Binance’s venture capital arm is announcing an investment into a new cross-chain decentralized exchange (DEX) and bridging aggregator. In a new blog post, the world’s largest crypto exchange by volume says that it is investing an unspecified amount of money into interoperability DEX Rango. Rango is a cross-chain exchange that aggregates sources and connects traders […]

The post Binance Labs Announces Investment in New Cross-Chain DEX and Bridging Aggregator appeared first on The Daily Hodl.

The cross-chain bridge was exploited for $82 million over New Year’s Eve, with the funds sitting dormant since Jan. 1.

The exploiter behind the $82 million Orbit Chain hack over New Year’s Eve has moved $47.7 million to cryptocurrency privacy mixer Tornado Cash after five months of “silence.”

A total of 12,932 Ether (ETH) — worth $47.7 million — was moved across seven transactions on June 8, to a new address, which sent the funds to crypto mixer Tornado Cash, according to blockchain analytics firm Arkham Intelligence.

It was widely reported that the exploit caused $82 million in losses but Arkham's recent posts suggest it was closer to $100 million.

Decentralized oracle network Chainlink (LINK) is skyrocketing after completing a fund tokenization pilot with the Depository Trust and Clearing Corporation (DTCC). According to a new press release, the DTCC has developed a new pilot program, known as Smart NAV, which utilizes both the firm’s digital asset capabilities as well as Chainlink’s data feeding and interoperability […]

The post Chainlink Soars 16%+ in 24 Hours After Completing Fund Tokenization Pilot With Major Securities Settlement Firm appeared first on The Daily Hodl.

Bitcoin embodies decentralization, security, and self-sovereignty. But today, financial transactions with Bitcoin require the use of custodians or bridges – a reliance on intermediaries that has led to disastrous losses numbering in the billions of dollars. Discreet Log Contracts (DLCs) are poised to change that by allowing users in the space, for the first time, […]

Bitcoin embodies decentralization, security, and self-sovereignty. But today, financial transactions with Bitcoin require the use of custodians or bridges – a reliance on intermediaries that has led to disastrous losses numbering in the billions of dollars. Discreet Log Contracts (DLCs) are poised to change that by allowing users in the space, for the first time, […] Ripple and XRPL Labs have become founding members of the Derec Alliance, which aims to create an interoperable recovery standard for digital assets. This initiative is expected to simplify the recovery process and encourage widespread adoption by making digital asset management more user-friendly and secure. Derec Alliance Forms to Enhance Blockchain Recovery Solutions The Derec […]

Ripple and XRPL Labs have become founding members of the Derec Alliance, which aims to create an interoperable recovery standard for digital assets. This initiative is expected to simplify the recovery process and encourage widespread adoption by making digital asset management more user-friendly and secure. Derec Alliance Forms to Enhance Blockchain Recovery Solutions The Derec […]

IBC has always had the bug but it only recently became exploitable due to developments in the protocol’s codebase, Asymmetric Research said.

Cosmos developers have fixed a “critical” security bug in its Inter-Blockchain Communication (IBC) protocol which put at least $126 million at risk, says a blockchain security firm that privately notified Cosmos of the issue.

“We privately disclosed the vulnerability through the Cosmos HackerOne Bug Bounty program and the issue is now patched,” Asymmetric Research said on April 23.

“No malicious exploitation took place and no funds were lost,” it added.

Decentralized exchange Sushi will test native Bitcoin DeFi functionality that promises to allow users to swap BTC across 30 blockchain networks.

DeFi platform Sushi has partnered with interoperability platform ZetaChain to explore the possibility of native Bitcoin swaps for its users across 30 different blockchain networks.

Sushi’s deployment of its decentralized exchange (DEX) on ZetaChain is touted to enable trading of BTC without wrapping across several blockchains in what the team describes as a “native, decentralized and permissionless manner”.

The integration is set to include Sushi’s v2 and v3 automated market makers and Sushi’s cross-chain swap SushiXSwap.

ZetaChain core contributor Ankur Nandwani tells Cointelegraph that the partnership can bring Bitcoin’s vast user base to the DeFi sector in a native manner. He also countered arguments that suggest that bridging BTC without wrapping the assets on another chain is not possible.

“There have already been early examples like THORChain who are trading Bitcoin natively with other chain assets. Other approaches like Bitcoin side chains also offer a flavor,” Nandwani said.

