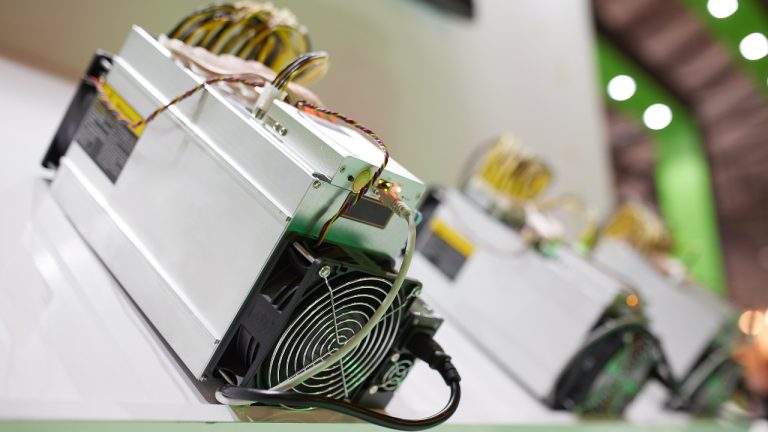

Compass Mining, a bitcoin mining firm, published a blog post stating that Bitmain, the company behind the application-specific integrated circuit (ASIC) mining rig, has made changes to its design. The post advised miners to be aware of the changes as Compass Mining identified “three issues” with two different Antminer S19 series mining devices. Bitcoin Miner […]

Compass Mining, a bitcoin mining firm, published a blog post stating that Bitmain, the company behind the application-specific integrated circuit (ASIC) mining rig, has made changes to its design. The post advised miners to be aware of the changes as Compass Mining identified “three issues” with two different Antminer S19 series mining devices. Bitcoin Miner […] Two residents of the Russian city of Tomsk will be tried for “large-scale robbery” involving the theft of cryptocurrency worth millions of rubles from a local miner. The digital coins were stolen from the owner at gunpoint, authorities said, adding that both criminals are now in custody. Thieves Face Trial in Russia for Armed Robbery […]

Two residents of the Russian city of Tomsk will be tried for “large-scale robbery” involving the theft of cryptocurrency worth millions of rubles from a local miner. The digital coins were stolen from the owner at gunpoint, authorities said, adding that both criminals are now in custody. Thieves Face Trial in Russia for Armed Robbery […]

While the Senator did not expand on other details of the upcoming bill, she suggested that DeFi should not be exempt from AML laws.

A bi-partisan anti-money laundering (AML) bill that covers “decentralized entities” such as decentralized finance (DeFi) protocols and DAOs will soon be reintroduced to Congress, according to United States Senator Elizabeth Warren.

Warren, a vocal crypto critic, argued at the Feb. 14 Senate Banking Committee’s hearing entitled “Crypto Crash: Why Financial System Safeguards are Needed for Digital Assets” that the crypto community wants decentralized entities running on code to be exempt from AML requirements:

“In other words, they want a giant loophole for DeFi written into the law so they can launder money whenever a drug lord or a terrorist pays them to do so.”

Due to this, Warren said she would re-introduce the Digital Asset Anti-Money Laundering Act of 2022 that she first introduced on Dec. 15, 2022. It was read twice before being referred to the Senate Banking Committee and has received no further traction since.

If legislated as it was, the seven-page bill would have prohibited financial institutions from using digital asset mixers such as Tornado Cash, which are designed to obscure blockchain data.

It also would have resulted in unhosted wallets, miners, and validators being required to write and implement AML policies.

The Senator noted current AML laws “don’t cover big parts of the crypto industry,” and claimed crypto exchange ShapeShift took advantage of the lack of regulation when it restructured itself as a DeFi platform in July 2021, adding:

“They said we're making this shift, quote, ‘to remove itself from regulated activity.’ Translation: Launder your money here.”

Warren claimed “big-time financial criminals love crypto,” and argued that crypto was “the method of choice for international drug traffickers,” North Korean hackers and ransomware attackers, adding:

“The crypto market took in $20 billion last year in illicit transactions, and that's only the part we know about.”

These figures are backed up by a Jan. 12 report from blockchain analytics firm Chainalysis, which found that the total cryptocurrency value received by illicit addresses reached $20.1 billion throughout 2022.

Related: US lawmakers and experts debate SEC's role in crypto regulation

According to a United Nations official speaking at a Counter-Terrorism Committee meeting in October 2022, cash is still the preferred choice for financing terrorists although they are beginning to turn to crypto more frequently.

