Dubai’s upcoming Crypto Tower will redefine blockchain innovation, offering on-chain transparency, AI-powered solutions, and cutting-edge facilities for Web3 startups and decentralized finance leaders. Dubai’s Crypto Tower: A Revolutionary Hub for Web3 Pioneers and Innovators Dubai Multi Commodities Centre (DMCC) and REIT Development unveiled on Wednesday plans for a pioneering Crypto Tower in Jumeirah Lakes Towers […]

Dubai’s upcoming Crypto Tower will redefine blockchain innovation, offering on-chain transparency, AI-powered solutions, and cutting-edge facilities for Web3 startups and decentralized finance leaders. Dubai’s Crypto Tower: A Revolutionary Hub for Web3 Pioneers and Innovators Dubai Multi Commodities Centre (DMCC) and REIT Development unveiled on Wednesday plans for a pioneering Crypto Tower in Jumeirah Lakes Towers […]

The Dubai-based venture capital firm said it plans to invest in 100 early-stage Web3 projects, 25 liquid tokens and 10 fund-of-fund allocations.

Cryptocurrency venture capital firm Sigma Capital has launched a $100 million investment fund, tipping plans to invest in Web3 startups across the United Arab Emirates and globally.

According to the announcement, the capital will be used to invest in early-stage Web3 companies and liquid tokens in the decentralized finance, blockchain infrastructure, metaverse, gaming and real-world asset (RWA) tokenization markets.

The capital will also be used for fund-of-fund allocations, a portfolio diversification strategy that distributes capital to a group of funds.

An executive from hedge fund Brevan Howard says that the United Arab Emirates’ (UAE) sensible approach to crypto regulations is making the country a top region for digital asset trading. According to a new report from Reuters, $35 billion hedge fund Brevan Howard group head of compliance Ryan Taylor told the AIM Conference in Dubai […]

The post $35,000,000,000 Hedge Fund Brevan Howard Eyeing One Country for Its ‘Sensible’ Crypto Regulations: Report appeared first on The Daily Hodl.

Dubai’s Virtual Assets Regulatory Authority (VARA) has implemented stricter regulations for crypto companies to enhance investor protection and ensure transparency. The new rules require firms to include risk warnings in marketing materials, obtain necessary licenses, and adhere to compliance standards. These measures aim to inform investors about the risks and volatility of cryptocurrencies, while fostering […]

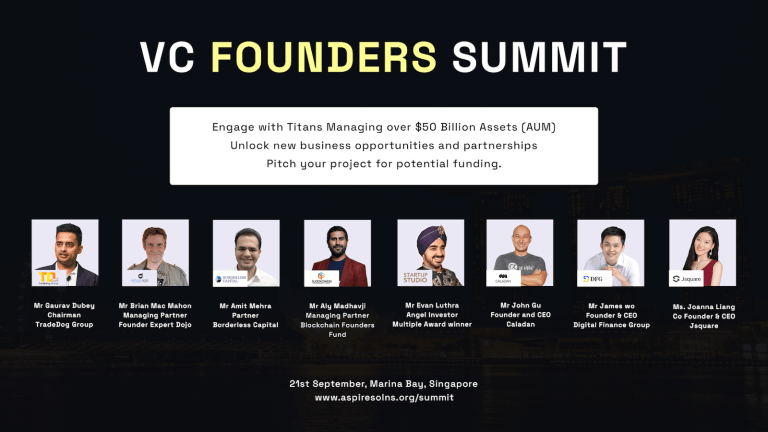

Dubai’s Virtual Assets Regulatory Authority (VARA) has implemented stricter regulations for crypto companies to enhance investor protection and ensure transparency. The new rules require firms to include risk warnings in marketing materials, obtain necessary licenses, and adhere to compliance standards. These measures aim to inform investors about the risks and volatility of cryptocurrencies, while fostering […] PRESS RELEASE. [Singapore, 2024] – The much-anticipated VC Founders Summit is set to take place on September 21st, bringing together venture capitalists, industry leaders, and innovators to shape the future of investment and entrepreneurship. As a dynamic side event of the renowned Token2049 conference, and coinciding with the excitement of Singapore Formula One Week, this […]

PRESS RELEASE. [Singapore, 2024] – The much-anticipated VC Founders Summit is set to take place on September 21st, bringing together venture capitalists, industry leaders, and innovators to shape the future of investment and entrepreneurship. As a dynamic side event of the renowned Token2049 conference, and coinciding with the excitement of Singapore Formula One Week, this […] Standard Chartered has launched a digital asset custody service in the United Arab Emirates (UAE), licensed by the Dubai Financial Services Authority. The service aims to provide secure storage for digital assets, initially focusing on bitcoin and ethereum. Brevan Howard Digital is the first client, and the bank plans further expansion into additional digital assets. […]

Standard Chartered has launched a digital asset custody service in the United Arab Emirates (UAE), licensed by the Dubai Financial Services Authority. The service aims to provide secure storage for digital assets, initially focusing on bitcoin and ethereum. Brevan Howard Digital is the first client, and the bank plans further expansion into additional digital assets. […]

Financial services behemoth Standard Chartered is launching a digital asset custody service in the United Arab Emirates following the approval of a license from local regulators. According to a new press release, Standard Chartered has selected the UAE for its product launch due to the region’s well-regarded approach to digital asset regulation and adoption. Says […]

The post Financial Giant Standard Chartered Announces New Digital Asset Custody Service in UAE appeared first on The Daily Hodl.

Crypto salaries are becoming more common, especially in countries with prevalent economic incentives like inflation.

Getting paid in crypto isn’t easy. Employees and employers alike have several legal hoops to jump through, but it’s getting simpler as courts and businesses recognize the benefits.

On Aug. 15, a Dubai court ruling recognized crypto assets as a valid means of salary payment.

Issued by the Dubai Court of First Instance, the judgment came in response to a dispute between an employee and employer over unpaid wages (a portion of which was denominated in crypto tokens).

Indian crypto exchange Coindcx is expanding globally by acquiring the Middle Eastern digital asset platform Bitoasis. This strategic move enhances Coindcx’s presence in the Middle East and North Africa (MENA) region while allowing Bitoasis to retain its branding and leadership, signaling a new phase of growth and maturity for both companies. Big Milestone: 2 Market […]

Indian crypto exchange Coindcx is expanding globally by acquiring the Middle Eastern digital asset platform Bitoasis. This strategic move enhances Coindcx’s presence in the Middle East and North Africa (MENA) region while allowing Bitoasis to retain its branding and leadership, signaling a new phase of growth and maturity for both companies. Big Milestone: 2 Market […]

NH Management’s Tao Xiao explained that VARA’s objective is not to hinder progress but to secure the market’s integrity.

Although Dubai’s Virtual Assets Regulatory Authority (VARA) has deployed comprehensive requirements for the crypto space, professionals working in licensing believe that the lengthy process is worth it.

Cointelegraph contacted crypto licensing executives working in Dubai to get their thoughts on the local licensing process and laws.

Tao Xiao, managing partner of business consulting firm NH Management, told Cointelegraph that VARA’s crypto licensing process can take up to a year. Xiao, who previously worked at Dubai’s Chamber of Commerce, said the process demands meticulous attention to detail and strong compliance measures. Xiao said: