The Hong Kong Monetary Authority is looking at a potential CBDC from a wide perspective.

The Hong Kong Monetary Authority (HKMA) has launched the second phase of the digital Hong Kong dollar (e-HKD) pilot study with 21 financial institutions working on 11 use cases for the central bank digital currency and tokenized deposits. In light of the broadening scope of the project, the HKMA is renaming it Project e-HKD+.

The new phase of the project will have its own sandbox and last about a year.

Project e-HKD+ will focus on three themes: settlement of tokenized assets, programmability and offline payments. Many of the use cases are highly generalized and several of them do not reference the e-HKD at all. For example:

The Carroll County Sheriff’s Office in the U.S. state of Georgia has issued a warning about a cryptocurrency scam. Scammers are posing as representatives of financial institutions, informing individuals that their accounts have been compromised. They then instruct victims to withdraw funds from their accounts and deposit them into bitcoin ATMs. The sheriff’s office emphasizes […]

The Carroll County Sheriff’s Office in the U.S. state of Georgia has issued a warning about a cryptocurrency scam. Scammers are posing as representatives of financial institutions, informing individuals that their accounts have been compromised. They then instruct victims to withdraw funds from their accounts and deposit them into bitcoin ATMs. The sheriff’s office emphasizes […] The publicly traded cryptocurrency exchange Coinbase has announced its expansion into Hawaii, allowing residents to access a range of crypto services. The move comes after the state clarified its regulations, enabling Coinbase to offer its platform to Hawaiian users. Hawaii Residents Gain Access to Coinbase’s Full Suite of Crypto Tools Coinbase’s entry into the Hawaiian […]

The publicly traded cryptocurrency exchange Coinbase has announced its expansion into Hawaii, allowing residents to access a range of crypto services. The move comes after the state clarified its regulations, enabling Coinbase to offer its platform to Hawaiian users. Hawaii Residents Gain Access to Coinbase’s Full Suite of Crypto Tools Coinbase’s entry into the Hawaiian […]

The sandbox could lead to more financial institutions adopting asset tokenization solutions.

Chainlink is ushering in a new turnkey solution for institutions looking to conduct tokenization trials in the latest development for the tokenization industry.

Chainlink has introduced its new Digital Assets Sandbox (DAS) for financial institutions, which aims to accelerate digital asset innovation.

DAS will enable financial institutions to quickly experiment with new revenue-generating opportunities, like bond tokenization, with improved time-to-market and greater overall efficiency.

Stablecoin giant Tether is eager to learn about the possibilities of introducing new business lines into Turkey’s banking in cooperation with the local crypto firm BTguru.

Tether is increasing its presence in Turkey by partnering with a local cryptocurrency firm to promote industry knowledge.

The firm, issuer of the Tether (USDT) stablecoin, has signed a memorandum of understanding (MoU) with local crypto platform BTguru to evaluate digital asset-related educational initiatives in Turkey, it announced on July 2.

BTguru positions itself as a technology and strategy partner, specializing in virtual crypto assets “for primarily banks.”

After a period of intense scrutiny of the cryptocurrency industry, many speculated that the Biden administration had reversed its stance by allowing the U.S. Securities and Exchange Commission (SEC) to approve several spot ethereum exchange-traded funds (ETFs). However, President Joe Biden has vetoed the latest resolution intended to quash the SEC’s crypto asset rules in […]

After a period of intense scrutiny of the cryptocurrency industry, many speculated that the Biden administration had reversed its stance by allowing the U.S. Securities and Exchange Commission (SEC) to approve several spot ethereum exchange-traded funds (ETFs). However, President Joe Biden has vetoed the latest resolution intended to quash the SEC’s crypto asset rules in […] Following the dramatic bank failures last year and the recent collapse of Philadelphia’s Republic First Bank last week, an analysis by Klaros Group indicates that hundreds of U.S. banks are at risk of failure. The study reveals that smaller and regional banks are experiencing stress due to burdensome commercial real estate loans and the current […]

Following the dramatic bank failures last year and the recent collapse of Philadelphia’s Republic First Bank last week, an analysis by Klaros Group indicates that hundreds of U.S. banks are at risk of failure. The study reveals that smaller and regional banks are experiencing stress due to burdensome commercial real estate loans and the current […]

Among the 300 finance professionals surveyed across 45 countries, 97% believe that blockchain will play a crucial role in faster payment systems within the next three years.

Blockchain has the potential to save financial institutions approximately $10 billion in cross-border payment costs by the year 2030, according to a recent report.

Published by digital payment network Ripple, in collaboration with the US Faster Payments Council (FPC) on July 29, the report surveyed 300 finance professionals across 45 different countries, from various sectors, such as fintech, banking, media, consumer technology and retail.

Results show that global payments leaders are dissatisfied with legacy rails for cross-border payments.

