- Home

- CPI

CPI

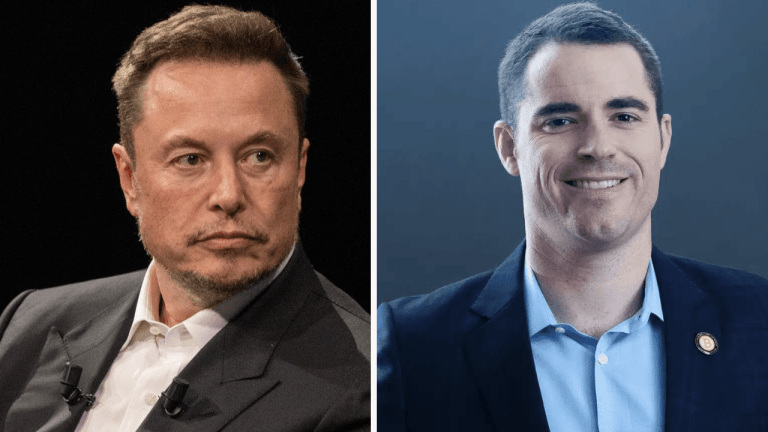

3 reasons why Bitcoin price failed to break $37K

Bitcoin’s latest price pullback to $35,000 was driven by softer U.S. inflation, China’s economic challenges and regulatory uncertainties.

Bitcoin (BTC) recently surged above $37,000 between Nov. 10 and 12, only to falter and undergo a correction toward $35,000 on Nov. 13.

This abrupt movement triggered the liquidation of $121 million worth of long futures contracts, and while Bitcoin’s price stabilized around $35,800 on Nov. 14, investors are left pondering the underlying factors behind this downturn.

U.S. inflation, gov’t shutdown impact on BTC price

Part of the catalyst behind this movement was the unexpected softening of United States inflation data on Nov. 14. The U.S. Consumer Price Index (CPI) showed a 3.2% increase in October compared to 2022, leading to a decline in yields on U.S. short-term Treasurys.

This triggered buying activity in traditional assets, potentially reducing the demand for alternative hedge instruments like Bitcoin. If the Federal Reserve’s strategy to curb inflation successfully without causing a recession pans out, Bitcoin may lose some of its appeal as a hedge.

Even Moody’s rating agency lowering its outlook on the U.S. credit to negative from stable on Nov. 11 did not sway favorably toward Bitcoin and other alternative hedges. Instead, investors sought refuge in short-term 5.25% fixed-income instruments, explaining why gold struggled to surpass $2,000 despite escalating debt levels and global economic challenges.

In China, October’s retail sales data indicated a 7.6% increase — the fastest since May. However, this apparent recovery conceals underlying issues, notably a 9.3% decline in property sector investments in the first 10 months of the year. China’s economic stimulus measures, including policy support and liquidity injections, have yielded only modest benefits.

Given that China is the world’s second-largest economy, its economic situation might contribute to investors’ cautious stance on riskier assets like Bitcoin, particularly when viewed within the broader global economic context. Additionally, recent political developments surrounding U.S. government shutdown threats could also influence Bitcoin’s performance.

The U.S. House of Representatives passed a bill on Nov. 14 to keep the government operational through the holiday season, temporarily averting a fiscal crisis. However, this measure sets the stage for potential spending disputes in the coming year, including a provision to cut federal spending by 1% across the board in 2024 if no agreement is reached.

Spot Bitcoin ETF expectations, regulatory scrutiny

The cryptocurrency market experienced a negative reaction to a fraudulent BlackRock XRP trust filing on Nov. 13. Although it initially sparked hopes for an XRP (XRP) spot exchange-traded fund (ETF) in the U.S., the $9 trillion asset manager swiftly dismissed the claim.

While this event is not directly linked to Bitcoin, it has drawn regulatory scrutiny to the crypto sector at a sensitive time when numerous spot Bitcoin ETF applications await review by the U.S. Securities and Exchange Commission (SEC). Consequently, irrespective of the parties involved, the outcome represents a net positive for the cryptocurrency market.

Related: Tether credits USDT growth surge to ETF excitement, emerging markets

On Nov. 13, Bloomberg ETF analyst James Seyffart emphasized that approval for a spot Bitcoin ETF should not be expected before January. This statement came amid heightened market anticipation surrounding upcoming SEC decisions scheduled for Nov. 17 and Nov. 21.

