Following the cyber breach of non-sensitive data, bankrupt cryptocurrency exchange FTX has reactivated account access to its customer claims portal.

Bankrupt cryptocurrency exchange FTX has restored its customer claims portal, which was previously shut down due to a cyber attack. Claimants can now continue to submit asset claims they held on the exchange prior to it becoming insolvent.

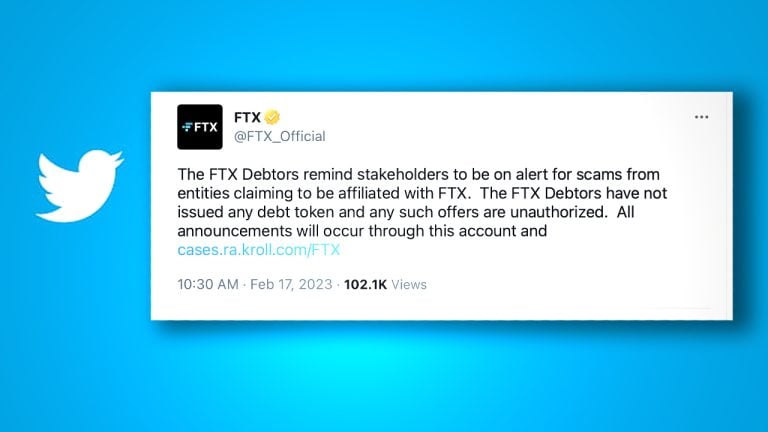

On September 16, FTX made a statement on X (formerly Twitter), confirming that none of its systems were affected by the cyber breach involving its appointed bankruptcy claims agent, Kroll.

FTX provided the following update regarding the recent Kroll cybersecurity incident. Claimants may now resume activities on our platform: https://t.co/DkYi2hDLbI. pic.twitter.com/Nfob4QQxjv

— FTX (@FTX_Official) September 16, 2023

It declared that account holders of the now-defunct crypto exchange can now access to their accounts and proceed with the bankruptcy claims process for digital assets they held on the exchange prior to it declaring bankruptcy in November 2022.

The claims portal allows customers who had accounts with FTX, FTX US, Blockfolio, FTX EU, FTX Japan and Liquid submit claims as part of the company's restructuring.

On September 11, Cointelegraph reported that approximately 36,075 customer claims, worth $16 billion have been filed against FTX and FTX US, and 10% of those have been agreed on.

Related: FTX claims portal becomes unavailable shortly after going live

It was further noted that 2,300 non-customer claims have been filed against the entity, worth $65 billion, including those from Genesis, Celsius and Voyager.

FTX asserted that freezing the accounts was a precautionary step and has stated it has introduced additional security measures.

No FTX systems were impacted by the Kroll incident, and freezing accounts was a precautionary measure.

This comes after numerous reports of issues with the claims portal in recent times.

On Aug. 27, FTX declared a temporary suspension of accounts for affected users who accessed its claims portal after the cybersecurity attack against Kroll was disclosed.

However, users could still submit a proof-of-claim through Kroll's online customer form and by mail.

The breach allegedly exposed non-sensitive customer data of specific claimants. At the time, FTX said it was overseeing the situation, assuring that account passwords, systems and funds remain unaffected.

The customer claims portal was launched on July 11 but went offline for unknown reasons after only one hour.

In related news, The Delaware Bankruptcy Court has recently granted approval for the sale of FTX's digital assets.

On Sept. 13, Judge John Dorsey issued a ruling permitting FTX will be allowed to sell off assets in weekly batches, with strict conditions, through an investment advisor. The initial week will have a limit of $50 million, followed by $100 million in subsequent weeks.

However, FTX is currently prohibited from selling its Bitcoin (BTC), Ethereum (ETH), and "certain insider-affiliated tokens." Any potential sales of these assets require a separate decision by FTX, following a 10 days' notice to the committees and U.S. Trustee.

Magazine: Deposit risk: What do crypto exchanges really do with your money?