Arthur Hayes, former CEO of Bitmex and current CIO of Maelstrom, has predicted the geopolitical and economic dynamics that will be taken to equilibrate the exchange rate between the U.S. dollar and the Japanese yen might propel bitcoin prices to $1 million. Hayes states that eventually, the U.S. will be forced to act by printing […]

Arthur Hayes, former CEO of Bitmex and current CIO of Maelstrom, has predicted the geopolitical and economic dynamics that will be taken to equilibrate the exchange rate between the U.S. dollar and the Japanese yen might propel bitcoin prices to $1 million. Hayes states that eventually, the U.S. will be forced to act by printing […] This week, the Japanese yen plummeted to its lowest point since 1990 against the U.S. dollar, weighed down by Japan’s monetary policy and uncertain economic indicators from the United States. Japanese Yen’s Rapid Decline Triggers Talk of Market Intervention The yen’s sharp drop to 158.283 per dollar signals a substantial downturn for the currency. This […]

This week, the Japanese yen plummeted to its lowest point since 1990 against the U.S. dollar, weighed down by Japan’s monetary policy and uncertain economic indicators from the United States. Japanese Yen’s Rapid Decline Triggers Talk of Market Intervention The yen’s sharp drop to 158.283 per dollar signals a substantial downturn for the currency. This […]

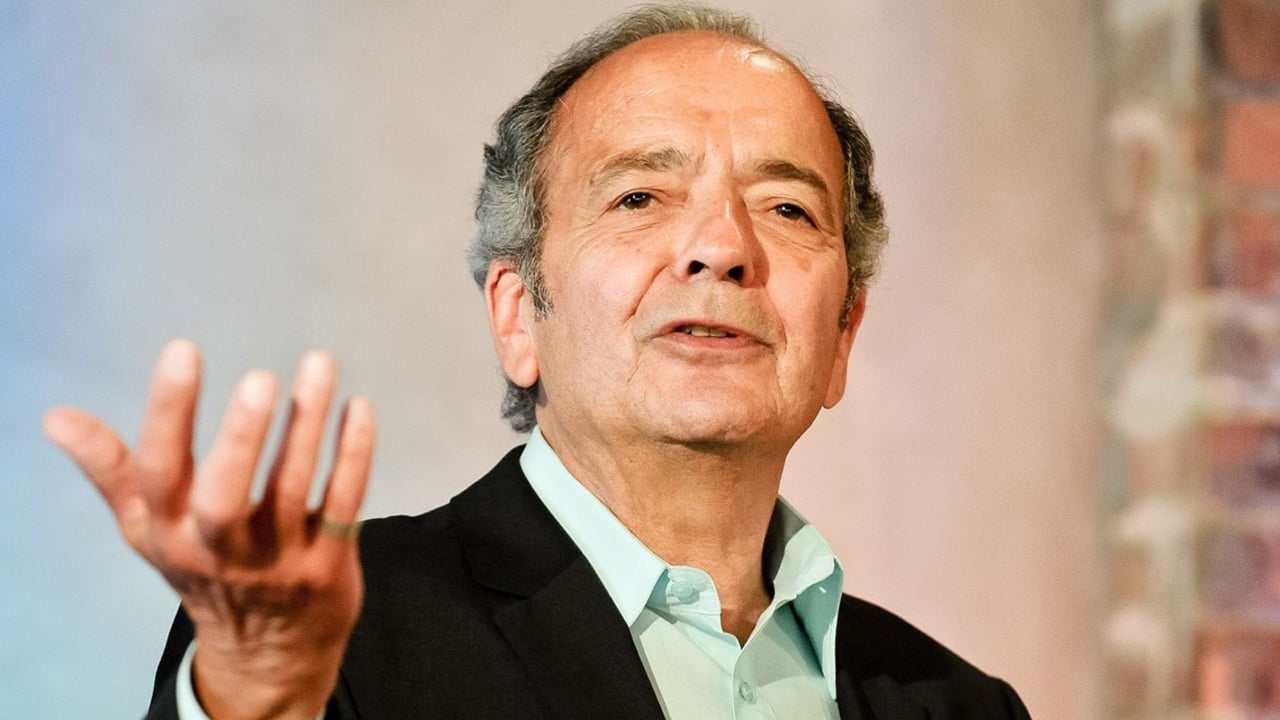

Marcus said there’s still no universal protocol when it comes to transferring money, unlike information which can be shared via email.

