Global investment bank Goldman Sachs says ether is the cryptocurrency with the highest real use potential and it could overtake bitcoin as the dominant digital store of value. Ether Could Overtake Bitcoin as Dominant Store of Value, Says Goldman Sachs Goldman Sachs shared its view on the future outlook for bitcoin and ether in a […]

Global investment bank Goldman Sachs says ether is the cryptocurrency with the highest real use potential and it could overtake bitcoin as the dominant digital store of value. Ether Could Overtake Bitcoin as Dominant Store of Value, Says Goldman Sachs Goldman Sachs shared its view on the future outlook for bitcoin and ether in a […] The Switzerland-based bank Sygnum revealed on Tuesday that the firm now allows Ethereum 2.0 staking. The FINMA-approved company’s customers can access the Ethereum-based staking services via Sygnum’s banking platform. Sygnum’s Banking Platform Offers Ethereum 2.0 Staking Last November, Sygnum Bank AG revealed that it is partnered with the company Taurus Group, a firm that also […]

The Switzerland-based bank Sygnum revealed on Tuesday that the firm now allows Ethereum 2.0 staking. The FINMA-approved company’s customers can access the Ethereum-based staking services via Sygnum’s banking platform. Sygnum’s Banking Platform Offers Ethereum 2.0 Staking Last November, Sygnum Bank AG revealed that it is partnered with the company Taurus Group, a firm that also […] Global investment bank JPMorgan has predicted that the bitcoin price slump will likely be over when the cryptocurrency’s dominance rises back above 50%. “I think that’s another indicator to watch here in terms of whether this bear phase is over or not,” the firm’s analyst explained. JPMorgan’s Bitcoin Market Prediction JPMorgan analyst Nikolaos Panigirtzoglou has […]

Global investment bank JPMorgan has predicted that the bitcoin price slump will likely be over when the cryptocurrency’s dominance rises back above 50%. “I think that’s another indicator to watch here in terms of whether this bear phase is over or not,” the firm’s analyst explained. JPMorgan’s Bitcoin Market Prediction JPMorgan analyst Nikolaos Panigirtzoglou has […] JPMorgan Chase has released an investor note stating that the cryptocurrency market appears “to be beginning the process of healing.” In the short term, however, the JPMorgan analysts expect further sell-offs before capitulation. JPMorgan’s Crypto Market Outlook JPMorgan Chase’s analysts, including Josh Younger and Veronica Mejia Bustamante, wrote about the outlook of the cryptocurrency market […]

JPMorgan Chase has released an investor note stating that the cryptocurrency market appears “to be beginning the process of healing.” In the short term, however, the JPMorgan analysts expect further sell-offs before capitulation. JPMorgan’s Crypto Market Outlook JPMorgan Chase’s analysts, including Josh Younger and Veronica Mejia Bustamante, wrote about the outlook of the cryptocurrency market […]

Bitcoin and the crypto market are at the beginning of a healing process, JPMorgan analysts say in a note.

Bitcoin’s (BTC) weekend dance between $30,000 and $34,000 seems to strengthen the short-term uncertainty narrative, as JPMorgan strategists believe the cryptocurrency market is not yet healthy.

A Friday note from the JPMorgan Chase team suggested that the near-term setup for Bitcoin still looks challenging. Based on the on-chain data, JPMorgan strategists said that “there is likely still an overhang of underwater positions which need to be cleared through the market.”

JPMorgan lists the Bitcoin futures market’s stability and the possibility of increased production costs due to miners’ migration from China as positive factors. Bitcoin’s cost of production is historically tied to its price, several analyses show. So, a price bump in the cost of mining may have a booster effect on Bitcoin price.

The note suggests that the cryptocurrency market appears to be at the beginning of a healing process but is not quite healthy yet. Fundstrat’s David Grider recommended reducing the risk or buying some protection, according to Bloomberg.

Related: Bitcoin bounces off $30,000 amid the possibility of exit to mid-$40K range

A bounce off $30,000, which is seen as a critical support level, came after the JPMorgan note. The Bitcoin price dove to $30,070 before quickly recovering to $33,445 over the weekend, according to data from Cointelegraph Markets Pro and TradingView.

The weekend saw a positive statement for the biggest cryptocurrency from Ricardo Salinas Pliego, Mexico’s third-richest man, who named Bitcoin the new gold. The price climbed above 35,000 as of Monday morning.

