The reasons ranged from cannibalizing their own businesses to releasing potentially inferior products.

Over a dozen of the biggest names in the United States technology industry have filed “risk factor” reports with the Securities and Exchange Commission (SEC) indicating that artificial intelligence (AI) could threaten company finances.

While not uncommon, these risk reports outline internal thinking when it comes to the potential pitfalls of dedicating resources and funds to the development of nascent technologies such as AI.

Those filing warnings, according to a report from Bloomberg, include Adobe, Dell, Google, Meta, Microsoft, Nvidia, Oracle, Palo Alto Networks, Uber and at least a few others.

Weak tech corporate earnings, spot Bitcoin ETF inflows and the potential arrival of a new major investor drove Bitcoin price above $63,000.

Bitcoin (BTC) rose by 4.5% from June 28 to July 1, breaking the $63,000 resistance for the first time in a week. The prior decline was largely due to fears stirred by the German government’s BTC transactions with exchanges and worries about Mt. Gox creditors selling large amounts of Bitcoin during the bankruptcy proceedings. However, this bearish trend was reversed by three key factors, including the entry of a possible new major investor into the market.

On July 1, the German government moved 1,500 BTC, valued at $95 million, to various cryptocurrency exchanges, as reported by the onchain analytics firm Arkham Intelligence. On a similar note, the United States government transferred 1,184 BTC on June 30 from a wallet linked to previously confiscated funds. As of now, the German government possesses Bitcoin assets worth $2.8 billion, primarily acquired from a defunct movie piracy site closed in 2013.

These transactions fueled speculation that the selling pressure might persist, as the U.S. government’s wallet also holds Bitcoin valued at $13.4 billion, according to data from Arkham Intelligence. The most significant recent transaction by the U.S. government occurred on June 26, when it sent 3,940 BTC, worth $214 million at that time, to a Coinbase Prime account. These funds were confiscated from Banmeet Singh, a convicted drug trafficker, earlier in 2024.

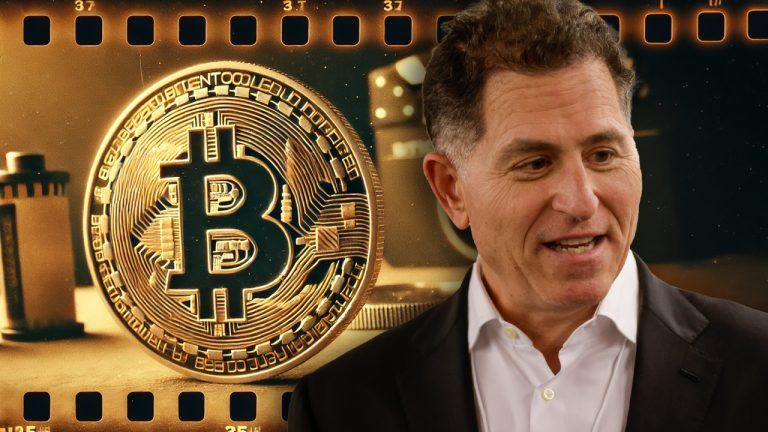

Dell CEO Michael Dell recently conducted a poll asking people to identify the most important factor among artificial intelligence (AI), love and relationships, and the crypto asset network Bitcoin. The poll concluded with Bitcoin receiving a majority of the more than 64,000 votes. Dell’s Poll on AI, Bitcoin, or Love and Relationships — Elon Musk […]

Dell CEO Michael Dell recently conducted a poll asking people to identify the most important factor among artificial intelligence (AI), love and relationships, and the crypto asset network Bitcoin. The poll concluded with Bitcoin receiving a majority of the more than 64,000 votes. Dell’s Poll on AI, Bitcoin, or Love and Relationships — Elon Musk […]

Dell's message on X follows his $2.1 billion cash out from his Dell Technologies Class C common stock holdings.

Michael Dell, founder and CEO of Dell Technologies, has generated excitement with a curious message suggesting that his company might explore Bitcoin (BTC) as a possible investment.

On June 21, Dell tweeted, "Scarcity creates value," a phrase often associated with Bitcoin due to its supply cap of 21 million tokens against rising demand. His tweet quickly drew the attention of Michael Saylor, a prominent advocate for Bitcoin as a corporate treasury asset.

Dell's subsequent repost of Saylor’s reply, coupled with an image of Cookie Monster eating Bitcoin, left the market abuzz with anticipation that he may invest in the cryptocurrency in the future, either from his personal investment portfolio or via his company.

The Iota Foundation joined Dell along with ClimateCHECK and BioE to fight climate change using real-time carbon footprint data.

Iota Foundation, a non-profit distributed ledger technology ecosystem provider, partnered with tech giant Dell Technologies to develop a data-driven solution for the real-time tracking of carbon footprints.

Edge solutions from Dell Technologies announced the onboarding of Iota, climate-change-focused technology company ClimateCHECK, and BioE, to develop a solution on top of Dell’s in-house initiatives: Data Confidence Fabric (DCF) and Project Alvarium.

We've partnered w/ @Iota, BioE, & @ClimateCHECK to develop real-time carbon footprint tracking through a #data confidence fabric!

— Dell Edge & Telecom (@Dell_Edge) June 6, 2022

Hear how #ProjectAlvarium accurately tracks carbon footprints w/ #DellTech Edge solutions.

https://t.co/u5CxmbMBAL@Intel #IOTA #Sustainability pic.twitter.com/52RENnEW3X

Iota has been an active participant in Project Alvarium, which was first conceptualized by Dell Technologies in 2019 to utilize vetted data from the DFC or “trust fabric” across heterogeneous systems. Matthew Yarger, head of sustainability at the Iota Foundation, stated:

“Transparency and trust in data is paramount for addressing the global issues of climate change and transitioning to climate action.”

Sharing details about the initiative, Yarger explained that the four companies together developed an integrated digital measurement, reporting and verification (MRV) tool.

In conjunction with Project Alvarium, the digital MRV can pick up data from sensors and manual input and process it through Dell PowerEdge servers to ultimately deliver near real-time insights into the carbon footprints of BioE’s sustainable energy and composting facility. Yarger added:

“We’re now able to track and verify data around climate change and how we’re actively trying to address it at a level that’s never been achieved before.”

Related: Kenyan energy company entices Bitcoin miners with geothermal power

KenGen, an energy company from Kenya recently invited Bitcoin (BTC) miners to run their operations using its renewable power capacity.

As Cointelegraph reported, KenGen generates 86% of its energy through renewable geothermal sources. Local reports suggest that KenGen plans to rent out space from its Olkaria facility, situated at a volcanic site.

The acting director of geothermal development at KenGen, Peketsa Mwangi, too confirmed the company’s intent to host Bitcoin miners in Kenya:

“We’ll have them here because we have the space and the power is near, which helps with stability.”