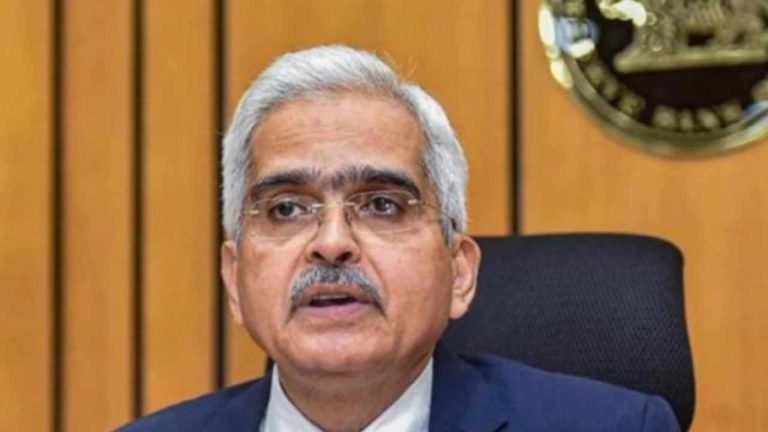

RBI Governor Shaktikanta Das has warned that the crypto market may crash and small investors will lose money. He added that the central bank believes that its warnings have deterred many people from investing in cryptocurrencies. RBI Governor’s Crypto Warnings The governor of the Indian central bank, the Reserve Bank of India (RBI), Shaktikanta Das, […]

RBI Governor Shaktikanta Das has warned that the crypto market may crash and small investors will lose money. He added that the central bank believes that its warnings have deterred many people from investing in cryptocurrencies. RBI Governor’s Crypto Warnings The governor of the Indian central bank, the Reserve Bank of India (RBI), Shaktikanta Das, […]

“Predicting a stock crash is a lot like predicting an earthquake. You know one will happen every so often but you can never tell exactly when or how severe it will be,” said Mati Greenspan.

Michael Burry, the investor who famously shorted the 2008 housing bubble, has dumped nearly all the stocks in his portfolio during Q2, suggesting there may be carnage ahead for stock and crypto markets.

According to a 13F disclosure filed with the Securities and Exchange Commission (SEC) on Aug. 15, Burry’s hedge fund Scion Asset Management shed around $292 million worth of shares across companies from Apple and Meta to pharmaceuticals giant Bristol-Myers Squibb, leaving only a minor position in a private prison company.

Michael Burry selling everything and buying a large position in a private prison company after seeing the IRS is hiring 87,000 new agents pic.twitter.com/lT5ny4SdlC

— Wall Street Memes (@wallstmemes) August 15, 2022

As Bitcoin (BTC) and crypto have a strong correlation to the stock market, especially in relation to macroeconomic events such as Federal Reserve interest rate hikes and the Russian/Ukraine conflict, Burry’s bearish outlook on stocks may also be a warning sign for the crypto sector.

However, asked by Cointelegraph whether Burry’s actions could spell potential gloom for the crypto markets, Quantum Economics founder and CEO Mati Greenspan said he is relatively unfazed by Burry’s moves, despite his track record of predicting bearish scenarios.

Greenspan stated that it's near impossible to predict the time and scale of crashes, and suggested that there is generally always something bearish on the horizon that could potentially send stock and crypto prices crashing.

“Predicting a stock crash is a lot like predicting an earthquake. You know one will happen every so often but you can never tell exactly when or how severe it will be.”

He also stressed that investors shouldn’t jump at every piece of FUD that circulates online, noting that “investing is a long-term play and doesn't normally work out for people who jump at shadows.”

Earlier this month, Burry warned investors that despite the recent rally in crypto and stocks, “winter is coming.” He pointed to U.S. consumer credit rates rising by $40 billion per month in contrast to its historical average of $28 billion month over month as reasons for such.

Seeking Alpha analyst Garret Duyck, however, offered a different take to Greenspan, outlining in an Aug. 16 article that Burry’s concerns over macro factors such as consumer credit, housing and business conditions may be something investors should take note of.

“I take notice when Michael Burry is a bear and right now he is a huge bear. By liquidating the positions in his portfolio, save one, he is putting his money where his mouth has been: out of the market.”

“The macro data seems to support his hypothesis. I'm seeing weakness all over the place. The consumer is struggling while housing and business conditions are projecting job weakness. Earnings estimates are too generous and negative earnings will materially impact equity valuations which are already stretched.” he added.

While Burry’s predictions have had varying accuracy since he rose to fame by shorting the 2008 housing bubble, some of his most recent takes on crypto have generally come into fruition.

For example, in March 2021 Burry described Bitcoin (BTC) as a “speculative bubble that poses more risk than opportunity” as he predicted a crash would soon unfold. This coincided with the price of BTC going from $59,000 in March to around $34,000 by the End of May.

Related: The Big Short’s Michael Burry takes aim at Cathie Wood’s Ark Innovation ETF

In June he followed that up by labeling the price action in stock and crypto markets as the “Greatest Speculative Bubble of All Time in All Things.” And while BTC went on a surge to a new ATH in November of around $69,044, no one needs reminding of how much the market has crashed since then.

New York Attorney General Letitia James is encouraging New Yorkers affected by the crypto crash to talk to her office about their experiences with digital asset exchanges. In a new Investor Alert, the NY Office of the Attorney General says it is encouraging crypto industry whistleblowers to approach the office as well. “New York Attorney General […]

The post New Yorkers Who Feel Deceived by Crypto Companies Urged To Report to Attorney General in Investor Alert appeared first on The Daily Hodl.

