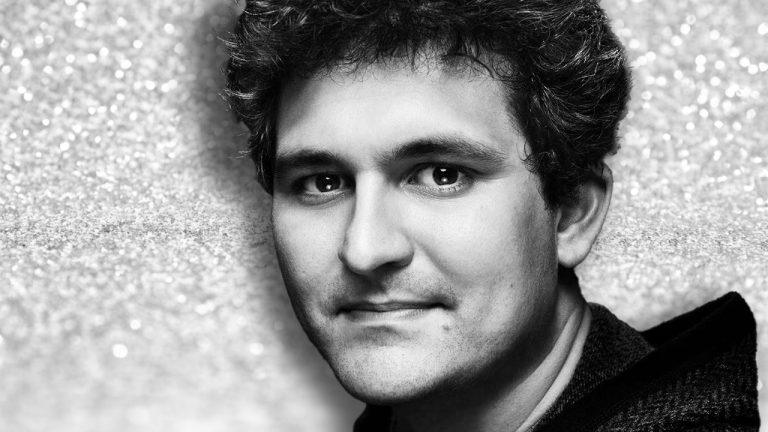

According to the Wall Street Journal, the convicted FTX co-founder Sam Bankman-Fried (SBF) is being transferred from the Metropolitan Detention Center in Brooklyn to an undisclosed location. Sources speculate that SBF might be headed to the Federal Correctional Institution in Mendota, California (FCI Mendota). SBF’s Potential Transfer to FCI Mendota Speculated A Wall Street Journal […]

According to the Wall Street Journal, the convicted FTX co-founder Sam Bankman-Fried (SBF) is being transferred from the Metropolitan Detention Center in Brooklyn to an undisclosed location. Sources speculate that SBF might be headed to the Federal Correctional Institution in Mendota, California (FCI Mendota). SBF’s Potential Transfer to FCI Mendota Speculated A Wall Street Journal […]

Gene Borrello, a former prisoner at the Metropolitan Detention Center told crypto blogger Tiffany Fong that Sam Bankman-Fried was targeted for his timid nature and having “the body of the 80-year-old.”

Sam Bankman-Fried was reportedly worried for his safety during his pre-trial detention time at the Brooklyn Metropolitan Detention Center and even considered paying another inmate for “protection,” according to a former inmate.

New York mob enforcer-turned-informant Gene Borrello told crypto blogger Tiffany Fong in a Nov. 30 interview that spent time with Bankman-Fried in the lead-up to his criminal trial.

I got a chance to interview Gene Borrello, a former mob enforcer who was in jail with Sam Bankman-Fried. pic.twitter.com/nszTXVUrSQ

— Tiffany Fong (@TiffanyFong_) November 30, 2023

Borrello said during his time there, other prisoners saw the former crypto mogul as timid, having “the body of the 80-year-old,” and was presumed to have access to money.

“He has the body of the 80-year-old. He has, like, no shape to him, you know what I mean?”

A prisoner attempted to make Bankman-Fried fearful to extort him for protection money.

The former FTX CEO is headed back to prison and awaits a potential second trial in March, while his lawyers pledged to “continue to vigorously fight the charges against him."

Sam Bankman-Fried is back in his federal prison cell in Brooklyn after being found guilty for all seven charges in his criminal trial. His lawyers however, say the fight isn’t yet over.

Bankman-Fried’s attorney Mark Cohen said in a Nov. 2 statement that Bankman-Fried “maintains his innocence and will continue to vigorously fight the charges against him."

If Bankman-Fried follows through then it’s possible he will appeal after being sentenced. The first step would see the FTX co-founder file a notice of appeal in the New York District Court where he was just found guilty.

STATEMENT FROM THE TEAM OF SAM BANKMAN-FRIED —

— Teddy Schleifer (@teddyschleifer) November 3, 2023

“We respect the jury’s decision. But we are very disappointed with the result. Mr. Bankman Fried maintains his innocence and will continue to vigorously fight the charges against him." pic.twitter.com/Q69w6nKB34

Bankman-Fried was hit with a guilty verdict from the jury on late Nov. 2 in New York. United States Attorney Damian Willaims called Bankman-Fried one of the biggest financial frauds in American history and perpetrator of “a multibillion-dollar scheme designed to make him the king of crypto."