Heightened fear of global economic recession

In essence, the drop in Bitcoin’s price after flirting with the $37,000 level cannot be attributed to a single event. Investors may have reassessed their positions, considering Bitcoin’s substantial $725 billion market capitalization. For comparison, Berkshire Hathaway, a major conglomerate, boasts a $760 billion valuation while posting profits of $76.7 billion in the past year.

Bitcoin’s stringent monetary policy ensures scarcity and predictability, but major global corporations can repurchase their own stocks using earnings, effectively reducing the available supply. Furthermore, during economic downturns, these trillion-dollar companies can leverage their strong balance sheets during economic downturns to acquire competitors or expand their market dominance.

Ultimately, Bitcoin’s challenge in maintaining momentum above $37,000 is influenced by factors such as data supporting the Federal Reserve’s strategy for a soft economic landing and concerns over global economic growth. These elements continue to create an unfavorable landscape for Bitcoin’s value, especially if the SEC delays decisions on spot BTC ETFs, aligning with market expectations.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Billionaire Chamath Palihapitiya Predicts Market Rally, Says $6,000,000,000,000 Waiting To Be Deployed

Billionaire venture capitalist Chamath Palihapitiya says that markets are ripe for a strong rally as a deluge of capital looks to find a new home. In a new episode of the All-In Podcast, the billionaire says that the macro picture is starting to look positive for the United States. The Social Capital founder first looks […]

The post Billionaire Chamath Palihapitiya Predicts Market Rally, Says $6,000,000,000,000 Waiting To Be Deployed appeared first on The Daily Hodl.

Bitcoin bounces at $36.2K lows as CPI inflation slows beyond forecasts

CPI positively surprises stocks, and Bitcoin catches a bid as inflationary pressures are shown to be declining faster than thought.

Bitcoin (BTC) targeted $37,000 at the Nov. 14 Wall Street open as the latest United States inflation data undercut expectations.

CPI offers Bitcoin, stocks a pleasant surprise

Data from Cointelegraph Markets Pro and TradingView showed BTC price strength returning as the Consumer Price Index (CPI) reflected slowing inflation in October.

CPI came in 0.1% below market forecasts both year-on-year and month-on-month. The annual change was 3.2% versus 4.0% for core CPI.

“The all items index rose 3.2 percent for the 12 months ending October, a smaller increase than the 3.7-percent increase for the 12 months ending September,” an official press release from the U.S. Bureau of Labor Statistics confirmed.

“The all items less food and energy index rose 4.0 percent over the last 12 months, its smallest 12-month change since the period ending in September 2021.”

Compared with October, where CPI was just one inflation metric, which overshot versus market consensus, the situation was palpably different. Stocks immediately offered a warm reaction at the Wall Street open, with the S&P 500 up 1.5% on the day.

“This is the 31st consecutive month with inflation above 3%. But, inflation seems to be back on the DECLINE,” financial commentary resource The Kobeissi Letter wrote in part of a reaction.

Kobeissi, traditionally skeptical of Fed policy in the current inflationary environment, nonetheless called the print a “good” result.

In line with other recent CPI releases, meanwhile, Bitcoin reacted only modestly, revisiting an intraday low before rising toward $37,000 while still rangebound.

Analyzing market composition, however, on-chain monitoring resource Material Indicators noted that liquidity was overall thin — a key ingredient for aiding volatility.

With whales quiet on exchanges, it added, retail investors were increasing BTC exposure.

“It's no coincidence that the 2 smallest order classes are buying,” it commented alongside a print of BTC/USDT order book liquidity on largest global exchange Binance.

“Upside liquidity around the active trading zone is so thin, whales can't make large orders without major slippage. Watching the smaller order classes on the FireCharts CVD bid BTC up as support strengthens above $36k.”

Analyst: Accept BTC price retracements

Down around 4% from the 18-month highs seen earlier in the month, BTC price action still impressed market participants, who argued that comedowns within the broader uptrend were not only standard, but appropriate.

Related: Bitcoin institutional inflows top $1B in 2023 amid BTC supply squeeze

“Bitcoin already down 4.5% from the highs; bull market corrections are normal and healthy,” James Van Straten, research and data analyst at crypto insights firm CryptoSlate, told X subscribers on the day.

“Could see up to 20% drawdowns, from profit-taking or liquidations. This is a normal occurrence and has been seen in previous cycles.”

Van Straten precised CryptoSlate analysis from Nov. 13 which suggested that deeper BTC price corrections could still come, given BTC/USD was up 120% year-to-date.

“It is important to note that market corrections are a normal part of any financial cycle, contributing to the overall health of the market,” he stressed.

