The chief executive of Coinbase is reportedly saying that the crypto exchange platform is staying put in the US, adding that there is no “break-the-glass” emergency plan. According to a new report by The Financial Times, Coinbase CEO Brian Armstrong says that the crypto firm leaving the US is “not in the realm of possibility” […]

The post Brian Armstrong Says Coinbase Staying in the US, Asserts There’s No ‘Break-the-Glass Plan’: Report appeared first on The Daily Hodl.

According to Brazil’s president Luiz Inácio Lula da Silva, developing countries should abandon the U.S. dollar and strengthen their own national currencies. During a speech at the New Development Bank in Shanghai, Lula expressed his nightly pondering: “Why do all countries have to base their trade on the dollar?” Brazil’s President Wants to Reduce the […]

According to Brazil’s president Luiz Inácio Lula da Silva, developing countries should abandon the U.S. dollar and strengthen their own national currencies. During a speech at the New Development Bank in Shanghai, Lula expressed his nightly pondering: “Why do all countries have to base their trade on the dollar?” Brazil’s President Wants to Reduce the […] As the artificial intelligence (AI) wars intensify, the AI firm Anthropic has raised $300 million from Google and sources say that the tech giant will get roughly a 10% stake in the AI company. Interestingly, in April 2022, Anthropic raised approximately $500 million from sources including Sam Bankman-Fried (SBF), co-founder of FTX; Caroline Ellison, former […]

As the artificial intelligence (AI) wars intensify, the AI firm Anthropic has raised $300 million from Google and sources say that the tech giant will get roughly a 10% stake in the AI company. Interestingly, in April 2022, Anthropic raised approximately $500 million from sources including Sam Bankman-Fried (SBF), co-founder of FTX; Caroline Ellison, former […] Brazil and Argentina are looking to begin work on the issuance of a common currency. Sergio Massa, minister of the economy of Argentina, also stated that the two countries will be inviting other nations in the area to join this economic integration project in the future. Brazil and Argentina to Spearhead Common Currency Issuance Project […]

Brazil and Argentina are looking to begin work on the issuance of a common currency. Sergio Massa, minister of the economy of Argentina, also stated that the two countries will be inviting other nations in the area to join this economic integration project in the future. Brazil and Argentina to Spearhead Common Currency Issuance Project […]

Tony Yates, the former senior advisor of the Bank of England, argues that CBDCs are not worth the headache.

Central banks worldwide are pushing forward with digital asset projects despite the various crypto industry implosions over the past 12 months. China has rolled out its central bank digital currency (CBDC) to several cities, and it was available for use at the Winter Olympics.

Many other central banks, including the Bank of England, are considering how to roll out a CDBC, while Nigeria’s CBDC has had poor uptake so far. India has already launched a pilot scheme, while Mexico has confirmed the launch of a digital peso.

However, Tony Yates, Financial Times writer and former senior advisor to the Bank of England, advises against CBDCs. According to Yates, “The huge undertaking of digital currencies is not worth the costs and risks.”

CBDCs are already in place in most countries as most countries already have digital versions of cash, coins and notes. Yates, therefore, questions the motivations behind global rollouts of CBDCs, calling them “suspect.”

CBDCs could be a way of quashing crypto, including decentralized currencies such as Bitcoin (BTC). However, “Cryptocurrencies are such ban candidates for money,” he explains, adding:

“They don’t have money supplies managed by humans to generate steady paths for inflation and are hugely expensive and time consuming to use in transactions.”

Yates’ take on Bitcoin is unsurprising: he has tweeted several times about Bitcoin, claiming that most of Bitcoin’s use is “illicit” and “speculative.”

I would guess that most of the use is 1) illicit, and not discouraged by central bank provision and 2) speculative; if CBDC were to cause a large price drop, this could wipe out and discourage a lot of users.

— Tony Yates (@t0nyyates) April 17, 2021

Since Bitcoin is using a public ledger that's available for everyone, its use for illicit purposes has decreased steadily over the years to less than 1% of total transactions, reports show.

On top of that, the layer-2 Lightning Network allows instant remittance payments, while other cryptocurrencies and even stablecoins continue to grow in use case and development.

For Yates, introducing CBDCs is akin to “making central bank reserves more widely available than just to counterparties”. But in a world in which the reserve currency in the US dollar, the competition for a new global CBDC is counterproductive.

Related: Tanzania ‘cautious’ on CBDC adoption after initial research

The Financial Times opinion piece summarizes that the most compelling arguments for CBDCs are about payments and settlement efficiency, but the debate is “mysterious.” Yates explains that it would be a colossal undertaking for the central bank to employ the staff to build and manage the hardware and software of a new payment system.

Sam Bankman-Fried was held in the sick bay where he reportedly had access to running water, a toilet, a TV, and vegan food.

Former FTX CEO Sam Bankman-Fried, who was remanded to the notorious Fox Hill Prison in Nassau, Bahamas, pending an investigation into the collapse of his exchange, had a different experience than many other prisoners.