While information today can be easily transferred over the internet via email or text, global payments on the other hand, have remained in a “fax era," according to the former president of PayPal.

In a Sept. 11 interview with CNBC, the former PayPal executive and co-founder of Bitcoin Lightning-focused payment service Lightspark said he believes Bitcoin's Lightning network could solve the cumbersome process of sending money across jurisdictions.

“If you were to stop [someone] and wanting to communicate with them you could ask them for an email address and you can email them easily the next minute [and] you could text them,” said Marcus.

However, there’s no universal protocol when it comes to transferring money over the internet, he said:

“If you were to send them money [but] they were not a U.S citizen here using one of the same fintech apps you're using then you wouldn't be able to do that. So we're still in the fax era of global payments.”

Marcus explained that a money transfer to non-U.S. residents in this case would involve obtaining their bank account number and walking to the local bank to pay $50 for an international wire.

“If it's after Friday at 5 pm, tough luck,” Marcus added.

David Marcus on #bitcoin as base settlement layer for "Trillions of dollars of transactions"pic.twitter.com/L21fmiwxyZ

— Alex Stanczyk ∞/21m (@alexstanczyk) September 11, 2023

Marcus, who co-founded Lightspark in May 2022 and serves as CEO, said his company is now in a race to solve that using the Bitcoin Lightning network.

Related: Bitcoin price dips below $25K — Opportunity, or sign of incoming disaster?

The former PayPal president however believes that ultimately, Bitcoin Lightning won't be used so much for everyday purchases, and instead be mainly used for overseas transfers.

“Our view is actually that Bitcoin is not the currency that people will use to buy things.” Instead Bitcoin will be used to send U.S. dollars to someone that ultimately receives it in the form of a Japanese Yen or Euro on the other side of the world, the Lightspark boss explained.

Marcus said Bitcoin’s settlement layer combined with Lightning’s real-time payments enables cash finality at a very low cost.

Magazine: Magazine: Recursive inscriptions — Bitcoin ‘supercomputer’ and BTC DeFi coming soon

The Japanese yen is up 3.42% against the U.S. dollar on Tuesday as the Bank of Japan surprised the world by deciding to allow the benchmark interest rate to rise to 0.5% from 0.25%. The Japanese central bank was one of the only banks worldwide to hold off on raising benchmark interest rates, as policymakers […]

The Japanese yen is up 3.42% against the U.S. dollar on Tuesday as the Bank of Japan surprised the world by deciding to allow the benchmark interest rate to rise to 0.5% from 0.25%. The Japanese central bank was one of the only banks worldwide to hold off on raising benchmark interest rates, as policymakers […]

Three world leaders of the banking industry are taking part in Project Guardian, an initiative from the Monetary Authority of Singapore (MAS) that aims to pilot use cases of digital assets and decentralized finance (DeFi). JPMorgan, DBS Bank and SBI Digital Asset Holdings just completed the first live trades for the program’s first industry pilot, […]

The post JPMorgan and Two More Banking Titans Conduct First Blockchain-Based Trade in New DeFi Pilot appeared first on The Daily Hodl.

