Stellar entered a new uptrend that has seen it rise over 60% since the beginning of the month. While institutional investors continue scooping up more XLM, prices look poised to break out.

Institutional Demand Skyrockets

Institutional demand for XLM seems to be picking up at an exponential rate. Although a recent technical glitch caused core validators to drop off the Stellar network momentarily, investors have not been discouraged from getting a piece of this altcoin.

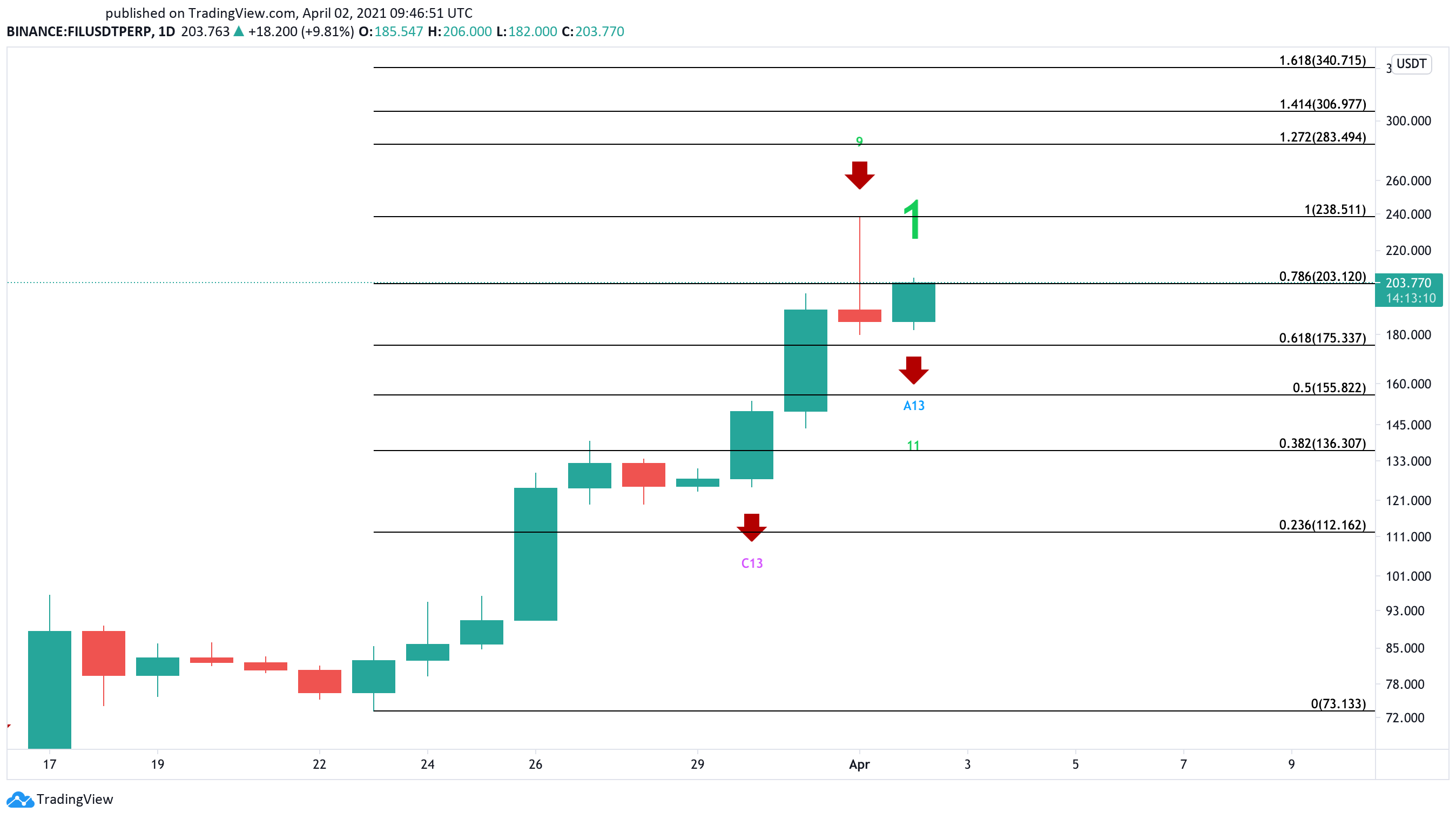

Data from Bybt shows that Grayscale has gone on a buying spree, adding more upward pressure to the cross-border remittances token. The world’s largest cryptocurrency asset management firm has raked 5,566,271 XLM over the past month, worth roughly $2.5 million.

As institutional investors gain exposure to Stellar, prices have responded strongly. Since the beginning of the month, XLM’s market value has risen by nearly 60%, going from a low of $0.41 to make a new-yearly high of $0.66.

