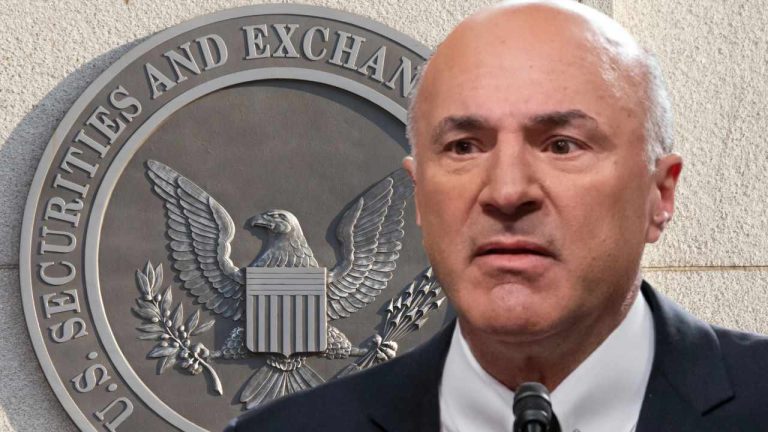

Shark Tank star Kevin O’Leary, aka Mr. Wonderful, has warned that U.S. crypto regulation is “getting very, very aggressive.” Noting that regulators are now “regulating by enforcement, penalties, and massive fines,” O’Leary emphasized the importance of staying out of the way of the SEC, Chair Gary Gensler, and other regulators. Kevin O’Leary Shares Outlook for […]

Shark Tank star Kevin O’Leary, aka Mr. Wonderful, has warned that U.S. crypto regulation is “getting very, very aggressive.” Noting that regulators are now “regulating by enforcement, penalties, and massive fines,” O’Leary emphasized the importance of staying out of the way of the SEC, Chair Gary Gensler, and other regulators. Kevin O’Leary Shares Outlook for […] Shark Tank star Kevin O’Leary, aka Mr. Wonderful, says that most crypto tokens are worthless and they will eventually drop to zero in value. He added that he now owns seven cryptocurrencies and he is getting the same volatility he did when he owned 32 crypto tokens prior to the collapse of crypto exchange FTX. […]

Shark Tank star Kevin O’Leary, aka Mr. Wonderful, says that most crypto tokens are worthless and they will eventually drop to zero in value. He added that he now owns seven cryptocurrencies and he is getting the same volatility he did when he owned 32 crypto tokens prior to the collapse of crypto exchange FTX. […]

The Shark Tank star said all unregulated exchanges are seeing “massive outflows” right now, and rightly so.

Unregulated crypto exchanges will continue to fall like dominoes post-FTX, with plenty more “meltdowns” to come, warns Shark Tank star and investor Kevin O’Leary.

O’Leary, a former spokesperson and proponent for the now-bankrupt FTX exchange, told Kitco anchor David Lin in a Jan. 17 interview that the collapse was just one in a long line of “unregulated exchanges” likely to fail:

“If you’re asking me if there’s going to be another meltdown to zero? Absolutely. 100% it’ll happen, and it’ll keep happening over, and over and over again.”

Unregulated exchanges are those that aren't subject to regular auditing, aren’t registered and regulated by a securities commission, and don’t operate under rules similar to traditional stock exchanges and brokerages.

“Well, all of these exchanges, all the unregulated exchanges are having massive outflows right now. Smart money has got the joke. They saw what happened at FTX and they’re not sitting around for an explanation,” he said.

The Shark Tank star then made a stark warning to so-called “unregulated” crypto exchanges.

“If you're not willing to be audited, [...] you don't have an audit, you don't want to be transparent, you don't want to disclose ownership, why should institutional capital stay? Of course, it's not going to.”

The collapse of FTX in November prompted fierce calls from the community for greater transparency from crypto exchanges. Within weeks, five centralized exchanges completed their proof-of-reserve audits, while plenty more announced plans to do the same.