North Korean hackers operating with Lazarus Group have also faced headwinds attempting to use crypto with the exchanges Binance and Huobi again freezing accounts, and in the process millions worth of crypto, linked to the notorious outfit.

Bitcoin miner, Iris Energy, announced plans to increase the company’s self-mining capacity, from 2 exahash per second (EH/s) to approximately 5.5 EH/s, after it receives 4.4 EH/s of new Antminer S19j Pro miners from Bitmain. Iris Energy Leverages $67 Million in Bitmain Prepayments for Latest Mining Expansion Bitcoin mining company, Iris Energy, announced plans to […]

Bitcoin miner, Iris Energy, announced plans to increase the company’s self-mining capacity, from 2 exahash per second (EH/s) to approximately 5.5 EH/s, after it receives 4.4 EH/s of new Antminer S19j Pro miners from Bitmain. Iris Energy Leverages $67 Million in Bitmain Prepayments for Latest Mining Expansion Bitcoin mining company, Iris Energy, announced plans to […] Statistics show transfer fees on the Bitcoin network have increased 122% since the end of last month, as the average transaction fee has climbed from $0.767 to $1.704 per transaction. The rise in onchain fees coincides with the new Ordinals digital collectible trend on the network, with the number of inscriptions nearing 20,000. Rising Transaction […]

Statistics show transfer fees on the Bitcoin network have increased 122% since the end of last month, as the average transaction fee has climbed from $0.767 to $1.704 per transaction. The rise in onchain fees coincides with the new Ordinals digital collectible trend on the network, with the number of inscriptions nearing 20,000. Rising Transaction […] In 2021, a number of 2010 block rewards were spent after the bitcoins sat idle for more than a decade. Furthermore, in 2020 and 2021, an early miner from 2010 spent strings of 20 ancient block rewards. In 2022, however, only 17 block rewards from 2010 were spent. Alongside this, on March 10, 2022, an […]

In 2021, a number of 2010 block rewards were spent after the bitcoins sat idle for more than a decade. Furthermore, in 2020 and 2021, an early miner from 2010 spent strings of 20 ancient block rewards. In 2022, however, only 17 block rewards from 2010 were spent. Alongside this, on March 10, 2022, an […]

Miners are in deep trouble due to increased hash rate and energy costs, but pro traders slightly added to their longs despite the recent BTC pullback.

Bitcoin (BTC) price lost 11.3% between Dec. 14 and Dec. 18 after briefly testing the $18,300 resistance.

The move followed a 7-day correction of 8% in the S&P500 futures after the U.S. Federal Reserve chair Jerome Powell issued hawkish statements after raising the interest rate on Dec. 14.

Macroeconomic trends have been the main driver of recent movements. For instance, the latest bounce from the 5-week-long ascending channel support at $16,400 has been attributed to the Central Bank of Japan's efforts to contain inflation.

The Bank of Japan increased the limit on government bond yields on Dec. 20, which are now trading at levels unseen since 2015.

However, not everything has been positive for Bitcoin as miners have struggled with the hash rate nearing all-time high and increased energy costs. For example, on Dec. 20, Bitcoin miner Greenidge reached an agreement with its creditor to restructure $74 million worth of debt — although the deal requires the miner to sell nearly 50% of their equipment.

Moreover, Bitcoin mining listed company Core Scientific reportedly filed for Chapter 11 bankruptcy on Dec 21. While the company continues to generate positive cash flows, the income is insufficient to cover the operational costs, which involve repaying the lease for its Bitcoin mining equipment.

During these events, Bitcoin has held $16,800, so there are buyers at these levels. But let's look at crypto derivatives data to understand whether investors have increased their risk appetite for Bitcoin.

Fixed-month futures contracts usually trade at a slight premium to regular spot markets because sellers demand more money to withhold settlement for longer. Technically known as contango, this situation is not exclusive to crypto assets.

In healthy markets, futures should trade at a 4% to 8% annualized premium, which is enough to compensate for the risks plus the cost of capital.

It becomes clear that the attempts to push the indicator above zero have utterly failed over the past 30 days. The absence of a Bitcoin futures premium indicates higher demand for bearish bets, and the metric has worsened from Dec. 14 to Dec. 21.

The current 1.5% discount indicates professional traders' reluctance to add leveraged long (bull) positions despite being actually paid to do so.

Still, investors should analyze the long-to-short ratio to exclude externalities that have solely impacted the quarterly contracts' premium.

The metric gathers data from exchange clients' positions on the spot and perpetual contracts, better informing how professional traders are positioned.

