The government of Ireland is preparing to ban political parties from accepting campaign donations in cryptocurrency. The move aims to block the perceived threat of Russian interference in the European nation’s elections against the backdrop of a clash between the West and Moscow over the war in Ukraine. Ireland to Limit Foreign Political Support for […]

The government of Ireland is preparing to ban political parties from accepting campaign donations in cryptocurrency. The move aims to block the perceived threat of Russian interference in the European nation’s elections against the backdrop of a clash between the West and Moscow over the war in Ukraine. Ireland to Limit Foreign Political Support for […]

A raft of new political and electoral integrity laws proposed in Ireland will see the banning of donations made in crypto to political parties in the country.

Donations made to political parties using cryptocurrencies will be banned in Ireland under new political integrity laws drafted due to concerns around foreign interference in politics.

Amendments proposed by Minister Darragh O’Brien also cover rules around foreign donations, misinformation, and other transparency requirements for political parties, citing fears of Russian interference in Ireland’s elections.

Speaking with the Independent on April 18th, O’Brien said that the laws will further protect Ireland’s democratic system “given the escalating threat of cyber warfare targeting free countries,” and a newly established Electoral Commission will oversee compliance with the laws.

It is unclear what percentage or monetary amount of political donations are currently paid to political parties or individuals using a cryptocurrency. Cointelegraph contacted Minister O’Brien and the Standards In Public Office Commission for comment but did not immediately hear back.

O’Brien started his campaign to reform the laws in January 2022, establishing a task force of political scientists and legal experts to investigate new election laws due to concerns about the escalating Russia-Ukraine war.

The task force advised on a series of measures that would build a “legal and digital bulwark” against election interference in the country, including parties providing streamlined accountancy reporting and declarations on adherence to the new political funding laws.

The banning of crypto political donations isn’t unheard of, the state of California banned the practice in 2018 citing issues of transparency and that cryptocurrencies are “hard to track”. Three other U.S. states, Oregon, Michigan, and North Carolina, also have laws against using cryptocurrencies in campaign financing according to data from Multistate.

Related: Crypto-focused PAC has used $9M to support Democratic candidates since January

The Irish central bank has taken an unfriendly approach to crypto in the past, as recently as February the bank stated it was unlikely to approve investment funds with exposure to crypto for retail investors as they lack a “high degree of expertise”.

The Central Bank of Ireland also issued a warning to consumers the following month on crypto assets, advising them to be mindful of “the risks of misleading advertisements, particularly on social media, where influencers are being paid to advertise crypto assets.”

The central bank warned people to be mindful of "the risks of misleading advertisements, particularly on social media, where influencers are being paid to advertise crypto assets."

The Central Bank of Ireland issued a warning to consumers about the risks around crypto investments in addition to “misleading” advertisements, including those pushed by influencers on social media.

In a Tuesday notice, Ireland’s central bank said the warning was part of a campaign organized by the European Supervisory Authorities, made up of the European Securities and Markets Authority, the European Banking Authority, and the European Insurance and Occupational Pensions Authority. The Central Bank of Ireland said that cryptocurrencies were “highly risky and speculative” for retail investors and warned people to be mindful of “the risks of misleading advertisements, particularly on social media, where influencers are being paid to advertise crypto assets.”

“In Ireland and across the EU we are seeing increasing levels of advertising and aggressive promotion of crypto asset investments,” said Derville Rowland, the central bank’s director general of financial conduct. “Before you buy crypto assets, you need to think about whether you can afford to lose all the money you invest [...] People should also be aware that if things go wrong, you do not have the protections you would have if you invested in a regulated product.”

The Central Bank has today issued a fresh warning ❗️ on the risks of investing in crypto assets, as part of a European-wide campaign by the European Supervisory Authorities: https://t.co/G3joUvctrO pic.twitter.com/D5ygXYdpZj

— Central Bank of Ireland (@centralbank_ie) March 22, 2022

The central bank’s warning echoes that of global regulators and lawmakers cracking down on influencers peddling cryptocurrencies. In January, the Spanish government announced regulations for advertisements on crypto investments and services, which specifically included “products or services promoted via influencers.” The United Kingdom’s Advertising Standards Authority has also repeatedly warned crypto firms or alleged violations for advertisements dealing in digital assets.

In the United States, celebrities and influencers were associated with many of the alleged initial coin offering scams from 2018. Kim Kardashian’s Instagram account posted a story shilling the ERC-20 token EthereumMax (EMAX) in June 2021, causing the price to spike before falling more than 99% and leaving many retail investors in the red. At least one American celebrity, actor Ben McKenzie, has used his platform to push back against these types of high-profile endorsements.

