The November 2022 Alameda gap exposed vulnerabilities in the crypto market, shedding light on FTX and Alameda Research’s fraud.

FTX collapse: Unraveling the cryptocurrency crisis of November 2022

In November 2022, the cryptocurrency world was rocked by the collapse of FTX, one of the largest cryptocurrency exchanges. The collapse was triggered by a liquidity crisis at FTX, which was caused by a combination of factors, including mismanagement of customer funds and risky trading practices by FTX’s sister company, Alameda Research.

The collapse of FTX had a ripple effect across the crypto market, causing a sharp decline in cryptocurrency prices, a drain of liquidity and a loss of confidence in the crypto industry. It also raised serious questions about the safety and security of customer funds on cryptocurrency exchanges. The crypto industry’s lack of risk management standards was exposed through the crisis.

FTX has filed for bankruptcy, revealing a debt of over $3 billion to its creditors. Additionally, the exchange is unable to locate approximately $8.9 billion worth of customer assets. The exact amount of money lost by customers is difficult to determine, as some customers may have been able to withdraw their funds before the exchange suspended withdrawals. However, it is estimated that customers lost billions of dollars in the FTX crash.

The collapse of FTX caused a sharp decline in cryptocurrency prices. The total market capitalization of the crypto market fell from over $1 trillion in November 2022 to under $800 billion in December 2022. This represents a market collapse of over $200 billion in dollar terms.

Sam Bankman-Fried’s strategic path

SBF saw an opportunity to create wealth at an unparalleled pace by combining the ICO method of token creation and subsequent leveraging.

SBF saw an opportunity to profit by creating a new cryptocurrency exchange that would exploit the shortcomings of existing exchanges. Bankman-Fried began by setting up a quantitative trading firm called Alameda Research.

Alameda Research used sophisticated algorithms to trade cryptocurrencies on a variety of exchanges. Alameda Research was very successful, and it quickly became one of the largest cryptocurrency traders in the world.

In 2019, Bankman-Fried launched FTX, a cryptocurrency exchange designed to be more user-friendly and efficient than existing exchanges. FTX also offered a number of features that were not available on other exchanges, such as margin trading and derivatives trading. However, none of the regulatory controls typically needed by mainstream financial services trading platforms were addressed.

Relationship between FTX and Alameda Research

FTX and Alameda Research were closely linked. Bankman-Fried and Caroline Ellison were the CEOs of FTX and Alameda Research respectively. However, Bankman-Fried controlled a majority of the shares in both companies. Alameda Research also used FTX as its primary exchange.

The close relationship between FTX and Alameda Research allowed Bankman-Fried to engage in a variety of fraudulent activities, including:

- Misappropriating customer funds: Bankman-Fried transferred customer funds from FTX to Alameda Research without the customer’s consent. He used these funds to cover Alameda Research’s losses and to fund his own lavish lifestyle.

- Manipulating the cryptocurrency market: Alameda Research used its large trading volume to manipulate the prices of cryptocurrencies on FTX. This allowed Bankman-Fried to profit from insider trading.

- Offering fraudulent financial products: FTX, under Bankman-Fried’s leadership, offered unregulated financial products like margin and derivatives trading. This lack of oversight allowed him to defraud customers by selling these products without disclosing the associated risks.

FTX scam and Alameda gap unveiled

The scam began to unravel in November 2022 when it was revealed that Alameda Research held a large position in FTT, the native token of FTX.

The report sparked a sell-off of FTX Token (FTT), which caused the token’s price to plummet. It also raised concerns about the financial health of Alameda Research and FTX. This led to a liquidity crisis at FTX, as customers rushed to withdraw their funds from the exchange.

FTX was unable to meet the withdrawal demands, and it was forced to suspend withdrawals. FTX also filed for bankruptcy on Nov. 11, 2022. The collapse of FTX had a devastating impact on the crypto market.

