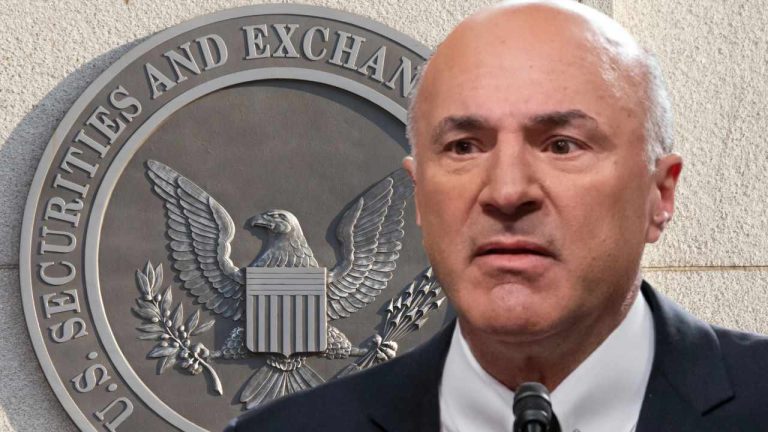

Shark Tank star Kevin O’Leary, aka Mr. Wonderful, has warned that U.S. crypto regulation is “getting very, very aggressive.” Noting that regulators are now “regulating by enforcement, penalties, and massive fines,” O’Leary emphasized the importance of staying out of the way of the SEC, Chair Gary Gensler, and other regulators. Kevin O’Leary Shares Outlook for […]

Shark Tank star Kevin O’Leary, aka Mr. Wonderful, has warned that U.S. crypto regulation is “getting very, very aggressive.” Noting that regulators are now “regulating by enforcement, penalties, and massive fines,” O’Leary emphasized the importance of staying out of the way of the SEC, Chair Gary Gensler, and other regulators. Kevin O’Leary Shares Outlook for […]

Kevin O'Leary believes U.S. Senators are “fatigued” and “pissed” at the cryptocurrency industry for having to deal with one blowup after another.

Shark Tank investor and venture capitalist Kevin O’Leary has urged crypto exchanges to “get on board with regulation” if they want to “stay out of the way” of Gary Gensler and the United States Securities Exchange Commission (SEC).

In a Feb. 20 interview with TraderTV Live, O’Leary said that U.S. lawmakers are “fatigued” over crypto collapses and that they’re only going to get more ruthless if companies continue to not comply:

“You got to get on board with regulation, you got to stay out of the way of Gensler at the SEC and other regulators. Those hombres [men] in Washington are not happy. FTX poked the bear, the bear is awake, and it is pissed.”

“These senators are really fatigued, they’re really tired of gathering every six months when the next crypto company blows up and goes to zero,” he said, adding “because they’re totally unregulated and they keep issuing tokens that are worthless.”

Venture funding for new #crypto projects is virtually dead and aftermarket trading for existing projects is at massive discounts. Reason? The #regulator is now regulating by enforcement, penalties & massive fines. The venture community has moved on to the next “big” thing, #AI pic.twitter.com/ChpjYIY9Dl

— Kevin O'Leary aka Mr. Wonderful (@kevinolearytv) February 20, 2023

O’Leary said the SEC whacking Kraken for $30 million and ordering them to immediately cease its staking services should put the industry on alert and to comply by all means.

In light of the recent regulatory crackdowns, the Shark Tank investor predicted that regulated trading platforms will be better investments than their unregulated counterparts over the next few years:

”I think the value of regulated exchanges is going to go up over the next few years, while the unregulated ones get put out of business or go to zero by the regulators.”

O’Leary recently confessed to losing basically 100% of the $15 million that FTX paid him to be its official spokesperson.

Related: ‘There will be many more zeros’ — Kevin O'Leary on FTX-like collapses to come

Despite admitting FTX to be a “bad” investment, Mr. Wonderful has continued to defend former FTX CEO Sam Bankman-Fried, claiming that the controversial figure should be treated as innocent until proven guilty and added that he wouldn’t rule out investing in the failed entrepreneur again:

I am not scared of investing in entrepreneurs that have had catastrophic failures. Failure is often the best teacher.

— Kevin O'Leary aka Mr. Wonderful (@kevinolearytv) February 7, 2023

Shark Tank investor has previously expressed dislike towards some of the more decentralized, unregulated players in the industry too.