Related: Year of sponsorships: Celebrities who embraced crypto in 2021

Amid repeated warnings over crypto investments and advertisements, some firms have set up operations in Ireland. After opening the doors to its Dublin office in early 2021, crypto exchange Gemini received a license to provide electronic money services in the country. Binance established three subsidiaries in Ireland in September 2021, while crypto firms Ripple and Kraken chose the nation as the base to launch their European operations.

The license does not allow Gemini to operate as an exchange in the country, but it will let it passport e-money services throughout the EEA.

Cryptocurrency exchange Gemini has received an electronic money license from the Central Bank of Ireland. It was the 18th organization to receive the license, and the first since October 2020. Gemini joined such license holders as Coinbase, Stripe, Square and Meta.

The e-money license, for which Gemini applied in early 2020 and received oMarch 14, will allow it to issue electronic money, provide electronic payment services and handle electronic payments for third parties. It will also enable the company to passport those services to European Economic Area countries, which are European Union members, Iceland, Liechtenstein and Norway. Gemini already provides exchange services in those countries.

Gemini also provides exchange and e-money services in the United Kingdom, thanks to its authorization by that country’s Financial Conduct Authority.

There is increasing consciousness in the country of the need for cryptocurrency regulation. The Oireachtas Finance Committee agreed to consider regulation in February when it requested briefing documents from the Central Bank and the Revenue Commissioners tax authority. The Central Bank already enforces European Anti-Money Laundering laws for virtual asset services providers.

Ireland has seen a growing crypto presence in the last year. Gemini opened its Dublin office in early 2021, and hired Gillian Lynch, a former executive at the Irish banking platform Leveris and Bank of Ireland, as head of Ireland and Europe. Kraken and Ripple (XRP) have also selected the country as their European base, and Binance (BNB) opened three subsidiaries in Ireland in September.

Back in February, Gemini joined the likes of Coinbase and Block as part of the Crypto Council for Innovation. At the time, the exchange stated it had spent $120,000 on lobbying activities within the U.S. in the second half of 2021.

The central bank feels that there is too much risk for retail investors who lack the expertise needed to trade crypto, but professional investors are welcome to continue trading.

The Central Bank of Ireland has stated that it is unlikely to approve investment funds for retail crypto investors because they lack the know-how to navigate the high-risk asset class.

The February 2022 report Securities Markets Risk Outlook Report: A Changing Landscape described crypto assets as a new product offering in securities markets that is complex and a “potential threat to investor protection.”

Although the bank fielded many queries last year about Alternative Investment Funds (AIF) regarding crypto, it is now not expected to approve an AIF for retail crypto investors. The bank feels that such investments “may be suitable for wholesale or professional investors,” but are too complicated for small fish:

“The Central Bank is highly unlikely to approve a UCITS or a Retail Investor AIF proposing any exposure to crypto-assets, taking into account the specific risks attached to crypto-assets and the possibility that appropriate risk assessment could be difficult for a retail investor without a high degree of expertise.”

A UCITS is an Undertaking for the Collective Investment of Transferable Securities which is used in the European Union (EU) as a regulatory framework for managing certain investments for sale across the EU.

Ireland’s Director of securities and markets supervision Patricia Dunne provided some explanation of the bank’s thinking to Bloomberg on Feb. 8, saying there are “too many unanswered questions around things like custody, money laundering, and even just volatility and liquidity” regarding retail crypto investing.

Related: US lawmaker pushes for state-level regulations on stablecoins at hearing on digital assets

Regulatory attitudes to crypto in the nearby U.K. aren’t much more favorable with Her Majesty’s Revenue and Customs (HMRC) laying out strict new guidelines for DeFi taxation recently. There, returns made on crypto earned through staking are considered property, and thus subject to capital gains tax.

Yesterday, Russia’s government agreed on a regulatory scheme which will allow residents to trade crypto. Crypto will be treated as an “analogue of currencies” rather than a currency itself, and any transaction with a value greater than about $8,000 must be declared.

As authorities in the EU are still discussing union-wide cryptocurrency regulations, a major U.S. bank has reportedly lobbied the Irish government to adopt its own rules for the space. BNY Mellon launched its digital asset business in Ireland this year to provide custodian services to institutional investors. Banking Giant BNY Mellon Calls for Irish Crypto […]

