Ethereum saw first-time profits only last year and if it can keep pace with its 2024 first-quarter results, it could see $1 billion in yearly income by the end of the year.

Blockchain network Ethereum is on the path to $1 billion in annualized profits after it netted income of $365 million in Q1, coming alongside a year-on-year quarterly revenue growth of 155%.

The network’s 2024 first-quarter income is a nearly 200% bump from the $123 million profit in Q4 2023, according to an April 17 report from The DeFi Report analyst Michael Nadeau.

Ethereum’s fee revenue — earned through users paying for transactions — hit $1.17 billion, up 155% from Q1 2023 and an 80% increase from the prior quarter.

Despite experiencing a downturn for four straight weeks, eight blockchain networks logged $3.77 billion in non-fungible token (NFT) sales in the first quarter of 2024. Leading the charge, Ethereum-centric NFTs accounted for $1.4 billion or 37% of the NFT sales during Q1 2024. The Dual Forces of Organic NFT Sales and Wash Volume Across Several […]

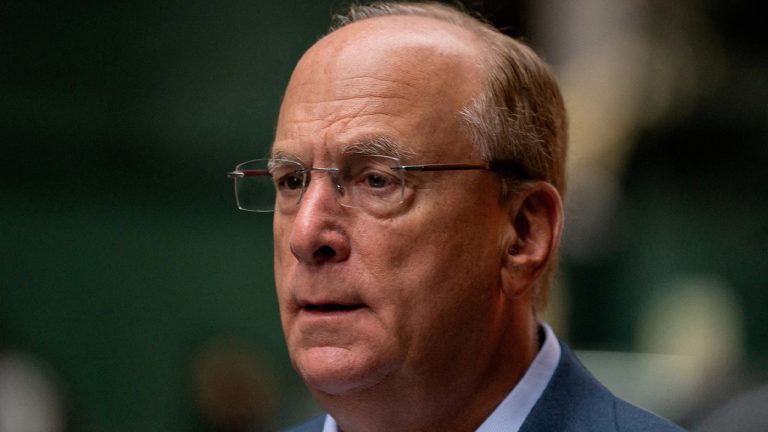

Despite experiencing a downturn for four straight weeks, eight blockchain networks logged $3.77 billion in non-fungible token (NFT) sales in the first quarter of 2024. Leading the charge, Ethereum-centric NFTs accounted for $1.4 billion or 37% of the NFT sales during Q1 2024. The Dual Forces of Organic NFT Sales and Wash Volume Across Several […] Blackrock’s CEO, Larry Fink, stated in an interview on Friday that he does not anticipate a “big recession” in the United States. However, he believes that “inflation is going to be stickier for longer.” In contrast to the U.S. central bank’s 2% goal, Fink predicts that “we’re going to have a 4ish floor in inflation.” […]

Blackrock’s CEO, Larry Fink, stated in an interview on Friday that he does not anticipate a “big recession” in the United States. However, he believes that “inflation is going to be stickier for longer.” In contrast to the U.S. central bank’s 2% goal, Fink predicts that “we’re going to have a 4ish floor in inflation.” […]

“There are so many customers beating a path to our door that we have to have all hands on deck just to keep everything running,” Coinbase CEO Brian Armstrong explained on earnings call.

Cryptocurrency exchange Coinbase has disclosed its first net loss as a public company of $430 million in Q1, but CEO Brian Armstrong said on an earnings call that he's “never been more bullish on where we are as a company.”

In its first quarter 2022 report Coinbase disclosed that revenue had dropped 27% to $1.17 billion, down from $1.6 billion in the first quarter of 2021 and a long way off its Q4 2021 revenue of $2.5 billion. Monthly transacting users also dropped by over 19% to 9.2 million, from last quarter's 11.4 million.

Shares of Coinbase had already fallen by over 16% to close at $73 over the day, and after the earnings disclosure after hours trading saw the price fall further to $61 at the time of writing. Coinbase's shares have been on a steady fall since November 2021 where it almost reached the $380 high from its initial public offering in April last year.

Despite the figures, Armstrong explained why he was still optimistic on an earnings call:

“There are so many customers beating a path to our door that we have to have all hands on deck just to keep everything running, so the down periods are often sometimes kind of a welcome change from that in the sense that we get to focus on building the next layer of innovation that will benefit us in the next cycle.”

Armstrong said that the company was “greedy when others are fearful”, acquiring talent and focusing on projects and infrastructure for the future. Addressing what he called the “elephant in the room” of the company earnings downturn, he said:

“The broader markets are down. We're seeing a downmarket for growth tech stocks and risk assets, Coinbase and crypto is no exception to that. The good news is as a crypto company we've lived through many different cycles in crypto, including major draw downs, which I think make us well suited to operate through these environments.”

He reminded shareholders of a prospectus released by the company a year ago which stated it aimed to grow crypto adoption long term, operating the company at a rough break even.

In its shareholder letter Coinbase mentioned its recent non-fungible token (NFT) market launch as an area it was focusing more on in a bid to become a market leader in the space and its ambition to develop its platform as an “on-ramp to the cryptoeconomy”.

Related: Coinbase CEO responds to insider trading allegations with changes for token listings

Armstrong stated that 54% of the platform's active users are doing something other than crypto trading, but didn’t clarify what activities and made no mention of the new NFT marketplace in his opening statement.

When asked specifically if the company is pleased with the activity in its NFT marketplace, Armstrong said it doesn't share “metrics on any of our new initiatives” adding that “there's a lot to build and the opportunity in the NFT space is enormous.”

The first day of the public opening of the marketplace saw only $75,000 in transaction volume taking place across 150 transactions according to on-chain metrics, a small percentage of the over 8 million email addresses which signed up for the waitlist.

Finishing his opening address Armstrong said the industry was in its early days and Coinbase sees the opportunities ahead adding that “regardless of whether the market is up or down, we're going to keep building.”

During the first three months of 2021, the cryptocurrency ethereum has shined as 90-day statistics highlight the digital asset has climbed close to 80% in value. On Monday, former Ark Invest analyst James Wang published a detailed summary highlighting the Ethereum project’s first-quarter financial results. Wang’s comprehensive Ethereum analysis showcases a myriad of data points […]

During the first three months of 2021, the cryptocurrency ethereum has shined as 90-day statistics highlight the digital asset has climbed close to 80% in value. On Monday, former Ark Invest analyst James Wang published a detailed summary highlighting the Ethereum project’s first-quarter financial results. Wang’s comprehensive Ethereum analysis showcases a myriad of data points […]