In an interview with Cointelegraph, Filbfilb, co-founder of trading suite DecenTrader, likewise predicted that Bitcoin could see a significant drawdown prior to the April 2024 block subsidy halving event.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Funding rates echo $69K BTC price — 5 things to know in Bitcoin this week

Bitcoin funding rates are in classic bull market territory, but can BTC price upside sustain as macro volatility triggers line up?

Bitcoin (BTC) starts a new week still riding high near $37,000 as macroeconomic data returns to the fore.

The largest cryptocurrency continues to circle its highest levels in 18 months, with excitement over a possible exchange-traded fund (ETF) approval in the United States driving sentiment.

That is getting increasingly greedy, however, as according to the Crypto Fear & Greed Index, conditions match those seen as BTC price action hit its current all-time highs in late 2021.

What could shake up the status quo to produce volatility in the coming days?

The odds of an external trigger are more significant this week. A raft of U.S. macro data, including the Consumer Price Index (CPI), has the potential to disrupt any sideways trading activity across risk assets.

Multiple officials from the Federal Reserve are also due to speak, while the precarious geopolitical situation in the Middle East grinds on in the background.

On the institutional side, meanwhile, the future looks firmly bullish for Bitcoin — ahead of the prospective ETF approval, the Grayscale Bitcoin Trust (GBTC) is closing in on parity with net asset value.

Can Bitcoin markets stay the course and avoid a significant retracement? Cointelegraph takes a look at conditions in the weekly rundown of BTC price volatility catalysts waiting in the wings.

Funding rates flash warning with BTC price stuck at $37,000

Bitcoin’s weekly close set a new 18-month high on Nov. 12, but what followed was not the gains seen after other recent closes.

During the Asia trading session, BTC/USD instead fell below $37,000, sticking firmly to the trading range in place throughout the weekend, per data from Cointelegraph Markets Pro and TradingView.

Monitoring the situation, popular trader and analyst Credible Crypto suggested that this would soon change. The reason, he said, was open interest (OI), now at multi-day highs and apt to spark volatility.

“OI has ramped right back up off the lows which means more positions to squeeze out,” part of an X post read.

Credible Crypto gave a target of $36,600 for a potential local low, with another post adding that Bitcoin was “very close” to further upside.

Countering the optimism over short-term market action was funding rates. These were not only positive, but at their highest since Bitcoin’s November 2021 all-time highs, indicating an overall disadvantage of being long BTC at current levels.

Bitcoin’s funding rates are at the highest level since last ATH. pic.twitter.com/mMlnJleQ5u

— Thomas Kralow (@TKralow) November 12, 2023

“Pretty elevated levels of funding rates across the board,” fellow trader Daan Crypto Trades commented alongside data from monitoring resource CoinGlass.

“Even though this isn't always an immediate reason for a flush, ideally this goes back to normal after some more ranging. Good to note that during strong up trends, this can stay this way for weeks or even months.”

Also noting the conspicuous state of play on funding, popular analyst Caue Oliveira told traders to exercise caution.

“This value suggests that optimism is prevailing in the market, driving a high number of futures contracts to bet on an increase in price,” he wrote in an Quicktake market update for on-chain analytics platform CryptoQuant on Nov. 10.

“However, this setup is dangerous as it can demonstrate excessively bullish sentiment and a price contraction could trigger a cascade of liquidations.”

CPI comes amid fresh U.S. gov't shutdown turmoil

A classic macro setup marks the third week of November — CPI leads a deluge of data prints which have sparked risk asset volatility in the past.

Due on Nov. 14 for the month of October, the CPI print is keenly watched by inflation monitors, with the Producer Price Index (PPI) following a day later.

Various Fed officials will also take to the stage in speaking engagements both during and after the data releases, providing insights into the Fed’s perspective on inflationary forces in real time.

“Important week for inflation and the Fed,” financial commentary resource The Kobeissi Letter summarized while uploading significant macro diary dates to X.

Key Events This Week:

— The Kobeissi Letter (@KobeissiLetter) November 12, 2023

1. October CPI Inflation data - Tuesday

2. October PPI Inflation data - Wednesday

3. Retail Sales data - Wednesday

4. Philly Fed Manufacturing data - Thursday

5. Building Permits data - Friday

6. Total of 14 Fed speaker events

Important week for…

Popular trader Skew meanwhile noted expectations pointing to receding inflation, this despite some unwelcome surprises in October’s data prints.

This should notionally provide a tailwind for crypto markets, but as Cointelegraph reported, Bitcoin’s reaction to even larger target misses has become muted this year.

