Core Scientific plans to shut down 37,000 bitcoin mining rigs belonging to now-defunct crypto lender Celsius, according to an agreement between the two bankrupt firms. Celsius owes Core Scientific approximately $7.8 million for energy and hosting costs, as the crypto lender has been unable to make regular payments as outlined in the hosting contract. Celsius […]

Core Scientific plans to shut down 37,000 bitcoin mining rigs belonging to now-defunct crypto lender Celsius, according to an agreement between the two bankrupt firms. Celsius owes Core Scientific approximately $7.8 million for energy and hosting costs, as the crypto lender has been unable to make regular payments as outlined in the hosting contract. Celsius […]

SBF’s last tweet before his arrest for reportedly committing wire fraud was dispelling his involvement in a group chat purportedly called “Wirefraud.”

Merely hours before news of his arrest by Bahamian police, Sam Bankman-Fried took to Twitter denying his involvement or knowledge of a secret group chat named “Wirefraud” — which allegedly involved former FTX and Alameda ranking executives.

In a Dec. 12 response to a report from the Australian Financial Review (AFR), Bankman-Fried used Twitter to deny involvement in or knowledge of a “Wirefraud” group chat on messaging app Signal, which reportedly included members of Bankman-Fried’s inner circle, including FTX co-founder Zixiao “Gary” Wang, FTX engineer Nishad Singh and former Alameda CEO Caroline Ellison.

The AFR report said the chat was used to send secret information about FTX and Alameda's operations in the lead-up to its failure.

Bankman-Fried however said on Twitter that if the group chat was “true” he “wasn't a member” and was “quite sure it's just false” as he had “never heard of such a group.”

If this is true then I wasn't a member of that inner circle

— SBF (@SBF_FTX) December 12, 2022

(I'm quite sure it's just false; I have never heard of such a group)

Sam Bankman-Fried was, until very recently, expected to appear remotely before a United States House Committee hearing on Dec. 13 to explain the collapse of the FTX exchange, but was taken into custody by Bahamian authorities on Dec. 12 with extradition to the U.S. likely to follow.

Committee Chair Maxine Waters on Dec. 12 later confirmed that it “will not be able to hear” his testimony at the House Committees hearing due to the arrest.

Bankman-Fried was also requested to attend a separate hearing on Dec. 14 with the Senate Committee on Banking but had never confirmed his attendance, while his lawyers had reportedly refused to accept a subpoena compelling his testimony, according to a Dec. 12 joint statement from Senators Sherrod Brown and Pat Toomey.

Related: $75M worth of FTX’s political donations at risk of being recalled due to bankruptcy: Report

Chief restructuring officer and FTX CEO John Ray in written testimony before his appearance at the House Committee hearing said FTX customer assets were “commingled” with Alameda’s.

Ray asserted Alameda “used client funds to engage in margin trading which exposed customer funds to massive losses” and the trading firm's business model required it to deploy those funds to “various [...] exchanges which were inherently unsafe.”

The US lawmaker has refuted a report from CNBC that suggested that they weren't planning to subpoena the former FTX CEO.

The United States House Financial Services Committee Chair Maxine Waters said a subpoena is "definitely on the table" for former FTX CEO Sam Bankman-Fried, who has been requested to testify at a Dec. 13 hearing looking into the collapse of FTX.

In a Dec. 8 tweet Waters said that "lies are circulating" after a report from CNBC suggested she doesn’t plan to subpoena Bankman-Fried to testify on Dec. 13.

Lies are circulating @CNBC that I am not willing to subpoena @SBF_FTX. He has been requested to testify at the December 13th hearing. A subpoena is definitely on the table. Stay tuned.

— Maxine Waters (@RepMaxineWaters) December 8, 2022

The report claimed Waters informed a group of Democrats that she wanted the Committee to convince Bankman-Fried to testify voluntarily.

Related: Crypto community baffled by SBF dictating terms over congressional hearing

Waters had first requested Sam Bankman-Fried to appear at the Dec. 13 hearing on Dec. 3 via a post on Twitter.

