The rise of the cryptocurrency market, with bitcoin leading the charge, from early November through December 2013 marked a defining chapter that thrust digital currencies into the global spotlight. A confluence of pivotal elements fueled this extraordinary growth, though many of the leading digital assets from that era have since faded into obscurity. Here, we […]

The rise of the cryptocurrency market, with bitcoin leading the charge, from early November through December 2013 marked a defining chapter that thrust digital currencies into the global spotlight. A confluence of pivotal elements fueled this extraordinary growth, though many of the leading digital assets from that era have since faded into obscurity. Here, we […] XRP price: $2.23, up 3.9% in the past 24 hours, with a market capitalization of $129.31 billion and a trading volume of $2.71 billion, as the cryptocurrency moved within an intraday range of $2.14 to $2.29. XRP On the 1-hour chart, XRP demonstrated a bullish trend as short-term momentum indicated continued buying pressure. The relative […]

XRP price: $2.23, up 3.9% in the past 24 hours, with a market capitalization of $129.31 billion and a trading volume of $2.71 billion, as the cryptocurrency moved within an intraday range of $2.14 to $2.29. XRP On the 1-hour chart, XRP demonstrated a bullish trend as short-term momentum indicated continued buying pressure. The relative […] Bitcoin plunges, panic spreads—former Binance CEO Changpeng Zhao (CZ) says only those who master risk and resilience will thrive in the relentless crypto market. Bitcoin’s Freefall: CZ’s Tough-Love Advice for Investors Who Can’t Handle the Heat Market volatility has once again sparked discussions among crypto investors, with Changpeng Zhao (CZ), the former CEO of crypto […]

Bitcoin plunges, panic spreads—former Binance CEO Changpeng Zhao (CZ) says only those who master risk and resilience will thrive in the relentless crypto market. Bitcoin’s Freefall: CZ’s Tough-Love Advice for Investors Who Can’t Handle the Heat Market volatility has once again sparked discussions among crypto investors, with Changpeng Zhao (CZ), the former CEO of crypto […] Bitcoin is trading at $84,926 to $85,125 over the last hour with a market capitalization of $1.68 trillion and a 24-hour trading volume of $39.79 billion, while the intraday price range has fluctuated between $83,232 and $86,517, signaling key technical levels that traders are closely monitoring. Bitcoin On the 1-hour chart, bitcoin (BTC) shows signs […]

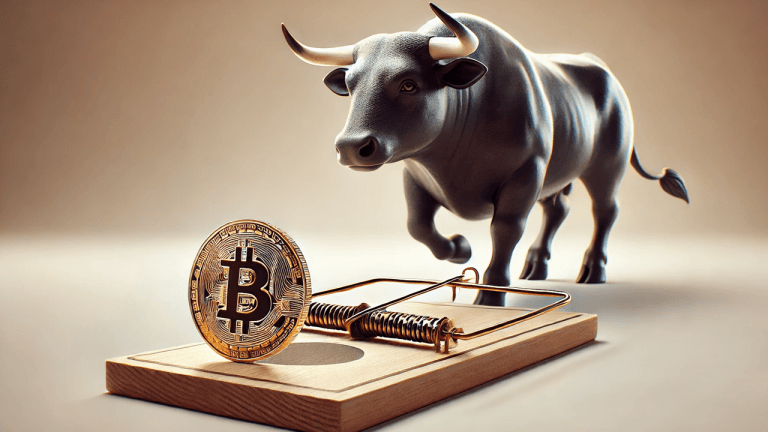

Bitcoin is trading at $84,926 to $85,125 over the last hour with a market capitalization of $1.68 trillion and a 24-hour trading volume of $39.79 billion, while the intraday price range has fluctuated between $83,232 and $86,517, signaling key technical levels that traders are closely monitoring. Bitcoin On the 1-hour chart, bitcoin (BTC) shows signs […] Bitcoin is currently priced at $83,779, with a market capitalization of $1.66 trillion and a 24-hour trading volume of $91.22 billion, as price action remains volatile within an intraday range of $78,197 to $84,854, potentially signaling a bull trap as technical indicators point to underlying weakness despite short-term rebounds. Bitcoin Recent price movement suggests bitcoin […]

Bitcoin is currently priced at $83,779, with a market capitalization of $1.66 trillion and a 24-hour trading volume of $91.22 billion, as price action remains volatile within an intraday range of $78,197 to $84,854, potentially signaling a bull trap as technical indicators point to underlying weakness despite short-term rebounds. Bitcoin Recent price movement suggests bitcoin […] Bitcoin (BTC) tumbled to an intraday low of $78,197 per coin early Friday, its sharpest descent in months. As of publication, the digital asset hovers listlessly below the $80,000 threshold at $79,875, signaling persistent bearish momentum. Crypto Carnage: Bitcoin Tumbles to Nov. 2024 Lows The leading cryptocurrency has shed 7% against the U.S. dollar today […]

Bitcoin (BTC) tumbled to an intraday low of $78,197 per coin early Friday, its sharpest descent in months. As of publication, the digital asset hovers listlessly below the $80,000 threshold at $79,875, signaling persistent bearish momentum. Crypto Carnage: Bitcoin Tumbles to Nov. 2024 Lows The leading cryptocurrency has shed 7% against the U.S. dollar today […]The decline in Bitcoin reflects broader market risk aversion, potentially signaling a shift in investor sentiment towards safer assets.

The post Bitcoin sinks under $80,000, faces potential drop to pre-election levels as correction continues appeared first on Crypto Briefing.

Bitcoin (BTC) saw a sharp plunge on Feb. 27, 2025, at 8:35 p.m. Eastern Time, dropping from around $84,000 to the $81,084 range in a matter of minutes on Bitstamp. The sudden move startled traders and triggered a wave of stop-loss orders, intensifying the rapid sell-off. Coinglass stats show $106 million in bitcoin longs were […]

Bitcoin (BTC) saw a sharp plunge on Feb. 27, 2025, at 8:35 p.m. Eastern Time, dropping from around $84,000 to the $81,084 range in a matter of minutes on Bitstamp. The sudden move startled traders and triggered a wave of stop-loss orders, intensifying the rapid sell-off. Coinglass stats show $106 million in bitcoin longs were […] As twilight falls on Thursday, Feb. 27, 2025, bitcoin danced just above $84,000, its movements a meandering ballet ahead of Friday’s opening sessions. Traders braced for a weekend tango between $82,000 and $89,000 per BTC, set against a backdrop of macroeconomic suspense with the current Trump administration. Futures Expiry and Political Winds Fuel Speculation At […]

As twilight falls on Thursday, Feb. 27, 2025, bitcoin danced just above $84,000, its movements a meandering ballet ahead of Friday’s opening sessions. Traders braced for a weekend tango between $82,000 and $89,000 per BTC, set against a backdrop of macroeconomic suspense with the current Trump administration. Futures Expiry and Political Winds Fuel Speculation At […] XRP is trading at $2.20 with a market capitalization of $127 billion, a 24-hour global trade volume of $5.43 billion, and an intraday price range between $2.16 and $2.27, indicating consolidation near key support levels as the cryptocurrency navigates a broader downtrend across multiple timeframes. XRP On the one-hour chart, XRP remains in a tight […]

XRP is trading at $2.20 with a market capitalization of $127 billion, a 24-hour global trade volume of $5.43 billion, and an intraday price range between $2.16 and $2.27, indicating consolidation near key support levels as the cryptocurrency navigates a broader downtrend across multiple timeframes. XRP On the one-hour chart, XRP remains in a tight […]