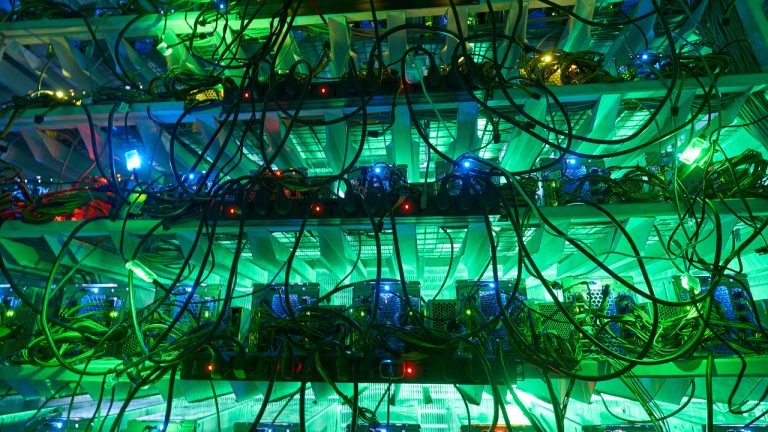

A new report claims Bitcoin (BTC) mining firm Iris Energy’s investors are seeing a multimillion-dollar wipeout in the value of their holdings a year since the public listing. According to an Australian Financial Review, shares of Iris Energy, which is listed on the NASDAQ, have fallen by 94.5% since the initial public offering in November […]

The post Top Asset Management Firms Suffer $220,000,000 in Losses From Bitcoin (BTC) Mining Investments: Report appeared first on The Daily Hodl.

Meta, the social network company, has announced that it will cut 11,000 jobs, letting go of 13% of the employees in its workforce amidst a “cultural shift” in the company. Mark Zuckerberg, CEO of the company, explained this decision was made due to a need to become more “capital efficient,” and described the next steps […]

Meta, the social network company, has announced that it will cut 11,000 jobs, letting go of 13% of the employees in its workforce amidst a “cultural shift” in the company. Mark Zuckerberg, CEO of the company, explained this decision was made due to a need to become more “capital efficient,” and described the next steps […] On Nov. 7, 2022, the bitcoin mining firm Core Scientific released the company’s October update after the company’s Form 8-K U.S. Securities and Exchange Commission (SEC) filing on Oct. 26, 2022. The filing noted that the company was in the process of exploring “restructuring its existing capital structure.” The update published on Monday indicates that […]

On Nov. 7, 2022, the bitcoin mining firm Core Scientific released the company’s October update after the company’s Form 8-K U.S. Securities and Exchange Commission (SEC) filing on Oct. 26, 2022. The filing noted that the company was in the process of exploring “restructuring its existing capital structure.” The update published on Monday indicates that […] The U.S. Federal Reserve introduced another jumbo rate hike on Wednesday, Nov. 2, 2022, by hiking the federal funds rate (FFR) by 75 basis points (bps). The American central bank said on Wednesday that the hike aims to curb inflation and the Fed says “recent indicators point to modest growth in spending and production.” U.S. […]

The U.S. Federal Reserve introduced another jumbo rate hike on Wednesday, Nov. 2, 2022, by hiking the federal funds rate (FFR) by 75 basis points (bps). The American central bank said on Wednesday that the hike aims to curb inflation and the Fed says “recent indicators point to modest growth in spending and production.” U.S. […] One of the largest publicly listed bitcoin miners, Core Scientific, has shaken investors with a recent filing with the U.S. Securities and Exchange Commission that raises the possibility the company may apply for bankruptcy protection. The filing notes that Core Scientific will be unable to pay down debt payments due for Oct. and early Nov. […]

One of the largest publicly listed bitcoin miners, Core Scientific, has shaken investors with a recent filing with the U.S. Securities and Exchange Commission that raises the possibility the company may apply for bankruptcy protection. The filing notes that Core Scientific will be unable to pay down debt payments due for Oct. and early Nov. […]

A Japanese crypto exchange and Web3 platform is looking to grow by going public on the Nasdaq Stock Market by 2023. According to a Q2 fiscal report filed with the U.S. Securities and Exchange Commission (SEC), Tokyo-based crypto exchange platform Coincheck is planning to go public on the Nasdaq next year. The report also details […]

The post Japanese Crypto Exchange Aims To Go Public on the Nasdaq Next Year appeared first on The Daily Hodl.