While the greenback has been rising higher, the Japanese yen tapped a 24-year low and Japan decided to intervene in foreign exchange markets (forex) for the first time since 1998. Reports say the Bank of Japan conducted the first forex intervention in 24 years, after the Japanese central bank kept its benchmark bank rate suppressed […]

While the greenback has been rising higher, the Japanese yen tapped a 24-year low and Japan decided to intervene in foreign exchange markets (forex) for the first time since 1998. Reports say the Bank of Japan conducted the first forex intervention in 24 years, after the Japanese central bank kept its benchmark bank rate suppressed […] This week Bitcoin.com News spoke with Gerald Celente, the popular trends forecaster, and publisher of the Trends Journal. During a telephone conversation, Celente discussed the uncertainty surrounding the global economy after governments worldwide locked down the world’s citizens over the Covid-19 pandemic, shut down businesses and injected trillions into the economy. The discussion touches upon […]

This week Bitcoin.com News spoke with Gerald Celente, the popular trends forecaster, and publisher of the Trends Journal. During a telephone conversation, Celente discussed the uncertainty surrounding the global economy after governments worldwide locked down the world’s citizens over the Covid-19 pandemic, shut down businesses and injected trillions into the economy. The discussion touches upon […]

U.S. dollar strength is waning as traders hope for critical levels to break to exit Bitcoin’s “no trade zone.”

Bitcoin (BTC) showed strength at the June 8 Wall Street open as impatient traders waited for a trend to emerge.

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD jumping to near $30,850 after the opening bell, helping claw back some of the ground lost in an overnight correction.

Choppy trading conditions prevailed within a familiar range on the day, however, leading to both long and short traders seeing increased risk on low timeframes.

For popular trader Crypto Chase, this was a prime period for the transfer of value to “smart money” — away from small-volume speculators and those with “weak hands.”

A prior Twitter post had argued for a hands-off approach until a decisive level had been breached.

Little interest in $BTC until one of these levels is breached. At that point, we watch for either continuation or price to re-enter range. If re-enter range, I expect the other side to fail and continuation in that direction (as drawn). I tend to lean towards left most drawing. pic.twitter.com/d5JgsAM4LR

— Crypto Chase (@Crypto_Chase) June 7, 2022

Fellow trader Crypto Tony argued that $29,700 needed to hold as support for a further upward momentum to enter.

“Simple playing field for Bitcoin,” Cointelegraph contributor Michaël van de Poppe added.

“Break through $31.5K = $32.8K and/or $35K. Support zones for longs probably $30K and $29.3K still. In between = no trade zone.”

Stocks were flat at the time of writing, with 48 hours still to go until the latest United States Consumer Price Index (CPI) readout.

Laying out the possible reactions from BTC/USD, Twitter account PlanC identified between 8% and 8.3% as having a “neutral” effect.

This CPI print on June 10, will be very interesting.

— Plan©️ (@TheRealPlanC) June 7, 2022

> 8.3%, short-term all markets tank (Bearish)

8% - 8.3%, slight dump or pump (Neutral)

< 8%, short-term all markets pump (Bullish)#Bitcoin #Crypto

Elsewhere in macro, the poor performance of the Japanese yen versus the U.S. dollar was again on crypto commentators’ radar.

Related: ‘Can it get any easier?’ Bitcoin whales dictate when to buy and sell BTC

Even as the U.S. dollar index (DXY) failed to continue its rally above 20-year highs, USD/JPY reached levels not seen since the start of 2002.

BTC/USD traded in a more modest territory near local highs from before May’s crypto dip, still far from its record peak, as with the dollar seen in November 2021.

Japan’s central bank continues a policy of quantitative easing, in stark contrast to both the U.S. and European Union, both of which are aiming to reduce their central banks’ balance sheets.

The third largest currency in the world is falling off a cliff vs. the USD.

— Stack Hödler (@stackhodler) June 8, 2022

Make no mistake. This is the fate awaiting every fiat currency vs. the USD, and eventually the fate of the USD vs. #Bitcoin pic.twitter.com/vZkN6Uyl5e

“Turns out that the monetary experiment in Japan is not going too well,” analyst Jan Wüstenfeld responded.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.