Even though Bitcoin briefly traded below $16,300 on Dec. 19, professional traders did not reduce their leverage long positions according to the long-to-short indicator. For instance, the Huobi traders' ratio stabilized at 1.01 between Dec. 16 and Dec. 21.

Similarly, OKX displayed a modest increase in its long-to-short ratio, as the indicator moved from 1.02 to the current 1.04 in five days.

Lastly, the metric slightly increased from 1.05 to 1.07 at Binance, confirming that traders did not become bearish after the ascending channel support was tested.

Traders cannot ascertain that the absence of a futures premium necessarily translates to bearish price expectations — for instance, the lack of confidence in the exchanges could have driven away potential leverage buyers.

Related: Pantera CEO on the FTX collapse; Blockchain didn’t fail

Moreover, the resilience of the top traders' long-to-short ratio has shown that whales and market makers did not reduce leverage longs despite the recent price dip.

In essence, the Bitcoin price movement has been surprisingly positive, considering the negative newsflow from miners and the bearish influence of raising interest rates on risk markets.

Therefore, as long as the $16,500 channel support continues to hold, bulls have reason to believe that another shot at the $18,400 upper band limit is viable before year-end.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

An IT specialist working for a medical institution in Russia’s Altai Republic has been detained for illegally mining cryptocurrency at the premises of a Covid-19 hospital. The man minted digital currencies using stolen electricity for almost a year before law enforcement busted his crypto farm. Altai Resident Apprehended for Running Underground Crypto Mining Operation An […]

An IT specialist working for a medical institution in Russia’s Altai Republic has been detained for illegally mining cryptocurrency at the premises of a Covid-19 hospital. The man minted digital currencies using stolen electricity for almost a year before law enforcement busted his crypto farm. Altai Resident Apprehended for Running Underground Crypto Mining Operation An […] After bitcoin miners caught a break ten days ago when the difficulty dropped 1.49% lower, the network’s hashrate increased more than 15% since then. Currently, the processing power has been coasting along above the 200 exahash per second (EH/s) zone but another difficulty increase is expected to occur in less than four days. Bitcoin’s Hashrate […]

After bitcoin miners caught a break ten days ago when the difficulty dropped 1.49% lower, the network’s hashrate increased more than 15% since then. Currently, the processing power has been coasting along above the 200 exahash per second (EH/s) zone but another difficulty increase is expected to occur in less than four days. Bitcoin’s Hashrate […]

A 'whale' solo Bitcoin miner with a whopping 1.14PH/s computing power solved a valid block on Tuesday.

Hopium is back on the menu for solo Bitcoin (BTC) miners. A circa $240,000 reward, or 6.25 BTC, was generated by yet another solo miner this morning.

This time, the odds were less than 20%, according to Con Kolivas, a Bitcoin software engineer and administrator for ckpool, whose name takes his initials. It’s the fourth “blockfind” for the ckpool since Jan. 11.

Kolivas tweeted his congratulations to the miner who joins the ranks of the few and fortunate successful solo BTC miners.

Congratulations to a miner with 1.14PH who solved the 264th solo Bitcoin block at https://t.co/UWgBvLkDqc ! https://t.co/5BsWlYkYJt There was once again ~20% chance that one of the miners at the pool would have solved a block by now. pic.twitter.com/NrlAbhhKCk

— Dr. Con Kolivas (@ckpooldev) February 1, 2022

The plucky miner belongs to the Solo ckpool, the service that offers anonymous solo Bitcoin mining with a fee. At 1.14 petahashes per second (PH/s), the miner is considered a ‘whale’ miner, with a considerable hash rate for one single entity.

A new BTC block is solved roughly every 10 minutes by miners competing against the entire bitcoin network hashrate. By way of comparison, United States Bitcoin miners Foundry are currently the largest contributors to the network hash rate, with 33,803 PH/s.

One Twitter user estimated that while 1.14PH/s is a lot, it is still less than a room full of S19s, the flagship mining product by Antminer.

Related: Bitcoin miners believe global hash rate to grow ‘aggressively’

The ckpool has taken the mining world by storm recently. A Bitcoin miner with a tiny hash rate of just 126 terahashes per second (TH/s)–possibly a single S19 machine–solved a valid block on January 12th. Two weeks later, another underdog with a mere 86 TH/s achieved the improbable by solving another valid block.

Over the course of the Bitcoin blockchain’s existence, 264 blocks or 0.037% of the circa 721,240 blocks were solved by ck’s solo Bitcoin miners. While the odds are clearly against the soloists, they continue to surprise and delight Bitcoiners.