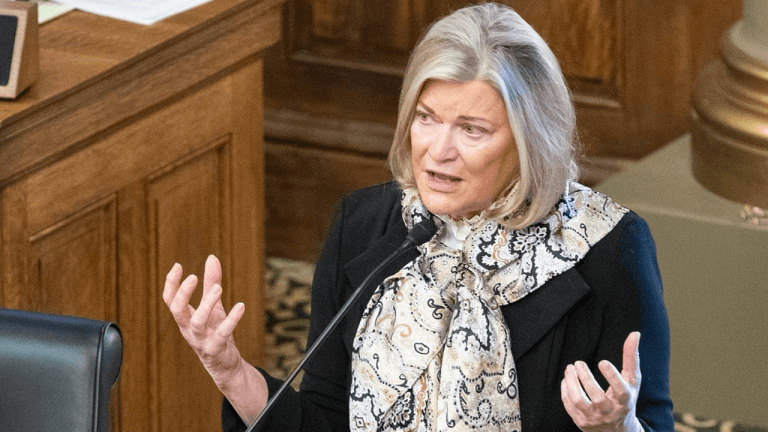

Wyoming Sen. Cynthia Lummis, a leading bitcoin proponent, cast doubt on the immediate feasibility of former President Donald Trump’s proposed cryptocurrency strategic reserve, citing insufficient Congressional backing as a critical barrier. Political Resistance Slows Trump’s Bitcoin Strategic Reserve, Lummis Says Trump’s plan, unveiled March 2, 2025, via Truth Social, calls for a “Crypto Strategic Reserve” […]

Wyoming Sen. Cynthia Lummis, a leading bitcoin proponent, cast doubt on the immediate feasibility of former President Donald Trump’s proposed cryptocurrency strategic reserve, citing insufficient Congressional backing as a critical barrier. Political Resistance Slows Trump’s Bitcoin Strategic Reserve, Lummis Says Trump’s plan, unveiled March 2, 2025, via Truth Social, calls for a “Crypto Strategic Reserve” […]

Wyoming has become the latest US state to propose a bill for a Strategic Bitcoin Reserve, just days before Donald Trump’s US presidential inauguration.

Wyoming, a state in the United States, has introduced a bill to create a Strategic Bitcoin Reserve, joining several other states nationwide ahead of Donald Trump’s presidential inauguration on Jan. 20.

“Wyoming took its first bold step toward a strategic Bitcoin reserve,” Wyoming Senator Cynthia Lummis wrote in a Jan. 17 X post, following the introduction of the bill titled “State Funds-investment in Bitcoin, which, if passed, allows Wyoming state funds to be invested in Bitcoin (BTC).

Lummis, a vocal Bitcoin advocate who introduced the Bitcoin Strategic Reserve bill for the US government in July 2024, praised Wyoming representative Jacob Wasserburger for introducing the legislation to “allow permanent funds to diversify into Bitcoin.”

U.S. Senator Cynthia Lummis (R-WY) wants the Federal Deposit Insurance Corporation (FDIC) to secure materials that could be related to the US government’s alleged efforts to de-bank crypto firms. In a new letter to FDIC chair Marty Gruenberg, Lummis says whistleblowers claim that the deposit insurer is destroying materials linked to its digital asset activities. […]

The post Whistleblowers Allege FDIC Officials Are Destroying Documents Related to Operation Chokepoint 2.0: Senator Lummis appeared first on The Daily Hodl.

This week, Senator Cynthia Lummis raised concerns about the U.S. Marshals Service’s management of seized bitcoin, calling for transparency and questioning the decision to liquidate nearly 70,000 BTC, worth billions. Government Bitcoin Sale Questioned by Wyoming Senator In a letter addressed to U.S. Marshals Service Director Ronald Davis, Senator Cynthia Lummis scrutinized the agency’s track […]

This week, Senator Cynthia Lummis raised concerns about the U.S. Marshals Service’s management of seized bitcoin, calling for transparency and questioning the decision to liquidate nearly 70,000 BTC, worth billions. Government Bitcoin Sale Questioned by Wyoming Senator In a letter addressed to U.S. Marshals Service Director Ronald Davis, Senator Cynthia Lummis scrutinized the agency’s track […]

Fed’s Barr once said the Federal Reserve would “likely view it as unsafe and unsound for banks to directly own crypto-assets on their balance sheets.”