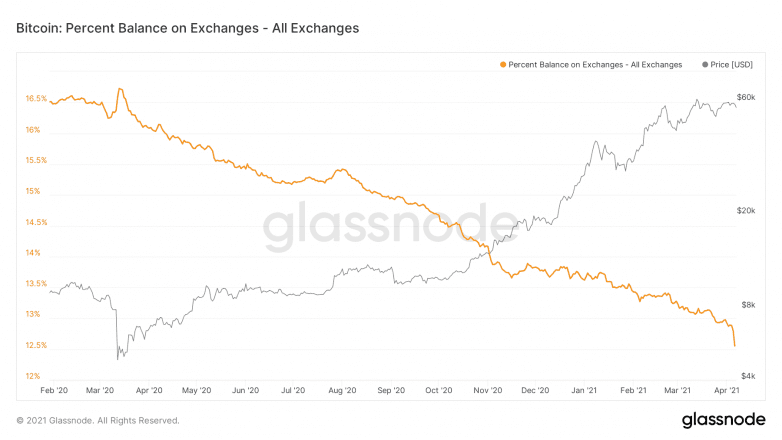

In November, a significant decrease in liquidity within the crypto market was coined as the “Alameda gap” by blockchain data firm Kaiko. This term emerged due to the notable role played by Alameda Research, the largest market maker during that period.

The Alameda Gap represented a substantial decline in available liquidity, impacting trading volumes and market stability. This phenomenon underscored the influence of major market participants and highlighted the intricate dynamics that govern cryptocurrency markets.

While the FTX episode may have been the last domino to fall in a series of bankruptcies that were filed during 2022, it was easily the biggest event of the year, and it put the industry under a legal and regulatory microscope.

The Bankman-Fried trial

SBF was arrested in the Bahamas on Dec. 12, 2022, after United States prosecutors filed criminal charges against him. He was extradited to the U.S. in January 2023 and went on trial in October 2023.

The arrest and trial of SBF was a major development in the crypto industry. It was the first time that a major crypto founder had been arrested and tried on criminal charges. Bankman-Fried was charged with seven counts of fraud and conspiracy.

The key witnesses for the prosecution were:

- Caroline Ellison, Bankman-Fried’s ex-girlfriend and the former CEO of Alameda Research

- Nishad Singh, former FTX engineering director

- Gary Wang, co-founder of FTX

Ellison, Singh and Wang all pleaded guilty to multiple charges and cooperated with the prosecution. They testified that Bankman-Fried knowingly misled investors and customers about the financial health of FTX and Alameda Research. They also testified that Bankman-Fried used FTX customer funds to cover losses at Alameda Research and to fund his own lavish lifestyle.

Bankman-Fried was found guilty of all seven charges on Nov. 2, 2023. He faces a maximum of 115 years in prison. Bankman-Fried denied all of the charges against him. He said that he made mistakes but that he did not commit any crimes.

Post-FTX reforms in the cryptocurrency industry

There is often a silver lining with black swan events. A black swan event is one that is impossible to predict and has severe consequences. In the wake of the FTX and Alameda Research scam, several things have gained momentum, and the industry has focused on getting itself regulated. Across the world, regulators and crypto firms have worked collaboratively and consciously to protect investors.

The following are some notable developments in the crypto industry post the FTX crisis:

- Increased regulation: Governments worldwide have started to develop and implement comprehensive regulations for the crypto industry. These regulations would focus on protecting investors and preventing fraud.

- Transparency: Cryptocurrency exchanges have come forward and offered transparency around their operations and financial condition through proper documentation and risk management practices. This helps investors make informed decisions about where to invest their money.

- Audits: Cryptocurrency exchanges are being regularly audited by independent auditors. This helps to ensure that the exchanges are operating honestly and that customer funds are safe.

Investors also need to be vigilant and do their own research before participating in any cryptocurrency exchange-related activities. Investors should look for exchanges that are regulated, transparent and have a good reputation.