Bankman-Fried faces the possibility of an another criminal trial slated for March 11 on five charges of bribery conspiracy, conspiracy to operate an unlicensed money-transmitting business, bank fraud conspiracy along with derivatives and securities fraud.

New York District Court Judge Lewis Kaplan gave government prosecutors a Feb. 1, 2024 deadline to confirm if they will still pursue the second trial.

If that goes ahead, Bankman-Fried has the option to plead guilty which could help reduce his sentence.

As for the recent guilty verdict — prosecutors will recommend a sentence by March 15, and will see Bankman-Fried will return to court for sentencing on March 28, 2024.

Kaplan however, will have the final say on how much time Bankman-Fried will serve. If Bankman-Fried served the maximum sentences for his crimes back-to-back he would be in jail for 110 years.

Kaplan, however, could instead decide that Bankman-Fried will serve his sentence concurrently. If so, his wire fraud, wire fraud conspiracy and money laundering conspiracy crimes alone each carry a maximum 20-year sentence.

Former federal prosecutor turned crypto venture capitalist Kathryn Haun said in a Nov. 2 X (Twitter) post that she thinks Bankman-Fried will likely spend “decades in prison.”

Now that SBF has been found guilty on all counts, people are asking what sentence he may get. I think the answer is likely decades in prison. People confuse the statutory maximum sentence (the max a judge is allowed to give) with the sentencing guidelines recommended sentence… pic.twitter.com/C7Tn81A7xh

— Kathryn Haun (@katie_haun) November 3, 2023

In the meantime, Bankman-Fried will stay in jail at the Metropolitan Detention Center in Brooklyn where he’s been incarcerated since Aug. 11 after breaking his bail conditions.

Kaplan previously said the Brooklyn jail was “not on anybody’s list of five-star facilities” and during Bankman-Fried’s time there before the trial, he complained about his lack of access to medication and vegan food.

Related: How long could Sam Bankman-Fried go to jail for? Crypto lawyers weigh in

In September, a week before the start of Bankman-Fried’s trial, lawyers gave mixed predictions as to how long his sentence would be.

Loevy & Loevy partner Michael Kanovitz said if Bankman-Fried was found guilty, “I think he will get the maximum sentence.”

Hogan & Hogan partner Jeremy Hogan predicted Bankman-Fried may not have the book thrown at him and get the maximum 110-year sentence but he’ll be “going to prison for quite some time.”

“I don’t know enough about it to get into details,” Hogan said. “Just a long time — more than 10 years.”

Magazine: Slumdog billionaire 2 — ‘Top 10… brings no satisfaction’ says Polygon’s Sandeep Nailwal

Convicted fraudster Pablo Renato Rodriguez will also need to serve three years of supervised release after he finishes his 12 year imprisonment sentence.

The co-founder of AirBit Club — a cryptocurrency pyramid scheme that swindled investors of over $100 million — has been sentenced to 12 years in prison for his role in a $100 million "pyramid scheme" that purported to be involved in crypto mining.

The sentencing comes nearly seven months after Rodriguez — the co-founder of AirBit Club — pleaded guilty to wire fraud conspiracy charges in a United States District Court in March.

In a Sept. 26 statement, Damian Williams, United States Attorney for the Southern District of New York said Rodriguez “preyed” on unsophisticated investors with false promises that their funds were invested into legitimate cryptocurrency trading and mining operations.

“Instead of investing on behalf of investors, Rodriguez hid victims’ money in a complex laundering scheme using Bitcoin, an attorney trust account, and international front and shell companies and used victims’ money to line his own pockets.”

District Court Judge George B. Daniels imposed an additional three years of supervised release for Rodriguez, which will follow his 12-year prison sentence.

.@HSINewYork's El Dorado Task Force, the largest anti-money laundering task force in the US, is proud to have played a vital role in delivering justice to the victims of Pablo Renato Rodriguez and the fraudulent "AirBit Club” Ponzi Scheme #HomelandSecurityInvestigations #HSINY https://t.co/UVco4ai3rI

— HSI New York (@HSINewYork) September 26, 2023

The convicted fraudster was ordered to pay a forfeiture of $65 million and to forfeit other items, including a total of 3,800 Bitcoins (BTC) (worth $100 million), Rodriguez’s Irvine residence in California, $900,000 in U.S. dollars seized from the property and nearly $1 million previously held in escrow for a Gulfstream Jet.