He adds that ZetaChain’s approach effectively allows anyone to build Bitcoin-interoperable decentralized applications (DApps) that can settle contracts and transactions natively.

“Of course, there are trust assumptions — namely trusting the decentralization of the network that is doing this cross-chain transaction.”

ZetaChain has reportedly proven the technology at a testnet level and will look to prove the utility when it launches its mainnet through partnerships with SushiSwap and other DeFi protocols.

Sushi head chef Jared Grey hailed the integration as a significant advancement for DeFi and described the capability to swap Bitcoin natively as a “game-changer” for the industry.

“It’s not only about the increased liquidity from Bitcoin; it’s about beginning a new chapter in DeFi, where we see more practical use cases of interoperability and enhanced connectivity.”

Sushi’s integration with ZetaChain is set to take place in two phases. The first will see Sushi introduce a DEX on ZetaChain’s testnet to support basic asset swaps and liquidity provision. This phase is also set to include beta testing and incentives for application testing.

Sushi will become one of ZetaChain’s launch partners when it deploys its mainnet. The launch is expected to be followed by full functionality for Bitcoin interoperability. Nandwani outlined the technical details behind the functionality that allows for native BTC cross-chain swaps.

A cross-chain swap contract is deployed on ZetaChain’s EVM (Ethereum Virtual Machine). The contract is omnichain, which means that while it’s deployed on ZetaChain, it can be called, and the value can be passed to it from any connected chain, including Bitcoin.

Calling a cross-chain swap contract involves a user sending a regular native token transfer transaction on Bitcoin with a special memo to a TSS address. The memo contains the omnichain contract address on ZetaChain and a value that is passed to the contract. For a cross-chain swap, the value would be the destination token, for example, ETH or USDC on Ethereum, as well as the recipient address on the destination chain.

Related: Bitcoin could become the foundation of DeFi with more single-sided liquidity pools

The TSS address is an address that is owned by ZetaChain signer validators. BTC transferred to the TSS address is locked and validators observe this transfer and cast a vote about this event on ZetaChain. If enough votes are cast, the event is considered observed and an inbound cross-chain transaction (CCTX, from Bitcoin to ZetaChain) is created.

Once a CCTX is processed, a ZetaChain ominchain contract is called and the amount of BTC transferred to the TSS address is minted as ZRC-20 BTC. During the cross-chain swap contract execution, a ZRC-20 BTC is swapped for ZRC-20 of another token, for example, ZRC-20 ETH.

ZRC-20 ETH is then finally withdrawn to the destination chain. During the withdrawal process ZRC-20 ETH is burned and an outbound CCTX is created from ZetaChain to Ethereum. Observer validators vote on this CCTX on ZetaChain. Once the outbound CCTX is processed, native ETH is transferred from the TSS address on Ethereum to the recipient on Ethereum.

Nandwani provides this example to outline how native BTC is swapped for native ETH in a decentralized manner facilitated by ZetaChain’s network validators across connected chains.

Magazine: Recursive inscriptions: Bitcoin ‘supercomputer’ and BTC DeFi coming soon

Polygon has allocated an estimated $1 billion on zero-knowledge technology underpinning its Ethereum scaling layer 2 solutions.

Polygon co-founder Sandeep Nailwal believes the layer 2 blockchain firm is reaping the benefits of allocating $1 billion to develop zero-knowledge proof (ZK-proof) powered scaling solutions for the Ethereum ecosystem.

Speaking at a keynote address during the latest edition of the Token2049 conference in Singapore, Nailwal touched on the development of 'Polygon 2.0' scaling efforts and the promise of recursive ZK-proof technology to create a seamless interoperable blockchain ecosystem.

Nailwal highlighted how Web2 and Web3 are similar in form and function, with the former serving as the internet of information with “practically unlimited scalability” as well as the ability to transfer or convey information in various forms seamlessly across the world at great speeds.

Related: Polygon’s ‘holy grail’ Ethereum-scaling zkEVM beta hits mainnet

Web3 meanwhile represents the “internet of value”, which according to Nailwal will require two capabilities to become ubiquitous.

“Firstly, infinite, unlimited unbounded scalability and unified liquidity for value to be transferred. There cannot be 100 chains with the value distributed across and they cannot interoperate.”

