U.S. inflation continues to roar higher as this week’s data from the consumer price index (CPI) jumped 6.2% from a year ago. Americans are concerned as the Federal Reserve has expanded the monetary supply like at no other time in history, suppressed the benchmark interest rate, and U.S. politicians are creating multi-trillion-dollar packages with money […]

U.S. inflation continues to roar higher as this week’s data from the consumer price index (CPI) jumped 6.2% from a year ago. Americans are concerned as the Federal Reserve has expanded the monetary supply like at no other time in history, suppressed the benchmark interest rate, and U.S. politicians are creating multi-trillion-dollar packages with money […] Inflation continues to remain hot in the United States as supply constraints and higher oil prices continue, seeing barrels of crude surge above $80 per unit. Meanwhile, data released on Friday indicates that consumer expenditures have risen to 4.4%, the highest run-up of inflation the country has seen in 30 years. Inflation Continues to Rise […]

Inflation continues to remain hot in the United States as supply constraints and higher oil prices continue, seeing barrels of crude surge above $80 per unit. Meanwhile, data released on Friday indicates that consumer expenditures have risen to 4.4%, the highest run-up of inflation the country has seen in 30 years. Inflation Continues to Rise […] St. Louis Federal Reserve president James Bullard told the press on Tuesday that he thinks the U.S. central bank needs to wind down the buying of $80 billion worth of monthly bond purchases. Bullard says he would support tapering starting as early as November, in order to “react to possible upside risks to inflation next […]

St. Louis Federal Reserve president James Bullard told the press on Tuesday that he thinks the U.S. central bank needs to wind down the buying of $80 billion worth of monthly bond purchases. Bullard says he would support tapering starting as early as November, in order to “react to possible upside risks to inflation next […] Americans are still concerned about dealing with inflation, as the cost of goods and services has continued to rise significantly in a short period of time. The Federal Reserve has published the latest Survey of Consumer Expectations report and U.S. households believe inflation will be up 5.3% one year from now. In addition to the […]

Americans are still concerned about dealing with inflation, as the cost of goods and services has continued to rise significantly in a short period of time. The Federal Reserve has published the latest Survey of Consumer Expectations report and U.S. households believe inflation will be up 5.3% one year from now. In addition to the […] Americans are still very concerned about inflation as the latest Survey of Consumer Expectations (SCE) report from August indicates that U.S. consumers expect inflation to be 5.2% a year from now. The SCE response data hasn’t been this high since 2013, and it’s increased since the month prior, when U.S. residents expected 4.9% at the […]