The other defendants — Dos Santos, Scott Hughes, Cecilia Millan and Karina Chairez have also pleaded guilty and are awaiting sentencing verdicts.

Related: How to tell if a cryptocurrency project is a Ponzi scheme

AirBit Club was launched in 2015. Prospective investors were told that AirBit Club earned returns on cryptocurrency mining and trading and that victims would earn passive, guaranteed daily returns on any membership purchased.

However, as early as 2016, club members wishing to withdraw proceeds were met with excuses, delays and hidden fees and told they must recruit new members if they wanted to receive the returns.

The operators of the club, including Rodriguez were charged with fraud and money laundering by the DOJ in August 2020 after a probe by the United States Homeland Security Investigations.

In 2022, $7.6 billion in funds were lost to cryptocurrency ponzi and pyramid schemes, according to a June 28 report by blockchain intelligence firm TRM Labs.

Magazine: Unstablecoins: Depegging, bank runs and other risks loom

The former FTX CEO has swapped his parent's cozy Stanford home for the Metropolitan Detention Center in Brooklyn, which isn't known for its comforts.

Former FTX CEO Sam Bankman-Fried is going into his third night with over 1,500 other inmates in one of New York's most notorious prisons — a far cry from his parent's multi-million dollar five-bedroom home in Stanford.

The FTX co-founder had his bail revoked by Judge Lewis Kaplan in an Aug. 11 hearing, where he described the Brooklyn Metropolitan Detention Center (MDC) as being a jail “not on anybody’s list of five-star facilities.”

Duuude they put SBF in MDC?

— Adam Cochran (adamscochran.eth) (@adamscochran) August 14, 2023

That’ll break him. Going to get a guilty plea within days…. https://t.co/WrUf8rzKUO

The MDC is a federal administrative detention center based in New York. It is an all-gender facility accommodating individuals under federal custody. The facility currently houses over 1,500 inmates but was only built to accommodate 1,000.

Bankman-Fried is expected to spend at least the next two months at the facility as he awaits his criminal trial, though his lawyers have already filed an appeal to have his bail revocation revised.

Unfortunately for Bankman-Fried, the prison has long been embroiled in scandals involving inmate mistreatment and corruption.

Ex-warden Cameron Lindsay said in 2019 that the MDC was “one of the most troubled, if not the most troubled facility in the Bureau of Prisons.”

In April prosecutors charged a guard with taking bribes in exchange for smuggling in contraband such as phones, cigarettes, and drugs.

In winter 2019 the facility suffered a week-long power outage leaving inmates with no heating.

The Intercept reported inmates were banging on cell windows to outside onlookers and those non-violently protesting the conditions were pepper sprayed, thrown in solitary confinement or had their toilets shuttered.

Many high-profile figures have previously been remanded in the Brooklyn big house including artists 6ix9ine, R. Kelly and Fetty Wap.

Martin Shkreli, better known as “pharma bro,” also had a stint at the MDC along with Jeffery Epstein’s sex trafficking accomplice Ghislaine Maxwell.

Up until recently, Bankman-Fried was on bail confined to his parent's $4 million Palo Alto home that boasts five bedrooms and a pool.

The revocation of Bankman-Fried’s bail came after a leak of a diary belonging to former Alameda Research CEO Caroline Ellison to The New York Times which described her feelings toward Bankman-Fried and her role at the company.

Related: FTX’s former law firm hit with lawsuit alleging it set up shadowy entities

Prosecutors alleged Bankman-Fried leaked the diary in an attempt to discredit Ellison — a witness in his criminal trial — and intimidate her.

His lawyers denied the allegations, calling Bankman-Fried’s contact with reporters a “proper exercise of his rights to make fair comment on an article already in progress” and appealed the judge’s decision to revoke his bail.

Deposit risk: What do crypto exchanges really do with your money?

