The Department of Justice (DOJ) and the Federal Bureau of Investigation (FBI) are reportedly investigating the collapse of the algorithmic stablecoin terra usd (UST) and the firm Terraform Labs. Unnamed sources say that former staff members from Terraform Labs, the company behind the Terra blockchain project, have been questioned by U.S. law enforcement. Unusual Relationship: […]

The Department of Justice (DOJ) and the Federal Bureau of Investigation (FBI) are reportedly investigating the collapse of the algorithmic stablecoin terra usd (UST) and the firm Terraform Labs. Unnamed sources say that former staff members from Terraform Labs, the company behind the Terra blockchain project, have been questioned by U.S. law enforcement. Unusual Relationship: […]

The incredible LUNA rally took place amid a flurry of positive and negative events while technicals suggest a correction is coming.

Terra has become a controversial blockchain project after the collapse of its native token LUNA and stablecoin TerraUSD (UST) in May. But its recent gains are hard to ignore for cryptocurrency traders.

After crashing to nearly zero in May, LUNA is now trading for around $6, a whopping 17,559,000% price rally in less than four months when measured from its lowest level.

Meanwhile, LUNA's performance in September is particularly interesting, given it has rallied by more than 300% month-to-date after a long period of sideways consolidation.

It is vital to note that LUNA also trades with the ticker LUNA2 across multiple exchanges.

In detail, Terraform Labs, the firm behind the Terra project, divided the old chain into Terra Classic (LUNC) and Terra LUNA 2.0 (LUNA/LUNA2).

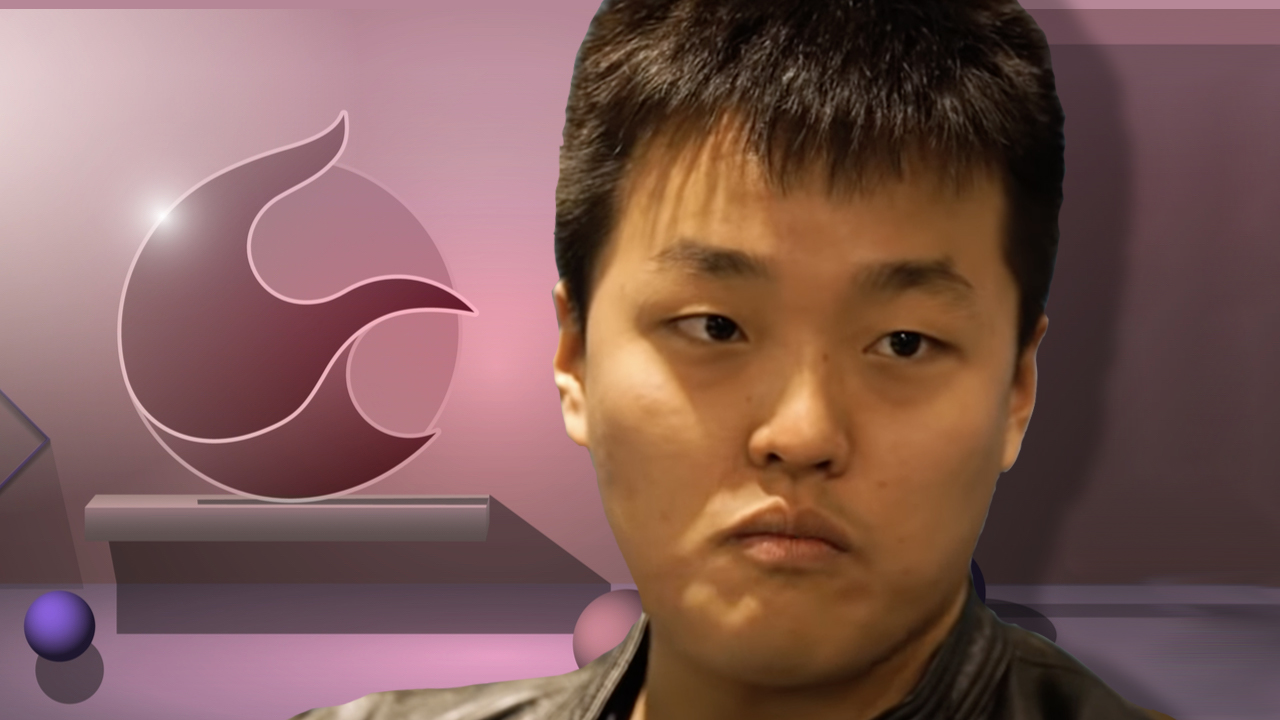

Related: Do Kwon reportedly hires lawyers in S. Korea to prepare for Terra investigation

Terra Classic is the original version of the Terra blockchain, while Terra LUNA 2.0 was created as a part of a regeneration strategy by Terraform Labs founder Do Kwon. In doing so, Kwon and his team periodically airdrop the LUNA2 tokens to users affected by Terra's collapse.

