The firm traditionally focuses on gaining exposure to NFT assets, but is keen to expand its portfolio to the metaverse space amid its recent emergence into the public discourse.

Nonfungible token, or NFT, investment firm Sfermion has announced a secondary funding raise of $100 million — appropriately titled Fund II — from a number of established cryptocurrency investors including British billionaire Alan Howard, American entrepreneur Chris Dixon, Gemini co-founders Cameron and Tyler Winklevoss, and venture capital firm Digital Currency Group, among others.

Whereas predecessor Fund I focused solely on NFT investment opportunities, seven-figure Fund II will be utilized to “accelerate the emergence of an open, decentralized metaverse” through strategic investments.

Founded in 2019 by Andrew Steinwold, Sfermion is intent on identifying and investing in emerging projects, technologies and individuals within the NFT space who seek to innovatively advance the ecosystem’s development. Their list of previous investments includes the likes of industry leaders OpenSea, alongside SuperRare, Artblocks and Yield Guild Games, to name a few.

One of the participants of this funding round, and general partner at Andreessen Horowitz, Chris Dixon, shared his perspective on the potential impact that Sfermion could have on the NFT space:

“NFTs are transforming digital experiences and creating new investment opportunities across a variety of decentralized marketplaces. Sfermion is well-positioned to succeed by leveraging Andrew’s deep experience and insightful perspective on the NFT markets.”

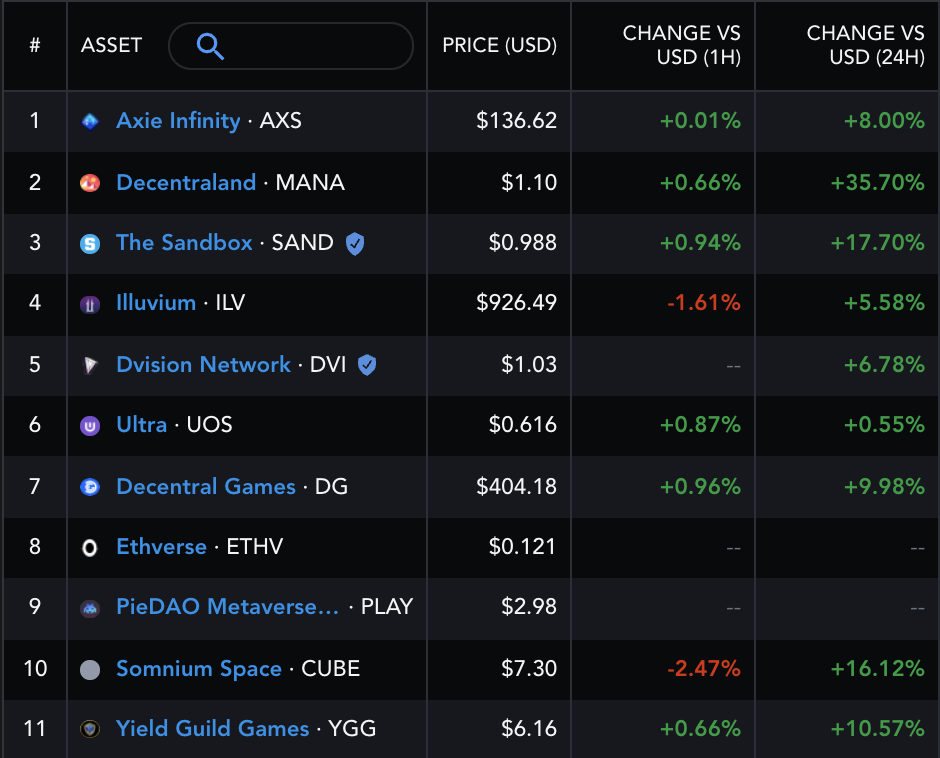

Related: Axie Infinity, Decentraland and ‘metaverse’ cryptos rally after Facebook rebrands to Meta

Facebook’s corporate rebranding from a social media empire to a metaverse organization last week sparked furious debate in the crypto community as to whether the company's previous demonstration of principles and morale practices across their consortium of platforms imply they can be trusted in building such an immersive virtual technology.

While mainstream headlines remained relatively neutral on the topic, the broad consensus of inhabitants in the crypto sphere swayed negatively. Alexandria Ocasio-Cortez passionately tweeted her feelings, while popular NFT trader Josh Ong shared his thoughts:

The Metaverse will not be trademarked. It won't be owned by a single company. We are the Metaverse.

— Josh Ong (@beijingdou) October 30, 2021