However, some observers, including a senior official from the United States Securities and Exchange Commission (SEC), warned that proof of reserves don’t paint a true picture of a company’s financial position and asked investors to be “very wary” of the claims being made.

Some of the auditors, such as Mazars have seemingly back-flipped on their support for crypto companies. In December, the company removed its audit for crypto exchange Binance and reportedly stopped doing proof-of-reserve audits for crypto companies altogether.

Other auditing firms such as FTX’s auditor Armanino have also reportedly stopped working with crypto exchanges like OKX and Gate.io. O'Leary commented:

“Frankly, you know, it's very hard to find an auditor that wants to touch this stuff right now because of the unregulated cowboy environment. It's all going to end and yes, there’ll be many more zeros.”

Earlier this month, O’Leary’s fellow Shark Tank host Mark Cuban told The Street that crypto wash trading on centralized exchanges will be the cause of the next crypto “implosion.”

As much as 70% of the volume on unregulated exchanges is wash trading according to a December report by the National Bureau of Economic Research (NBER).

Related: Binance 'put FTX out of business' — Kevin O'Leary

Despite the noise, O’Leary says he’s doubling down on his crypto investments, particularly in Bitcoin (BTC).

“I have been going back into crypto markets lately. Any time Bitcoin drops below $17,000 I add to our positions there.”

“Crypto is getting very interesting because we’re finally starting to see the bearer of regulation coming into play and I think long-term that’s a good thing,” he added.

Kevin O’Leary fessed up to making a massive mistake with FTX, and is working to find out where his money went amid the bankruptcy.

Shark Tank star and investor Kevin O’Leary, known in some circles as Mr. Wonderful, has claimed he has all but lost the $15 million FTX paid him to be its official spokesperson.

Speaking at CNBC’s Squawk Box on Dec. 8, O’Leary outlined that after taxes, agents fees, a $1 equity investment into FTX, and buying a whole lot of crypto that's now stuck on the FTX exchange, he's got nothing left to show for his time with FTX.

“Total deal was just under $15 million, [...] I put about $9.7 million into crypto. I think that’s what I’ve lost. It's all at zero, I don’t know cos my account got scraped a couple of weeks ago. All the data, all the coins, everything.”

“It was not a good investment [...] I don’t make good investments all the time, luckily I make more good ones than bad ones, but that was a bad one,” he added.

He will probably be just fine without the funds however, as the 68-year-old is estimated to have a net worth of around $400 million — if such estimates are anything to go by.

Mr. Wonderful was also questioned on what initially drove him to jump on the FTX bandwagon back in August 2021, given that he previously indicated that he held back from crypto in its early days due to his own rigorous compliance standards.

In response, he essentially fessed up to making a massive error, noting “I obviously know all the institutional investors in this deal, we all look like idiots, let's put that on the table.”

“We relied on each other’s due diligence but we also relied on another investment theme that I felt drove a lot of interest in FTX. Sam Bankman-Fried is an American, his parents are American compliance lawyers. There were no other American large exchanges to invest in if you wanted to invest in infrastructure plays,” he said.

O’Leary reiterated that he is currently working to find out where his capital on FTX actually went and how he can get it back. He also added that he has “agreed” to testify at the upcoming Senate Committee hearing set for Dec. 14.

Related: Sam Bankman-Fried misses deadline to respond to testimony request, now what?

Despite the whole debacle, O'Leary has previously said he would still have SBF on his team, and in an tweet on Dec.8, he reiterated that he is not scared off investing in entrepreneurs that have massive failures as “failure is often the best teacher.”

You invested in a fraud - not an entrepreneur

— sassal.eth (@sassal0x) December 9, 2022

During another interview with Yahoo Finance on Dec. 6, O’Leary stated that SBF should be treated as innocent until proven guilty as he called for FTX to be audited in the wake of its collapse.

