Digital currency markets have continued to slide downward in value as the crypto economy has dropped by 14% during the past 24 hours. Amid the market rout, the native Terra blockchain token LUNA has dropped to fresh new lows, slipping to $0.0156 per unit. Terra’s founder Do Kwon revealed a plan on Wednesday, but after […]

Digital currency markets have continued to slide downward in value as the crypto economy has dropped by 14% during the past 24 hours. Amid the market rout, the native Terra blockchain token LUNA has dropped to fresh new lows, slipping to $0.0156 per unit. Terra’s founder Do Kwon revealed a plan on Wednesday, but after […]

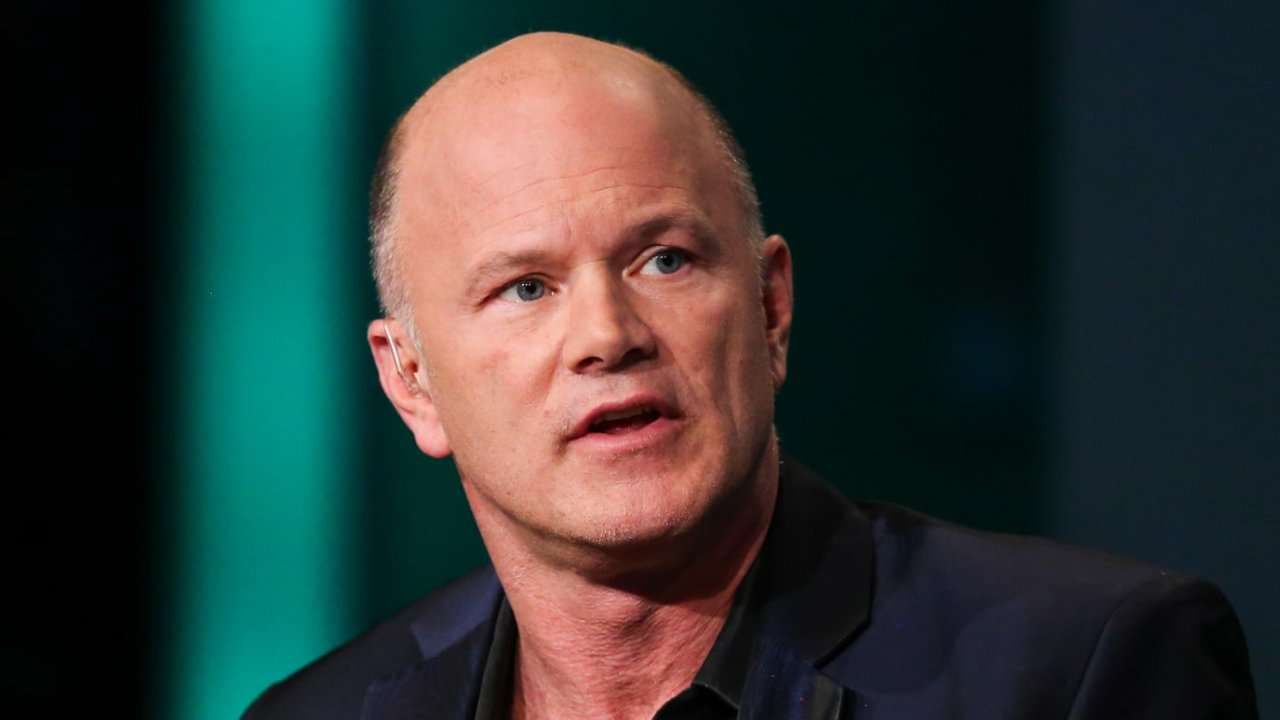

Galaxy Digital CEO and billionaire Mike Novogratz says he doesn’t think the crypto markets will bounce back any time soon. In the 2022 Galaxy Digital Q1 investor call, the CEO of the investment management firm says even though increased adoption from traditional finance firms has kept him optimistic about the crypto space overall, he’s not […]

The post Billionaire Mike Novogratz Warns Bitcoin and Crypto Carnage Far From Over appeared first on The Daily Hodl.