LUNA/LUNA2 started pumping on Sep. 9, the day on which many things happened inside the Terra ecosystem.

First, Terra Classic (LUNC) passed governance proposals to add a 1.2% tax on all its on-chain transactions on the day. In other words, the proposals will permanently remove 1.2% of the LUNC supply from each on-chain transaction, as Cointelegraph covered here.

Terra Luna Classic (#LUNC) skyrockets >37,000% since its bottom after the Terra collapse

— Hailey LUNC ✳️ (@TheMoonHailey) September 7, 2022

This comes after a proposal to implement a 1.2% token burn tax on all transactions that will enable $LUNC to become a deflationary cryptocurrency.#LUNC ✨ #HaileyLUNC ✨ $LUNC ✨ pic.twitter.com/oIxI7tqVkW

Second, a self-proclaimed Terra whistleblower, FatMan, reported a suspicious transaction worth 435,000 LUNA2 tokens to Binance, alleging that the sender is TerraForm Labs.

“Was eating lunch [and] saw LUNA2 pump. Checked the TFL Dawn wallet. Sure enough, after months of farming rewards with the airdrop they claim they never received, they sent all 435K available LUNA 2 to Binance just days ago. That’s just one address."

.@clayop tallied up the numbers - TFL sent a total of $3.9 billion USD (in UST) to exchanges including Binance and KuCoin.

— FatMan (@FatManTerra) September 9, 2022

Let the enormity of that figure sink in, and consider how many people's savings that is added up. Crypto's biggest fraud.

No explanation from @stablekwon https://t.co/qc2kCFPMHW

However, Do Kwon dismissed the allegations.

The Sep. 9 pump also occurred a week after Terra passed the proposal to conduct its second airdrop of over 19 million LUNA tokens until Oct. 4.

From a technical perspective, LUNA's price risks undergoing a massive correction in the coming days.

Firstly, on the four-hour chart, the token's relative strength index (RSI) has jumped above 70, which is considered overbought territory where a correction becomes more likely. Secondly, the price has been forming a rising wedge, a bearish reversal pattern, since Sep. 9.

Notably, a rising wedge forms when the price trends higher inside an ascending range whose upper and lower trendlines converge toward one another. It resolves after the price breaks below the lower trendline together with a rise in trading volume.

As of Sep. 11, LUNA was testing its wedge's lower trendline for a potential breakdown move. In this case, the price will risk falling by as much as the wedge's maximum height.

In other words, LUNA could drop to $4.5, down 30% from today's price.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

While digital currencies jumped in value during the early morning trading sessions on Friday (ET), the new Terra token, LUNA 2.0, jumped more than 200% in value against the U.S. dollar. LUNA jumped from a low of $1.90 per unit to a high of $6.87, but the token’s value has slipped to the $5.41 per […]

While digital currencies jumped in value during the early morning trading sessions on Friday (ET), the new Terra token, LUNA 2.0, jumped more than 200% in value against the U.S. dollar. LUNA jumped from a low of $1.90 per unit to a high of $6.87, but the token’s value has slipped to the $5.41 per […] During the last 24 hours, crypto asset prices have improved as the global cryptocurrency market capitalization today has risen 1.9% to $1.07 trillion. Interestingly, the two so-called ‘defeated’ Terra blockchain tokens, now called terraclassicusd (USTC) and luna classic (LUNC), have seen significant gains. LUNC has climbed 8% higher during the past 24 hours and the […]

During the last 24 hours, crypto asset prices have improved as the global cryptocurrency market capitalization today has risen 1.9% to $1.07 trillion. Interestingly, the two so-called ‘defeated’ Terra blockchain tokens, now called terraclassicusd (USTC) and luna classic (LUNC), have seen significant gains. LUNC has climbed 8% higher during the past 24 hours and the […] While most of the crypto economy’s digital assets have seen significant gains this month, Terra’s luna 2.0 has been stagnant as it has shed 24.37% against bitcoin during the last 30 days. LUNA is down 89.8% from the token’s all-time price high two months ago on May 28. Moreover, the whistleblower Fatman has revealed that […]

While most of the crypto economy’s digital assets have seen significant gains this month, Terra’s luna 2.0 has been stagnant as it has shed 24.37% against bitcoin during the last 30 days. LUNA is down 89.8% from the token’s all-time price high two months ago on May 28. Moreover, the whistleblower Fatman has revealed that […] After the downfall of the two most popular crypto assets on the Terra blockchain, the digital currencies terrausd (UST) and luna classic (LUNC) increased a great deal in value against the U.S. dollar in recent times. During the last seven days, LUNC has risen 96.3% and the once-stable coin UST has increased 472.4% this week. […]

After the downfall of the two most popular crypto assets on the Terra blockchain, the digital currencies terrausd (UST) and luna classic (LUNC) increased a great deal in value against the U.S. dollar in recent times. During the last seven days, LUNC has risen 96.3% and the once-stable coin UST has increased 472.4% this week. […]

The USTC price rally does not mean it would reclaim its lost U.S. dollar peg in the future.