In order to tap into the characteristics that have made Web2 able to become the internet of information, Nailwal pointed to the importance of an aggregator or interoperability layer to amalgamate ZK-proofs of different chains to a common layer.

“The moment those two proofs are submitted on Ethereum layer, we have a mechanism where we have a global state route on Ethereum and then any kind of liquidity can move across the chain without coming to Ethereum.”

Recursive ZK-proving technology holds the key to this aggregator layer which Nailwal expects to be deployed in the coming months. The technology will allow different blockchains to submit ZK-proofs of their network state to the aggregator, which then submits a proof of these combined attestations to the Ethereum network.

“Our goal is that this proving will eventually go down to like probably two seconds. So every chain is submitting a proof of whatever has happened on their ecosystem or on their chain every two seconds to this aggregator layer.”

The Polygon co-founder believes that cross chain transactions could be executed in 4 to 5 seconds, one third of an Ethereum block time, which will begin to feel “like one single big block space.”

Nailwal highlights the potential benefit of having high liquidity chains like it's zkEVM and proof-of-stake chain to share value to applications, while noting that larger layer 1 blockchain platforms have expressed interest in tapping into an interoperable layer.

“Anybody can join this layer and it's a mutual win-win because everybody benefits from each other's liquidity.”

Polygon zkEVM's beta hit mainnet in March 2023, allowing developers to deploy smart contracts and decentralized applications that benefit from faster throughput and lower costs than Ethereum's layer 1.

The company also recently launched its Chain Development Kit, which allows developers to build, customize and deploy layer 2 chains connected to the wider Ethereum ecosystem.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Recursive inscriptions: Bitcoin ‘supercomputer’ and BTC DeFi coming soon

The mantra of this year’s Polkadot Decoded 2023 conference is to focus on building better products instead of worrying about token price.

The Polkadot Decoded 2023 conference just wrapped up and this year more than 100 speakers and 100 blockchain projects were in attendance.

The beauty of crypto bear markets is they catalyze a realignment of perspectives and objectives.

All the hidden leverage is gone and most of the speculation is gone.

SBF is gone.

Do Kwon is gone.

Three Arrows Capital, Su Zhu, Kyle Davies and a handful of other hucksters and snake oil salesmen have been exiled.

And good riddance to all of them. Crypto doesn’t need hopium, messiahs, populists and dream peddlers. What we need are builders, fresh ideas, solutions that have product-to-market fit and some sort of realistic real world application.

That’s what I like about blockchain conferences. Especially during a bear market.

The buidl first mentality is the whole vibe of Polkadot Decoded. For the past two days, a tightly knit community of ecosystem siblings composed of developers, investors, ambassadors and a few curious journalists such as myself rendezvoused at the Øksnehallen conference center which is tucked away from the bustling, cobblestoned streets of central Copenhagen, Denmark.

The location is almost poetic given that it is a surprisingly quiet spot that is discreetly nestled within a thriving city center, and that ethos carried on through the conference events where the focus has been:

Hardly anyone is talking about airdrops, token prices, memecoins, Bitcoin (BTC) hitting a new all-time high or any of the general conversational fodder that forms the bulk of most crypto discussions.

Rather than price, panellists discussed the challenges and occasional successes of helping TradFi and Web2 companies transition into Web3, the steps being taken to make the VC funding of projects more transparent, and the need for all the crypto jargon and rigamarole to be placed on the backend of DApps and the frontend UX to be more seamless.

Many folks even suggested that “blockchain,” “crypto,” and “Web3” should not be mentioned on projects’ websites, apps, roadmaps and so on.

According to Public Pressure CEO Giulia Maresca:

“I think it's not about talking about the technology because mass adoptees don’t know how the phone or Google maps or any technology is working. We need to create products that are really easy for the user, but given the benefit that they are built on Web3 tech. It should be really easy for the user; it shouldn’t be complicated. We shouldn’t talk about wallets, or bridging or doing complicated crypto things. People get scared the minute you start talking about wallets. It should be as easy as using Instagram.”

Speaking of Web3 and the need for crypto to have a better product-to-market fit and connection to real-world assets, I moderated the opening panel at Polkadot Decoded, which focused on on-chain entertainment within music and film. It was an intriguing conversation, given that the general consensus among creators and builders is that music and film will be the most sticky when it comes to user growth, retention and mass application of NFTs within everyday life.