CPI & PPI this coming week

— Skew Δ (@52kskew) November 12, 2023

CPI - Tuesday 14th Nov

PPI - Wednesday 15th Nov

Expectations are for a considerable decline of entrenched inflation ~ less inflation expected pic.twitter.com/PrQ0Rsf1Ab

Adding to the mix is another familiar wildcard — a partial U.S. government shutdown in the making. While so far avoided this year, the need to reach a deal on spending in Congress is once again becoming tangible ahead of the Nov. 17 deadline.

Should it occur, the shutdown would only be the fourth in the U.S. in the past ten years.

Altcoins in focus as crypto capital inflows return

With a potential ETF approval firmly on the radar for crypto market participants, capital inflows into the industry are being keenly monitored.

Buyer interest forms a key item on the list for a bull market comeback, and the about turn in inflows is already attracting mainstream attention.

“For the first time in years, crypto markets are beginning to see tons of new liquidity,” Kobeissi wrote in a dedicated X post.

It noted that the combined crypto market cap has increased $600 billion since November 2022, in the aftermath of the FTX meltdown and Bitcoin’s cycle lows of $15,600.

“That's a +75% jump in one year while Bitcoin is up +120% over the last year,” it added.

“This comes after years of consistent outflows from crypto markets. One thing we have seen multiple times in the past? A return of liquidity always causes historic moves in crypto.”

It is not just Bitcoin showing potential — altcoin markets are waking up, traders and analysts say.

#Altcoins are flying. It will be epic. pic.twitter.com/bSAw0nKKL0

— Stockmoney Lizards (@StockmoneyL) November 9, 2023

Despite Bitcoin’s dominance of the overall crypto market cap still being strong, analyst CryptoCon suggested not to take this as a sign of comparative altcoin weakness.

“Some people have told you to completely ignore Altcoins because Bitcoin dominance is going up. And as you might have noticed, this is a critical mistake,” he told X subscribers at the weekend.

An accompanying chart showed BTC price behavior in each year of its halving cycle, with altcoins likewise exhibiting specific reactions.

With Bitcoin due an “early” cycle top in mid-2024, per CryptoCon, altcoins are unlikely to underdeliver.

“I think it is now very likely that Altcoins have already bottomed for the cycle, and those who did nothing will have to buy higher,” he continued.

“Imagine being told, ‘Ignore Altcoins at their bottoms and only buy Bitcoin which is already up.’ That's happened this year. 2024 is coming, Altcoins are ready to get even stronger!”

GBTC discount passes two-year lows

A yardstick for the return of Bitcoin to the mainstream spotlight — despite the absence of retail interest — is its largest institutional investment vehicle.

The Grayscale Bitcoin Trust (GBTC) is fast approaching parity to net asset value (NAV), the Bitcoin spot price.

GBTC traded with an implied share price higher than BTC/USD in the past, but the past two years has seen the premium become a discount which at one point neared 50%.

Now, the discount to NAV is just 10.35% — its smallest since August 2021.

Commenting on the phenomenon, William Clemente, co-founder of market research firm Reflexivity, tied GBTC’s reversal of fortune to a prospective ETF go-ahead.

“Looks like the market is pricing in very high probability of BTC ETF approval at this point,” he wrote last week.

Grayscale continues to petition to gain the right to convert GBTC to a Bitcoin spot ETF.

Crypto investors stay greedy

There is no ignoring the desire to squeeze profits after a record long crypto bear market.

Related: Pre-ETF BTC price 'crash' or $150K in 2025? Bitcoin forecasts diverge

This continues to be aptly displayed by the Crypto Fear & Greed Index, the classic market sentiment gauge now at levels last seen in November 2021.

While not at its extreme levels yet, the Index unequivocally shows that the average crypto investor is nearing a state of irrational exuberance.

Fear & Greed stood at 72/100 on Nov. 13, having hit 74/100 on Nov. 6.

Commenting on market psychology at the start of the month, popular trader Pentoshi reminded X readers that extreme levels of both fear and greed can offer the “best opportunities” for those able to time and exploit market volatility at extreme sentiment levels.

Typically, when the Index is either below 10/100 or above 90/100, crypto markets are in line for a snap trend reversal.

Now is a good time to share this again

— Pentoshi euroPeng (@Pentosh1) November 12, 2023

Fear and greed

Markets force participation, they force you to act https://t.co/f1nJOyGaLS

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin faces elevated CPI with BTC price tackling $26.8K focal point

CPI joins macro data coming in higher than predicted — something not conducive to BTC price upside, Bitcoin analysts continue to imply.

