On Tuesday, Sept. 24, 2024, Caroline Ellison, the former CEO of Alameda Research, was sentenced to 24 months in prison after admitting to her involvement in several crimes. The courtroom banned cameras, video, and phone recordings during the sentencing. Even though the judge commended her in court, saying, “I’ve seen a lot of cooperators in […]

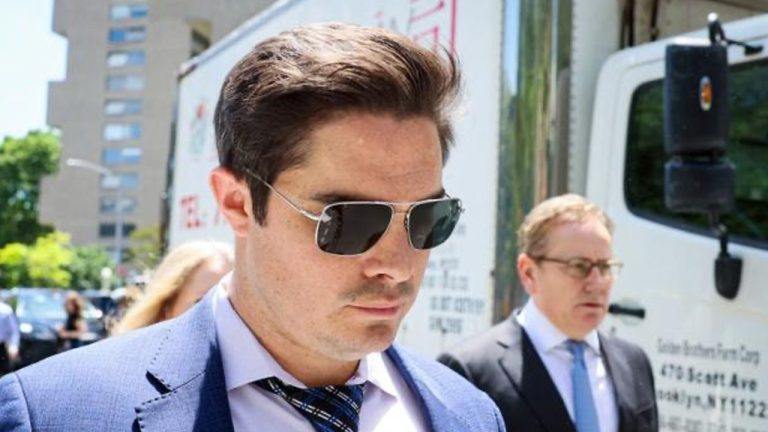

On Tuesday, Sept. 24, 2024, Caroline Ellison, the former CEO of Alameda Research, was sentenced to 24 months in prison after admitting to her involvement in several crimes. The courtroom banned cameras, video, and phone recordings during the sentencing. Even though the judge commended her in court, saying, “I’ve seen a lot of cooperators in […] Ryan Salame, a former executive at the now-defunct cryptocurrency exchange FTX, has filed a motion to withdraw his guilty plea in federal court. Salame claims that prosecutors breached an agreement that led him to plead guilty by resuming an investigation into his domestic partner, Michelle Bond. Ryan Salame Challenges Guilty Plea, Claims Government Reneged on […]

Ryan Salame, a former executive at the now-defunct cryptocurrency exchange FTX, has filed a motion to withdraw his guilty plea in federal court. Salame claims that prosecutors breached an agreement that led him to plead guilty by resuming an investigation into his domestic partner, Michelle Bond. Ryan Salame Challenges Guilty Plea, Claims Government Reneged on […] An Indian national has pleaded guilty in the U.S. to wire fraud conspiracy for stealing over $37 million by spoofing crypto exchange Coinbase’s website. He and his co-conspirators created a fake Coinbase Pro site to steal login credentials and two-factor authentication codes, transferring victims’ cryptocurrency to their own wallets. Guilty Plea in $37M Coinbase Crypto […]

An Indian national has pleaded guilty in the U.S. to wire fraud conspiracy for stealing over $37 million by spoofing crypto exchange Coinbase’s website. He and his co-conspirators created a fake Coinbase Pro site to steal login credentials and two-factor authentication codes, transferring victims’ cryptocurrency to their own wallets. Guilty Plea in $37M Coinbase Crypto […]

This court “hereby accepts the guilty plea of the defendant to the charge [...] and the defendant is adjudged guilty of such offense,” wrote Judge Richard Jones.

A federal judge accepted Binance founder Changpang "CZ" Zhao's guilty plea to money laundering, but hasn't decided if he can leave the United States before his February sentencing date.

In a Dec. 6 filing to a Seattle District Court, Judge Richard Jones said he accepted Zhao’s guilty plea to one count of Bank Secrecy Act violations, which he submitted over two weeks ago on Nov. 21 alongside his exchange’s $4.3 billion settlement with the U.S.

As part of the settlement deal, Zhao agreed to step down as CEO of Binance and paid $150 million to regulators.

Co-founder Rodriguez and senior promoters Millan, Aguilar and Chairez all recently pled guilty to the charges, while the other founder, Dos Santos pled guilty in October, 2021.

Six people involved in a cryptocurrency “Ponzi scheme” that raked in about $100 million over five years have pled guilty to a series of fraud and money laundering charges, each carrying a maximum sentence of 20 to 30 years of prison.

One of the founders of “AirBit Club,” Pablo Renato Rodriguez, was the latest to plead guilty to wire fraud conspiracy charges on Mar. 8.

According to a Mar. 8 statement from the United States Department of Justice (DOJ), AirBit Club was a fake cryptocurrency mining and trading company operating between 2015 to 2020, where executives and promoters induced victim investors into believing that they’d make guaranteed passive income and profits on any membership purchased.

Operators and attorney of global multi-million-dollar cryptocurrency Ponzi scheme “AirBit Club” plead guiltyhttps://t.co/MT3mM9aqPV

— US Attorney SDNY (@SDNYnews) March 8, 2023

According to the DOJ, the perpetrators traveled throughout the United States, Latin America, Asia and Eastern Europe to market AirBit at “lavish expos” to convince investors to purchase AirBit Club memberships.

Victims saw “profits” accumulate on the AirBit Club online portal, but no actual mining or trading was ever carried out. One victim trying to withdraw was asked to “bring new blood” into the AirBit Club scheme in order to withdraw her funds.

