The Thai Securities and Exchange Commission (SEC) has launched a Digital Asset Regulatory Sandbox, allowing crypto services to be tested in a controlled environment. This initiative aims to promote innovation in Thailand’s capital market by accommodating six specific digital asset-related services, including exchanges and custodial wallet providers. Thai SEC Launches Digital Asset Regulatory Sandbox The […]

The Thai Securities and Exchange Commission (SEC) has launched a Digital Asset Regulatory Sandbox, allowing crypto services to be tested in a controlled environment. This initiative aims to promote innovation in Thailand’s capital market by accommodating six specific digital asset-related services, including exchanges and custodial wallet providers. Thai SEC Launches Digital Asset Regulatory Sandbox The […] Institutional investors are optimistic about the U.S. Securities and Exchange Commission (SEC) having more power to regulate the crypto market, a recent survey shows. They believe that if the SEC is granted extra powers, the prices of cryptocurrencies will be positively impacted. What Institutional Investors Think About Crypto Nickel Digital Asset Management, a regulated European […]

Institutional investors are optimistic about the U.S. Securities and Exchange Commission (SEC) having more power to regulate the crypto market, a recent survey shows. They believe that if the SEC is granted extra powers, the prices of cryptocurrencies will be positively impacted. What Institutional Investors Think About Crypto Nickel Digital Asset Management, a regulated European […] A growing number of fund managers and institutional investors now prefer bitcoin over gold. They see the cryptocurrency as a better store of value and a better inflation hedge. “I think it’s probably going to be ten times better than gold over a long period of time,” said the founder of one asset management firm. […]

A growing number of fund managers and institutional investors now prefer bitcoin over gold. They see the cryptocurrency as a better store of value and a better inflation hedge. “I think it’s probably going to be ten times better than gold over a long period of time,” said the founder of one asset management firm. […]

More than 80% of institutional investors polled that have already invested in digital assets expect to increase their exposure.

A new survey suggests that hedge fund executives, wealth managers, and institutional investors already holding crypto assets intend to increase their holdings.

The survey, conducted by London-based crypto fund Nickel Digital Asset Management, revealed that 82% of the 100 investors and wealth managers polled expect to increase their exposure to digital assets between now and 2023.

The research, conducted online in May and June and shared with Cointelegraph, surveyed 50 wealth managers and 50 institutional investors with prior exposure to crypto assets spanning the U.S., U.K., France, Germany and the UAE.

Four out of ten, or 40%, stated that they will “dramatically increase their holdings” with just 7% stating that they intend to reduce their exposure, and only 1% planning to sell their entire holdings.

However, Nickel did state that in most cases institutional investors with crypto holdings have very low levels of exposure as “many have just been testing to market to see how it works.”

The survey revealed that the primary reason given for investing more in digital assets is the long-term capital growth prospects according to 58% of the respondents. Even with the massive market slump, BTC has still made 18% so far this year and Ethereum is up a whopping 215% since January 1.

Around 38% of those surveyed claimed having some exposure to crypto assets gave them more confidence in the asset class, while 37% cited more leading corporates and fund managers investing in crypto assets as a reason to invest further.

Related: 1 in 5 investors at firms that don't trade in crypto say they are 'likely' to in future

Co-founder and CEO of Nickel Digital, Anatoly Crachilov, commented that confidence in the asset class is increasing and he expects the trend to continue, adding:

“Our analysis at the start of June this year revealed that 19 listed companies with a market cap of over $1 trillion had around $6.5 billion invested in Bitcoin, having originally spent $4.3 billion buying the cryptocurrency.”

As reported by Cointelegraph last month, a survey conducted by U.K. investment firm AJ Bell’s revealed that more people bought crypto assets than stock related savings products over the past year.

A MasterCard survey in May revealed that four in ten people plan to use cryptocurrency for payments within the next year.