Bitcoin (BTC) is clinging to the key $26,800 mark prior to the Oct. 12 Wall Street open as United States inflation data continued to beat expectations.

BTC price reacts as CPI surpasses predictions

Data from Cointelegraph Markets Pro and TradingView showed BTC price volatility staying muted after two-week lows seen the day prior.

These had come thanks to U.S. macroeconomic data revealing persistent inflation continuing to take markets by surprise.

On the day, the September print of the Consumer Price Index (CPI) bolstered the trend, coming in at 3.7% year-on-year versus 3.6% expected. Less food and energy, the tally was 4.1% — matching forecasts.

“The all items index increased 3.7 percent for the 12 months ending September, the same increase as the 12 months ending in August,” an official press release from the U.S. Bureau of Labor Statistics confirmed.

“The all items less food and energy index rose 4.1 percent over the last 12 months. The energy index decreased 0.5 percent for the 12 months ending September, and the food index increased 3.7 percent over the last year.”

Reacting, financial commentary resource The Kobeissi Letter nonetheless emphasized the tight spot in which monetary policy — and the Federal Reserve — now found itself.

“We have PCE and PPI inflation rising with CPI inflation above expectations,” it wrote on X.

“How can the Fed cut interest rates any time soon?”

The concept of “higher for longer” when it comes to U.S. interest rates is broadly expected to result in pressure for risk assets, including crypto.

Following CPI, the odds of the Fed hiking rates further at the next meeting of the Federal Open Market Committee (FOMC) on Nov. 1 were nonetheless minimal at just 7.4% per data from CME Group’s FedWatch Tool.

Analyst on Bitcoin vs. macro: "Bad = bad"

Turning to Bitcoin itself, already cautious market participants had little reason to expect a return to upside in the short term.

Related: BTC price rally in doubt? Bitcoin young supply echoes 2022 bear market

Popular trader Skew continued to flag $26,800 as the zone for bulls to flip to support.

$BTC 4H

— Skew Δ (@52kskew) October 12, 2023

CPI later today going to see how LTF structure develops

clear 4H demand area here & $26.8K remains important for control

If buyers can reclaim & hold $26.8K will look for some kind of 4H EMA trend test or reclaim

staying more cautionary till confirmations pic.twitter.com/58BKDZyLBj

Monitoring resource Material Indicators revealed a lack of bid liquidity much above $24,750, a key level from the past two quarters.

Looking at #BTCUSDT on #FireCharts < 30 mins ahead of today's Economic Reports 3 things stand out:

— Material Indicators (@MI_Algos) October 12, 2023

1. Bid liquidity laddered down to the LL at $24,750

2. Yellow stopped their TWAP sell strategy

3. Purple Whales have been selling pic.twitter.com/4cant18F4o

“It's been a while since we've discussed whether good = good or good = bad for BTC price,” co-founder Keith Alan added in commentary on the macro aspect ahead of CPI.

“I'm no economist, but based on yesterday's reports, the overall economic outlook and geopolitical tensions, I'm going to go with bad = bad.”

Continuing, trading firm QCP Capital described “unabated” downhill trajectory on Bitcoin and largest altcoin Ether (ETH) coming despite various potential bullish factors in Q4.

“Hopefully the relative underperformance of BTC and ETH to the upside now also mean their beta is lower to the downside as well, should CPI come in stronger than expected,” it wrote in a market update earlier on the day.

“Otherwise, we continue looking at the key levels of 25-26k on the downside, and 29-30k on the topside as critical to determine the next trend.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

War, CPI and $28K BTC price — 5 things to know in Bitcoin this week

Bitcoin prepares for a testing macro week as geopolitical uncertainty injects volatility into gold, oil and the U.S. dollar, but BTC price action has yet to react.

Bitcoin (BTC) starts the second week of October up 4% month-to-date as geopolitical instability provides a snap market focus.

BTC price action continues to hold steady at $28,000, but what will happen next as markets react to the war in Israel?

In what could end up a volatile period for risk assets, Bitcoin has yet to offer a significant reaction, spending the weekend in a tight corridor.

That could soon change, however, as the Wall Street open comes amid a hike in oil and gold, along with U.S. dollar strength.

Macroeconomic triggers are also far from lacking, with the coming days due to see the September print of the U.S. Consumer Price Index (CPI). In the wake of surprise employment data last week, the readout holds additional importance for the Federal Reserve.

Beneath the hood, meanwhile, on-chain metrics are pointing to interesting times for Bitcoin, as BTC/USD trades in a key range, which has formed a watershed area since 2021.