Bitcoin and altcoins declined sharply in the first quarter in a selloff that was partly triggered by a shift in central bank policy.

Cryptocurrency investment manager Galaxy Digital Holdings reported a sharp loss in the first quarter due to unrealized losses in its digital asset portfolio, underscoring heightened volatility in the digital asset sector in 2022.

Galaxy Digital reported a net comprehensive loss of $111.7 million in the quarter ending March 31, compared to a gain of $858.2 million in the same quarter of 2021, the company announced Monday. In addition to unrealized losses in its digital asset portfolio, Galaxy’s overall losses were also attributed to investments in its trading and investment businesses.

The firm did report aggregate profitability for its asset management, investment banking and mining operations. Investment banking and mining posted record revenue and net comprehensive income during the quarter.

Assets under management held by Galaxy Digital Asset Management declined 5% during the quarter to $2.7 billion.

Galaxy’s declining profitability in the first quarter reflected extreme volatility in the digital asset market as Bitcoin (BTC) and altcoins experienced multiple large drawdowns. The market appears to be entering a capitulation phase in May due to Bitcoin’s strong correlation with other risk-on assets.

Risk assets, including crypto, have nosedived ever since the United States Federal Reserve and other central banks decided to aggressively pursue rate hikes to combat soaring inflation. Last week, the Fed hiked interest rates by 50 basis points, marking the largest upward adjustment in over two decades.

Related: VC Roundup: Gaming, crypto fintech and blockchain infrastructure dominate venture capital rounds

Galaxy Digital, a crypto investment manager, founded by Mike Novogratz, is set to acquire institutional custodian service and wallet operator BitGo for $1.2 billion. https://t.co/QinaTE3PRE

— Cointelegraph (@Cointelegraph) May 5, 2021

Despite market volatility, crypto fund managers and venture capitalists continue to make large, strategic investments in the space. Galaxy plans to finalize its aquisition of BitGo later this year after first announcing its intent to buy the digital asset custodian in May 2021. Meanwhile, venture capital funding in crypto and blockchain projects reached a record high in the first quarter.

Investment management firm Galaxy Digital CEO Mike Novogratz says that while US markets will continue to dip lower amid economic concerns, the crypto industry has a bulwark that can eventually stop its bleeding. In a new interview with CNBC, the billionaire says that we’re experiencing a period of stagflation and that US markets will not […]

The post Galaxy Digital CEO Mike Novogratz Says Crypto Markets Have a ‘Backstop’ Amid Stagflation Concerns – Here’s Why appeared first on The Daily Hodl.

According to a recent report, a secretly held, invitation-only crypto gala took place in Beverly Hills called the “Medici LA 22” event. The exclusive cryptocurrency gathering took place under the radar, but the two-day meeting was reported on after “130 or so” attendees met. An Exclusive, Closed-Door Meeting Took Place in Beverly Hills With Wall […]

According to a recent report, a secretly held, invitation-only crypto gala took place in Beverly Hills called the “Medici LA 22” event. The exclusive cryptocurrency gathering took place under the radar, but the two-day meeting was reported on after “130 or so” attendees met. An Exclusive, Closed-Door Meeting Took Place in Beverly Hills With Wall […]

Galaxy Digital CEO Mike Novogratz is adjusting his Bitcoin (BTC) outlook as new players continue to enter the world of blockchain technology. In Galaxy Digital’s Q4 earnings call, the billionaire says that in light of continued industry innovation plus increased interest from the general investing public, he expects Bitcoin to exceed his previous 2022 price […]

The post Billionaire Mike Novogratz Says Bitcoin May Significantly Outperform His Earlier Targets for 2022 appeared first on The Daily Hodl.

The acquisition is scheduled to follow Galaxy's domestication in Delaware, which is expected to become effective between Q2 and Q4 of 2022.