On Aug. 13, O’Leary said Dutch authorities were in the right to arrest Alexey Pertsev — the creator of Ethereum-based crypto mixer Tornado Cash — because such applications and the “crypto cowboys” that run them “mess with the primal forces of regulation.”

Shark Tank star Kevin O’Leary, aka Mr. Wonderful, says that most crypto tokens are worthless and they will eventually drop to zero in value. He added that he now owns seven cryptocurrencies and he is getting the same volatility he did when he owned 32 crypto tokens prior to the collapse of crypto exchange FTX. […]

Shark Tank star Kevin O’Leary, aka Mr. Wonderful, says that most crypto tokens are worthless and they will eventually drop to zero in value. He added that he now owns seven cryptocurrencies and he is getting the same volatility he did when he owned 32 crypto tokens prior to the collapse of crypto exchange FTX. […]

Venture capitalist and Shark Tank star Kevin O’Leary says that he thinks crypto exchange Binance may face regulatory scrutiny in the near future. In a new interview with Scott Melker, the former paid FTX promoter says that Binance shareholders should be worried about regulators all over the world looking into the crypto exchange. “I don’t […]

The post Kevin O’Leary Says Binance Should Be Worried About Regulators Swarming, Warns 10,000 Tokens Will Go to Zero appeared first on The Daily Hodl.

The Shark Tank star said all unregulated exchanges are seeing “massive outflows” right now, and rightly so.

Unregulated crypto exchanges will continue to fall like dominoes post-FTX, with plenty more “meltdowns” to come, warns Shark Tank star and investor Kevin O’Leary.

O’Leary, a former spokesperson and proponent for the now-bankrupt FTX exchange, told Kitco anchor David Lin in a Jan. 17 interview that the collapse was just one in a long line of “unregulated exchanges” likely to fail:

“If you’re asking me if there’s going to be another meltdown to zero? Absolutely. 100% it’ll happen, and it’ll keep happening over, and over and over again.”

Unregulated exchanges are those that aren't subject to regular auditing, aren’t registered and regulated by a securities commission, and don’t operate under rules similar to traditional stock exchanges and brokerages.

“Well, all of these exchanges, all the unregulated exchanges are having massive outflows right now. Smart money has got the joke. They saw what happened at FTX and they’re not sitting around for an explanation,” he said.

The Shark Tank star then made a stark warning to so-called “unregulated” crypto exchanges.

“If you're not willing to be audited, [...] you don't have an audit, you don't want to be transparent, you don't want to disclose ownership, why should institutional capital stay? Of course, it's not going to.”

The collapse of FTX in November prompted fierce calls from the community for greater transparency from crypto exchanges. Within weeks, five centralized exchanges completed their proof-of-reserve audits, while plenty more announced plans to do the same.

However, some observers, including a senior official from the United States Securities and Exchange Commission (SEC), warned that proof of reserves don’t paint a true picture of a company’s financial position and asked investors to be “very wary” of the claims being made.

Some of the auditors, such as Mazars have seemingly back-flipped on their support for crypto companies. In December, the company removed its audit for crypto exchange Binance and reportedly stopped doing proof-of-reserve audits for crypto companies altogether.

Other auditing firms such as FTX’s auditor Armanino have also reportedly stopped working with crypto exchanges like OKX and Gate.io. O'Leary commented:

“Frankly, you know, it's very hard to find an auditor that wants to touch this stuff right now because of the unregulated cowboy environment. It's all going to end and yes, there’ll be many more zeros.”

Earlier this month, O’Leary’s fellow Shark Tank host Mark Cuban told The Street that crypto wash trading on centralized exchanges will be the cause of the next crypto “implosion.”

As much as 70% of the volume on unregulated exchanges is wash trading according to a December report by the National Bureau of Economic Research (NBER).

Related: Binance 'put FTX out of business' — Kevin O'Leary

Despite the noise, O’Leary says he’s doubling down on his crypto investments, particularly in Bitcoin (BTC).

“I have been going back into crypto markets lately. Any time Bitcoin drops below $17,000 I add to our positions there.”

“Crypto is getting very interesting because we’re finally starting to see the bearer of regulation coming into play and I think long-term that’s a good thing,” he added.