Cointelegraph looks at these factors and more in the weekly rundown of potential BTC price triggers to come.

Bitcoin “illiquid and choppy” as weekly close passes

The weekend saw market participants fully focused on the abrupt breakout of war in Israel, and as markets themselves reopen, change is already afoot.

For Bitcoin, however, the ongoing events have yet to deliver a palpable chain reaction, data from Cointelegraph Markets Pro and TradingView shows.

BTC price action has centered on $28,000 since Friday, and that level remains key as traders hope for a resistance/support flip.

“Nothing special going on this weekend,” Daan Crypto Trades summarized on X (formerly Twitter) into the weekly close.

“Would expect volumes to pick up a bit soon but ultimately we should be hovering around this price region until futures open back up tonight.”

A further post noted that Bitcoin had yet to decisively break through the 200-week moving average (MA), which sits at $28,176 at the time of writing.

Analyzing the 4-hour chart, popular trader Skew described BTC price behavior as “illiquid and choppy.”

$BTC 4H

— Skew Δ (@52kskew) October 9, 2023

these wicks really say how illiquid & choppy price action is pic.twitter.com/Qq13GsuqfB

“Bitcoin’s bullish flag is still in play — but it is taking too long to play out,” fellow trader Jelle continued, zooming out to monthly performance.

“October is generally the most bullish month of the year, thus I’m still expecting this one to break out upwards.”

War returns to crypto observers’ radar

When it comes to price triggers, however, the unfolding conflict in Israel has Bitcoin and crypto market participants anticipating the bulk of volatility is still to come.

With the memory of Bitcoin’s reaction to the war in Ukraine in February 2022 still in the background, Jelle was cautious over what might happen to BTC/USD next.

“All I do know is that the Ukraine war triggered an 8% down candle, that was erased within a day,” part of the day’s X commentary explained.

Mike McGlone, senior macro strategist at Bloomberg Intelligence, meanwhile described Bitcoin as now showing a “risk-off tilt” among traders.

“My bias is the downward sloping 100-week moving average is likely to win the battle vs. the up trending 50-week. Spiking #crudeoil is a liquidity pressure factor,” he wrote on Oct. 8.

At the time, the 100-week and 50-week MAs were at $28,938 and $24,890, respectively.

McGlone touched on an unfolding macro asset phenomenon, with gold up 1% on the day and Brent crude up 3.25% ahead of the Wall Street open.

“Markets reacting quite defensively,” Skew added, noting renewed strength in the U.S. Dollar Index (DXY), which gained 0.4%.

Last week, the DXY hit its highest levels since late 2022.

CPI leads “huge week for inflation”

In the U.S., attention focuses on the week’s macroeconomic data prints, headlined by the September CPI report.

After jobs data last week showed that employment levels remained resilient despite anti-inflation moves from the Fed, Bitcoin briefly recoiled over fears that officials would enact another interest rate hike, further pressuring liquidity.

While BTC/USD rebounded, those fears remain.

“A good CPI data on Thursday could provide a chance to break out from this range, whereas a hot CPI would push us back into the range lows with the premise that the FED might be forced to hike 25bsp,” part of weekend analysis from popular commentator CrypNuevo read.

According to data from CME Group’s FedWatch Tool, markets are increasingly betting on rates staying at current levels on decision day, set for Nov. 1.

Beyond CPI, this week will see the Producer Price Index (PPI) release, along with more jobless claims and a total of 12 Fed speakers delivering commentary. The minutes of the Fed meeting around the previous rates decision will also be unveiled on Oct. 11.

Key Events This Week:

— The Kobeissi Letter (@KobeissiLetter) October 8, 2023

1. September PPI Inflation - Wednesday

2. Fed Meeting Minutes - Wednesday

3. September CPI Inflation - Thursday

4. OPEC Monthly Report - Thursday

5. Jobless Claims Data - Thursday

6. Total of 12 Fed speaker events

Huge week for inflation and the Fed.

“Huge week for inflation and the Fed,” financial commentary resource The Kobeissi Letter summarized in part of an X thread.

“In addition, markets will react to geopolitical tensions from this weekend. Volatility is the new normal.”

NVT signal spikes to highest since 2018

Within Bitcoin, the network value to transaction (NVT) signal leads the pack on on-chain metric volatility to start the week.

NVT, which its creator, Dmity Kalichkin, describes as a “PE ratio” for Bitcoin, seeks to estimate local BTC price tops and bottoms by comparing market cap to daily on-chain transaction values.