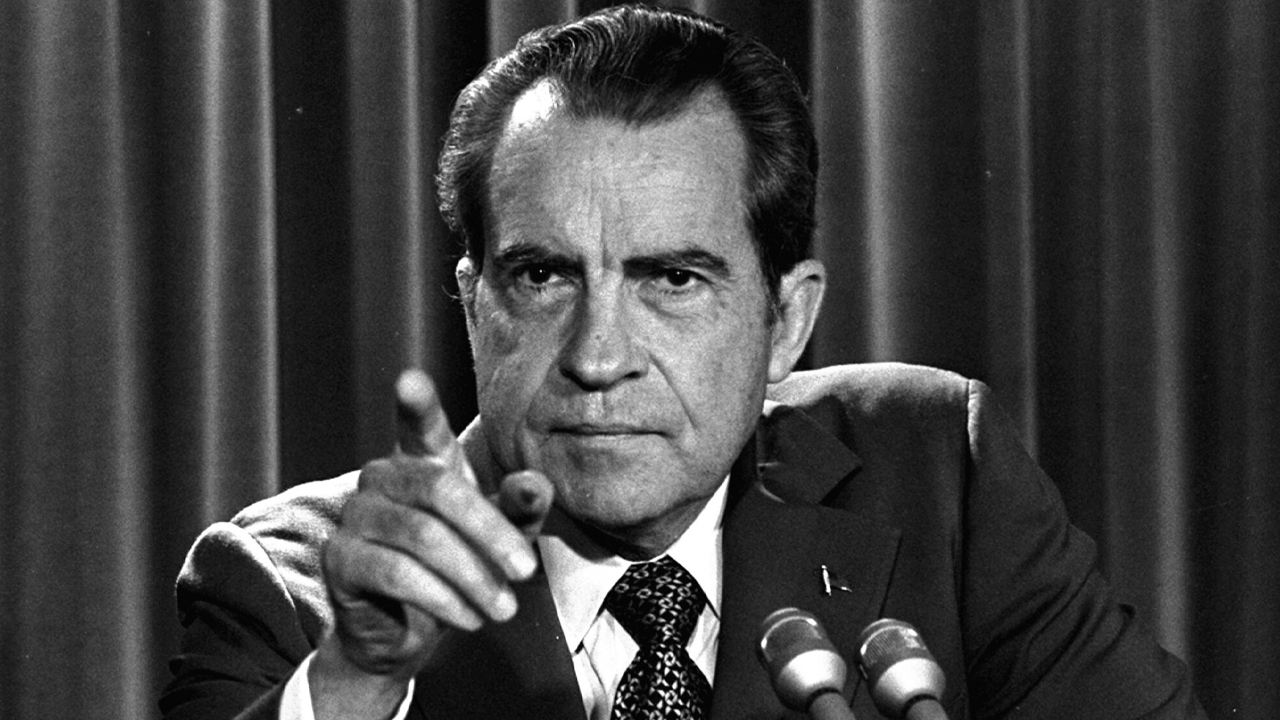

Americans are still very concerned about inflation as the latest Survey of Consumer Expectations (SCE) report from August indicates that U.S. consumers expect inflation to be 5.2% a year from now. The SCE response data hasn’t been this high since 2013, and it’s increased since the month prior, when U.S. residents expected 4.9% at the […] Approximately 50 years ago today, Americans were introduced to ‘Nixon Shock’ when the 37th president of the United States suspended the convertibility of the U.S. dollar into gold. Since this point in time, the U.S. economy has never been the same as many believe Richard Nixon ushered in a new era of uncontrollable fiat currency […]

Approximately 50 years ago today, Americans were introduced to ‘Nixon Shock’ when the 37th president of the United States suspended the convertibility of the U.S. dollar into gold. Since this point in time, the U.S. economy has never been the same as many believe Richard Nixon ushered in a new era of uncontrollable fiat currency […] The Federal Reserve Bank of New York published the Survey of Consumer Expectations report on Monday, which shows U.S. consumers are expecting short-term inflation levels to be higher than usual. Meanwhile, the report also shows American consumers’ expectations of long-term inflation have reached the highest level since 2013. New York Fed’s Survey of Consumer Expectations […]

The Federal Reserve Bank of New York published the Survey of Consumer Expectations report on Monday, which shows U.S. consumers are expecting short-term inflation levels to be higher than usual. Meanwhile, the report also shows American consumers’ expectations of long-term inflation have reached the highest level since 2013. New York Fed’s Survey of Consumer Expectations […]

Senator Cynthia Lummis said that inflation and massive government spending is accelerating the adoption of digital assets.

Republican Senator and Bitcoin proponent Cynthia Lummis said that massive government spending is accelerating crypto adoption.

Lummis made the comments while sharing an interview she did with “Varney & Co” on the Fox Business cable network on July 29, in which she called for a crypto regulatory sandbox and support to attract Bitcoin miners to set up in US states.

On Twitter she stated that “big gov’t spenders are (accidentally) doing far more to accelerate the adoption of digital assets than I am,” and asserted that the debasement of the U.S. dollar is driving citizens to store value in digital assets such as Bitcoin. Not that this was necessarily a good thing:

“BUT spending America deeper into a hole is a stupid, inflationary & altogether undesirable way to drive ppl to digital assets.”

“I want USD to continue as the world's reserve currency. We need to reign in spending & support financial innovation on US soil,” she added.

During the cable TV interview, Lummis gave her thoughts on the July 27 hearing held by the Senate Banking Committee regarding the risks of crypto and offered views on the regulatory landscape moving forward.

The Senate Banking Committee held a hearing about the risk in the Crypto market - what form of #Crypto regulation could we see going forward? @CynthiaMLummis is on that committee - she joins us to explain what regulation she's hoping to see for the cryptos! #VarneyCo #Bitcoin pic.twitter.com/7Bb8uWJPym

— Varney & Co. (@Varneyco) July 28, 2021

The Senator emphasized that the first step should be “good solid definitions” that are agreed upon in legislation and called for “a regulatory sandbox where everyone understands the rules, but innovation can still occur unrestricted.”

Lummis stated that “we wanna make sure that Bitcoin can continue to serve as a good store of value,” and she appears view the asset primarily in that way. However, she did also note that if the U.S. were to follow El Salvador’s route and make BTC legal tender, it would need to be regulated under the bank secrecy act, anti-money laws and in a way that it can be “ferreted out” if it’s used illegitimately.

The Bitcoin proponent also said she wants to see the U.S. welcome and support crypto miners that are flocking to the country following the Chinese mining ban:

“We wanna make sure that these miners [...] can come to places like Pennsylvania, Texas, Wyoming and elsewhere. Where they can get the energy to mine it and then once it's produced that it can be on the blockchain in a way that enhances the non-fiat currency advantages that cryptocurrency has.”

Related: Law professor calls for crypto mining regulation during US Senate hearing

Lummis is a Bitcoin hodler who previously stated that she was excited to buy the dip in June, and has advocated for holding BTC as part of a retirement diversification strategy. However, her pro-crypto sentiments were not shared by Democrat senator Sherrod Brown and others during the Senate Banking Committee’s recent hearing.

“After a decade of experience with these technologies, it seems safe to say that the vast majority haven’t been good for anyone but their creators,” Brown said in his opening statement.

“They claim to enable ‘transparency.’ Their backers talk about the ‘democratization of banking.’ There’s nothing ‘democratic’ or ‘transparent’ about a shady, diffuse network of online funny money.”