— Ripple (@Ripple) July 28, 2023

Learn why 97% believe #blockchain and #crypto will transform the way money moves in our latest whitepaper with @Faster_Payments. https://t.co/qacuAAzZrR pic.twitter.com/ForjM05Wbb

Among the participants surveyed – ranging from analysts to directors and CEOs – 97% firmly believe that blockchain technology will play a crucial role in facilitating faster payment systems within the next three years.

Furthermore, over half of the participants agreed that the most significant benefit of cryptocurrency is the potential to cut costs.

"In the survey, over 50% of respondents believe that lower payments cost–both domestically and internationally–is crypto’s primary benefit" it was noted.

According to the report, fintech analyst company Juniper Research predicts that the use of blockchain in global transactions will result in substantial cost savings for banks over the next six years.

“Juniper Research supports this notion, pointing to blockchain’s potential to significantly increase savings for financial institutions conducting cross-border transactions – an estimated $10 billion by 2030.”

As the e-commerce landscape continues to expand and businesses prioritize international markets, cross-border payments are only expected to grow over the coming years. The report pointed out that there is a significant anticipated increase in international payment transactions by the year 2030.

“Global cross-border payment flows are expected to reach $156 trillion – driven by a 5% compound annual growth rate (CAGR)," the report noted.

Related: X’s ad revenue sharing: Crypto payments on the horizon?

However there was a split in opinions among the participants over when the majority of merchants would embrace digital currency payments.

While 50% of those surveyed were confident that most merchants would adopt crypto payments within the next three years, there were varied confidence levels whether it would happen within the next year.

Participants from the Middle East and African region showed the highest level of confidence, with 27% of them believing that most merchants will accept crypto as a payment method within the next year.

Meanwhile, leaders in the Asia-Pacific (APAC) region were the least confident, with only 13% believing in the same timeframe. However, across all 300 surveyed participants worldwide, 17% expressed their belief that such adoption could happen within the next year.

This comes after research from the Bank of International Settlements (BIS) revealed there could be up to 24 central bank digital currencies (CBDC) by the year 2030.

In a report published by BIS on July 10 – which surveyed 86 central banks from October to December 2022 – it revealed 93% of those institutions are researching CBDCs, and there could be up to 15 retail and 9 wholesale CBDCs in circulation by 2030.

Magazine: ‘Elegant and ass-backward’: Jameson Lopp’s first impression of Bitcoin

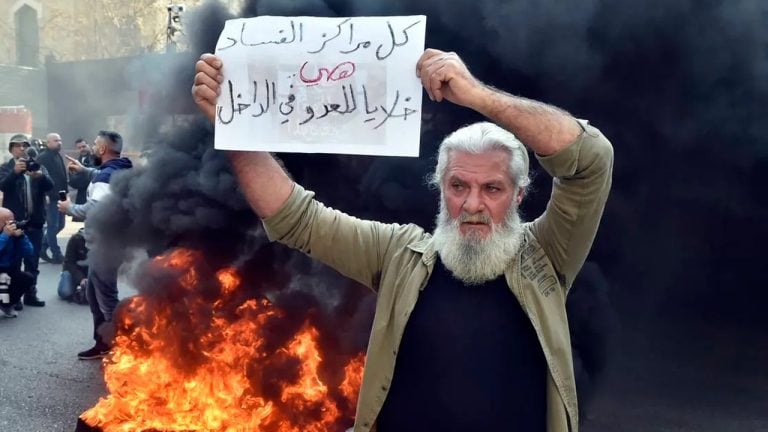

Amid Lebanon’s financial crisis, significant demonstrations have erupted in Beirut targeting financial institutions. Outraged Lebanese depositors, witnessing their savings vanish, have resorted to smashing bank windows, setting fires, and engaging in riots. Simultaneously, leaders of Lebanon’s central bank face grave allegations of fraud, embezzlement, and political corruption. Lebanese Citizens Left Penniless as Financial Institutions Crumble […]

Amid Lebanon’s financial crisis, significant demonstrations have erupted in Beirut targeting financial institutions. Outraged Lebanese depositors, witnessing their savings vanish, have resorted to smashing bank windows, setting fires, and engaging in riots. Simultaneously, leaders of Lebanon’s central bank face grave allegations of fraud, embezzlement, and political corruption. Lebanese Citizens Left Penniless as Financial Institutions Crumble […] 2023 has been a rollercoaster ride for the U.S. banking industry. The collapse of three major banks has sent shockwaves through the financial world, with their combined assets surpassing the top 25 banks that crumbled in 2008. The following is a closer look at what has triggered a ‘great consolidation’ in the banking sector, a […]

2023 has been a rollercoaster ride for the U.S. banking industry. The collapse of three major banks has sent shockwaves through the financial world, with their combined assets surpassing the top 25 banks that crumbled in 2008. The following is a closer look at what has triggered a ‘great consolidation’ in the banking sector, a […]