Around 4,000 institutional funds with almost 2 trillion euros in assets under management in Germany can now invest 20% of their portfolios in cryptocurrency, including bitcoin. The highly anticipated Fund Location Act (Fondsstandortgesetz) went into effect on July 1 in Germany. The German federal parliament, the Bundestag, cleared the legislation on April 22. Under this […]

Around 4,000 institutional funds with almost 2 trillion euros in assets under management in Germany can now invest 20% of their portfolios in cryptocurrency, including bitcoin. The highly anticipated Fund Location Act (Fondsstandortgesetz) went into effect on July 1 in Germany. The German federal parliament, the Bundestag, cleared the legislation on April 22. Under this […] Fidelity, Standard Chartered Bank, and TP ICAP are collaborating to launch a cryptocurrency trading platform. It will feature a marketplace for spot crypto trading and provide “connectivity and post-trade infrastructure into a network of digital assets custodians.” TP ICAP, a leading provider of market infrastructure, announced Tuesday that it is launching a cryptocurrency trading platform […]

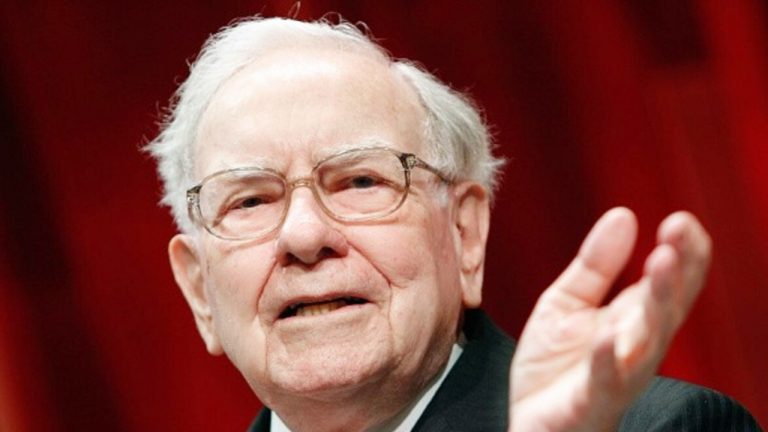

Fidelity, Standard Chartered Bank, and TP ICAP are collaborating to launch a cryptocurrency trading platform. It will feature a marketplace for spot crypto trading and provide “connectivity and post-trade infrastructure into a network of digital assets custodians.” TP ICAP, a leading provider of market infrastructure, announced Tuesday that it is launching a cryptocurrency trading platform […] Investment bank JPMorgan conducted a survey of thousands of investors from 1,500 institutions and found that 49% of them think that cryptocurrency is either “rat poison squared,” the term used by Berkshire Hathaway CEO Warren Buffett to describe bitcoin, or “a temporary fad.” 49% of Investors Told JPMorgan Cryptocurrency Is a Fad or ‘Rat Poison […]

Investment bank JPMorgan conducted a survey of thousands of investors from 1,500 institutions and found that 49% of them think that cryptocurrency is either “rat poison squared,” the term used by Berkshire Hathaway CEO Warren Buffett to describe bitcoin, or “a temporary fad.” 49% of Investors Told JPMorgan Cryptocurrency Is a Fad or ‘Rat Poison […]

Bitwise has attracted significant investments from major American institutional investors to the tune of $70 million.

Bitwise, a four-year-old crypto asset management firm, has closed a Series B funding round, raising $70 million in fresh capital from investors.

According to a report by CNBC on Tuesday, major Wall Street figures such as billionaire investor and Bitcoin (BTC) proponent Stanley Druckenmiller and David McCormick, CEO of asset management giant Bridgewater Associates, participated in the funding.

Commenting on the stellar cast of investors, CNBC quoted Bitwise CEO Hunter Horsley stating that the company was keen to attract major Wall Street and crypto backers.

Bitwise will reportedly utilize the newly raised funds to beef up its balance sheet as well as double the size of its team. As previously reported by Cointelegraph, Bitwise’s assets under management crossed the $1-billion mark back in February 2021.

The milestone came shortly on the heels of its AUM moving north of $500 million only a month prior. The company’s asset base growth coincided with a bullish frenzy in the crypto market as Bitcoin raced to a new all-time high above $64,000 before the current price downturn.

At the time of writing, the AUM for the Bitwise 10 Crypto Index Fund has dipped to $796 million amid the cryptocurrency market downturn.

According to Horsley, the company’s focus is more long-term and is unfazed by periods of downtrends, stating, “We serve the long-term investor thinking if this has a role to play in the next five to 10 years of how they approach their portfolio and building a thesis.”

Related: For the long haul? When Bitcoin nosedived, institutions held fast

In a previous conversation with Cointelegraph, Matt Hougan, chief investment officer of Bitwise, also espoused similar sentiments. At the time, Hougan argued that institutional investors are “making a generational bet” by investing in Bitcoin and are not worried about “a few weeks of volatility.”

Indeed, a recent survey by Intertrust of 100 financial officers at major hedge funds across the world has shown significant interest in crypto investments. According to the survey, as many as 10.6% of hedge funds in the United States will hold crypto assets within the next five years.

Mike Novogratz declared institutional investors are waiting for the next narrative shift in a recent interview at the Bitcoin 2021 conference in Miami. The CEO of Galaxy Digital thinks the market is now in a consolidation phase after the price crash last month. Novogratz also commented on what the rise of defi could mean for […]

Mike Novogratz declared institutional investors are waiting for the next narrative shift in a recent interview at the Bitcoin 2021 conference in Miami. The CEO of Galaxy Digital thinks the market is now in a consolidation phase after the price crash last month. Novogratz also commented on what the rise of defi could mean for […] The Nasdaq-listed cryptocurrency exchange Coinbase has revealed record growth in its institutional business. “This year, interest from pension funds and hedge funds has skyrocketed, supported by the roll-out of crypto-ETPs as well as an increased understanding of the crypto economy,” said Coinbase. Coinbase Sees Interest From Institutional Investors Skyrocketing Cryptocurrency exchange Coinbase (Nasdaq: COIN) reportedly […]

The Nasdaq-listed cryptocurrency exchange Coinbase has revealed record growth in its institutional business. “This year, interest from pension funds and hedge funds has skyrocketed, supported by the roll-out of crypto-ETPs as well as an increased understanding of the crypto economy,” said Coinbase. Coinbase Sees Interest From Institutional Investors Skyrocketing Cryptocurrency exchange Coinbase (Nasdaq: COIN) reportedly […] Switzerland-based 21shares announced it’s going to offer its crypto exchange-traded product (ETP) to institutional investors in Britain. The platform said the aim is to provide U.K. investors with exposure to bitcoin without the need to deal with crypto custody and security. New Bitcoin ETP to Be Offered on London-Based Aquis Exchange The 21shares bitcoin ETP […]

Switzerland-based 21shares announced it’s going to offer its crypto exchange-traded product (ETP) to institutional investors in Britain. The platform said the aim is to provide U.K. investors with exposure to bitcoin without the need to deal with crypto custody and security. New Bitcoin ETP to Be Offered on London-Based Aquis Exchange The 21shares bitcoin ETP […]