“I am of the ilk and of the group of people that says, ‘You’re innocent until proven guilty.’ That’s what I believe. And I want the facts. And so, if you tell me that you didn’t — you did or didn’t do something, I’m going to believe you until I find out it’s a falsehood,” he said.

Shark Tank star Kevin O’Leary, aka Mr. Wonderful, expects the price of bitcoin to go up when the Stablecoin Transparency Act passes, which he believes could be soon after the November midterm elections. O’Leary emphasized that crypto cannot be stopped, stating: “You either join the wave or get lost.” ‘Regulations Come, Bitcoin Goes Up’ Shark […]

Shark Tank star Kevin O’Leary, aka Mr. Wonderful, expects the price of bitcoin to go up when the Stablecoin Transparency Act passes, which he believes could be soon after the November midterm elections. O’Leary emphasized that crypto cannot be stopped, stating: “You either join the wave or get lost.” ‘Regulations Come, Bitcoin Goes Up’ Shark […] Shark Tank star Kevin O’Leary, aka Mr. Wonderful, has warned of an impending “big panic event” in the crypto space. “I don’t believe we’ve seen the bottom yet and I have a different view of it,” he said. Kevin O’Leary Warns of a ‘Big Panic Event’ in Crypto Shark Tank star Kevin O’Leary shared his […]

Shark Tank star Kevin O’Leary, aka Mr. Wonderful, has warned of an impending “big panic event” in the crypto space. “I don’t believe we’ve seen the bottom yet and I have a different view of it,” he said. Kevin O’Leary Warns of a ‘Big Panic Event’ in Crypto Shark Tank star Kevin O’Leary shared his […] Shark Tank star Kevin O’Leary, aka Mr. Wonderful, says he is not selling any of his cryptocurrencies despite the crypto market downturn. “Long term, you just have to stomach it. You have to understand you’ll get volatility,” he stressed. Kevin O’Leary: I’m Not Selling Anything Shark Tank star Kevin O’Leary talked about bitcoin and other […]

Shark Tank star Kevin O’Leary, aka Mr. Wonderful, says he is not selling any of his cryptocurrencies despite the crypto market downturn. “Long term, you just have to stomach it. You have to understand you’ll get volatility,” he stressed. Kevin O’Leary: I’m Not Selling Anything Shark Tank star Kevin O’Leary talked about bitcoin and other […]

Despite betting that NFTs will surpass Bitcoin, Kevin O'Leary said he will hedge his bets and invest on “both sides” of the equation.

Millionaire investor and crypto proponent Kevin O'Leary thinks that the NFT sector could be worth more than Bitcoin in the future.

Speaking with CNBC’s Capital Connection on Jan. 5, O'Leary — also known as Mr. Wonderful — argued that NFTs provide a greater potential to attract capital than Bitcoin due to their ability to tokenize and authenticate physical assets such as cars, watches and real estate:

“You’re going to see a lot of movement in terms of doing authentication and insurance policies and real estate transfer taxes all online over the next few years, making NFTs a much bigger, more fluid market potentially than just Bitcoin alone.”

Mr. Wonderful admitted however, that he is not tied to that bet and will still be investing on “both sides of that equation.”

The former crypto skeptic told Cointelegraph in a recent interview that his change in tune towards blockchain and digital assets was due to the growing trend of regulators warming up across the globe over the past couple of years.

Not everyone agrees with comparisons between Bitcoin and NFTs however, with Coingecko digital marketing associate Khai Ren Kuan telling Cointelegraph that it’s “probably not fair to compare Bitcoin, which is a single asset, to NFTs which are an entire sector.”

Kuan did note however, that the NFT adoption curve in 2022 is only going to increase upwards as the sector is still in its early days:

“I think collectively if you look across all NFTs, and the fact that 2021 was year one of market adoption, there’s definitely still a lot of room to grow.”

“We’ve already got a set of 'blue chip' NFTs, but I think the industry is still barely scratching the surface of what NFTs could be and what they could do, particularly if the Metaverse comes to fruition,” he added.

