Bitcoin’s mining difficulty reached an all-time high (ATH) on Feb. 24, 2023, at block height #778,176, reaching 43.05 trillion hashes and surpassing the 40 trillion mark for the first time ever. The network’s difficulty increased by 9.95%, which is the second-largest rise this year, as Bitcoin recorded a combined 24.89% increase during the last 60 […]

Bitcoin’s mining difficulty reached an all-time high (ATH) on Feb. 24, 2023, at block height #778,176, reaching 43.05 trillion hashes and surpassing the 40 trillion mark for the first time ever. The network’s difficulty increased by 9.95%, which is the second-largest rise this year, as Bitcoin recorded a combined 24.89% increase during the last 60 […] After the transition from proof-of-work (PoW) to proof-of-stake (PoS), Ethereum’s annual issuance rate has been reduced to negative 0.057%, according to statistics 158 days after The Merge. The metrics indicate that more ethereum tokens have been removed than issued, and if the chain were still under PoW consensus, 1,823,678 ether would have been minted to […]

After the transition from proof-of-work (PoW) to proof-of-stake (PoS), Ethereum’s annual issuance rate has been reduced to negative 0.057%, according to statistics 158 days after The Merge. The metrics indicate that more ethereum tokens have been removed than issued, and if the chain were still under PoW consensus, 1,823,678 ether would have been minted to […] On Wednesday, Napster, the music streaming service originally launched in 1999, announced that the company has finalized a deal to acquire the Web3 music startup Mint Songs. Napster’s CEO, Jon Vlassopulos, insists that “we are in an unprecedented era of innovation in the digital music space,” and he believes Web3 innovations can help musicians find […]

On Wednesday, Napster, the music streaming service originally launched in 1999, announced that the company has finalized a deal to acquire the Web3 music startup Mint Songs. Napster’s CEO, Jon Vlassopulos, insists that “we are in an unprecedented era of innovation in the digital music space,” and he believes Web3 innovations can help musicians find […] Recent data shows that Silvergate Bank, a crypto-friendly financial institution, has become the most shorted stock in the United States, according to the Financial Industry Regulatory Authority. On Tuesday, Silvergate’s stock saw a rise after it was discovered that Citadel Securities holds a 5.5% stake in the bank, according to a Schedule 13G filing with […]

Recent data shows that Silvergate Bank, a crypto-friendly financial institution, has become the most shorted stock in the United States, according to the Financial Industry Regulatory Authority. On Tuesday, Silvergate’s stock saw a rise after it was discovered that Citadel Securities holds a 5.5% stake in the bank, according to a Schedule 13G filing with […] It appears that the circulation of the stablecoin usd coin has decreased while tether’s has grown, as the latest statistics paint a contrasting picture. Tether saw a 3% increase in coins in circulation over the last month, while the U.S. dollar-pegged crypto asset usd coin recorded a decrease of approximately 4.9% in the same time […]

It appears that the circulation of the stablecoin usd coin has decreased while tether’s has grown, as the latest statistics paint a contrasting picture. Tether saw a 3% increase in coins in circulation over the last month, while the U.S. dollar-pegged crypto asset usd coin recorded a decrease of approximately 4.9% in the same time […]

A survey from a sample of the general U.S. public suggests that millennials are more likely to join a DAO than any other age group.

A survey sample of working Americans suggests that millennial and Generation Z workers are far more in favor of joining decentralized autonomous organizations (DAOs) and working remotely in the post-Covid-19 world.

Over 1,100 Americans took part in a survey conducted by MetisDAO Foundation which explores trends in remote working preferences and the emergence of DAOs in recent years. A key consideration is the effect that Covid-19 has had on worker sentiment and the growth of DAOs in corporate governance.

Citing a research report on DAOs published by the Harvard Law School Forum on Corporate Governance, the results of the survey highlight how DAOs saw their treasuries swell from $400 million to $16 billion in 2021.

This coincided with growing participant figures, up from 13,000 to 1.6 million people during the same period. Drawing comparisons to some of the largest multinational corporations, global DAO workforce numbers are equal to one Amazon, 18 Facebooks, seven Microsofts or 11 Google.

