An Ethereum (ETH) challenger is surging after blue-chip investors poured hundreds of millions of dollars into the crypto project. According to a new report by Bloomberg, Near Protocol (NEAR) just raised $350 million led by tech investment firm Tiger Global, nearly double what it acquired through fundraising just three months ago. NEAR is a layer-1 […]

The post One Ethereum Rival Is Exploding As Institutional Investors Pile In – And It’s Not Solana, Avalanche or Cardano appeared first on The Daily Hodl.

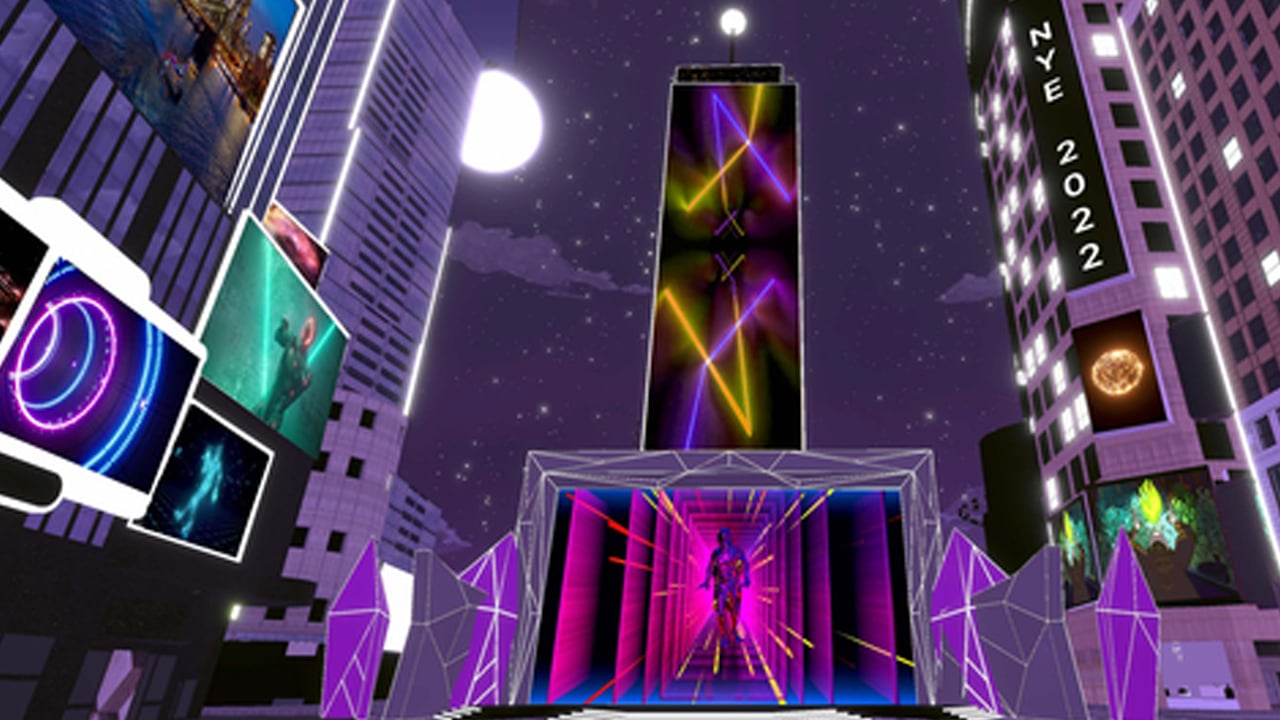

There’s a New Year’s Eve fiesta in the metaverse called the Metafest 2022 Global Party hosted by the real estate firm Jamestown and the crypto investment firm Digital Currency Group (DCG) in Decentraland. According to the announcement, the owner of One Times Square, Jamestown will recreate the iconic site in Decentraland for the 2022 ball […]

There’s a New Year’s Eve fiesta in the metaverse called the Metafest 2022 Global Party hosted by the real estate firm Jamestown and the crypto investment firm Digital Currency Group (DCG) in Decentraland. According to the announcement, the owner of One Times Square, Jamestown will recreate the iconic site in Decentraland for the 2022 ball […] Genesis Trading’s head of market insights says that the institutional investment growth in the crypto space over the last 12 months “has been astonishing.” The executive added: “We’re seeing strong signs of that accelerating over the next year.” Strong Signs of Institutional Investment Growth Accelerating Next Year Noelle Acheson, head of market insights at Genesis […]

Genesis Trading’s head of market insights says that the institutional investment growth in the crypto space over the last 12 months “has been astonishing.” The executive added: “We’re seeing strong signs of that accelerating over the next year.” Strong Signs of Institutional Investment Growth Accelerating Next Year Noelle Acheson, head of market insights at Genesis […] Foundry, the Digital Currency Group (DCG) subsidiary and cryptocurrency mining and consulting firm from Rochester, New York announced the launch of a new platform on Wednesday called Foundry Staking. The company says the product currently supports 20 blockchain networks and will provide digital asset staking and advisory services going forward. Foundry Launches Staking Services The […]

Foundry, the Digital Currency Group (DCG) subsidiary and cryptocurrency mining and consulting firm from Rochester, New York announced the launch of a new platform on Wednesday called Foundry Staking. The company says the product currently supports 20 blockchain networks and will provide digital asset staking and advisory services going forward. Foundry Launches Staking Services The […] Ripio, a Latin American (Latam) exchange headquartered in Argentina, raised $50 million in its latest funding round, led by Digital Currency Group (DCG). The exchange, which has a stronghold in countries like Argentina and Brazil, will use these new funds to further expand to new countries in the area and consolidate its spot as one […]