Cryptocurrency investment firm Galaxy Digital has not managed to finalize the acquisition of the digital asset custodian BitGo in the first quarter of 2022 as the firm originally planned.

Galaxy Digital has made some changes to the terms of its acquisition of BitGo, CEO Mike Novogratz announced in an earnings call on Thursday.

“We’ve adjusted the deal some, for progress that BitGo has made,” Novogratz said, noting that BitGo has hired about 150 people since the firms originally signed the deal in May last year.

He added that Galaxy remains committed to “integrating BitGo and becoming an institutional crypto platform” and the companies will continue to work on integration.

According to an official statement, Galaxy Digital and BitGo have renegotiated the acquisition to happen “immediately following” the domestication of Galaxy Digital as a Delaware corporation. The domestication will become effective between Q2 and Q4 of 2022 and is subject to a review process with the United States Securities and Exchange Commission, the firm noted.

In case Galaxy fails to complete the transaction by the end of 2022, the firm undertakes to pay a fee significant fee, the statement reads:

“A reverse termination fee of $100 million will be payable by Galaxy Digital to BitGo in certain circumstances if the transaction has not been completed by December 31, 2022, subject to specific provisions.”

As previously reported by Cointelegraph, Galaxy was planning to close the BitGo acquisition by the end of Q1 2022, paying 33.8 million in newly issued Galaxy shares, or $1.2 billion, and additional $265 million in cash to settle the deal.

The new acquisition terms include 44.8 million newly issued shares and $265 million in cash, implying an aggregate transaction value of approximately $1,158 million based on Galaxy Digital’s closing price on March 30.

In conjunction with the BitGo acquisition, Galaxy also planned to go public in the U.S. in the first three months of 2022. The company previously debuted its first-ever listing on Toronto's TSX Venture Exchange in August 2018.

Galaxy shares significantly tumbled since the company announced the BitGo acquisition, dropping from about $30 to below $12 in January 2022. At the time of writing, the stock is trading at $17, down 14% over the past 24 hours, according to data from TradingView.

Related: Goldman Sachs completes first OTC crypto options trade with Galaxy

Galaxy also reported that its net comprehensive income increased 55% from around $336 million in Q3 2021 to $521 million in Q4 2021. At the same time, net comprehensive income is expected to be a loss of $110 million to $130 million, bringing the to approximately $2.45 billion, the firm added.

The company is known for posting significant losses several times in recent years. In Q2 2021, Galaxy posted a loss of nearly $176 million, with Novogratz stating that the company remained “significantly profitable” in the first half of 2021 as net comprehensive income totaled $684 million.

Billionaire Mike Novogratz says he is much more optimistic about the crypto market now than he was a month ago. He explained that bond sell-offs and increased crypto adoption have boosted the prices of cryptocurrencies, particularly bitcoin. “I think you are going to see the Democrats taking a softer stance,” he added. Mike Novogratz Expects […]

Billionaire Mike Novogratz says he is much more optimistic about the crypto market now than he was a month ago. He explained that bond sell-offs and increased crypto adoption have boosted the prices of cryptocurrencies, particularly bitcoin. “I think you are going to see the Democrats taking a softer stance,” he added. Mike Novogratz Expects […] On Monday, the multinational investment bank and financial services company Goldman Sachs disclosed it has conducted an over-the-counter (OTC) crypto transaction with the digital currency firm Galaxy Digital. Following the OTC settlement, the head of digital assets for Goldman Sachs’ Asia Pacific unit, Max Minton, said the firm was pleased to have executed the bank’s […]

On Monday, the multinational investment bank and financial services company Goldman Sachs disclosed it has conducted an over-the-counter (OTC) crypto transaction with the digital currency firm Galaxy Digital. Following the OTC settlement, the head of digital assets for Goldman Sachs’ Asia Pacific unit, Max Minton, said the firm was pleased to have executed the bank’s […]