The latest data from on-chain analytics firm Glassnode shows NVT hitting its highest levels in five years — over 1,750 and far beyond its position at the start of 2023.

NVT has undergone various overhauls in recent years, as the dynamics of the BTC supply call for different guidance figures for determining price tops.

“If the trend towards side-chains and private transactions continues, we can expect less-and-less transactions to be captured in the public on-chain data (reducing the relative value of the “T” in NVT),” Charles Edwards, founder of quantitative Bitcoin and digital asset fund Capriole Investments, wrote in part of his own research in 2019.

“This could cause the fair value NVT range to increase with time.”

Analyzing the NVT spike, crypto market intelligence platform IntoTheBlock suggested that it was representative of a broader metamorphosis.

“The lens through which we view Bitcoin's value is changing,” it wrote at the weekend.

“Transaction value & volume were once the go-to metrics. However, recent spikes in NVT ratios hint that Bitcoin's value is now moving independently of transactional utility, hinting at its growing role as a store of value.”

Neither fearful, nor greedy

Providing a fleeting insight into crypto market sentiment, the classic Crypto Fear & Greed Index reflects an overall air of indecision.

Related: Bitcoin bull market awaits as US faces ‘bear steepener’ — Arthur Hayes

The average investor is ambivalent when it comes to the market, as shown by the Index sticking rigidly to its “neutral” territory.

As of Oct. 9, Fear & Greed is at 50/100 — exactly half way along its scale between two sentiment extremes.

Zooming out, recent months have marked some of its least volatile conditions on record.

“You know the drill, i will be mass buying when we drop down to Extreme Fear and a $20,000 Bitcoin,” popular trader Crypto Tony reacted to the latest data.

“May take a while, but i feel Q1 / Q2 2024 will be the ticket. If i see a change in behaviour i will re-evaluate.”

Crypto Tony referenced an inkling that BTC/USD will return to $20,000 for a final retest before expanding higher after the 2024 block subsidy halving.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

3 key Ethereum price metrics suggest that ETH is gearing up for volatility

Network, futures and user data all point toward Ethereum potentially charting a new course.

Ether (ETH) price has been dealing with some strong headwinds and on Sept. 11, the price of the altcoin endured a critical test when it plunged to the $1,530 support level. In the days that followed, Ether managed to stage an impressive recovery, by surging by 6%. This resurgence may signal a pivotal moment, following a month that had seen ETH endure losses of 16%.

Even with the somewhat swift recovery, Ether’s price performance raises questions among investors about whether it has the potential to climb back to $1,850, and ETH derivatives and network activity might hold the key to this puzzle.

Macroeconomic factors have played a significant role in mitigating investor pessimism given that inflation in the United States accelerated for the second consecutive month, reaching 3.7% according to the most recent CPI report. Such data reinforces the belief that the U.S. government's debt will continue to surge, compelling the Treasury to offer higher yields.

Scarce assets are poised to benefit from the inflationary pressure and the expansive monetary policies aimed at bridging the budget deficit. However, the cryptocurrency sector is grappling with its own set of challenges.

Regulatory uncertainty and high network fees limit investors’ appetite

There's the looming possibility of Binance exchange facing indictment by the U.S. Department of Justice. Furthermore, Binance.US has found itself entangled in legal battles with the U.S. Securities and Exchange Commission (SEC), leading to layoffs and top executives departing from the company.

Besides the regulatory hurdles faced by cryptocurrencies, the Ethereum network has witnessed a notable decline in its smart contract activity, which is at the core of its original purpose. The network still grapples with persistently high average fees, hovering above the $3 mark.

Over the past 30 days, the top Ethereum dApps have seen an average 26% decrease in the number of active addresses. An exception to this trend is the Lido (LDO) liquid staking project, which saw a 7% increase in its total value locked (TVL) in ETH terms during the same period. It's worth mentioning that Lido's success has been met with criticism due to the project's dominance, accounting for a substantial 72% of all staked ETH.

Vitalik Buterin, co-founder of Ethereum, has acknowledged the need for Ethereum to become more accessible for everyday people to run nodes in order to maintain decentralization in the long term. However, Vitalik does not anticipate a viable solution to this challenge within the next decade. Consequently, investors have legitimate concerns about centralization, including the influence of services like Lido.

ETH futures and options show reduced interest from leverage longs

A look at derivatives metrics will better explain how Ether’s professional traders are positioned in the current market conditions. Ether monthly futures typically trade at a 5 to 10% annualized premium — a situation known as contango, which is not unique to crypto markets.

