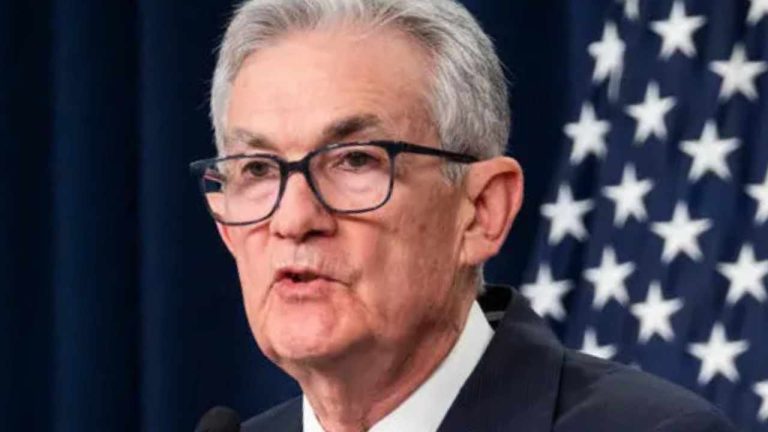

The president-elect cannot officially nominate anyone until after he is inaugurated on Jan. 20, but the US Senate has been holding hearings to question his potential picks.

Scott Bessent, US President-elect Donald Trump’s anticipated pick for the country’s Treasury secretary, faced Senators in a hearing to explain his positions on financial issues.

In a Jan. 16 hearing of the US Senate Committee on Finance, Bessent responded to questions from Republican Senator Marsha Blackburn regarding a US central bank digital currency (CBDC).

The Tennessee lawmaker brought up Chinese officials introducing a digital yuan to foreign attendees at the 2022 Olympics and asked how Bessent could handle a potential digital dollar if officially nominated and confirmed in the Senate.

“I see no reason for the US to have a central bank digital currency,” said Bessent. “In my mind, a central bank digital currency is for countries who have no other investment alternatives. [...] Many of these countries are doing it out of necessity, whereas the US — if you hold US dollars, you can hold a variety of very secure US assets.”