During the panel, Maresca explained why she believes that there is a natural synergy between creative industries and Web3 ideology:

“Web3 is a very socratic and creative space, and that aligns with the workflow and ideas of artists and creators.”

Maresca also firmly believes that phygital NFTs and experiences will gain a firm foothold in the areas of fashion design, the film industry and all aspects of the music industry.

Providing a real-world example of how fashion labels like Diesel were making entry to the Web3 space,, Maresca explained:

“Diesel would like to be more into Web3, so we’ve helped them to build a really strong concept using music at the center of their strategy, so Diesel acting like a discovery label, discovering emerging and breakthrough artists to give voice to their art. And they’ve done a few drops with us already which were really successful, but we’re planning a big drop at the beginning of September that is going to be a phygital drop. So, I think now a big part of the future is phygital; it is giving experience, utilities, what the community wants, which is to have a VIP experience. They want something from the brand, not only the garments. They want to be part of the Diesel family. It’s a long process and lots of education to the C-level, but there are a lot of opportunities for brands to work with the music community, to fans, and to new fans.”

Ed Hill, senior vice president of media services at Beatport, emphasised that rather than being a mere buzzword, Web3 needs to become a tangible and actionable ideology within the corporate structure of the entertainment industry.

When asked about the disconnect between consumer desires, creators’ objectives and the products and experiences currently provided by the entertainment industry, Hill said:

“That's a tough one to crack, but we have to go deeper and build better communities. If you look at YouTube and Facebook, those platforms are audience builders, and all anyone has cared about is views, and reach, and impressions and things like that. We have to go deeper into community building, and failure to do that is why younger audiences have been splitting away from traditional Web2 social media platforms, and I think, in time, if we build better, authentic communities from the ground up, that space between the corporate to creator to consumer gap begins to tighten.”

Related: New Web3 ID app lets users find each other based on proven interests

From my vantage point, and that of most conference attendees, crypto is about community, and the most viable projects tend to have a very grassroots approach where community members are stakeholders and their desires factor into the direction of the project. Historically, every time the crypto sector strays from this ethos and falls victim to the whimsy of money chasers and demagogues, investors and community members are essentially robbed of their agency within the project.

In order for corporations to transition into Web3 in an authentic way that bears fruit, creators, consumers and community members have to be viewed as more than a simple proletariat within a system purely focused on spinning up revenue and co-opting culture and turning creator IP into corporate marketing trinkets. Crypto media should take note too, but I digress.

Similar sentiments, which culminated with an optimistic take on the future of Web3, were expressed by Define Creative founder Finn Martin, who said:

“What gets me excited about Web3 is it offers all the tools and solutions to actually fix the problems that traditional Web2 has. By moving the assets on a chain, you can make it transparent for creators, you can give them direct revenue because, currently, the streaming model is broken. As a music creator, you own a fraction of a cent from each stream, and all of that can be addressed and solved via Web3.”

Generally, vast blockchain ecosystems tend to have a disjointed feel where a multiplicity of objectives and philosophies have investors and advocates feeling lost at sea. These projects tend to struggle with clearly defining their purpose, and this has a knock-on effect of impacting market fit efficacy.

They basically still struggle with the age-old crypto problem, which entails creating solutions for problems that aren’t actually problems for normal people. What stands out most to me at Polkadot Decoded 2023 is a unified goal of making the chain easier to use for builders, investors and users.

Regardless of whether the project is an AMM, DEX, lending market, blockchain-gaming startup, IPFS storage solution or a cross-chain bridge, each panel has made some reference to the need for composability, interoperability and turning the concept of Web3 from a thought to reality by building our infrastructure for projects to thrive on.

Which is why I again emphasize the importance of getting out from behind the screen and TradingView token price action charts and into fellowship with the community at conferences. No man is an island, and there’s value in finding a safe space to socialize, ideate, test and refine one’s investment thesis and views on the evolution of blockchains.