Despite appearing in multiple media interviews discussing FTX, Bankman-Fried stated on Dec. 4 that he won’t appear before the Committee until he’s “finished learning and reviewing what happened” and he’s “not sure” if that would happen in time for the hearing.

Citing his media appearances, Waters has previously pushed back at the FTX founders’ excuse, saying on Dec. 5 that the information he holds is “sufficient for testimony.”

"It is imperative that you attend our hearing," Waters added, and said the Committee was "willing to schedule continued hearings if there is more information to be shared later."

This is a developing story and more information will be added as it becomes available.

The Texas Securities Board has asked the judge to consider leveling a cease-and-desist order, administrative fines, and forced refunds against SBF and FTX US.

Former FTX CEO Sam Bankman-Fried has been called to a Feb. 2 hearing by the Texan securities regulator as part of an investigation into whether he and FTX US have violated Texas securities laws.

In a Notice of Hearing signed off by Texas State Securities Board’s (SSB’s) director of enforcement Joe Rotunda and served to Bankman Fried on Nov. 29, the regulator alleges that FTX US offered unregistered securities to Texans through its “EARN” accounts.

The investigation was first announced on Oct. 14, before the dramatic collapse and bankruptcy of FTX’s global operations. The regulator announced at the time it was investigating FTX Trading and FTX US and its principals including Sam Bankman-Fried for offering unregistered securities through its yield-bearing products.

On Nov. 18, Rotunda used Twitter to appeal to the public to reach out to him if they were a previous client of FTX and based in Texas.

If you’re a client if @FTX_Official and you live in Texas, please reach out to me. We want to hear your story. My Texas State Securities Board email address is jrotunda@ssb.texas.gov.

— Joe Rotunda (@joe_rotunda) November 18, 2022

In the latest notice, the SSB alleged that Sam Bankman-Fried violated a section of the Securities Act during his role as the then-CEO of FTX.

“Respondent [Sam Bankman-Fried] violated Section 4003.001 of the Securities Act by offering and selling securities in Texas that were not registered or permitted for sale in Texas,” said Rotunda, adding it also didn’t register as a dealer or agent in Texas.

The regulator said it hoped that the hearing will lead to a Cease and Desist order to prevent FTX from “engaging in fraud in connection with the offer or sale of securities in Texas.”

It was also “praying” for the judge to order Bankman-Fried to return money to Texan customers that had invested in its “unregistered EARN accounts.”

The regulator also wants consideration of an “administrative fine” to be issued to Bankman-Fried should he have gained any economic benefit from the securities law violations. This amount wouldn’t exceed $20,000 per violation but could go to $250,000 for every “illegal or fraudulent act” that was perpetrated against Texans over the age of 65.

Rotunda said the hearing will commence at 9am local time on Feb. 2, 2023, and Bankman-Fried can attend the hearing using Zoom.

Related: ‘I never opened the code for FTX’: SBF has long, candid talk with vlogger

Bankman-Fried is understood to currently be in the Bahamas.

In a recently published interview between crypto blogger Tiffany Fong and Bankman-Fried, the former FTX CEO expressed remorse over his handling of FTX and the bankruptcy filing.

“You don’t get into the situation we got in if you, like, make all the right decisions,” he said in the recently released Nov. 16 interview.

Alexander Vinnik, the alleged owner and operator of the infamous cryptocurrency exchange BTC-e, has been found not eligible for release on bail in the United States, where he was recently transferred from Greece. The Russian, accused of large-scale money laundering through the now-defunct trading platform, and other crimes, rejects U.S. charges. Alexander Vinnik Remains in […]

