own NFT marketplace on Nov. 24 featuring only Yuga Labs-backed collections.

Following the surprise win of the Saudi Arabian soccer team at the FIFA World Cup over Argentina on Nov. 22, the floor price of a Saudi Arabian-themed NFT collection unrelated to the team jumped by 52.6% with some appearing to view the tokens as an indirect way to bet on the success of soccer teams.

Amid the chaotic economy, plagued with central bank tinkering, supply chain issues, and red-hot inflation, the professor of applied economics at Johns Hopkins University, Steve Hanke believes a “pretty big recession” will take place in 2023. Speaking in an interview on Oct. 28, Hanke said that he updated the probability of a U.S. recession to […]

Amid the chaotic economy, plagued with central bank tinkering, supply chain issues, and red-hot inflation, the professor of applied economics at Johns Hopkins University, Steve Hanke believes a “pretty big recession” will take place in 2023. Speaking in an interview on Oct. 28, Hanke said that he updated the probability of a U.S. recession to […] After the inflation rate in the eurozone reached a high of 7.5% in March, the European Central Bank (ECB) and the bank’s president Christine Lagarde explained on Thursday the central bank’s bond purchases will cease in Q3. Reiterating what she said at a press conference in Cyprus two weeks ago, Lagarde stressed on Thursday that […]

After the inflation rate in the eurozone reached a high of 7.5% in March, the European Central Bank (ECB) and the bank’s president Christine Lagarde explained on Thursday the central bank’s bond purchases will cease in Q3. Reiterating what she said at a press conference in Cyprus two weeks ago, Lagarde stressed on Thursday that […]

BTC price is in a freefall, and data suggests bears will keep the pressure on until April 8’s options expiry.

Some analysts argue that Bitcoin (BTC) rallied too fast and too soon and the weakness that we see on April 7 is a result of that. Currently, a new COVID-19 variant has caused the Chinese government to implement severe restrictions on Shanghai and other major cities and persistent regulatory concerns continue to weigh down th sentiment within the crypto sector.

Another concerning development is the March 31 European Parliament's Committee on Economic and Monetary Affairs (ECON) vote to update the regulations in regards to the ability of exchange platforms to deal with noncustodial crypto wallets.

Should the regulatory project make it to the legislative phase in the upcoming months, it would place strict disclosure requirements on transactions for crypto exchanges in the European Union.

Not everything has been negative for Bitcoin because the cost of moving Bitcoin across the network has hit decade lows, according to research by Galaxy Digital. The Bitcoin median transaction fee has plummeted to 0.00001292 Bitcoin ($0.59) in 2022, the lowest in 11 years.

According to Glassnode on-chain analyst James Check, "batching and Segwit is certainly part of the mix," because it increases the number of transactions that fit in a block.

Bitcoin's drop below $45,000 on April 6 took bulls by surprise because only 8% of the call (buy) option bets for April 8 have been placed below this price level.

Bulls might have been fooled by the recent attempt to overtake $48,000 on March 29 and this is shown in their bets for April 8's $610 million options expiry that go all the way to $65,000.

A broader view using the 0.97 call-to-put ratio shows balanced bets between the $300 million call (buy) open interest stands and the $310 million put (sell) options. Now that Bitcoin is back below $45,000, most of these bullish bets will become worthless.

For example, if Bitcoin's price remains below $45,000 at 8:00 am UTC on April 8, only $24 million worth of these call (buy) options will be available. This difference happens because there is no use in the right to buy Bitcoin at $50,000 if it trades below this level at expiry.

Listed below are the four most likely scenarios based on the current price action. The number of options contracts available on April 8 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side makes up the theoretical profit:

This crude estimate considers the call options used in bullish bets and the put options exclusively in neutral-to-bearish trades. Even so, this oversimplification disregards more complex investment strategies.

For instance, a trader could have sold a put option, effectively gaining positive exposure to Bitcoin above a specific price but unfortunately, there is not an easy way to estimate this effect.

Related: Scaramucci sees bright future for crypto but ‘very worried’ about US politicians

Bitcoin bears need to push the price below $44,000 on April 8 to secure a $145 million profit. On the other hand, the bulls' best case scenario requires a 4.3% gain from the current $44,200 to $46,000 zone to balance the scales.

Bitcoin bulls had $65 million in leveraged long positions liquidated on April 6, so they probably have fewer resources to push the price higher in the short term. With this said, bears will likely try to suppress BTC below $45,000 before the April 8 options expiry.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

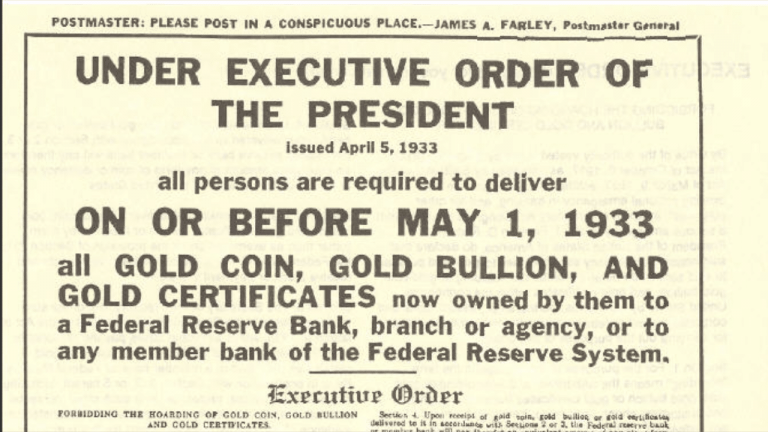

This past Tuesday, April 5, was the 89th anniversary of Executive Order 6102 when the U.S. government would strictly “forbid the hoarding of gold coin, gold bullion, and gold certificates within the continental United States.” While the global economy seems to be heading toward disaster and the U.S. dollar’s strength is being examined, many have […]

This past Tuesday, April 5, was the 89th anniversary of Executive Order 6102 when the U.S. government would strictly “forbid the hoarding of gold coin, gold bullion, and gold certificates within the continental United States.” While the global economy seems to be heading toward disaster and the U.S. dollar’s strength is being examined, many have […]