Hat tip to Polkadot Decoded for having the right narrative on lock this year.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

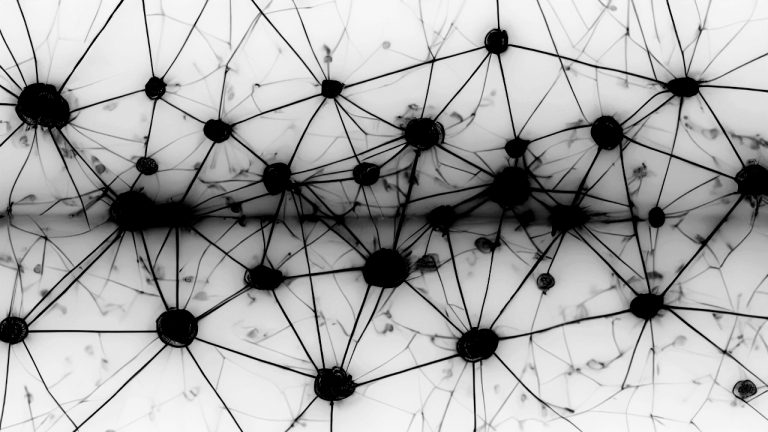

Blockchains without interoperability are like computers without an internet connection — incapable of transferring data and value, a Chainlink Labs executive says.

Blockchain technology needs a benchmark communications standard that can be easily integrated by every network in order for a complete transition from Web2 to Web3 to occur, industry commentators say.

Many expect there will be multiple blockchains and such an ecosystem requires communication protocols similar to the Transmission Control Protocol/Internet Protocol (TCP/IP) used on the internet.

Ryan Lovell, director of capital markets at crypto price oracle solutions firm Chainlink Labs, told Cointelegraph that blockchains without interoperability are like what computers are without the internet — isolated machines thacannot transfer data and value across networks.

“To realize a fully interoperable blockchain ecosystem at scale, there needs to be an open communication standard analogous to the TCP/IP, which currently serves as the internet’s de facto connection protocol.”

Lovell believed a similar standard for blockchain networks would “pave the way for a seamless, internet-like experience” for the platform and their applications.

This is particularly important given that the last bull market saw a host of new layer-1 blockchains make their mark. However, nearly all of them operate in isolation from one another.

Lovell stressed that blockchain interoperability is “crucial” for financial institutions looking to tokenize real-world assets because that would ensure that liquidity isn’t “stifled” by only existing in a “siloed ecosystem.”

Brent Xu, the founder and chief executive of Umee — a lending platform backed by Cosmos’ Inter-blockchain Communication Protocol (IBC) — tolCointelegraph that before real-world assets are brought on-chain, proper risk management systems need to be put in place to facilitate this interoperability.

Xu explained that financial institutions would need to tick off Know Your Client (KYC) credentials to ensure the authenticity of the real-world assets before being tokenized on-chain and then make sure that they can be identified by an on-chain proof-of-reserve audit.

In order to avoid an on-chain catastrophe, he stressed the risk of cutting corners simply isn’t worth it:

“Think of the ‘08 mortgage crisis. Tremendous financial value was lost due to a broken legacy system. Imagine if this value was ported into the blockchain ecosystem, we would see tremendous value loss due to the contagion.”

Cross-chain bridges, independent layer-2 sidechains and oracles are three of the most commonly used blockchain interoperability solutions to date. The first two operate solely on-chain, while the latter feeds off-chain data on-chain.

Related: Why interoperability is the key to blockchain technology’s mass adoption

There have been issues with some of these solutions, however, most notably cross-chain bridges.

An October report highlighted that half of all exploits in decentralized finance (DeFi) took place on a cross-chain bridge, the most notable example being the $600 million Ronin bridge hack in March 2022.

Xu noted that many of these hacks have come from multi-signature security setups or proof-of-authority consensus mechanisms, which are considered to be centralized and much more vulnerable to attack.

He added that many of these interoperability solutions favored “speed of development” over security early on, which backfired.

The key, Xu said, is to incorporate interoperability within the platform, as that will result in a more secure end-to-end transaction than through the use of third-party bridges:

“Bridges are particularly susceptible because they provide two ends at which hackers can potentially infiltrate any vulnerabilities.”

Among the most commonly used blockchain interoperability protocols are Chainlink’s Cross-Chain Interoperability Protocol (CCIP); the IBC, which leverages the Cosmos ecosystem; Quant Network’s Overledger and Polkadot.

Magazine: ZK-rollups are ‘the endgame’ for scaling blockchains, Polygon Miden founder