Global investment bank JP Morgan is not optimistic about the price of Bitcoin heading into July as the threat of sell pressure looms on the horizon. Bloomberg reports that JP Morgan strategists are not lifting their bearish Bitcoin outlook, as a large Grayscale Bitcoin fund, GBTC, prepares to unlock more shares, giving BTC holders a […]

The post JP Morgan: Bitcoin Bottom Not In, Turnaround Not Happening Until Price Hits This Level appeared first on The Daily Hodl.

JPMorgan does not expect a bull run for Bitcoin over the medium term based on the BTC-to-gold volatility ratio.

As Bitcoin (BTC) price failed to hold its breath above the $35,000 yesterday, JPMorgan expects an overall bearish movement below the critical price level based on the BTC-to-gold volatility ratio.

In a note sent to investors on Wednesday, JPMorgan detailed its reasoning to see the fair value of Bitcoin between $23,000–$35,000 over the medium term. The banking giant previously pictured a $140,000 roadmap if the biggest cryptocurrency matches gold’s allocation and volatility profile.

But that’s off the table for the foreseeable future, according to JPMorgan’s note, which predicts that “full convergence or equalization of volatilities or allocations [between gold and bitcoin] is unlikely in the foreseeable future.“

JPMorgan also said that China’s crackdown on mining operations would have a positive impact on Bitcoin over the medium term, “as it accelerates a shift away from China's high share in bitcoin's hash rate, reducing concentration.”

Not many institutions are joining MicroStrategy's hunt to buy the dip. “More than a month after the May 19 crypto crash, bitcoin funds continue to bleed, even as inflows into physical gold ETFs stopped,” JPMorgan said, adding:

“This suggests that institutional investors, who tend to invest via regulated vehicles such as publicly listed bitcoin funds or CME bitcoin futures, still exhibit little appetite to buy the bitcoin dip.”

Related: Bitcoin price dips below $34K as day of Grayscale’s BTC unlocking draws near

According to JPMorgan, another major factor preventing a possible bull run is the end of a six-month lock-up period for the Grayscale Bitcoin Trust fund, which saw a nearly $4 billion inflow in December and January. As Cointelegraph reported, July 19 will see the most significant single unlocking day, with 16,000 BTC worth around $627 million released.

Following the April all-time high, Bitcoin is hovering between $30,000–$40,000 for the last couple of weeks. After diving below $29,000 on June 22, BTC price is moving around $34,000, according to Cointelegraph Markets Pro and TradingView data.

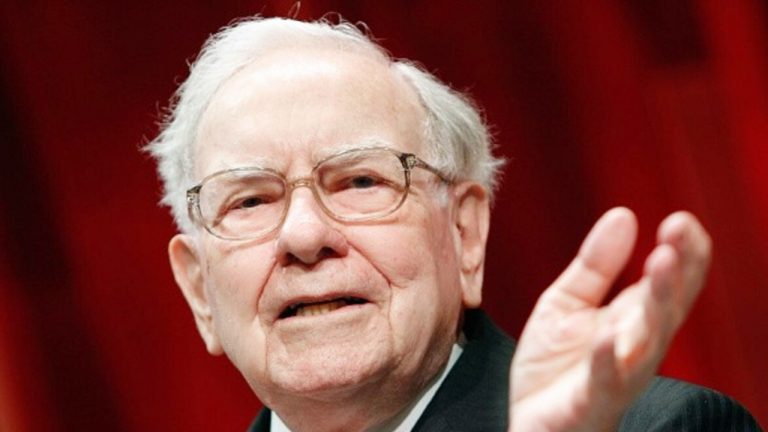

Investment bank JPMorgan conducted a survey of thousands of investors from 1,500 institutions and found that 49% of them think that cryptocurrency is either “rat poison squared,” the term used by Berkshire Hathaway CEO Warren Buffett to describe bitcoin, or “a temporary fad.” 49% of Investors Told JPMorgan Cryptocurrency Is a Fad or ‘Rat Poison […]

Investment bank JPMorgan conducted a survey of thousands of investors from 1,500 institutions and found that 49% of them think that cryptocurrency is either “rat poison squared,” the term used by Berkshire Hathaway CEO Warren Buffett to describe bitcoin, or “a temporary fad.” 49% of Investors Told JPMorgan Cryptocurrency Is a Fad or ‘Rat Poison […]