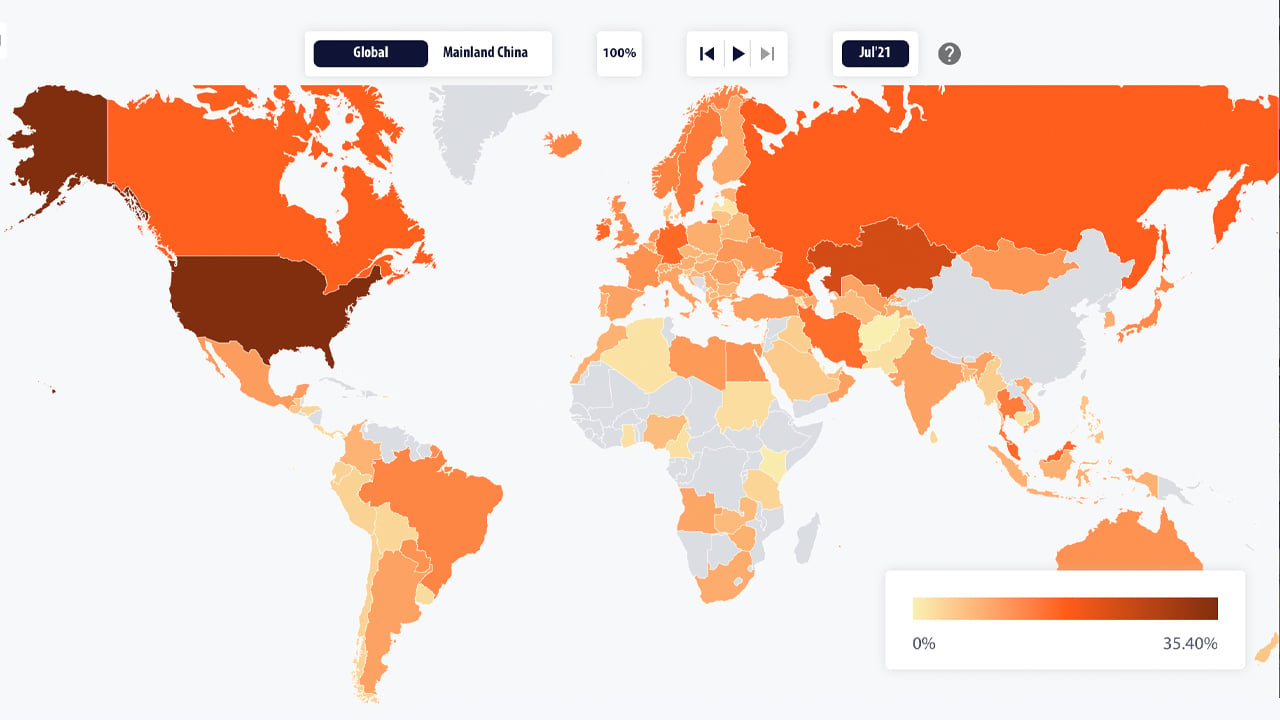

As authorities in the EU are still discussing union-wide cryptocurrency regulations, a major U.S. bank has reportedly lobbied the Irish government to adopt its own rules for the space. BNY Mellon launched its digital asset business in Ireland this year to provide custodian services to institutional investors. Banking Giant BNY Mellon Calls for Irish Crypto […] After China has reigned for a number of consecutive years as the dominant bitcoin mining epicenter of the world, the United States has “taken the leading position in bitcoin mining,” according to new data from Cambridge University. Data Shows US, Kazakhstan, Russian Federation Rule the Bitcoin Mining Roost In mid-July, researchers from the Cambridge Bitcoin […]

After China has reigned for a number of consecutive years as the dominant bitcoin mining epicenter of the world, the United States has “taken the leading position in bitcoin mining,” according to new data from Cambridge University. Data Shows US, Kazakhstan, Russian Federation Rule the Bitcoin Mining Roost In mid-July, researchers from the Cambridge Bitcoin […] Investors in Ireland are attracted to digital opportunities offering better returns and often find them online, a new survey has indicated. According to the poll, 11% of investors have already bought a digital asset and a quarter of the young Irish are betting on cryptocurrencies. Low Interest Rates, Search for Long-Term Returns Push More Irish […]

Investors in Ireland are attracted to digital opportunities offering better returns and often find them online, a new survey has indicated. According to the poll, 11% of investors have already bought a digital asset and a quarter of the young Irish are betting on cryptocurrencies. Low Interest Rates, Search for Long-Term Returns Push More Irish […] British bank Standard Chartered will offer cryptocurrency broker services in Ireland through its Zodia Custody subsidiary. The digital asset custodian will focus on signing up institutional investors in the Republic which has become a European base for many financial institutions and crypto companies. Standard Chartered to Provide Crypto Custody to Institutions in Ireland Zodia Custody, […]

British bank Standard Chartered will offer cryptocurrency broker services in Ireland through its Zodia Custody subsidiary. The digital asset custodian will focus on signing up institutional investors in the Republic which has become a European base for many financial institutions and crypto companies. Standard Chartered to Provide Crypto Custody to Institutions in Ireland Zodia Custody, […]