The former CEO of FTX, Sam Bankman-Fried (SBF), has published a Substack newsletter on Jan. 12, 2023, and the first post is titled “FTX Pre-Mortem Overview.” In the post, SBF maintains that an “extreme, quick, targeted crash precipitated by the CEO of Binance made Alameda insolvent.” The blog post does not mention the allegations made […]

The former CEO of FTX, Sam Bankman-Fried (SBF), has published a Substack newsletter on Jan. 12, 2023, and the first post is titled “FTX Pre-Mortem Overview.” In the post, SBF maintains that an “extreme, quick, targeted crash precipitated by the CEO of Binance made Alameda insolvent.” The blog post does not mention the allegations made […] FTX co-founder Sam Bankman-Fried (SBF) had a difficult day in court on Monday according to a number of accounts that said SBF’s local attorney seemed to be in conflict with his U.S. legal team. Furthermore, courtroom reports noted that SBF dozed off for an extended period of time and had to be shaken awake by […]

FTX co-founder Sam Bankman-Fried (SBF) had a difficult day in court on Monday according to a number of accounts that said SBF’s local attorney seemed to be in conflict with his U.S. legal team. Furthermore, courtroom reports noted that SBF dozed off for an extended period of time and had to be shaken awake by […] Disgraced FTX co-founder Sam Bankman-Fried (SBF) has reportedly reversed his decision to contest his extradition to the United States. Bankman-Fried has spent close to five days in the Bahamas Department of Correctional Services (BDOCS) jail Fox Hill, an overcrowded prison known for being filthy and one that has been accused of prison maltreatment. Reuters Source […]

Disgraced FTX co-founder Sam Bankman-Fried (SBF) has reportedly reversed his decision to contest his extradition to the United States. Bankman-Fried has spent close to five days in the Bahamas Department of Correctional Services (BDOCS) jail Fox Hill, an overcrowded prison known for being filthy and one that has been accused of prison maltreatment. Reuters Source […]

Two other associates that helped run the U.S.-based fraudulent crypto platform EmpiresX left the country early this year and are believed to be in Brazil.

One of the leading figures convicted of being behind the $100 million crypto “Ponzi” scheme, EmpiresX, has just been handed an over four-year jail sentence by a United States court.

The sentencing was handed to Joshua David Nicholas, the “head trader” of purported crypto platform EmpiresX, who is nowset to serve a 51-month prison sentence along with three years of supervised release for his role in the fraudulent scheme.

It follows a Sept. 8 guilty plea from Nicholas for conspiracy to commit securities fraud.

According to the Department of Justice (DOJ), over a two-year period, Nicholas made claims the platform would make daily “guaranteed” returns using a trading bot that utilized “artificial and human intelligence” to maximize returns.

In reality, the “bot” was fake, and Nicolas and his associates, Emerson Pires and Flavio Goncalves, operated a "Ponzi" scheme that paid earlier investors with money from later investors. The DOJ alleges blockchain analytics shows Pires and Goncalves, both Brazilian nationals, laundered investors’ funds through a “foreign-based” crypto exchange.

Only around $1 million of investor funds were sent to a futures trading account for EmpiresX with the majority of funds either lost or misappropriated according to the Commodity Futures Trading Commission (CFTC) which filed civil actions against the three in June.

At the same time, fraud charges were leveled against the trio by the Securities and Exchange Commission (SEC) which said investor money was used to “lease a Lamborghini, shop at Tiffany & Co., make a payment on a second home, and more.”

Related: HashFlare founders arrested in ‘astounding’ $575M crypto fraud scheme

Investors were also told EmpiresX was registered with the SEC as a hedge fund and that Nicholas was a licensed trader.

The SEC said the platform was never registered with the Commission and Nicholas’ was suspended from trading by the National Futures Association for misappropriating customer funds.

The scheme ran for two years, from around September 2020 until early 2022 when it fell apart as the platform refused to honor customer withdrawals who were likely wanting to leave the crypto market due to significant price drawdowns that began at the time.

Pires and Goncalves, who were residing in Florida, allegedly began winding down the operations of EmpiresX in early 2022 and left the U.S., they are now believed to be in Brazil.

Following his release from prison, the former hedge fund manager and convicted felon, Martin Shkreli, discussed cryptocurrencies and using the decentralized exchange (dex) platform Uniswap from a federal penitentiary. The so-called ‘Pharma Bro’ further explained that eventually, a crypto entity could dethrone some of the largest banking giants. Martin Shkreli Talks Defi and Cryptocurrencies Martin […]

Following his release from prison, the former hedge fund manager and convicted felon, Martin Shkreli, discussed cryptocurrencies and using the decentralized exchange (dex) platform Uniswap from a federal penitentiary. The so-called ‘Pharma Bro’ further explained that eventually, a crypto entity could dethrone some of the largest banking giants. Martin Shkreli Talks Defi and Cryptocurrencies Martin […]