The Galaxy Digital CEO says top crypto by market cap Bitcoin (BTC) could dip lower as digital asset firms continue to deleverage. In a new interview with CNBC’s Squawk Box, Mike Novogratz says that while he doesn’t foresee BTC dipping to the $13,000 price level, he does believe it will dip further. “This is a […]

The post Billionaire Mike Novogratz Updates Outlook on Crypto Markets As Bitcoin Touches $21,000 appeared first on The Daily Hodl.

Cryptocurrency-related lending has become a black smudge for the industry these days and according to a recent report, bitcoin’s low price has put billions in mining loans under stress. The report, which quotes the co-founder of mining company Luxor Technologies, Ethan Vera, says that roughly $4 billion in loans backed by crypto mining rigs are […]

Cryptocurrency-related lending has become a black smudge for the industry these days and according to a recent report, bitcoin’s low price has put billions in mining loans under stress. The report, which quotes the co-founder of mining company Luxor Technologies, Ethan Vera, says that roughly $4 billion in loans backed by crypto mining rigs are […]

“Selling a portion of our BTC holdings and daily production as a source of liquidity is the best and least expensive method in the current market environment," said chief financial officeJeff Lucas.

Canadian crypto mining firm Bitfarms sold roughly $62 million worth of Bitcoin (BTC) in June, using the proceeds from the sale to reduce its debt.

In a Tuesday announcement, Bitfarms said it had sold 3,000 Bitcoin in the last seven days, roughly 47% of the crypto mining firm’s roughly 6,349 BTC holdings. According to the company, it will use the funds from the BTC sales — $62 million — to “rebalance its indebtedness by reducing its BTC-backed credit facility with Galaxy Digital.” The sold crypto seemingly included 1,500 BTC Bitfarms used to reduce its credit facility from $100 million to $66 million in June, bringing its debt down to $38 million at the time of publication.

According to Bitfarms chief financial officer Jeff Lucas, the mining firm is “no longer HODLing” all the Bitcoin it produces daily — roughly 14 BTC — instead choosing to “take action to enhance liquidity and to de-leverage and strengthen” the company’s balance sheet. Bitfarms said it also closed a $37-million deal with NYDIG to finance equipment, bringing the firm’s liquidity to roughly $100 million.

“While we remain bullish on long-term BTC price appreciation, this strategic change enables us to focus on our top priorities of maintaining our world-class mining operations and continuing to grow our business in anticipation of improved mining economics,” said Lucas. “We believe that selling a portion of our BTC holdings and daily production as a source of liquidity is the best and least expensive method in the current market environment.”

#Bitfarms Adjusts #HODL Strategy

— Bitfarms (@Bitfarms_io) June 21, 2022

• Pays down BTC-back credit facility to US$38 million

• Currently holds total of 3,349 BTC

• Daily BTC production of approximately 14 BTC adds further liquidity

More info: https://t.co/xCcIUHkWsU

$BITF #BTC #BitcoinMining #Blockchain pic.twitter.com/L58siaA99c

Bitfarms held a reported 4,300 BTC as of January, worth roughly $177 million when the crypto asset was at a price of more than $41,000. Founder and CEO Emiliano Grodzki said at the time the company’s strategy was “to accumulate the most Bitcoin for the lowest cost and in the fastest amount of time.”

Related: Bitcoin vs. BTC miner stocks: Bitfarms mining chief explains key differences

The move from Bitfarms came amid extreme price volatility among major cryptocurrencies including BTC and Ether (ETH). On Saturday, the price of Bitcoin dropped under $18,000 for the first time since December 2020 but has since returned to more than $21,000 at the time of publication. The ETH price experienced a similar drop to under $1,000 on Saturday — an 18-month low — before rising to more than $1,200 on Tuesday.

Galaxy Digital founder and CEO Mike Novogratz is optimistic Bitcoin (BTC) will lead the markets to recovery once a key policy decision is reversed. Novogratz says in a CNBC interview that once the Federal Reserve pauses or reverses the interest rate hikes, the flagship crypto asset will spearhead a market-wide rally. “Bitcoin will lead the […]

The post Crypto Billionaire Mike Novogratz Says Bitcoin Will Lead Market Recovery When One Policy Is Reversed appeared first on The Daily Hodl.

The chief executive of crypto asset management company Galaxy Digital, Mike Novogratz, thinks the majority of crypto hedge funds could be headed toward dark days in the future. Novogratz outlined his opinions while speaking at Piper Sandler Global Exchange & Brokerage Conference on Wednesday, predicting that two-thirds of the roughly 1900 crypto hedge funds in […]

The post The Majority of Crypto Hedge Funds Will Go Out of Business, Predicts Galaxy Digital CEO Mike Novogratz: Report appeared first on The Daily Hodl.