Venture capitalist Kevin O’Leary is doubling down on crypto markets despite being involved with the collapse of FTX, which he was a paid sponsor of. In a new interview with Kitco, O’Leary reveals his current strategy for accumulating Bitcoin (BTC), and gives his outlook on the development of regulation in the crypto industry. “I have […]

The post Kevin O’Leary Doubles Down on Bitcoin (BTC) Accumulation, Predicts Unregulated Crypto Exchanges ‘Go to Zero’ appeared first on The Daily Hodl.

The decision comes after a Jan. 8 filing by FTX’s lawyers, who argued that public disclosure could create an undue risk of identity theft or unlawful injury to FTX creditors.

The names of up to nine million FTX customers are set to remain confidential for at least three more months following the latest ruling in FTX bankruptcy proceedings.

The decision was reportedly made by Judge John Dorsey in the Delaware-based bankruptcy court on Jan. 11 in response to a 168-page filing by FTX on Jan. 8, which requested the court to withhold confidential customer information.

Judge Dorsey said that he remains “reluctant at this point” to disclose the confidential information, as it may put creditors “at risk,” despite increased pressure from several media outlets:

“We’re talking about individuals here who are not present – individuals who may be at risk if their name and information is disclosed.”

Days earlier, FTX lawyers argued “that disclosure of the information would create an undue risk of identity theft or unlawful injury to the individual or the individual’s property” and that the court should use its “broad discretion” under the U.S. Bankruptcy Code to protect those affected by FTX’s collapse.

In late December, a group of non-U.S. FTX customers also pushed the Delaware bankruptcy court to keep customer information private, arguing in a Dec. 28 joinder filing that public disclosure would cause “irreparable harm.”

Judge Dorsey’s decision does however run contrary to most bankruptcy proceedings where creditor information is disclosed — which is what happened in cryptocurrency lender Celsius’ bankruptcy proceedings in October.

Related: Getting funds out of FTX could take years or even decades: Lawyers

The Delaware-based bankruptcy court hasn’t been as kind to FTX equity holders, having released a Jan. 9 document that disclosed the investors expected to be wiped out and the number of shares they held with FTX.

Among those included NFL legend and former FTX brand ambassador Tom Brady, his ex-wife Gisele Bündchen, tech entrepreneur Peter Thiel and Shark Tank investor Kevin O’Leary.

It appears that progress is being made though, with FTX reported to have already recovered $5 billion in cash and cryptocurrency, FTX attorney Andy Dietderich said in a Jan. 11 statement.

According to early bankruptcy filings in November, more than 1 million creditors were speculated to be involved, with $3 billion being owed to the 50 largest creditors alone.

Sam Bankman-Fried, Do Kwon and Alex Mashinsky might look back on this year and wish they had hired a social media adviser or logged off Twitter.

To put it lightly, it has been a wild year for the crypto sector.

In the span of less than 12 months, the third-most valuable stablecoin imploded, leading to a domino effect that saw crypto lender Celsius go bankrupt, Three Arrows Capital’s founders go runabout and one of crypto’s most “altruistic” executives flown home in cuffs.

In this article, Cointelegraph has selected 10 crypto-related tweets that have aged like spoilt milk.

On May 10, just as the algo-stablecoin formerly known as TerraUSD started to fall below its dollar peg, the Terraform Labs founder attempted to allay fears of a further depeg, tweeting: “Deploying more capital - steady lads.”

Well, we all know what happened after. The collapse of the Terra ecosystem in May 2022 saw more than $40 billion wiped from the market in that month alone.

Deploying more capital - steady lads

— Do Kwon (@stablekwon) May 9, 2022

Since then, Do Kwon and the remaining Terra community have tried to revive the project with a newer stablecoin coming into the works. TerraUSD has since been rebranded to TerraClassicUSD (USTC) and is worth $0.02 at the time of writing.

Next on the list is Kwon’s famous response to crypto trader Algod, who outlined on March 9 that if LUNA “breaks new ATH’s I will short it with size. It’s a big ass ponzi, pretty sure VC’s will also hedge their investments on perps.”

Kwon then hit back by essentially calling Algod poor, stating, “Yeah but your size is not size” before adding, “$10 short incoming, everyone take cover.”