The company’s financial statements showed a decline in operating revenue and income due to the crypto bear market.

Japanese cryptocurrency exchange Coincheck has confirmed plans to pursue a public stock offering in the United States through Nasdaq — a move that would give the company access to the country’s lucrative capital markets.

In documents filed with the U.S. Securities and Exchange Commission on Oct. 28, Coincheck’s majority owner, Monex Group, confirmed that it is proceeding with Nasdaq listing procedures through a merger with special purpose acquisition company (SPAC) Thunder Bridge Capital Partners IV. If all goes according to plan, Coincheck’s Nasdaq listing will take place on July 2, 2023.

Coincheck said the SPAC merger would allow the exchange to expand its crypto-asset business and gain direct access to U.S. capital markets. The technology-rich Nasdaq is one of the world’s largest stock exchanges by volume and market capitalization.

As reported by Cointelegraph, Coincheck announced its public-listing ambitions in March of this year. At the time, the value of its merger with Thunder Bridge Capital was reported to be $1.25 billion.

According to Coincheck’s financial statements, the company has 1.75 million verified accounts, representing 27% of Japan’s crypto trading market share. However, the company reported a loss in trading volume due to the crypto bear market. Total operating revenues declined by roughly half quarter-on-quarter.

Related: Bitcoin weak hands ‘mostly gone’ as BTC ignores Amazon, Meta stock dip

Several crypto-oriented companies have expressed a desire to go public through SPAC agreements. In April, Bitcoin (BTC) mining company PrimeBlock announced it would go public via a $1.25 billion SPAC. In August, blockchain cloud infrastructure provider W3BCloud unveiled an identical price tag for its SPAC merger. Stock and crypto exchange eToro had plans for a $10 billion merger before terminating the agreement over the summer.

Bitcoin’s volatility has fallen below that of the Nasdaq and the S&P 500, according to crypto data provider Kaiko. Compared to equity markets, cryptocurrency markets have become less reactive to volatile macro events, including high inflation, an appreciating dollar, rising interest rates, ongoing war, and the energy crisis, the firm explained. ‘Bitcoin Volatility Is at […]

Bitcoin’s volatility has fallen below that of the Nasdaq and the S&P 500, according to crypto data provider Kaiko. Compared to equity markets, cryptocurrency markets have become less reactive to volatile macro events, including high inflation, an appreciating dollar, rising interest rates, ongoing war, and the energy crisis, the firm explained. ‘Bitcoin Volatility Is at […]

Despite delisting VBB, Valkyrie still continues to manage the Bitcoin Strategy ETF and its Bitcoin futures ETF and the Valkyrie Bitcoin Miners ETF.

Valkyrie Funds, a major cryptocurrency fund manager in the United States, will soon be liquidating one of its Bitcoin (BTC)-related exchange-traded funds (ETFs).

The firm announced on Oct. 11 plans to close the Valkyrie Balance Sheet Opportunities ETF, a crypto investment product offering indirect exposure to BTC.

The fund will be delisted from the Nasdaq Exchange as Valkyrie plans to liquidate the ETF on Oct. 31, 2022.

According to the announcement, Shareholders will be able to sell shares up until the end of the trading day on Oct. 28, 2022. Any investors still holding the fund shares at liquidation will receive a cash distribution equal to the net asset value of their shares, the announcement notes.