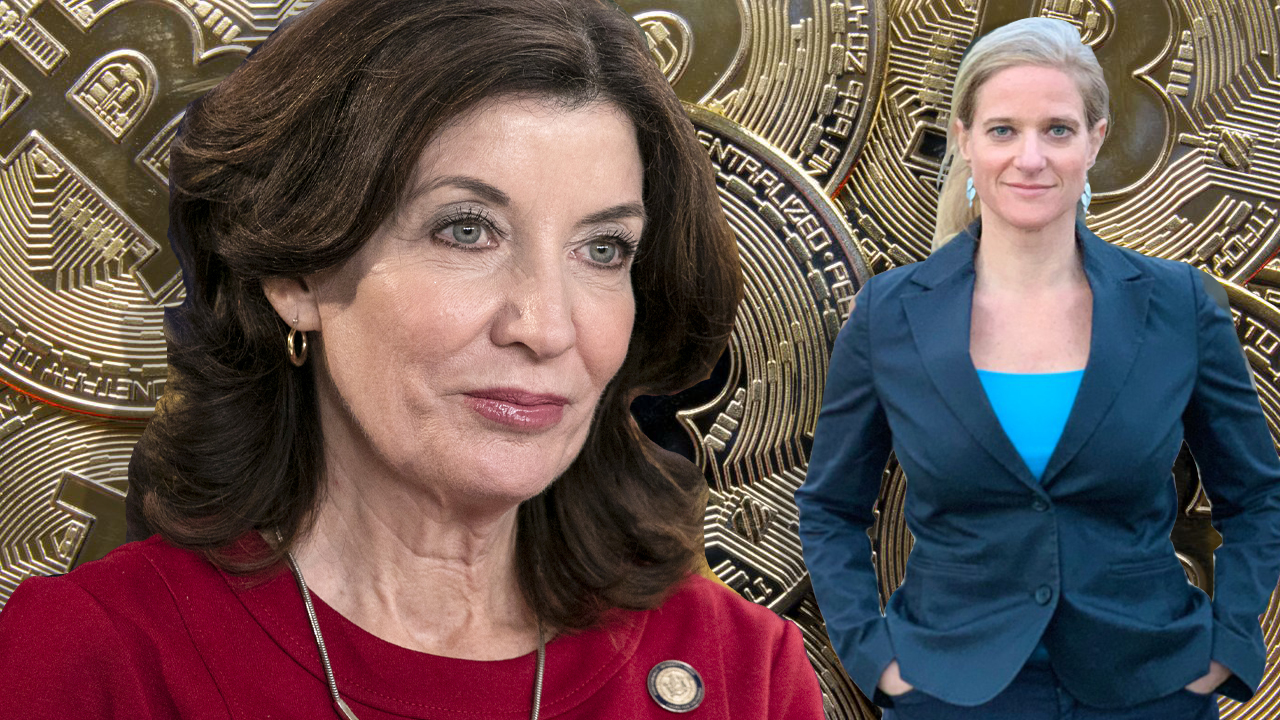

The state of New York passed a bill that puts a moratorium on specific types of cryptocurrency mining operations that leverage carbon-based energy sources. The policy will place a two-year ban on proof-of-work (PoW) mining if the assembly bill is approved by New York governor Kathy Hochul. New York PoW Mining Moratorium Legislation to Be […]

The state of New York passed a bill that puts a moratorium on specific types of cryptocurrency mining operations that leverage carbon-based energy sources. The policy will place a two-year ban on proof-of-work (PoW) mining if the assembly bill is approved by New York governor Kathy Hochul. New York PoW Mining Moratorium Legislation to Be […] After the LUNA and UST meltdown, many crypto investors have been curious about the project’s rise in popularity and people wonder about the background of Terra’s co-founder Do Kwon. Moreover, it is not commonly known that Terraform Labs was also founded by Daniel Shin, the founder of a payment firm called CHAI. After Shin left […]

After the LUNA and UST meltdown, many crypto investors have been curious about the project’s rise in popularity and people wonder about the background of Terra’s co-founder Do Kwon. Moreover, it is not commonly known that Terraform Labs was also founded by Daniel Shin, the founder of a payment firm called CHAI. After Shin left […] This week, both Goldman Sachs’ Lloyd Blankfein and Tesla boss Elon Musk weighed in on the issue of an impending recession in the U.S., issuing sobering estimations. In the wake of Terra’s epic implosion, the topic is all the more critical, but LUNA-tattooed Galaxy Digital CEO Mike Novogratz still thinks the “crypto revolution is here […]

This week, both Goldman Sachs’ Lloyd Blankfein and Tesla boss Elon Musk weighed in on the issue of an impending recession in the U.S., issuing sobering estimations. In the wake of Terra’s epic implosion, the topic is all the more critical, but LUNA-tattooed Galaxy Digital CEO Mike Novogratz still thinks the “crypto revolution is here […] On May 18, the billionaire investor and crypto proponent Mike Novogratz published a post about the recent Terra blockchain fallout. Novogratz and his firm Galaxy Digital were big believers in the Terra project, and the investor even got a LUNA-centric tattoo on his arm. Despite the recent events and losses, the crypto economy felt this […]

On May 18, the billionaire investor and crypto proponent Mike Novogratz published a post about the recent Terra blockchain fallout. Novogratz and his firm Galaxy Digital were big believers in the Terra project, and the investor even got a LUNA-centric tattoo on his arm. Despite the recent events and losses, the crypto economy felt this […]

Crypto asset manager Galaxy Digital has taken a deep hit following the significant downturn in digital asset markets. According to a recent press release, the firm is reporting that is on track to lose $300 million for the second quarter of 2022. The firm is also hinting that it has no exposure at all to […]

The post Mike Novogratz’s Galaxy Digital Sees Massive $300,000,000 Loss This Quarter, Hints at Zero Exposure to TerraUSD appeared first on The Daily Hodl.