According to the Financial Times, Bankman-Fried was held in the sickbay where he had access to a toilet, running water, a TV, local newspapers, crossword puzzles, and many other perks, including vegan food. Anonymous prison officials disclosed that the former CEO spent his days watching the news and reading articles about himself.

SBF’s prison experience appears to have been very different from what many other prisoners endure in their overcrowded, poorly ventilated, rat-infested prison cells, where they are forced to sleep on the floor using makeshift cards. Unlike other prisoners held at Fox Hill, the former CEO slept in a cot in the sick bay, which was occupied by only four other men.

A human rights report published by the U.S. State Department in 2021 revealed that conditions at Fox Hill were “harsh,” as prisoners suffered from overcrowding, poor nutrition, and inadequate sanitation and medical care. The report also alleged cases of physical abuse by correctional officers.

The report revealed that “maximum-security cells for men measured approximately six feet by 10 feet and held up to six persons with no mattresses or toilet facilities.” It also detailed the following conditions:

“Inmates removed human waste by bucket. Prisoners complained of the lack of beds and bedding. Some inmates developed bedsores from lying on bare ground. Sanitation was a general problem, and cells were infested with rats, maggots, and insects.”

The Office of the Attorney General of The Bahamas announced the extradition to the United States of Sam Bankman-Fried (“SBF”), the former CEO of FTX. SBF will depart from The Bahamas for the United States tonight. pic.twitter.com/WttWmNpIw4

— Latrae L. Rahming (DOC) (@latraelrahming) December 21, 2022

Related: Alameda’s Caroline Ellison escapes potential 110-year prison term via plea deal

On Dec. 22, Cointelegraph reported that SBF was preparing to be extradited to the U.S. A statement from The Bahamas Attorney General Ryan Pinder confirmed that Bankman-Fried was scheduled to depart The Bahamas for the United States on the night of Dec. 22.

Amid the ongoing FTX bankruptcy proceedings, court documents indicate that media firms such as Bloomberg, the New York Times (NYT), Dow Jones & Company, and the Financial Times (FT) want the redacted information tied to FTX creditors unsealed. The media companies believe the public should be made aware of the creditors’ information, as the publications […]

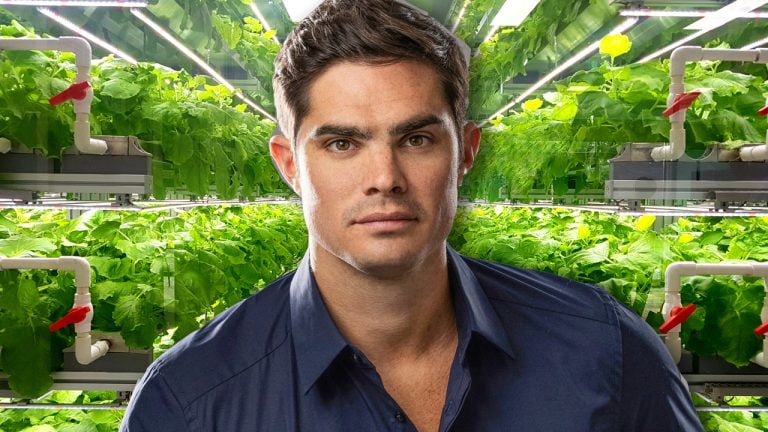

Amid the ongoing FTX bankruptcy proceedings, court documents indicate that media firms such as Bloomberg, the New York Times (NYT), Dow Jones & Company, and the Financial Times (FT) want the redacted information tied to FTX creditors unsealed. The media companies believe the public should be made aware of the creditors’ information, as the publications […] After discovering that ten holding firms associated with FTX Digital and Alameda Research invested roughly $5.4 billion into nearly 500 firms and projects, people have been curious about a few specific investments. One specific investment made by FTX Ventures Ltd. was for $25 million into the Ohio-based firm 80 Acres, a company that specializes in […]

After discovering that ten holding firms associated with FTX Digital and Alameda Research invested roughly $5.4 billion into nearly 500 firms and projects, people have been curious about a few specific investments. One specific investment made by FTX Ventures Ltd. was for $25 million into the Ohio-based firm 80 Acres, a company that specializes in […]

Several US auditing firms are reportedly going to charge crypto companies a steeper fee for their services in the fallout of FTX’s implosion. According to the Financial Times, many audit firms are reclassifying crypto companies as “high-risk” clients that require additional scrutiny. Jeffrey Weiner, CEO of auditing firm Marcum, which provides services for Bitcoin miners […]

The post US Auditing Firms To Charge More for Crypto Company Services Following FTX Collapse: Report appeared first on The Daily Hodl.

New documents reveal that bankrupt crypto exchange FTX reportedly had liabilities 10x larger than the value of all of its liquid assets combined prior to its implosion last week. According to a recent report by the Financial Times, FTX’s balance sheet reveals the extent of the embattled crypto exchange’s outstanding debt. The document shows that […]

The post Bankrupt FTX Had $9,000,000,000 in Liabilities With Only $900 Million in Liquid Assets Prior to Collapse: Report appeared first on The Daily Hodl.