Related: Global search interest for 'NFT' surpasses 'crypto' for the first time ever

Coingecko recently published a new book called “How to NFT” which provides a rundown for newbies entering the nonfugible space on how to buy, sell, store and mint NFTs. Questioned on whether he thinks the “NFT art narrative” will continue to dominate in 2022, or if the trend will shift towards utility-based NFTs, Kuan said:

“Arts and collectibles are always going to be high on the list as they’re the most beginner-friendly and easiest to understand. In terms of utility NFTs I think what’s probably interesting to watch for is how some NFTs are going to both be art, and have utility.”

“We’ve seen BAYC which the NFT doubles as membership into their ‘club’, and it really helps build a sense of identity and community,” he added.

Shark Tank star Kevin O’Leary, aka Mr. Wonderful, is increasing his cryptocurrency allocation. He is also taking an equity stake in the FTX crypto exchange and has signed a multi-year deal to become its ambassador and spokesperson. He will be paid in crypto for his services. Kevin O’Leary Increasing His Crypto Allocation Shark Tank’s Kevin […]

Shark Tank star Kevin O’Leary, aka Mr. Wonderful, is increasing his cryptocurrency allocation. He is also taking an equity stake in the FTX crypto exchange and has signed a multi-year deal to become its ambassador and spokesperson. He will be paid in crypto for his services. Kevin O’Leary Increasing His Crypto Allocation Shark Tank’s Kevin […]

Mr. Wonderful has signed a multi-year deal to serve as a brand ambassador and spokesperson for FTX and will be paid in crypto assets and take an equity stake in FTX.

Shark Tank host Kevin O’Leary has become an official spokesman for Sam Bankman-Fried’s FTX crypto exchange and will be paid in crypto and receive equity as part of the deal.

According to an Aug.10 announcement, the partnership with FTX Trading Ltd. and West Realm Shires Services Inc. (owners of FTX.US and FTX.com) will see O’Leary take an equity stake in both firms.

The venture capitalist also known colloquially as “Mr. Wonderful” signed the multi-year deal to serve as a brand ambassador and spokesperson. He asked to be paid in crypto assets to increase his holdings.

Finally solved my compliance problems with #cryptocurrencies I'm going to use FTX to increase my allocation and use the platform to manage my portfolios https://t.co/yaoRUnXy14

— Kevin O'Leary aka Mr. Wonderful (@kevinolearytv) August 10, 2021

In the announcement, O’Leary noted that “institutional investors struggle with the decision to invest in crypto assets” as they harbor compliance-related concerns as he did regarding crypto:

“I am no different. I want to increase my crypto exposure but also serve my compliance mandates. When it comes to rapidly changing compliance and tax reporting requirements, the current cryptocurrency ecosystem is fraught with risks that I can not take.”

He added that, “To find crypto investment opportunities that met my own rigorous standards of compliance, I entered into this relationship with FTX.”

Regulatory compliance in crypto has been a long-standing issue of the investor, and he previously stated back in 2019 that:

“I have no interest in doing any of this crypto crap because it is not compliant.”

Related: Regulatory clarity for crypto would take 3 to 5 years, FTX CEO says

O’Leary has been tasked with elevating the brand to large audiences and has already got to work on social media by promoting a FTX CryptoPunk NFT giveaway on Twitter. However, he unfortunately misspelled a word in the caption of his post which reads “what to win a CryptoPunk? Here’s your chance!”

da faq? english much?

— DG (@lpdelat) August 10, 2021

The venture capitalist has a knack for coming up with colorful nicknames for crypto, and in January he referred to Bitcoin (BTC) as a “giant nothing-burger” due to its inconsistent regulatory frameworks across the globe. He has also described BTC mined in non-environmentally friendly ways as “Blood Coin.”

He changed his tune on Bitcoin and revealed plans to allocate 3% of his investment portfolio to BTC in March.This week he called Ethereum "ultrasound money' in a Cameo video.