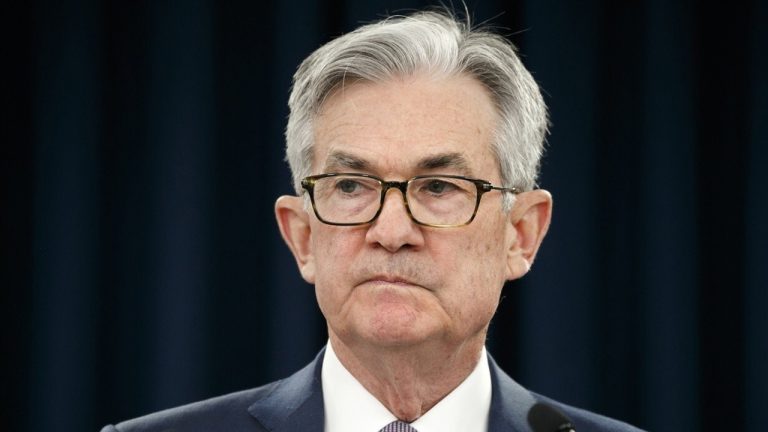

BTC price retraced the entirety of its intraday gains after Fed chair Jerome Powell issued hawkish statements in relation to today’s 0.50% interest rate hike.

On Dec. 14, Bitcoin (BTC) price hit a 1-month high and saw a brief resurgence in bullish momentum, but the Federal Reserve’s Federal Open Market Committee (FOMC) hawkish report and comments from Fed chair Jerome Powell sent BTC to an intraday low at $17,659.

Stocks and Bitcoin started the day slightly up but quickly retracted on the FOMC report. To date, Bitcoin price remains closely correlated to equities and a majority of investors have concerns about the impact of further rate increases in the future.

Rising interest rates and hawkish talk from Powell impact BTC price

While the Consumer Price Index (CPI) report showed easing inflation at 7.1%, Powell still wants to reach 2% overall inflation. Inflation has been a determining factor in raising interest rates and the current 0.5% hike had consensus amongst FOMC participants. The Fed members also agree that rate hikes should continue in 2023.

During the Dec. 14 press conference, Powell stated:

“We may see higher rates for a longer period to achieve the 2% inflation goal”

This hawkish tone, combined with the FOMC survey shows interest rates will continue to rise for the foreseeable future.

What will Bitcoin do next?

The short-lived Bitcoin rally ahead of Powell’s speech correlated to the price action seen across other risk assets. After the FOMC and Powell’s speech, these assets continued to retrace and some analysts see the recent dip as a metric to buy more Bitcoin.

Late longs to the current rally could also be at risk of liquidation if BTC price continues to retrace. According to derivatives data, Bitcoin open interest shows 60.16% of traders are long.

Currently, the market is digesting the views expressed by the FOMC and Powell, so a spike in short-term volatility is not abnormal. Investors should keep an eye on the next few daily closes to see whether Bitcoin’s macro trend has changed.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.