United States Attorney Damian Williams said the office is working “around the clock” to respond to the implosion of FTX.

The United States Attorney’s Office for the Southern District of New York (SDNY) has formed the FTX Task Force to “trace and recover” missing customer funds, as well as handle investigations and prosecutions related to the exchange’s collapse.

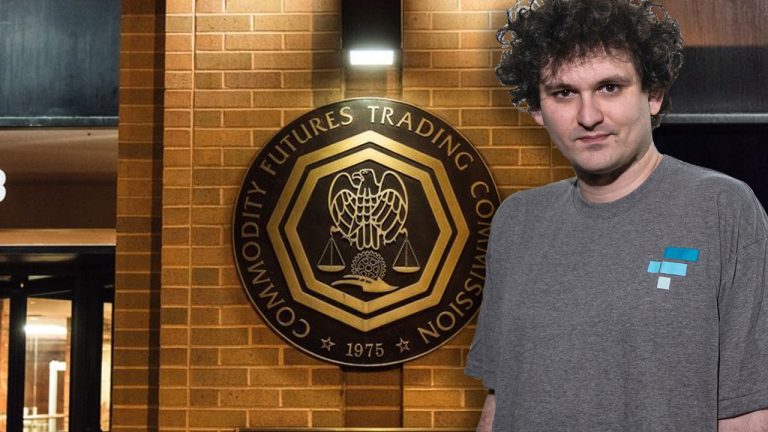

The announcement came in a statement from U.S. Attorney Damian Williams, who is the federal prosecutor in the FTX case involving founder Sam Bankman-Fried.

Charges from the Manhattan attorney’s office against Bankman-Fried include wire and securities fraud, conspiracy to commit wire and securities fraud, money laundering and violation of campaign finance laws.

“The Southern District of New York is working around the clock to respond to the implosion of FTX,” said Williams in the statement, adding:

“It’s an all-hands-on-deck-moment.”

“We are launching the SDNY FTX Task Force to ensure that this urgent work continues, powered by all of SDNY’s resources and expertise until justice is done.”

According to the SDNY, the task force’s team consists of senior prosecutors from its securities and commodities fraud, public corruption, money laundering and transnational crime enterprise units — which will be responsible for the “investigation and prosecution of matters related to the FTX collapse.”

Meanwhile, its “asset forfeiture and cyber capabilities” will be used to “trace and recover” the billions of dollars worth of missing customer funds, it added.

A similar effort had already been underway by FTX’s new management, which hired financial advisory company AlixPartners in December to conduct “asset-tracing” for FTX’s missing digital assets.

Related: Sam Bankman-Fried enters not guilty plea for all counts in federal court

The Manhattan U.S. Attorney’s Office reportedly first began its probe of FTX’s collapse shortly after the firm filed for bankruptcy on Nov. 11.

According to its website, the U.S. Attorney's Office for the Southern District of New York is known for prosecuting cases involving the violation of federal laws and investigates a broad array of criminal conduct “even when the conduct arises in distant places.”

FTX and key executives including Bankman-Fried, co-founder Gary Wang and Alameda Research former CEO Caroline Ellison had since September 2021 been operating out of the Bahamas, where many of the alleged crimes are believed to have been perpetrated.

On Jan. 3, Bankman-Fried pleaded “not guilty” to all eight criminal charges related to FTX’s implosion — which carries a total of 115 years of prison for the FTX founder if he is convicted.

Last month, Wang and Ellison pleaded guilty to federal fraud charges relating to their role in the collapse of the FTX exchange.