Terra's $40-billion experiment to create a functional "algorithmic stablecoin" project has failed drastically following its collapse in May.

Nonetheless, its native stablecoin TerraClassicUSD (USTC), earlier called TerraUSD (UST), has been thriving in the past week.

To recap, UST lost its U.S. dollar peg in May following mass withdrawals from Anchor Protocol, a lending and borrowing platform offering up to 20% yield to clients on their UST deposits. As of June 15, the token was almost worthless, trading at $0.005 at the Kraken crypto exchange.

But USTC started recovering afterward, insomuch that its value per token almost reached $0.10 on June 29. Simultaneously, its capitalization surged from $65 million to $767 million in the same period, according to data from CoinMarketCap.

That is despite USTC operating as an abandoned token after Terra launched a new blockchain with a new native asset LUNA 2.0, following a "hard fork" in May.

Interestingly, LUNA 2.0's older version, called LUNA, which now operates under the name "Terra Classic (LUNC), has also witnessed a spike in its market valuation like USTC, surging from around $160 million to $767 million in June.

According to CoinMarketCap, more than 45% of trading volume behind USTC and LUNC's surprising price boom has originated from KuCoin, a centralized exchange platform reportedly operating from Seychelles.

KuCoin's lead backer is NEO Global Capital, a Singapore-based venture capital firm also exposed to financial platforms like Babel Finance and CoinFLEX. Both platforms have been facing liquidity troubles due to the ongoing crypto market decline.

"This isn't a boom, bust and boom again cycle," warned InvestmentU, a financial analytics group in its June 28 note, saying that LUNC could decline massively because "the tech behind it is dead."

"Its (LUNC) raison d'etre has been vanquished. And so has its price. While we can appreciate investors' natural desires for outsized gains, there are better ways to go about it than this."

Related: Terra's LUNA2 skyrockets 70% in nine days despite persistent sell-off risks

The outlook appears the same for USTC, which has failed to perform its main function, i.e. providing clients a digital, stable version of the U.S. dollar.

This is a game for whales Dump Next Time ☝️ all newcomers Lose Money

— Crypto Bull (@_Crypto_Bull) June 29, 2022

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

During a recent interview with the Wall Street Journal (WSJ), Terraform Labs (TFL) founder Do Kwon said he was “devastated” by the LUNA and UST implosion that took place in mid-May. He told the WSJ that he was probably a billionaire when LUNA tapped an all-time high before the collapse, but lost a great portion […]

During a recent interview with the Wall Street Journal (WSJ), Terraform Labs (TFL) founder Do Kwon said he was “devastated” by the LUNA and UST implosion that took place in mid-May. He told the WSJ that he was probably a billionaire when LUNA tapped an all-time high before the collapse, but lost a great portion […] Terra’s new LUNA 2.0 token has lost 54% in value in the last two weeks, after reaching $11.33 per unit on May 30. Meanwhile, the whistleblower Fatman has accused Terra’s co-founder Do Kwon of cashing out $2.7 billion a few months before the UST de-pegging incident. Kwon, however, has been keeping tabs on Fatman’s accusations […]

Terra’s new LUNA 2.0 token has lost 54% in value in the last two weeks, after reaching $11.33 per unit on May 30. Meanwhile, the whistleblower Fatman has accused Terra’s co-founder Do Kwon of cashing out $2.7 billion a few months before the UST de-pegging incident. Kwon, however, has been keeping tabs on Fatman’s accusations […] After climbing to $11.33 per unit seven days ago on May 30, Terra’s new LUNA 2.0 token has lost more than 56% in value against the U.S. dollar. Amid the market performance, a number of former Terra-based decentralized finance (defi) projects are transitioning over to the new Phoenix-1 blockchain. In addition to the defi projects […]

After climbing to $11.33 per unit seven days ago on May 30, Terra’s new LUNA 2.0 token has lost more than 56% in value against the U.S. dollar. Amid the market performance, a number of former Terra-based decentralized finance (defi) projects are transitioning over to the new Phoenix-1 blockchain. In addition to the defi projects […]