Yeah but your size is not size

— Do Kwon (@stablekwon) March 9, 2022

This of course was memed back to Kwon on many occasions during and after he went into damage control mode as TerraUSD spiraled out of control.

Sam Bankman-Fried (SBF) has a near-endless amount of statements that likely look terrible in current circumstances. Not only has he lied about “assets are fine” but shortly before his company filed for bankruptcy, the FTX founder also left us with the $3 Solana (SOL) meme.

In a debate on Twitter from January, crypto trader CoinMamba got under SBF’s skin in January 2021, suggesting that SOL was a great shorting opportunity over the price of $3.

After a back in forth in which the two were trying to iron out a bet on the future price, SBF finally had enough of CoinMamba’s SOL taunting and said:

“I’ll buy as much SOL as you have, right now, at $3. Sell me all you want. Then go fuck off.”

The comment became legendary in the crypto community, particularly after the price of SOL went to an all-time high of $259.96 on Nov. 6, 2021.

However, CoinMamba appears to have had the last laugh, as Bankman-Fried’s firm catastrophically collapsed a year later.

I'll buy everything you have, right now, at $3.

— CoinMamba (@coinmamba) November 11, 2022

Sell me all you want.

Then go fuck off. pic.twitter.com/f1eJjqNKIk

Replying to the nearly two-year-old thread, CoinMamba gave Bankman-Fried a taste of his own medicine. “I’ll buy everything you have, right now, at $3. Sell me all you want. Then go fuck off.”

Amid the LUNA fiasco in May, rumors started to float that Celsius was having liquidity issues and could be heading for serious trouble, while others had claimed the firm had already been “completely wiped out.”

In a bid to quickly assure Celsius customers, Mashinsky responded to the rumors by stating in a May 12 tweet: “Notwithstanding the extreme market volatility, Celsius has not experienced any significant losses,” adding:

“All funds are safe.”

These four words went on to become a harbinger of doom for the industry.

A month later, on June 12, the firm paused all withdrawals. On July 13, it filed for Chapter 11 bankruptcy. Users are still battling to get even a portion of their funds back as we speak.

— Make it a quote (@MakeItAQuote) August 6, 2022

Accompanying Mashinsky is a classic from Celsius Network, in which the firm was touting the whole “unbank yourself” catchphrase. The crypto lender often suggested it was more trustworthy than the banking system.

In a Nov. 14 tweet from 2019, Celsius Network tweeted, “If you don’t have free and unlimited access to your own funds, are they really *your* funds?” before adding:

“#UnbankYourself with Celsius and join the next generation of financial services — no fees, no penalties, no lockups, just profit.”

That statement hasn’t fared too well in 2022.

Amid its Chapter 11 bankruptcy process, users have had zero access to their locked-up funds, while profits are in doubt, too, considering they might not get all the funds back.

If you don't have free and unlimited access to your own funds, are they really *your* funds?#UnbankYourself with Celsius and join the next generation of financial services - no fees, no penalties, no lockups, just profit https://t.co/Qsrcu9hmhu

— Celsius (@CelsiusNetwork) November 14, 2019

Following a similar line to Celsius and Mashinky, fellow bankrupted crypto lender Voyager published a lengthy Twitter thread in June, which now looks a bit out of place as 2022 comes to a close.

In an attempt to assure customers that the company was safe during the bear market following the collapse of the Terra ecosystem, Voyager assured customers it carefully manages “risk” and its mission is to “make crypto as simple as safe as possible.”

“Our straightforward, low-risk approach to asset management is the result of our decades of experience leading companies through market cycles. We have the experience to back our decisions and weather any bear market.”

Over the next couple of weeks, it was widely reported that the company was facing liquidity issues, and by July 5, Voyager had filed for bankruptcy.

(2/4) We manage risk and prioritize the security of customer funds first and foremost. We keep things simple. No DeFi lending activities, no algorithmic stablecoin staking or lending, no derivative assets, and certainly no stETH.

— Voyager (@investvoyager) June 14, 2022

Next in line is a tweet dating back to 2018 from fintech news outlet TechCrunch that reads: “The collapse of ETH is inevitable.”

The tweet is accompanied by an extremely bearish article in which the author, Jeremy Rubin, predicts that “ETH — the asset, not the Ethereum Network itself — will go to zero.”