The firm also said that it will satisfy expenses related to the liquidation and potential distribution of cash proceeds, aside from brokerage expenses.

Valkyrie noted that the decision to liquidate the fund has been taken as part of an ongoing review of products as the firm aims to “best meet client demand,” stating:

“This action was taken after thorough consultation with the Firm's Board of Directors and comes after it was determined that discontinuing the fund was the best course of action for all involved.”

Valkyrie Funds is one of the major companies in the U.S. issuing cryptocurrency ETFs. The company is known for launching one of the first Bitcoin futures ETFs in the U.S. in October last year following approval from the U.S. Securities and Exchange Commission. The ETF product is called the Valkyrie Bitcoin Strategy ETF (BTF).

The soon-to-be-delisted Valkyrie Balance Sheet Opportunities was launched in December 2021, offering exposure to securities of U.S. companies with Bitcoin on their balance sheets. Listed under the ticker VBB, the ETF tracks companies like crypto custodians, exchanges and trading firms.

Related: SEC rejects WisdomTree’s application for a spot Bitcoin ETF... again

Despite delisting VBB, Valkyrie still continues to manage funds, including the BTF and the Valkyrie Bitcoin Miners ETF (WGMI). The latter was launched in February 2022, with 80% of assets tracking securities of companies that derive their revenue or profits from BTC mining.

The firm did not immediately respond to Cointelegraph’s request for comment. This article will be updated pending new information.

The Middle East, one of the world’s fastest-growing crypto markets, now offers a new opportunity for direct investment in Bitcoin through the 21Shares Bitcoin ETP.

21Shares, a major global provider of cryptocurrency exchange-trading products (ETP), is debuting a physical Bitcoin (BTC) ETP in the United Arab Emirates.

The new 21Shares Bitcoin ETP has started trading on the international financial exchange Nasdaq Dubai under the ticker ABTC, the firm announced on Oct. 12.

The newly launched crypto product is physically backed, which means that it’s fully collateralized by the underlying Bitcoin assets they track with 1:1 leverage, 21Shares co-founder and CEO Hany Rashwan told Cointelegraph. The ETP’s underlying crypto assets are deposited in an offline wallet to ensure better security, he noted.

21Shares’ expansion into the UAE is a major milestone in the company’s international growth. Including Nasdaq Dubai, 21Shares’ ETPs are listed across 12 exchanges, including SIX Swiss Exchange, Deutsche Börse, EuroNext, BXSwiss, Wiener Börse, Quotrix, Gettex, Börse Stuttgart, Börse München, Börse Düsseldorf and Nasdaq.

According to Rashwan, Germany and Switzerland are currently the two of the biggest markets for 21Shares’ crypto ETPs in Europe.

“In terms of MENA, we expect strong interest given the crypto-friendly nature of the region,” Rashwan said, adding that the UAE received more cryptocurrency than any other Arab country in 2021.

The CEO also mentioned that the MENA region has become a hub for crypto companies and major exchanges like FTX, Kraken and Blockchain.com, attracting even more investors following India’s decision to tax crypto earnings at 30%. “The Middle East’s level of interest and crypto-friendliness made it a prime market for expansion for 21Shares,” Rashwan stated.

21Shares is not the only firm that has listed crypto investment products on Nasdaq Dubai. Last year, Canadian investment fund manager 3iQ listed a Bitcoin ETP on Nasdaq Dubai as well. The product is trading under the ticker QBTC and offers indirect exposure to Bitcoin. “The 3iQ Bitcoin Fund is not physically-backed,” the 21Shares CEO stressed.

Related: Middle East and North Africa are fastest-growing crypto markets: Data

The news comes soon after 21.co, the new parent firm of 21Shares, appointed Sherif El-Haddad as head of the MENA in August. The former head of asset management at Dubai-based Al Mal Asset Management, El-Haddad previously attempted to launch a physically-backed crypto exchange-traded fund at Al Mal, but his proposal was not approved.