Robert Kiyosaki, the author of Rich Dad Poor Dad, has warned that the U.S. is adding a trillion dollars to its debt every 100 days. He advises investing in gold, silver, and bitcoin to safeguard against economic instability. Kiyosaki also points out the dangers of relying on traditional banks, noting that banking panics are often […]

Robert Kiyosaki, the author of Rich Dad Poor Dad, has warned that the U.S. is adding a trillion dollars to its debt every 100 days. He advises investing in gold, silver, and bitcoin to safeguard against economic instability. Kiyosaki also points out the dangers of relying on traditional banks, noting that banking panics are often […] Binance’s Financial Crimes Compliance Department recently collaborated with Taiwan’s Ministry of Justice Investigation Bureau and the Taipei District Prosecutors Office on a significant cryptocurrency-assisted money laundering case involving nearly NT$200 million (approximately US$6 million). The criminal operation had been laundering money through virtual assets by creating fake customer records and forged identity data. Law enforcement […]

Binance’s Financial Crimes Compliance Department recently collaborated with Taiwan’s Ministry of Justice Investigation Bureau and the Taipei District Prosecutors Office on a significant cryptocurrency-assisted money laundering case involving nearly NT$200 million (approximately US$6 million). The criminal operation had been laundering money through virtual assets by creating fake customer records and forged identity data. Law enforcement […] Juno Finance acknowledges the disruption in banking services and is collaborating with its brokerage and banking service providers, Synapse and Evolve Bank & Trust, to restore full service as soon as possible. Juno is a financial platform that integrates checking and savings accounts with cryptocurrency trading. “Currently, Evolve Bank & Trust has frozen all card […]

Juno Finance acknowledges the disruption in banking services and is collaborating with its brokerage and banking service providers, Synapse and Evolve Bank & Trust, to restore full service as soon as possible. Juno is a financial platform that integrates checking and savings accounts with cryptocurrency trading. “Currently, Evolve Bank & Trust has frozen all card […] The president of the Federal Reserve Bank of Minneapolis, Neel Kashkari, says the current banking crisis has pushed the U.S. economy closer to a recession. “We have fundamental issues, regulatory issues facing our banking system,” the Fed official stressed. Neel Kashkari on U.S. Economy, Banking Crisis, Recession Federal Reserve Bank of Minneapolis President Neel Kashkari […]

The president of the Federal Reserve Bank of Minneapolis, Neel Kashkari, says the current banking crisis has pushed the U.S. economy closer to a recession. “We have fundamental issues, regulatory issues facing our banking system,” the Fed official stressed. Neel Kashkari on U.S. Economy, Banking Crisis, Recession Federal Reserve Bank of Minneapolis President Neel Kashkari […]

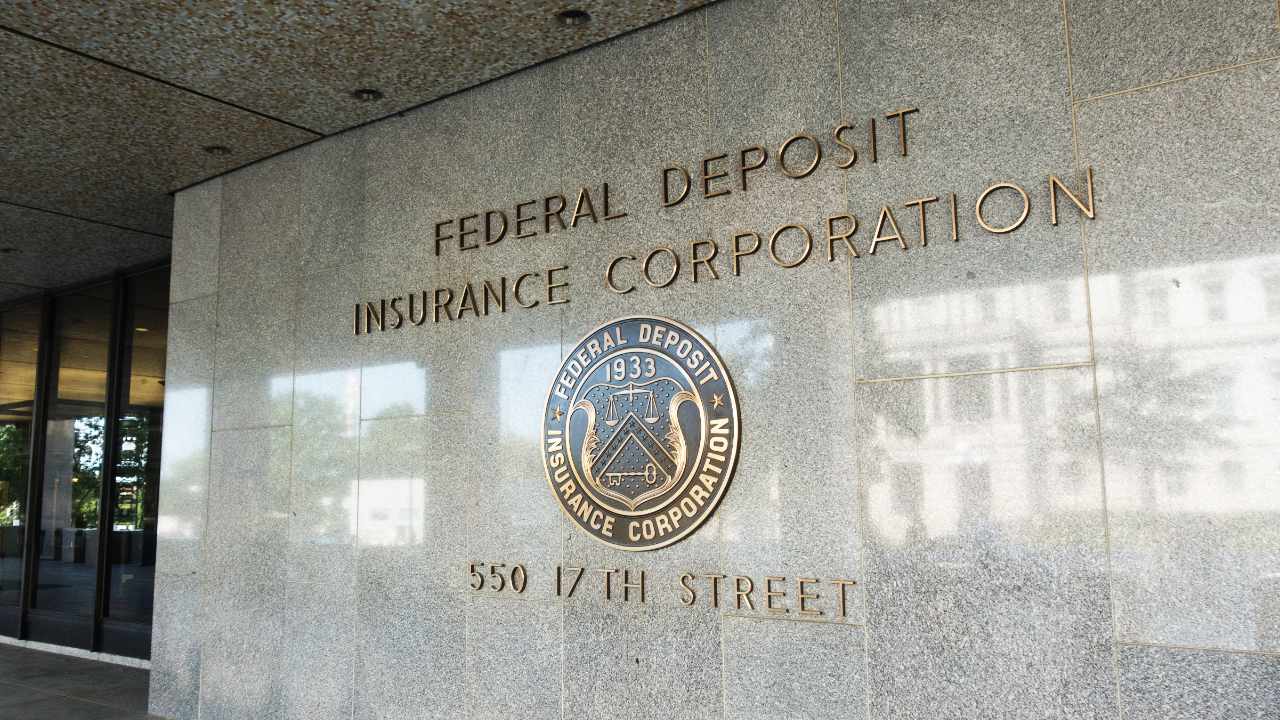

The current deposit insurance cap under the FDIC is $250,000, but recent banking collapses have seen calls to increase that amount.