Related: Toss in your job and make $300K working for a DAO? Here’s how

The impact of Covid-19 is a primary driver of Metis’ report investigating workers readiness for decentralized employment opportunities. The unexpected, rapid shift to remote working conditions of the pandemic has seemingly driven knowledge and understanding of DAOs and decentralized autonomous companies (DAC), particularly among millennial and generation Z workers.

A major takeaway from the results is that nearly 75% of respondents believe that companies will need to adapt how they run their businesses to offer more remote work options. Millennials working in hybrid or remote settings offered the most positive responses on how DACs offer workers opportunities to help govern a company.

47% of the respondents also indicated that they would be open to working for a DAO or DAC as a contracted employee. The survey also indicates that millennial workers are more willing to work for a DAO or DAC than any other age group.

Meanwhile, Gen Z respondents most accurately defined a DAO compared to respondents from other age groups and a majority of Gen Z participants also defined DAOs as ‘revolutionary movement changing the future of work’.

MetisDAO concludes by highlighting the influence of prolonged remote working conditions driving the desire for more decentralized and autonomous work environments.

“The survey results show that a majority of respondents seek all of the things that DACs provide; remote work opportunities, independence from management, and influence over the organizations they work in.”

MetisDAO’s survey came from a sample of 1112 respondents through SurveyMonkey in November 2022. The DAO forms part of Metis, an Ethereum layer-2 rollup solution.

The American venture capitalist and founder of Draper Fisher Jurvetson (DFJ), Tim Draper, is still confident his bitcoin prediction that says the crypto asset will tap $250K per unit. Draper said in April 2018, at the Draper University blockchain party, that he predicted: “$250K by 2022.” At this year’s Web Summit 2022 event, Draper said […]