XLM Targets New Yearly Highs

Despite the significant gains already incurred, the eleventh-largest cryptocurrency by market cap seems to have more room to grow.

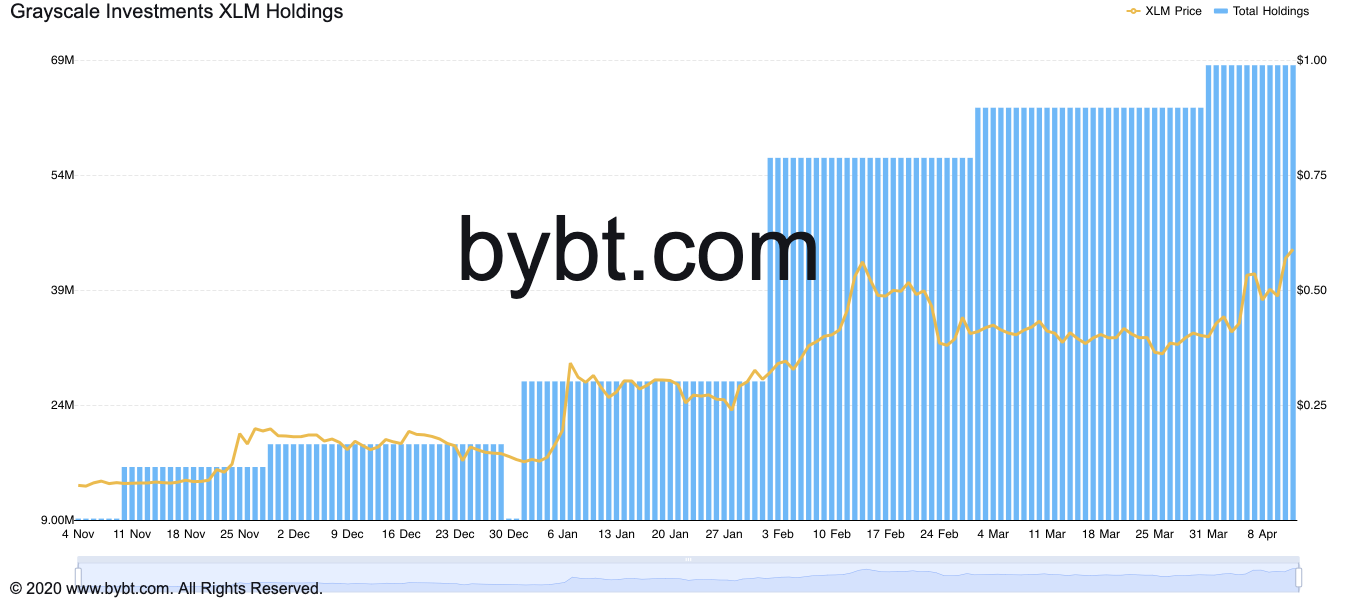

XLM appears to have entered a consolidation phase on the 1-hour chart after its peak on Apr. 11. The short-term lackluster price action seen over the last 28 hours seems to be creating the pennant of a bull pennant formation. Meanwhile, the 37.60% upswing seen since Apr. 9 appears to have developed the pattern’s flagpole.

Another spike in buying pressure around the current price levels in which Stellar slices through the pennant’s upper trendline or the 78.6% Fibonacci retracement level at $0.61 will signal a potential breakout.

If this were to happen, XLM’s price could surge by nearly 30% towards the 141.4% or 161.8% Fibonacci retracement level. These resistance barriers sit at $0.74 and $0.78, respectively.

Such an optimistic target is determined by measuring the flagpole’s height and adding that distance to the breakout point.

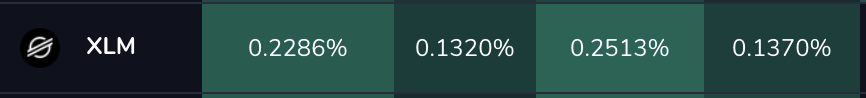

Even though the odds seem to favor the bulls, XLM perpetual swaps’ funding rates are at unsustainable levels.

Funding rates of 0.1% or higher every eight hours suggest that market participants have entered a state of euphoria, leading to steep corrections.

At the time of writing, XLM’s funding rate is hovering at 0.2308% on Binance, 0.1320% on FTX, 0.2513% on Huobi, and 0.1380% on OKEx.

Given the levels of greed in the cryptocurrency market, investors must note that XRP needs to hold above the 61.8% Fibonacci retracement level at $0.58 for the bullish outlook to prevail.

Failing to do so could lead to a correction to the 38.2% or the 23.6% Fibonacci retracement level. These support levels sit at $0.53 and $0.50, respectively.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.