U.S. Attorney Damian Williams said the operators used funds from victims to purchase luxurious cars, houses and jewerly. Some of the proceeds were used to finance more expos to recruit more victims too:

“The defendants took advantage of the growing hype around cryptocurrency to con unsuspecting victims around the world out of millions of dollars with false promises that their money was being invested in cryptocurrency trading and mining."

"Instead of doing any cryptocurrency trading or mining on behalf of investors, the defendants built a Ponzi scheme and took the victims’ money to line their own pockets," he added.

The representatives were first officially charged Aug. 18, 2020.

Since then, senior promoters Cecilia Millan, Jackie Aguilar and Karina Chairez each pled guilty to a series of wire fraud conspiracy, bank fraud conspiracy and money laundering conspiracy charges on Jan. 31, Feb. 8 and Feb. 22, while another founder, Gutenberg Dos Santos pled guilty to wire fraud and money laundering conspiracy charges on Oct. 21, 2021, according to the Mar. 8 statement.

These guilty pleas send a clear message that we are coming after all of those who seek to exploit cryptocurrency to commit fraud,” Williams added.

Related: ‘Far too easy’ — Crypto researcher’s fake Ponzi raises $100K in hours

The operators have been ordered to forfeit their fraudulent proceeds of AirBit Club, which include fiat currency, real estate and Bitcoin (BTC), collectively valued at about $100 million.

Cointelegraph found there are still videos of the AirBit Club representatives marketing the membership scheme on YouTube.

The scheme often used the hashtag “#AirBitBillionaireClub” and shared several fake success stories of investors to try to lure in more victims.

California-licensed Attorney Scott Hughes, an attorney accused of laundering proceeds of the scheme, also pled guilty to money laundering charges on Mar. 2.

Rodriguez, Millan, Aguilar, Chairez and Hughes will be sentenced on different dates between June and August this year.

Magazine: ‘Account abstraction’ supercharges Ethereum wallets: Dummies guide

Roughly 11 days ago, it was reported that Nishad Singh, the former director of engineering at FTX, was working with federal prosecutors to arrange a plea deal. On Tuesday, Singh pleaded guilty to criminal charges and stated, “I am unbelievably sorry for my role in all of this.” Singh Cooperating With Authorities in FTX Investigation; […]

Roughly 11 days ago, it was reported that Nishad Singh, the former director of engineering at FTX, was working with federal prosecutors to arrange a plea deal. On Tuesday, Singh pleaded guilty to criminal charges and stated, “I am unbelievably sorry for my role in all of this.” Singh Cooperating With Authorities in FTX Investigation; […]

Eddy Alexandre, the CEO of the purported crypto trading platform EminiFX is facing as much as 10 years behind bars for his part in the fraudulent enterprise.

Eddy Alexandre, CEO of purported crypto trading platform EminiFX has pleaded guilty to commodities fraud in a New York district court, agreeing to pay back millions to investors who lost funds to his "cryptocurrency investment scam."

The United States Department of Justice (DOJ) announced on Feb. 10 that Alexandre submitted a guilty plea to one count of commodities fraud, and will pay over $248 million in forfeiture along with restitution yet to be specified.

Alexandre was arrested and charged in May 2022 over his role in EminiFX and originally pleaded not guilty, but changed his plea on Feb. 10. He faces a maximum sentence of 10 years in prison.

According to U.S. Attorney for the Southern District of New York, Damian Williams, from around September 2021 to May 2022, Alexandre ran the crypto and forex trading platform and “solicited more than $248 million in investments from tens of thousands of individual investors.”

Williams said Alexandre purported EminiFX could give “weekly returns of at least 5%” but in reality, the CEO didn’t invest a “substantial portion” of the funds and “even used some funds for personal purchases.”

He touted EminiFX as a platform for passive income that used a secret new technology to automate trading in crypto and foreign currencies that “guaranteed” the stated returns on investment.

Alexandre refused to state to investors what the technology was and promised they would double their money within five months. Investors in the scheme were falsely presented with information that they had earned the stated 5% returns.

Related: Crypto exchanges tackle insider trading after recent convictions

In reality, Alexandre lost millions of dollars on the funds he did invest — which he didn’t disclose to investors.

He also directed around $14.7 million to his personal bank account and used around $155,000 to buy a BMW and more on payments to a Mercedes Benz.

Some of the EminiFX investors were supportive of Alexandre despite the fraud he committed.

A handful traveled from abroad to attend an August 2022 plea hearing according to an Aug. 10 Bloomberg report. One supporter claimed the case against Alexandre was racist.

He also faces a separate civil suit from the Commodity Futures Trading Commission (CFTC) which is suing Alexandre for “fraudulent solicitation and misappropriation” relating to crypto and foreign exchange trading.

The brother of a former Coinbase product manager has pleaded guilty in a cryptocurrency insider trading case. According to the U.S. Department of Justice (DOJ), he is facing up to 20 years in federal prison. DOJ’s First Crypto Insider Trading Case The U.S. Department of Justice (DOJ) announced Monday that Nikhil Wahi, the brother of […]

The brother of a former Coinbase product manager has pleaded guilty in a cryptocurrency insider trading case. According to the U.S. Department of Justice (DOJ), he is facing up to 20 years in federal prison. DOJ’s First Crypto Insider Trading Case The U.S. Department of Justice (DOJ) announced Monday that Nikhil Wahi, the brother of […]