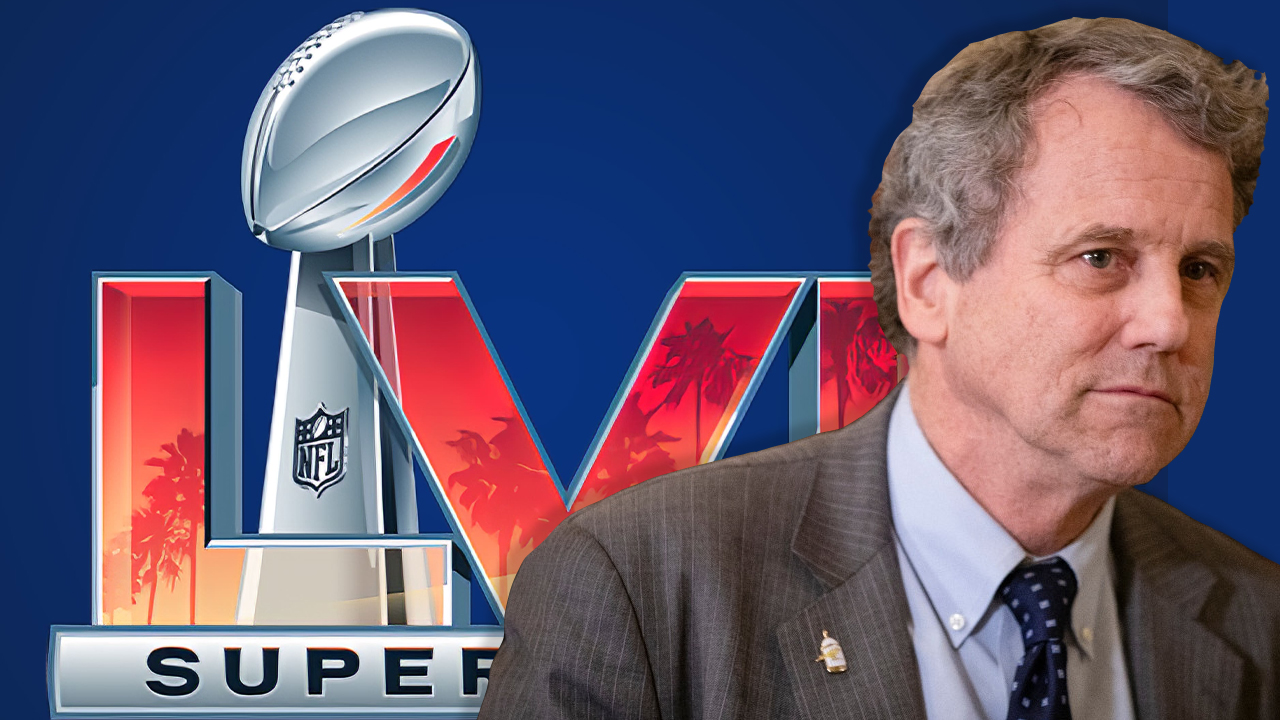

Alexander Vinnik, the alleged owner and operator of the infamous cryptocurrency exchange BTC-e, has been found not eligible for release on bail in the United States, where he was recently transferred from Greece. The Russian, accused of large-scale money laundering through the now-defunct trading platform, and other crimes, rejects U.S. charges. Alexander Vinnik Remains in […] The United States senator from Ohio and Senate Banking Committee chief Sherrod Brown is not a fan of cryptocurrencies. This week during Tuesday’s stablecoin hearing, Brown criticized all the cryptocurrency companies who advertised during the Super Bowl this past weekend and stressed that he’s “never seen the Federal Reserve buy a multimillion-dollar commercial for U.S. […]

The United States senator from Ohio and Senate Banking Committee chief Sherrod Brown is not a fan of cryptocurrencies. This week during Tuesday’s stablecoin hearing, Brown criticized all the cryptocurrency companies who advertised during the Super Bowl this past weekend and stressed that he’s “never seen the Federal Reserve buy a multimillion-dollar commercial for U.S. […]Delivered by Alesia Haas, Coinbase Chief Financial Officer

Chairwoman Waters, Ranking Member McHenry and Members of the Committee, good morning and thank you for this opportunity to testify on digital assets and the future of finance.