Bitcoin fell to its lowest level since December 2020 to start the trading week, as crypto markets continue to plunge. ETH also fell considerably on Monday, as prices declined by over 16%, falling below $1,200 in the process. Bitcoin Bitcoin fell to its lowest level since December 2020 on Monday, as crypto markets plunged to […]

Bitcoin fell to its lowest level since December 2020 to start the trading week, as crypto markets continue to plunge. ETH also fell considerably on Monday, as prices declined by over 16%, falling below $1,200 in the process. Bitcoin Bitcoin fell to its lowest level since December 2020 on Monday, as crypto markets plunged to […] NEAR fell to a one-month low to start the weekend, as prices moved below their long-term support point. WAVES was also lower during Saturday’s session, falling by as much as 14%. Overall, crypto markets are down nearly 5% as of writing. Near Protocol (NEAR) NEAR was one of the most notable movers to start the […]

NEAR fell to a one-month low to start the weekend, as prices moved below their long-term support point. WAVES was also lower during Saturday’s session, falling by as much as 14%. Overall, crypto markets are down nearly 5% as of writing. Near Protocol (NEAR) NEAR was one of the most notable movers to start the […]

Macro guru Raoul Pal says the crypto market is nearing its bottom amid a downturn that’s seen Bitcoin (BTC) fall below $30,000. As the prices of crypto assets continue to plummet, the former Goldman Sachs executive tells his 938,900 Twitter followers why he thinks the market could be on the verge of recovery. “Crypto is […]

The post Crypto Assets Are Showing Signs of Bottoming Out, Says Macro Guru Raoul Pal – Here’s Why appeared first on The Daily Hodl.

Cardano (ADA) founder Charles Hoskinson says large corrections are routine parts of the crypto industry and that the hysteria surrounding the latest market crash is inflated. In a new video update, Hoskinson says that seasoned investors seem unfazed by the most recent sharp market downturn as they have witnessed similar-sized corrections in the past, while […]

The post Cardano Founder Charles Hoskinson Says Fears of Crypto Market Collapse Overblown, Sets Timeframe for Recovery appeared first on The Daily Hodl.

Bank of England Deputy Governor Jon Cunliffe says that a collapse in the cryptocurrency market is certainly “plausible,” stating that regulators worldwide need to pursue crypto rules “as a matter of urgency.” While cryptocurrencies do not currently pose a threat to the country’s financial stability, the deputy governor says there are some “very good reasons” […]

Bank of England Deputy Governor Jon Cunliffe says that a collapse in the cryptocurrency market is certainly “plausible,” stating that regulators worldwide need to pursue crypto rules “as a matter of urgency.” While cryptocurrencies do not currently pose a threat to the country’s financial stability, the deputy governor says there are some “very good reasons” […] The director of the Netherlands’ Bureau for Economic Policy Analysis, a part of the country’s Ministry of Economic Affairs and Climate Policy, has predicted “The ultimate collapse of the crypto bubble.” He urges the government to ban bitcoin and other cryptocurrencies immediately. However, the country’s finance minister disagrees that banning cryptocurrency is right for the […]

The director of the Netherlands’ Bureau for Economic Policy Analysis, a part of the country’s Ministry of Economic Affairs and Climate Policy, has predicted “The ultimate collapse of the crypto bubble.” He urges the government to ban bitcoin and other cryptocurrencies immediately. However, the country’s finance minister disagrees that banning cryptocurrency is right for the […]

Bitcoin and Ethereum transaction fees have declined down to $7.20 and 4.80 respectively.

The transaction fees of Bitcoin and Ethereum have slumped to six-month lows as the markets cool after the recent crypto downturn.

According to BitInfoCharts, the average price of performing a transaction using Bitcoin has fallen from an early-April all-time high of $62.77 to around $7.20 — an 88% drop over just six weeks.

The falling Bitcoin transaction fees appear to have been driven by a decline in overall market activity, with daily volumes evaporating from more than $67 billion on May 10 to $30 billion as of this writing, according to CoinGecko.

The meteoric 2021 crypto bull-run has seen the average transaction fees associated with using Bitcoin or the Ethereum mainnet frequently skyrocket to unprecedented levels in recent months.

In February 2021, Bitcoin’s fees nearly tripled in two weeks following a Feb. 8 announcement that Tesla added $1.5 billion worth of Bitcoin to its balance sheet.

The news sparked a surge in crypto speculation, with the price breaking its former high of $40,000 before topping out at $54,410. Data from CoinGecko shows that 24-hour volume for BTC increased by nearly double from $57 billion on Feb. 7 — the day before Tesla’s announcement — to $101 billion on Feb. 23.

The average price of Bitcoin fees again surged into a record high of $62.77 on April 21 after the price of BTC spike to tag a local top of $64,804 on April 14. Bitcoin’s fees peaked on April 21 sparked by an increase in market activity as the markets began showing weakness, as traders raced each other to cash out near the highs.

Data from YCharts also shows that average Ethereum fees have dropped from May 20’s record high of $72.21 to just $4.80, a 93% reduction in less than two weeks.

Increasing adoption of Ethereum-powered decentralized finance and nonfungible tokens saw average fees increase from $3.50 at the beginning of the year to new highs of nearly $40 by the end of February.

While developers sought to discipline the fee markets through April’s Berlin hard fork, a speculative frenzy surrounding Shiba Inu and other ERC-20 dog tokens drove further congestion on the Ethereum mainnet, again pushing fees to record highs last month.

Ethereum’s transaction fees last established a new all-time high of $71.21 on May 19, with Cointelegraph reporting that a rush of traders racing to exit leveraged positions on-chain amid plummeting crypto prices was responsible for the hike.

Complex smart contract transactions incurred fees of more than 10 times the average at the peak of the market turmoil, with CoinShares CSO, Meltem Demirors, reporting claiming to have paid more than $1,000 for a single transaction.