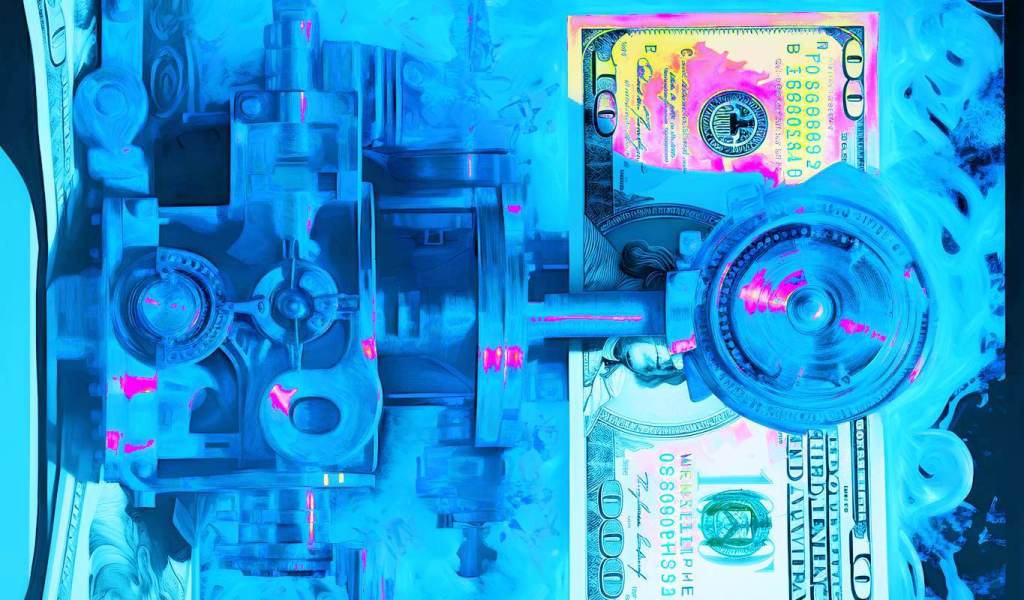

New numbers are shedding light on the multi billion-dollar flow of capital out of the US banking system. In a new report, S&P Global says total non-brokered deposits, or funds coming mostly from retail customers, recorded their sixth consecutive quarterly decline in Q3 of this year. The market intelligence firm says non-brokered deposits dropped from […]

The post $174,303,000,000 in Deposit Flight Hits US Banks in Three Months As S&P Global Declares Banking Industry Is ‘Gradually Shrinking’ appeared first on The Daily Hodl.

Several of America’s biggest banks are facing a flood of complaints about issues with account balances and direct deposits. Customers at JPMorgan Chase, Bank of America, US Bank, Wells Fargo and Truist say money that should have arrived in their accounts is not showing up. The network monitoring app Downdetector is reporting widespread issues at […]

The post JPMorgan Chase, Bank of America, Wells Fargo Suffer Major Outage As Customers Scramble to Locate Deposits appeared first on The Daily Hodl.

Three US financial titans just witnessed the flight of $44.354 billion in deposits in a single quarter. According to Bank of America’s (BofA) most recent quarterly earnings press release, the lender’s average deposits fell from $1.0063 trillion on June 30th to $980.1 billion by September 30th – a reduction of about $26.2 billion in three […]

The post $44,354,000,000 Exits Bank of America, Morgan Stanley and BNY Mellon in Three Months As Deposit Flight Refuses to Relent appeared first on The Daily Hodl.

The newly created fake APT token called “ClaimAPTGift.com” made its way to 400,000 Aptos wallets, and users found they were able to deposit and sell it on the exchange.

South Korea cryptocurrency exchange Upbit has resumed Aptos (APT) deposits and withdrawals again after fixing an issue that saw a scam APT token incorrectly recognized as the real deal.

On Sept. 24, Upbit abruptly halted Aptos token services after noting an “abnormal deposit attempt,” prompting an inspection of the wallet system.

The problem appears to have originated from a newly created fake APT token called “ClaimAPTGift.com” which had made its way to 400,000 Aptos wallets after its creation on Sept. 21.

