Given the uncertainty in the macroeconomic environment, Bitcoin price bulls have no reason to bet against a six-week descending wedge pattern.

A bearish market structure has been pressuring cryptocurrencies’ prices for the past six weeks, driving the total market capitalization to its lowest level in two months at $1.13 trillion. According to two derivative metrics, crypto bulls will have a hard time to break the downtrend, even though analyzing a shorter timeframe provides a neutral view with Bitcoin (BTC), Ether (ETH) and BNB, on average, gaining 0.3% between May 12 and May 19.

Notice that the descending wedge formation initiated in mid-April could last until July, indicating that an eventual break to the upside would require an extra effort from the bulls.

Furthermore, there’s the impending U.S. debt ceiling standoff, as the U.S. Treasury is quickly running out of cash.

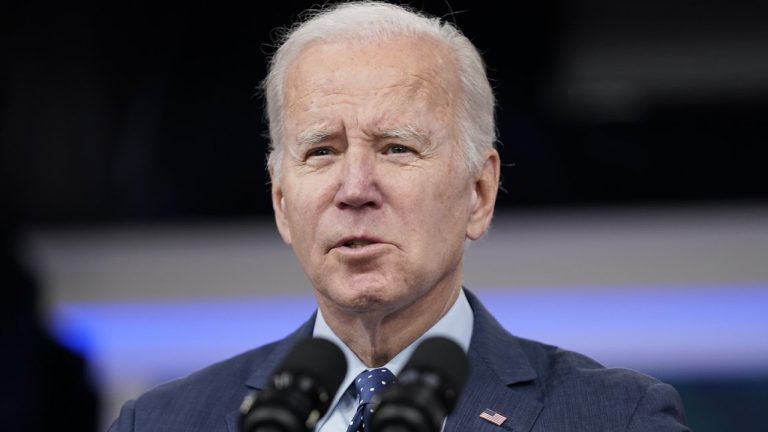

Even if the majority of investors believe that the Biden administration will be able to strike a deal before the effective default of its debt, no one can exclude the possibility of a government shutdown and subsequent default.

Gold or stablecoins as a safe haven?

Not even gold, which used to be considered the world’s safest asset class, has been immune to the recent correction, as the precious metal traded down from $2,050 on May 4 to the present $1,980 level.

Related: Bitcoin, gold and the debt ceiling — Does something have to give?

Circle, the company behind the USDC stablecoin, has ditched $8.7 billion in Treasuries maturing in longer than 30 days for short-term bonds and collateralized loans at banking giants such as Goldman Sachs and Royal Bank of Canada.

According to Markets Insider, a Circle representative stated that:

“The inclusion of these highly liquid assets also provides additional protection for the USDC reserve in the unlikely event of a U.S. debt default.”

The stablecoin DAI, managed by the decentralized organization MakerDAO, approved in March an increase to its portfolio holdings of the U.S. Treasuries to $1.25 billion to “take advantage of the current yield environment and generate further revenue”.

Derivatives markets show no signs of bearishness

Perpetual contracts, also known as inverse swaps, have an embedded rate that is usually charged every eight hours.

A positive funding rate indicates that longs (buyers) demand more leverage. Still, the opposite situation occurs when shorts (sellers) require additional leverage, causing the funding rate to turn negative.

The seven-day funding rate for BTC and ETH was neutral, indicating balanced demand from leveraged longs (buyers) and shorts (sellers) using perpetual futures contracts. Curiously, even Litecoin (LTC) displayed no excessive long demand after a 14.5% weekly rally.

To exclude externalities that might have solely impacted futures markets, traders can gauge the market’s sentiment by measuring whether more activity is going through call (buy) options or put (sell) options.

The expiration of options can add volatility to Bitcoin’s price, which resulted in an $80-million advantage for bears in the latest May 19 expiry.

A 0.70 put-to-call ratio indicates that put option open interest lags the more bullish calls and is, therefore, bullish. In contrast, a 1.40 indicator favors put options, which can be deemed bearish.

The put-to-call ratio for Bitcoin options volume has been below 1.0 for the past couple of weeks, indicating a higher preference for neutral-to-bullish call options. More importantly, even as Bitcoin briefly corrected down to $26,800 on May 12, there was no significant surge in demand for the protective put options.

Glass half full, or investors prepping for the worst?

The options market shows whales and market makers unwilling to take protective puts even after Bitcoin crashed 8.3% between May 10 and May 12.

However, given the balanced demand on futures markets, traders seem hesitant to place additional bets until there’s more clarity on the U.S. debt standoff.

Less than two weeks remain until June 1, when the U.S. Treasury Department has warned that the federal government could be unable to pay its debts.

Related: U.S. debt ceiling crisis: bullish or bearish for Bitcoin?

It is unclear whether the total market capitalization will be able to break from the descending wedge formation. From an optimistic perspective, professional traders are not using derivatives to bet on a catastrophic scenario.

On the other hand, there seems to be no rationale for th bulls to jump the gun and place bets on a speedy crypto market recovery given the uncertainty in the macroeconomic environment. So, ultimately, bears are in a comfortable place according to derivatives metrics.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.