U.S. officials are reportedly studying ways to expand the current scope of deposit insurance that would guarantee all U.S. bank deposits should the current banking crisis worsen.

The current deposit insurance cap under the Federal Deposit Insurance Corporation stands at $250,000, however, following the collapse of several banks in March, there have been calls to increase that amount.

Organizations such as the Mid-Size Bank Coalition of America called on March 18 for the cap to be lifted for the next two years, citing a need to protect depositors and to stop capital being pulled from smaller banks for supposedly safer-looking heavyweights.

According to a March 21 Bloomberg report citing “people with knowledge of the talks,” Treasury Department staff members are currently discussing the possibility of the FDIC being able to expand the current deposit insurance beyond the max cap to cover all deposits. According to the FDIC, domestic U.S. bank deposits totaled $17.7 trillion as of December 31.

After some intense "studying" they realised that they needed $17 trillion to guarantee all bank deposits. pic.twitter.com/Z15HLiBp23

— Coin Bureau (@coinbureau) March 21, 2023

The move would ultimately hinge on what level of emergency authority federal regulators have and if the insurance cap can be increased without formal consent from Congress.

Bloomberg’s sources indicated, however, that U.S. authorities don’t deem such a drastic move necessary at the moment, as recent steps taken by financial regulators are likely to be sufficient.

As such, they stated that a potential strategy is being whipped up just in case the current situation gets worse.

The US Govt says it studies ways to guarantee all bank deposits if the banking crisis grows.

— Kim Dotcom (@KimDotcom) March 21, 2023

They say that because they know that the banking crisis will grow?

They don’t have the $18 trillion required to protect depositors.#RunOnTheBank while you can.

Gold, Silver, Crypto.

In response to Silvergate, Signature Bank and Silicon Valley Bank going bust in recent weeks, the Federal Reserve rolled out the $25 billion Bank Term Funding Program (BTFP) on March 13, as the government pushed to stem any further contagion.

Related: UBS Group agrees to $3.25B ‘emergency rescue’ of Credit Suisse

Meanwhile, in a March 20 press briefing, White House Press Secretary Karine Jean-Pierre was specifically asked if the federal government was supportive of a push from small- and mid-size banks to expand FDIC insurance beyond $250,000.

But Jean-Pierrre was tight-lipped on the Biden Administration’s view, saying on that “our goal is to ensure the financial system is stable” and emphasizing that creating a fair playing field was the “focus of Treasury and the bank regulators.”

“And as you saw, due to our actions this week at the direction of the President, Americans should be confident of their deposits. We’ll be there when they — when they need them.”

“And — and so, again, that’s what our focus is going to be. We don’t have any new announcements at this time. But clearly, we want to make sure that our financial system is stable,” she added.

A U.S. congressman has urged the federal government to temporarily insure every bank deposit in the country. Following the collapses of several major banks, he stressed that if the government does not do this, there will be a run on smaller banks. “This is a contagion that could be spread across the entire banking system,” […]

A U.S. congressman has urged the federal government to temporarily insure every bank deposit in the country. Following the collapses of several major banks, he stressed that if the government does not do this, there will be a run on smaller banks. “This is a contagion that could be spread across the entire banking system,” […] The Mid-Size Bank Coalition of America has asked federal regulators to extend FDIC insurance to cover all deposits for the next two years. “Doing so will immediately halt the exodus of deposits from smaller banks, stabilize the banking sector and greatly reduce chances of more bank failures,” the group claimed. “It is imperative we restore […]

The Mid-Size Bank Coalition of America has asked federal regulators to extend FDIC insurance to cover all deposits for the next two years. “Doing so will immediately halt the exodus of deposits from smaller banks, stabilize the banking sector and greatly reduce chances of more bank failures,” the group claimed. “It is imperative we restore […] After the failure of Silicon Valley Bank (SVB), a great deal of Americans are starting to realize the dangers of fractional-reserve banking. Reports show that SVB suffered a significant bank run after customers attempted to withdraw $42 billion from the bank on Thursday. The following is a look at what fractional-reserve banking is and why […]

After the failure of Silicon Valley Bank (SVB), a great deal of Americans are starting to realize the dangers of fractional-reserve banking. Reports show that SVB suffered a significant bank run after customers attempted to withdraw $42 billion from the bank on Thursday. The following is a look at what fractional-reserve banking is and why […] The Federal Deposit Insurance Corporation (FDIC) is probing crypto lender Voyager Digital over claims that it is FDIC-insured. The crypto firm previously explained that through its strategic relationships with Metropolitan Commercial Bank, “all customers’ USD held with Voyager is FDIC insured.” Voyager Probed by FDIC The Federal Deposit Insurance Corporation (FDIC) is looking into Voyager […]

The Federal Deposit Insurance Corporation (FDIC) is probing crypto lender Voyager Digital over claims that it is FDIC-insured. The crypto firm previously explained that through its strategic relationships with Metropolitan Commercial Bank, “all customers’ USD held with Voyager is FDIC insured.” Voyager Probed by FDIC The Federal Deposit Insurance Corporation (FDIC) is looking into Voyager […]