Ripio, a Latin American (Latam) exchange headquartered in Argentina, raised $50 million in its latest funding round, led by Digital Currency Group (DCG). The exchange, which has a stronghold in countries like Argentina and Brazil, will use these new funds to further expand to new countries in the area and consolidate its spot as one […] The Los Angeles-based company Big Time Studios has announced the company is set to raise $21 million in two funding rounds backed by a number of investors. The company’s founder Ari Meilich was the CEO and co-creator of the Ethereum metaverse Decentraland. Big Time Studios aims to bring non-fungible token (NFT) assets to the billion-dollar […]

The Los Angeles-based company Big Time Studios has announced the company is set to raise $21 million in two funding rounds backed by a number of investors. The company’s founder Ari Meilich was the CEO and co-creator of the Ethereum metaverse Decentraland. Big Time Studios aims to bring non-fungible token (NFT) assets to the billion-dollar […]

The Grayscale Bitcoin Trust continues to trade at a discount compared to BTC, a situation that presents a unique challenge to Grayscale and investors.

Since 2013 the Grayscale Bitcoin Trust Fund (GBTC) has offered its investors exposure to Bitcoin (BTC) through a publicly quoted private instrument. However, the trust's convertibility and liquidity vastly differ from an Exchange Traded Fund (ETF).

Trusts are structured as companies, at least in regulatory form, and are 'closed-end funds' which can initially only be sold to accredited investors. This means the number of available shares is limited, and retail traders can only access them via secondary markets. Furthermore, a GBTC share cannot be redeemed for the underlying BTC position.

Historically, GBTC used to trade above the equivalent BTC held by the fund, which was caused by the retail crowd's excess demand. The common practice for institutional clients was to buy shares directly from Grayscale at par and sell at a profit after the six-month lock-up period.

During most of 2020, GBTC shares traded at a premium to its Net Asset Value (NAV), which varied from 5% to 40%. However, this situation drastically changed in March 2021. The approval of two Bitcoin ETFs in Canada heavily contributed to extinguishing the GBTC premium.

ETF funds are less risky and cheaper compared to trusts. Moreover, there is no lock-up period, and retail investors can attain direct access to buy shares at par. Therefore, the emergence of a better Bitcoin investment vehicle seized much of allure that GBTC once possessed.

In late February, the GBTC premium entered adverse terrain, and holders began desperately flipping their positions to avoid getting stuck in an expensive and non-redeemable instrument. The situation deteriorated up to an 18% discount despite BTC price reaching an all-time high in mid-March.

On March 10, Digital Currency Group (DCG), Grayscale Investments' parent company, announced a plan to purchase up to $250 million of the outstanding GBTC shares. Although the conglomerate did not specify the reason behind the move, the excessive discount certainly would have pressured their reputation.

As the situation deteriorated, DCG announced a roadmap for turning its trust funds into a U.S. ETF, although no specific guarantees or deadlines have been informed.

On May 3, the firm announced that it had purchased $193.5 million worth of GBTC shares by April. Moreover, DCG increased its GBTC shares repurchase potential to $750 million.

Considering the $36.3 billion in assets under management for the GBTC trust, there's reason to believe that buying $500 million worth of shares might not be enough to ease the price discount.

Because of this, some important questions arise. For example, can DCG lose money by making such a trade? Who's desperately selling, and is a conversion to an ETF being analyzed?

As the controller of the fund administrator, DCG can buy the trust fund's shares at market prices and withdraw the equivalent Bitcoin for redemption. Therefore, buying GBTC at a discount and selling the BTC at market prices will consistently produce a profit and there's no risk by doing this.

Apart from a few funds that regularly report their holdings, there's no way to know who has been selling GBTC below net asset value. The only investors with 5% or more holdings are BlockFi and Three Arrows Capital, but none have reported reducing their position.

Therefore, it could be potentially multiple retail sellers exiting the product at any cost, but it is impossible to know right now.

While buying GBTC at a 10% or larger discount might seem a bargain at first, investors must remember that as of now, there's no way of getting out of those shares apart from selling it at the market.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Investment management firm, Marlton, has applauded the recent decision to authorize the purchase by Digital Currency Group (DCG) of up to a total of $750 million worth of shares of Grayscale Bitcoin Trust (GBTC). This latest action follows Marlton’s recent call for DCG and the Grayscale board to do more to narrow the discount on […]

Investment management firm, Marlton, has applauded the recent decision to authorize the purchase by Digital Currency Group (DCG) of up to a total of $750 million worth of shares of Grayscale Bitcoin Trust (GBTC). This latest action follows Marlton’s recent call for DCG and the Grayscale board to do more to narrow the discount on […] On April 23, the publicly listed mining operation Bitfarms revealed a partnership with the Digital Currency Group (DCG) subsidiary Foundry Digital LLC. Bitfarms will be joining Foundry’s American mining pool and the two bitcoin mining firms have revealed the joint purchase of 2,465 Whatsminer M30S ASIC mining machines. Bitfarms Partners With Foundry’s US Operations At […]

On April 23, the publicly listed mining operation Bitfarms revealed a partnership with the Digital Currency Group (DCG) subsidiary Foundry Digital LLC. Bitfarms will be joining Foundry’s American mining pool and the two bitcoin mining firms have revealed the joint purchase of 2,465 Whatsminer M30S ASIC mining machines. Bitfarms Partners With Foundry’s US Operations At […]