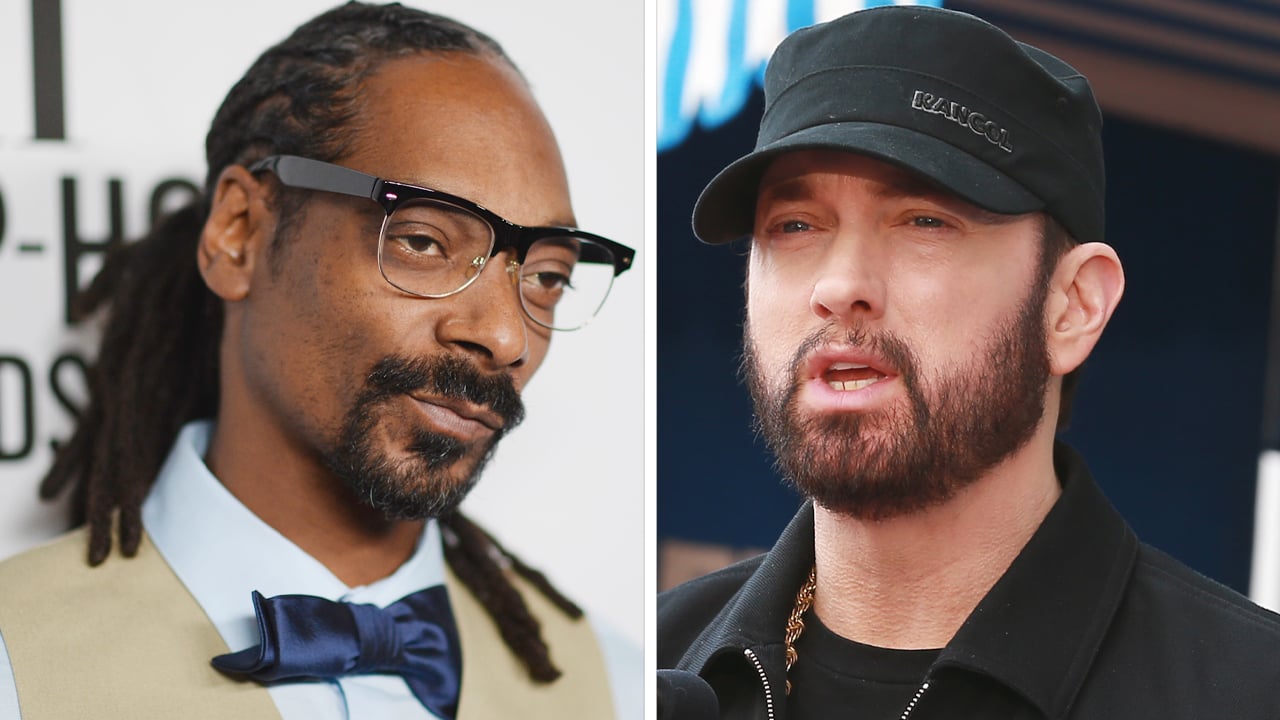

The American venture capitalist and founder of Draper Fisher Jurvetson (DFJ), Tim Draper, is still confident his bitcoin prediction that says the crypto asset will tap $250K per unit. Draper said in April 2018, at the Draper University blockchain party, that he predicted: “$250K by 2022.” At this year’s Web Summit 2022 event, Draper said […] The prominent rap stars Eminem and Snoop Dogg released a new music video that showcases the Bored Ape Yacht Club (BAYC) non-fungible token (NFT) collection. The duo’s latest single called “From the D 2 The LBC” debuted at this year’s Apefest, an annual gathering for BAYC and Mutant Ape Yacht Club (MAYC) owners. From the […]

The prominent rap stars Eminem and Snoop Dogg released a new music video that showcases the Bored Ape Yacht Club (BAYC) non-fungible token (NFT) collection. The duo’s latest single called “From the D 2 The LBC” debuted at this year’s Apefest, an annual gathering for BAYC and Mutant Ape Yacht Club (MAYC) owners. From the […]

Bitcoin prices could reach $6 million per coin in forty years’ time, but the whales may eventually pull the plug.

A former lead developer for the Bitcoin network has postulated a possible future for the world’s most popular cryptocurrency which includes an epic price prediction.

Software developer Gavin Andresen published a recent blog post called “A Possible BTC Future” in which he predicts the demise of the Bitcoin network.

Before BTC meets its end, it will reach a price of $6 million per coin in 2061, Andresen predicts. Before you get too excited, he added that $1 million dollars today will be worth $6 million in the next forty years, due to massive inflation.

The former Bitcoin client programmer admitted that his predictions were a “little piece of science fiction,” but that the scenario was entirely possible. Transaction fees would cost around $7,500 but most transactions will not occur on the network itself, he added.

Instead they’d be on a mirrored chain using wrapped tokens to save on fees and improve speeds. The whales, which would control the entire thing, would continue to transact on the main chain. By 2100, these whales would recognize that the mining fee had dropped to near zero and so few transactions are occurring so they will shut it down, Andresen predicted.

“Eventually, there are zero new BTC being produced on the BTC network, and zero BTC circulating on the BTC network. There is nothing left to secure, and the chain stops.”

The silver lining is that there will still be 20 million or so BTC moving around on other blockchains which would retain their value through scarcity, he added. Mathematically, the last Bitcoin is due to be mined in 2140. Currently, just 2.17 million, or 10.5%, remain to be mined.

Related: 5 Surprising Facts From Gavin Andresen’s Sworn Deposition

Andresen, who also founded the Bitcoin Foundation, stepped down from his lead role in 2014 and has receded from the spotlight in recent years. In 2016, he was ostracized from the Bitcoin community for supporting Craig Wright’s claims to be BTC creator Satoshi Nakamoto.

He later admitted that this was a mistake and testified that he had been “bamboozled” by Wright’s claims in June 2020.

American venture capital investor Tim Draper still believes in a bitcoin price prediction he made in mid-April 2018, at the Draper University blockchain party. At the time, Draper said that he thinks bitcoin could reach $250K by 2022, and during an interview with CNBC’s Jade Scipioni this week, Draper reiterated his six-digit bitcoin price forecast. […]

American venture capital investor Tim Draper still believes in a bitcoin price prediction he made in mid-April 2018, at the Draper University blockchain party. At the time, Draper said that he thinks bitcoin could reach $250K by 2022, and during an interview with CNBC’s Jade Scipioni this week, Draper reiterated his six-digit bitcoin price forecast. […]