The fake token was likely part of a typical token airdrop scam, in which users are airdropped tokens that contain links pointing unsuspecting users to phishing websites.

However, a reported failure by Upbit to properly verify the source code of the scam tokens led to the exchange recognizing the fake tokens as real Aptos tokens, allowing users to deposit them on Upbit and sell them for Aptos' market price, according to X user Definalist.

“It seems that during the process of reflecting $APT coin deposits, there was a failure to check the type arguments, and all same functions transfers were recognized as the same APT native token.”

⚡️How did such a huge and foolish incident occur?

— Definalist (@definalist) September 24, 2023

- It seems that during the process of reflecting $APT coin deposits, there was a failure to check the type arguments, and all same functions transfers were recognized as the same APT native token.

- Under normal circumstances,… https://t.co/CvDgTdqnGl pic.twitter.com/8gEx5YnOLH

This reportedly led to users being able to walk away with funds. Upbit’s customer center has reportedly started to request refunds from users who sold the fake APT tokens.

The issue has since been fixed. As of Sept. 24 at 11:00 pm local time, Upbit confirmed it has resumed deposits and withdrawals after completing the wallet inspection.

Related: Aptos token rises 11.6% after Microsoft deal to marry AI with blockchain

“The action against the abnormal deposit attempt has been completed, and there is no problem with your Aptos transaction,” it said in a statement.

It however warned that there could be delays in processing deposits and withdrawals, and possible temporary price fluctuations in the APT tokens as compared to other exchanges.

APT is currently trading at $5.31 over the last 24 hours, however, the price of APT on Upbit is around $5.56, according to CoinGecko.

Magazine: China’s blockchain satellite in space, Hong Kong’s McNuggets Metaverse: Asia Express

CoinEx has rebuilt its wallet system following a $70 million hack and is set to resume deposit and withdrawals for select cryptocurrencies.

Cryptocurrency exchange CoinEx is set to resume deposit and withdrawals for its users more than a week after it suffered a $70 million hack due to compromised hot wallet private keys.

In previous correspondence with Cointelegraph, the exchange outlined its priority to build and deploy a new wallet system to facilitate activities for the 211 blockchains and 737 tokens that it served before the hacking incident.

The latest statement from the exchange announces the resumption of deposit and withdrawal services of BTC, ETH, USDT, USDC and other tokens from Sept. 21.

CoinEx will update deposit addresses for the listed tokens and will generate new deposit addresses for its users.

CoinEx customers were advised not to deposit into old addresses on the platform, as this would result in assets being permanently lost. The exchange also warned of a potentially large number of pending withdrawals at the resumption of its operations:

“We ensure the new wallet system is stable, and we will gradually resume deposit and withdrawal services for more assets.”

The exchange maintains that it has implemented a 100% asset reserve policy to safeguard users against potential security threats. Previous updates following the hacking incident also stated that users assets were not affected and that CoinEx's User Asset Security Foundation would cover any financial losses.

Cointelegraph has reached out to CoinEx to ascertain if it will refund users in the event that assets were affected or are affected in the future by the event.

Gemini is investigating the root cause behind the suspected price glitch.

Crypto users have reported seeing “wonky” prices for Ripple’s XRP (XRP) token on the Gemini crypto exchange hours after it relisted the token on its platform for deposits and trading.

Several crypto community members on X (Twitter) on Aug. 11 posted screenshots of what many have described as a "price glitch" that has seen XRP’s displayed price on the exchange rise above $1 a number of times and even spiking to $50 on one occasion.

Major exchange @Gemini had a glitch.

— JackTheRippler ©️ (@RippleXrpie) August 10, 2023

$50 per #XRP! pic.twitter.com/UBEWN7Rv7j

However, the current market price for XRP is $0.63, according to the crypto tracking website CoinGecko.

Wow. Current price of $XRP on @Gemini. Is this a glitch? pic.twitter.com/Nbzro1ahlW

— Yassin Mobarak (@Dizer_YM) August 11, 2023

Meanwhile, as of Aug. 11, 1:25 am UTC, Gemini announced it has put its platform into full site maintenance.