Rubin, who disclosed at the end of the article that he was a Bitcoin (BTC) and Litecoin (LTC) hodler at the time, bizarrely suggests that if the Ethereum network completes everything on its roadmap, no one will have any use for the asset.

The collapse of ETH is inevitable https://t.co/NxsCPbaO8Z pic.twitter.com/YYPYm7jnSh

— TechCrunch (@TechCrunch) September 2, 2018

At the time of writing, however, Ether (ETH) sits at $1,196 and presents a host of reasons for people to want to hold it: staking rewards, borrowing, lending and deflationary tokenomics.

Additionally, it also serves utility purposes, such as pushing through transactions on the largest smart contract network on the market.

Avraham Eisenberg, the crypto trader behind the $110-million exploit of decentralized exchange Mango Markets, makes the list due to a tweet from October that looks terrible in current circumstances.

The tweet itself revolves around a rather harmless back-and-forth regarding Eisenberg’s incorrect use of the @inversebrah tag, with Sheik Swampert noting, “You don’t call inversebrah on yourself dude.”

In response, Eisenberg said, “What are you gonna do, arrest me?”

RIP BOZO pic.twitter.com/8peCRwVR6x

— Sheikh Swampert ️ (@sheikhswampert) December 27, 2022

As of this week, Eisenberg has actually been arrested and is facing market manipulation charges over the Mango Markets exploit, which he had consistently maintained was “a highly profitable trading strategy” facilitated via “legal open market actions.”

As such, this tweet has fast become a popular meme that will most likely live on for a long time in Crypto Twitter folklore.

American business magazine Fortune has also got itself on this list for speaking in glowing terms of SBF back in August.

In a Twitter thread, the publication labeled him the “de facto leader of the crypto community” before suggesting that he was the “next Warren Buffet, Crypto’s white knight” and “Prince of risk.”

2) Some say SBF is the:

— FORTUNE (@FortuneMagazine) August 1, 2022

Next Warren Buffet

Crypto’s white knight

Prince of risk

Shark Tank’s Kevin O’Leary, also known as Mr. Wonderful, makes the list for his backing of FTX and its former CEO, Sam Bankman-Fried.

O’Leary’s now-deleted tweet came on Aug. 10, 2021, after he signed a deal to become an FTX spokesperson. In the tweet, he emphasized:

“Finally solved my compliance problems with #cryptocurrencies I’m going to use FTX to increase my allocation and use the platform to manage my portfolios.”

Unfortunately for O’Leary, FTX was anything but compliant, and the millionaire said he has likely lost the entire $15 million he was paid to be FTX’s spokesperson after taxes, agent fees and all the crypto he kept on the exchange was lost after the firm’s bankruptcy.

Shark Tank star Kevin O’Leary’s Twitter account was hacked Thursday and used to promote a bitcoin and ethereum giveaway scam. The scammers claimed that Mr. Wonderful is giving away 5,000 bitcoin and 15,000 ether, and anyone can participate. Kevin O’Leary’s ‘Fake’ Bitcoin and Ether Giveaways The official Twitter account for Shark Tank star Kevin O’Leary, […]

Shark Tank star Kevin O’Leary’s Twitter account was hacked Thursday and used to promote a bitcoin and ethereum giveaway scam. The scammers claimed that Mr. Wonderful is giving away 5,000 bitcoin and 15,000 ether, and anyone can participate. Kevin O’Leary’s ‘Fake’ Bitcoin and Ether Giveaways The official Twitter account for Shark Tank star Kevin O’Leary, […] Shark Tank star Kevin O’Leary, aka Mr. Wonderful, has defended his support of the collapsed crypto exchange FTX and its former CEO Sam Bankman-Fried (SBF). “This is America. The justice system provides the presumption of innocence unless proven otherwise,” he stressed. O’Leary also denied the accusation by Binance CEO Changpeng Zhao (CZ) that he perjured […]

Shark Tank star Kevin O’Leary, aka Mr. Wonderful, has defended his support of the collapsed crypto exchange FTX and its former CEO Sam Bankman-Fried (SBF). “This is America. The justice system provides the presumption of innocence unless proven otherwise,” he stressed. O’Leary also denied the accusation by Binance CEO Changpeng Zhao (CZ) that he perjured […]