The United States Federal Reserve’s Michael Barr is set to resign as vice chair for supervision — marking the latest exit by a US official apparently linked to “Operation Chokepoint 2.0” — a purportedly concerted federal effort to debank crypto companies.

Barr’s resignation will take effect on Feb. 28 — or earlier, if a successor is appointed, he said in a Jan. 6 letter addressed to US President Joe Biden.

Barr will, however, continue to serve as a member of the Federal Reserve Board of Governors.

U.S. Senator Cynthia Lummis recently reinforced the intention of extending faculties to the Federal Reserve to purchase and own bitcoin as part of its reserve assets. Lummis stated that the U.S. debt can be repaid through a bitcoin strategic bitcoin reserve, as proposed in her BITCOIN Act. US Senator Cynthia Lummis Proposes Allowing the Federal […]

U.S. Senator Cynthia Lummis recently reinforced the intention of extending faculties to the Federal Reserve to purchase and own bitcoin as part of its reserve assets. Lummis stated that the U.S. debt can be repaid through a bitcoin strategic bitcoin reserve, as proposed in her BITCOIN Act. US Senator Cynthia Lummis Proposes Allowing the Federal […] A U.S. senator has proposed selling gold reserves to create a strategic bitcoin reserve, a revolutionary move to bolster the dollar and tackle U.S. national debt. Selling Gold for Bitcoin: US Senator’s Game-Changing Proposal U.S. Senator Cynthia Lummis (R-WY) shared insights during a Thursday interview with CNBC as bitcoin reached a historic peak. She attributed […]

A U.S. senator has proposed selling gold reserves to create a strategic bitcoin reserve, a revolutionary move to bolster the dollar and tackle U.S. national debt. Selling Gold for Bitcoin: US Senator’s Game-Changing Proposal U.S. Senator Cynthia Lummis (R-WY) shared insights during a Thursday interview with CNBC as bitcoin reached a historic peak. She attributed […]

Avik Roy, the president of a nonprofit think tank, said Senator Cynthia Lummis’ idea that Bitcoin could eliminate federal debt is an “overselling” of what Bitcoin can do.

United States Senator Cynthia Lummis’ plan to set up a strategic Bitcoin reserve won’t be enough to solve the country’s debt crisis, which has now swelled to $35 trillion, the president of the nonprofit think tank says.

“When Senator Cynthia Lummis of Wyoming talks about how a Bitcoin reserve could help us eliminate the federal debt, that’s an overselling of what Bitcoin could do,” Avik Roy, president of the Foundation for Research on Equal Opportunity said on stage at the North American Blockchain Summit 2024 in Dallas, Texas on Nov. 20.

A scenario where the US buys an “enormous” amount of Bitcoin (BTC) that appreciates could help, Roy said, but it won’t catch the $35.46 trillion debt that has been rising nearly exponentially since the 1980s.

The House and Senate Republicans claimed the SEC evaded the notice and comment rulemaking process required by the Administrative Procedure Act by issuing SAB 121.

More than 40 United States Republicans have called on the US securities regulator to rescind its “disastrous” Staff Accounting Bulletin No. 121 rule after a repeal bill received bipartisan support before being vetoed.

SAB 121 upends custody rules for cryptocurrencies, weakens consumer protections, and stifles financial innovation, House Financial Services Committee Chair Patrick McHenry, Senator Cynthia Lummis and 40 other politicians claimed in a Sept. 23 letter to the Gary Gensler-led Securities and Exchange Commission.

The 42 politicians further claimed that SAB 121 — a proposed rule mandating that SEC-reporting entities custodying cryptocurrencies must record those holdings as liabilities on their balance sheets — was issued without consulting any “prudent regulators” and that the accounting approach “deviates from established accounting standards.”

Economist and gold advocate Peter Schiff argues that bitcoin exchange-traded funds (ETFs) contradict the core principles of the cryptocurrency by undermining decentralization and peer-to-peer transactions. He criticizes recent buyers of bitcoin for focusing solely on profit, suggesting this behavior indicates an impending collapse. Schiff also slammed Senator Cynthia Lummis’ bill proposing a U.S. bitcoin reserve, […]

Economist and gold advocate Peter Schiff argues that bitcoin exchange-traded funds (ETFs) contradict the core principles of the cryptocurrency by undermining decentralization and peer-to-peer transactions. He criticizes recent buyers of bitcoin for focusing solely on profit, suggesting this behavior indicates an impending collapse. Schiff also slammed Senator Cynthia Lummis’ bill proposing a U.S. bitcoin reserve, […]