Equity strategists and portfolio managers were asked about what the price of bitcoin will be by the year-end. Almost half of the surveyed participants say the price of the cryptocurrency will fall below the $30K level but some believe it will rise to $60K. Year-End Bitcoin Price Expectations by Equity Strategists and Portfolio Managers Equity […]

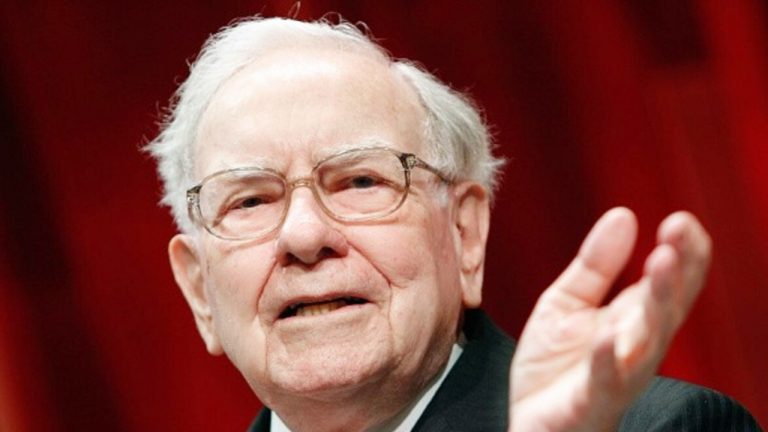

Equity strategists and portfolio managers were asked about what the price of bitcoin will be by the year-end. Almost half of the surveyed participants say the price of the cryptocurrency will fall below the $30K level but some believe it will rise to $60K. Year-End Bitcoin Price Expectations by Equity Strategists and Portfolio Managers Equity […] Investment bank JPMorgan conducted a survey of thousands of investors from 1,500 institutions and found that 49% of them think that cryptocurrency is either “rat poison squared,” the term used by Berkshire Hathaway CEO Warren Buffett to describe bitcoin, or “a temporary fad.” 49% of Investors Told JPMorgan Cryptocurrency Is a Fad or ‘Rat Poison […]

Investment bank JPMorgan conducted a survey of thousands of investors from 1,500 institutions and found that 49% of them think that cryptocurrency is either “rat poison squared,” the term used by Berkshire Hathaway CEO Warren Buffett to describe bitcoin, or “a temporary fad.” 49% of Investors Told JPMorgan Cryptocurrency Is a Fad or ‘Rat Poison […] A professor of finance and business economics at the University of Southern California says that asset managers focusing on growth strategy could violate their fiduciary duty if they do not consider bitcoin in their portfolios. Asset Managers With Growth Focus Need to Consider Bitcoin Financial researcher Nik Bhatia said last week that asset managers seeking […]

A professor of finance and business economics at the University of Southern California says that asset managers focusing on growth strategy could violate their fiduciary duty if they do not consider bitcoin in their portfolios. Asset Managers With Growth Focus Need to Consider Bitcoin Financial researcher Nik Bhatia said last week that asset managers seeking […] The most recent Bank of America Fund Manager Survey finds that the most crowded trade is “long bitcoin.” Nonetheless, 75% of fund managers say the cryptocurrency is in a bubble zone. Fund Managers Say Long Bitcoin Is Most Crowded Trade but Most See Bubble The Bank of America (BoA) Fund Manager Survey for May, published […]

The most recent Bank of America Fund Manager Survey finds that the most crowded trade is “long bitcoin.” Nonetheless, 75% of fund managers say the cryptocurrency is in a bubble zone. Fund Managers Say Long Bitcoin Is Most Crowded Trade but Most See Bubble The Bank of America (BoA) Fund Manager Survey for May, published […] The Spanish financial regulator is easing the entity’s tough stance towards cryptocurrencies by announcing an unprecedented measure that green lights institutional investors to enter into such business decisions. The National Securities Market Commission (CNMV) unveiled guidelines that approve institutional crypto investment under certain conditions. Fund Managers Should Specify ‘High Risks’ of Cryptos in Marketing Resources […]

The Spanish financial regulator is easing the entity’s tough stance towards cryptocurrencies by announcing an unprecedented measure that green lights institutional investors to enter into such business decisions. The National Securities Market Commission (CNMV) unveiled guidelines that approve institutional crypto investment under certain conditions. Fund Managers Should Specify ‘High Risks’ of Cryptos in Marketing Resources […] Investment bank Cowan, founded in 1918, is launching a cryptocurrency service in partnership with Standard Custody & Trust Co. to help institutional clients “seamlessly secure, access and leverage cryptocurrencies and digital assets in their portfolios.” Cowan’s CEO said: “The demand is clearly here. We’re going to be able to help a lot of our institutional […]

Investment bank Cowan, founded in 1918, is launching a cryptocurrency service in partnership with Standard Custody & Trust Co. to help institutional clients “seamlessly secure, access and leverage cryptocurrencies and digital assets in their portfolios.” Cowan’s CEO said: “The demand is clearly here. We’re going to be able to help a lot of our institutional […]