“We are currently performing maintenance on the Gemini platform and so all services are currently unavailable. All customers assets and funds remain secure. We will provide updates here once we have more information to share.”

It also reported some users were seeing timeout issues on spot markets.

Related: Digital Currency Group files motion to dismiss Gemini lawsuit, claiming it’s a PR campaign

Gemini announced it had made XRP available again for trading on the crypto exchange on Aug. 10.

It comes after United States District Court Judge Analisa Torres ruled in the Ripple’s case against the Securities Exchange Commission that XRP is not a security when sold on exchanges.

Xcited to announce $XRP is now available for trading on Gemini. pic.twitter.com/E9Xiv8BTo3

— Gemini (@Gemini) August 10, 2023

Magazine: Deposit risk: What do crypto exchanges really do with your money?

Customers at one of America’s largest banks are reporting missing deposits on social media. People who bank with Wells Fargo say their direct deposits are not showing up in their accounts. Reports began to spread across the social media platform X on Thursday as frustrated account holders tried to track down their money. ?-heart attack. […]

The post Customers at US bank say deposits are missing as angry reports spread on social media appeared first on The Daily Hodl.

Billions of dollars in institutional cash is exiting JPMorgan Chase in a search of higher yields, according to a new report. New numbers show the amount of cash deposits at JPMorgan’s corporate and investment bank fell by $75 billion in the second quarter of 2023, reports the Financial Times. That’s a loss of 10% from […]

The post JPMorgan Chase Loses $75,000,000,000 in Institutional Deposits As Customers Demand Higher Yields: Report appeared first on The Daily Hodl.

The news comes less than a month after Binance announced their plans to integrate Bit Lightning Network.

Cryptocurrency exchange Binance has completed the integration of the Bitcoin Lightning Network on its platform for BTC withdrawals and deposits.

The development was confirmed by Binance in a July 17 blog post, where they noted that Binance users can now use the layer-2 scaling solution for BTC withdrawals and deposits.

When users now choose to withdraw or deposit Bitcoin, they will now be able to select "LIGHTNING" as an option. Other options include BNB Smart Chain (BEP20), Bitcoin, BNB Beacon Chain (BEP2), BTC (SegWit), and Ethereum ERC20.

Binance first hinted at the integration of the Lightning Network in May after it had to temporarily pause BTC withdrawals due to a flood of pending transactions caused by "the recent surge in BTC network gas fees."

The explosion in transaction fees has largely been attributed to the creation of memecoins on Bitcoin in the form of BRC-20 tokens — a new token standard on the network.

#Binance has completed the integration of Bitcoin ( #BTC ) on the Lightning Network and deposits and withdrawals are now open.

— Binance (@binance) July 17, 2023

More details here https://t.co/aIofPdtAGY

Binance later confirmed it was working to onboard the Lightning Network on June 20 shortly after users spotted Binance's own Lightning nodes.

Related: What is the Bitcoin Lightning Network, and how does it work?

Binance joins Bitfinex, River Financial, OKX, Kraken and CoinCorner as the other prominent exchanges to have embraced the Lightning Network.

Coinbase CEO Brian Armstrong also signaled his intention to integrate the Bitcoin layer 2 network on Coinbase in April. However, he didn't give a timeline as to when that may happen.

The Lightning Network aims to make Bitcoin transactions faster and cheaper by allowing users to create off-chain transaction channels.

Magazine: Bitcoin 2023 in Miami comes to grips with ‘shitcoins on Bitcoin’

Nearly $47 billion has entered the US banking system in just one week as banks deploy new strategies to bring customers back. Depositors added exactly $46.95 billion to American bank accounts in the week ending June 21st, according to new stats compiled by the Federal Reserve Economic Data (FRED) system. The multibillion-dollar jump is thanks, in […]

The post $46,950,000,000 Enters US Banking System in One Week As Banks Deploy ‘Expensive Fix’ For Deposit Flight appeared first on The Daily Hodl.