My name is Alesia Haas and I am Chief Financial Officer of Coinbase Global Inc. I also serve in the role of Chief Executive Officer of our U.S. subsidiary, Coinbase Inc. I joined Coinbase in 2018 after serving as Chief Financial Officer at Sculptor Capital and OneWest Bank, and have over 20 years of experience in the finance industry.

Today I’d like to introduce Coinbase, discuss the evolution of crypto, and highlight how today’s regulations could be changed to advance the bipartisan goals of protecting consumers and promoting innovation.

Coinbase’s mission is to increase economic freedom in the world. We were founded in 2012 with the idea that anyone, anywhere, should be able to easily and securely send and receive Bitcoin. Over the last nine years, our products and services have expanded to meet our customers’ needs in the rapidly innovating crypto industry. We have customers in every state except Hawaii and, as a remote-first company, we have employees in 45 states and the District of Columbia, including 24 of the 25 states represented by the members of this committee.

We now securely store 12% of the world’s crypto across more than 150 asset types, we offer customers the opportunity to learn about and buy, sell, send and receive more than 100 assets. We also offer customers the opportunity to spend, borrow, earn and stake on select assets. We serve more than 73 million customers globally, including 10,000 institutions and 185,000 application developers. Importantly, nearly 50% of our transacting customers are doing something other than buying and selling crypto, which indicates to us that crypto is moving beyond its initial investment phase into the long expected utility phase.

Since our founding, Coinbase has strived to be the most secure, trusted, and legally compliant bridge to the cryptoeconomy. Coinbase is federally registered as a money services business with FinCEN, licensed as a money transmitter in 42 states, holds a “BitLicense’’ and trust charter from the New York Department of Financial Services, and we are authorized to engage in consumer lending in 15 states.

We have a robust AML/BSA program, and we are one of only two digital asset members of the Department of the Treasury’s Bank Secrecy Act Advisory Group.

In addition to the various state regulatory regimes, we are subject to federal oversight from Treasury, the CFTC, SEC, FTC, and CFPB.

Much like the adoption curve of the Internet in the 1990s, we are seeing dramatic advancements in crypto participation. There are more than 220 million crypto holders globally, and around 16 percent of Americans have invested in, traded, or used cryptocurrency. Total crypto market capitalization at the end of Q3 was over $2.0 trillion, up from $800 billion at the end of 2020.

Coinbase’s platform is powering the cryptoeconomy — a new financial system for the internet age — which is a critical infrastructure layer to Web 3.0. Technologies like non-fungible tokens, which we call NFTs, and decentralized application platforms will lead the way for Web 3.0 to revolutionize the internet, much like the internet was revolutionized when it went from static content to a place for dynamic engagement.

We believe sound regulation is central to fueling crypto innovation and adoption. That is why we introduced our Digital Asset Policy Proposal, which we refer to as dapp. The dApp assessed the challenges of the existing regulatory framework and proposed a four pillar solution.

First, we believe the government should regulate digital assets under a new, comprehensive framework that recognizes the unique technological innovations underpinning digital assets.

Second, responsibility for this new framework should be assigned to a single federal regulator. This regulator would be charged with establishing a registration process for intermediaries, which we refer to as Marketplaces for Digital Assets.

Third, this new framework should have three goals to ensure holders of digital assets are empowered and protected: A) Enhance transparency through robust and appropriate disclosure requirements. B) Protect against fraud and market manipulation. And C) Promote efficiency and strengthen market resiliency.

Our fourth and final pillar is to ensure that regulatory solutions promote interoperability and fair competition.

In conclusion, Coinbase believes crypto will drive transformational change across society in positive ways. That is why our mission is to promote economic freedom around the world. Disruption always challenges the status quo, but we believe sound policy solutions can improve the system for everyone. We applaud Chairwoman Waters, Ranking Member McHenry and the members of this Committee for holding this hearing. Thank you for the opportunity to discuss these important issues, and I look forward to answering any questions you may have.

Opening Testimony: U.S. House Committee on Financial Services was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.