The premium for Ether futures hit its lowest point in three weeks, standing at 2.2%, indicating a lack of demand for leveraged long positions. Interestingly, not even the 6% gain following the retest of the $1,530 support level on Sept. 11 managed to push ETH futures into the 5% neutral threshold.

One should look at the options markets to better gauge market sentiment, as the 25% delta skew can confirm whether professional traders are leaning bearish. In short, if traders expect a drop in Bitcoin’s price, the skew metric will rise above 7%, while periods of excitement typically have a -7% skew.

On Sept. 14 the Ether 25% delta skew indicator briefly shifted to a bullish stance. This shift was driven by put (sell) options trading at an 8% discount compared to similar call (buy) options. However, this sentiment waned on Sept. 15, with both call and put options now trading at a similar premium. Essentially, Ether derivatives traders are displaying reduced interest in leverage long positions, despite the successful defense of the $1,530 price level.

On one hand, Ether has potential catalysts, including requests for a spot ETH exchange-traded fund (ETF) and macroeconomic factors driven by inflationary pressure. However, the dwindling use of dApps and ongoing regulatory uncertainties create a fertile ground for FUD. This is likely to continue exerting downward pressure on Ether's price, making a rally to $1,850 in the short to medium term appear unlikely.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Crypto Analyst Dives Into FTX Bankruptcy Development, Offers Words of Encouragement to Traders

A widely followed crypto analyst is breaking down the latest developments in the FTX bankruptcy and their implications for the broader markets. Crypto trader Michaël van de Poppe tells his 666,900 followers on the social media platform X that FTX’s approval to sell $3.4 billion in crypto assets, approximately a third of which is Solana (SOL), combined […]

The post Crypto Analyst Dives Into FTX Bankruptcy Development, Offers Words of Encouragement to Traders appeared first on The Daily Hodl.

Bitcoin ignores CPI, FTX as BTC price hits September high near $26.6K

BTC price strength marches on despite the curveball CPI print and FTX liquidation go-ahead, and Bitcoin traders are hopeful for long opportunities.

Bitcoin (BTC) hit new September highs after the Sep. 14 daily close as markets digested macroeconomic and crypto industry news.

Trader: Bitcoin market "feels different"

Data from Cointelegraph Markets Pro and TradingView tracked overnight BTC price highs of $26,535 on Bitstamp.

The largest cryptocurrency had shaken off higher-than-expected United States Consumer Price Index (CPI) the day prior, maintaining $26,000.

Subsequent confirmation that defunct exchange FTX had received legal permission to liquidate its remaining assets likewise failed to dent Bitcoin’s comparatively solid intraday performance.

At the time of writing, BTC/USD traded at near $26,300, still up 5.5% versus its September lows.

“Coming up to the range highs and once e flip these levels we can look to finally get into a safe position and long,” popular trader Crypto Tony told subscribers on X (formerly Twitter) on the day.

Fellow trader Daan Crypto Trades suggested that overall Bitcoin market dynamics had changed versus the period of weakness seen around the monthly close.

“Market feels different this week. Dips being bought up relatively quick and while price keeps sweeping highs it keeps crawling itself back and leaving lows untouched,” he wrote.

“Spot bid also stronger than the past few weeks. Might be wrong but I'm optimistic.”

Additional analysis predicted a longer-term BTC price breakout should U.S. regulators approve a Bitcoin spot price exchange-traded fund, or ETF, in the coming months.

$BTC.D Still holding on to the previous range high and bouncing.

— Daan Crypto Trades (@DaanCrypto) September 13, 2023

In the chop region but ultimately I think this would go higher in case of a BTC ETF Approval (one day). pic.twitter.com/3ob4MHl53l

More cautious was trader Skew, who referenced on-chain volume primed to cool once more after a “relief rally.”

“Daily structure looks fairly good here & decreasing volume so could definitely be looking towards a relief rally before lower,” part of commentary read, noting that BTC/USD was still holding the key $25,000 level.

First "green" September in seven years?

Up 1.15% month-to-date at the time of writing Bitcoin was nonetheless on course for its best-performing September in years.

Related: Bitcoin all-time high in 2025? BTC price idea reveals ‘bull run launch’

According to data from monitoring resource CoinGlass, the last time that BTC/USD gained in September was in 2016.

That year was its best on record at 6.35%, while its biggest "red" September month two years prior, when it lost 19%.

In 2022, Bitcoin shed 3.1% before climbing another 5.6% in October — a popular month among bulls, who informally refer to it as "Uptober."

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.